Ever found yourself in a situation where you needed a payment made quickly, but the process felt like navigating a maze blindfolded? Maybe you’re an employee needing reimbursement for business expenses, or a small business owner trying to keep track of vendor payments. Without a clear, standardized system, requesting a check can become a source of confusion, delays, and even financial errors. That’s where a well-designed form comes into play, streamlining an otherwise cumbersome task and bringing much-needed order to your financial workflows.

Imagine a world where every check request follows the same simple steps, ensuring all necessary information is captured from the get-go. This not only speeds up the approval and processing time but also significantly reduces the chances of errors or missing details that can derail a payment. A consistent approach simplifies things for everyone involved, from the person making the request to the finance team processing it.

Why a Standardized Request For Check Form Template is a Game-Changer

Think about the sheer volume of financial transactions happening in any organization, big or small. Each payment, whether it is a vendor invoice, an employee reimbursement, or a charitable donation, requires careful consideration and proper authorization. Without a structured approach, these requests can become scattered emails, scribbled notes, or even verbal agreements, leading to a chaotic environment where accountability is elusive and financial records are difficult to audit. A standardized check request form template eliminates this disarray by providing a single, clear channel for all payment requests, ensuring no detail is overlooked and every request is properly documented.

The benefits extend far beyond just tidiness. A well-implemented template introduces a layer of efficiency that can save countless hours of administrative work. It ensures that approvers have all the necessary information at their fingertips to make informed decisions, reducing back-and-forth communication and accelerating the approval cycle. Furthermore, it enhances financial transparency and accountability, as every request is documented with a clear purpose, amount, and necessary approvals, making auditing and financial reporting much smoother. This systematic approach also minimizes the risk of fraudulent requests or errors, protecting the organization’s financial integrity.

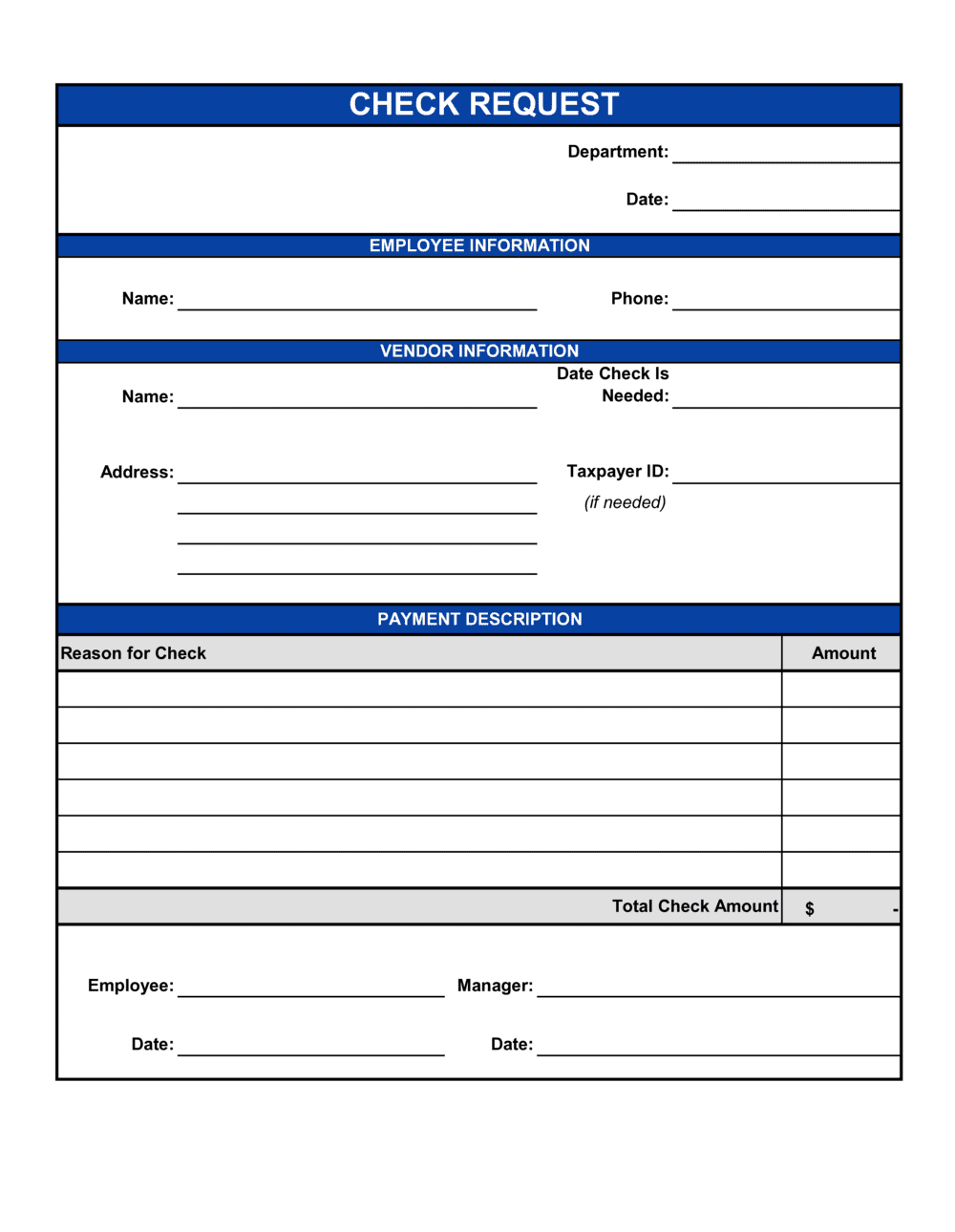

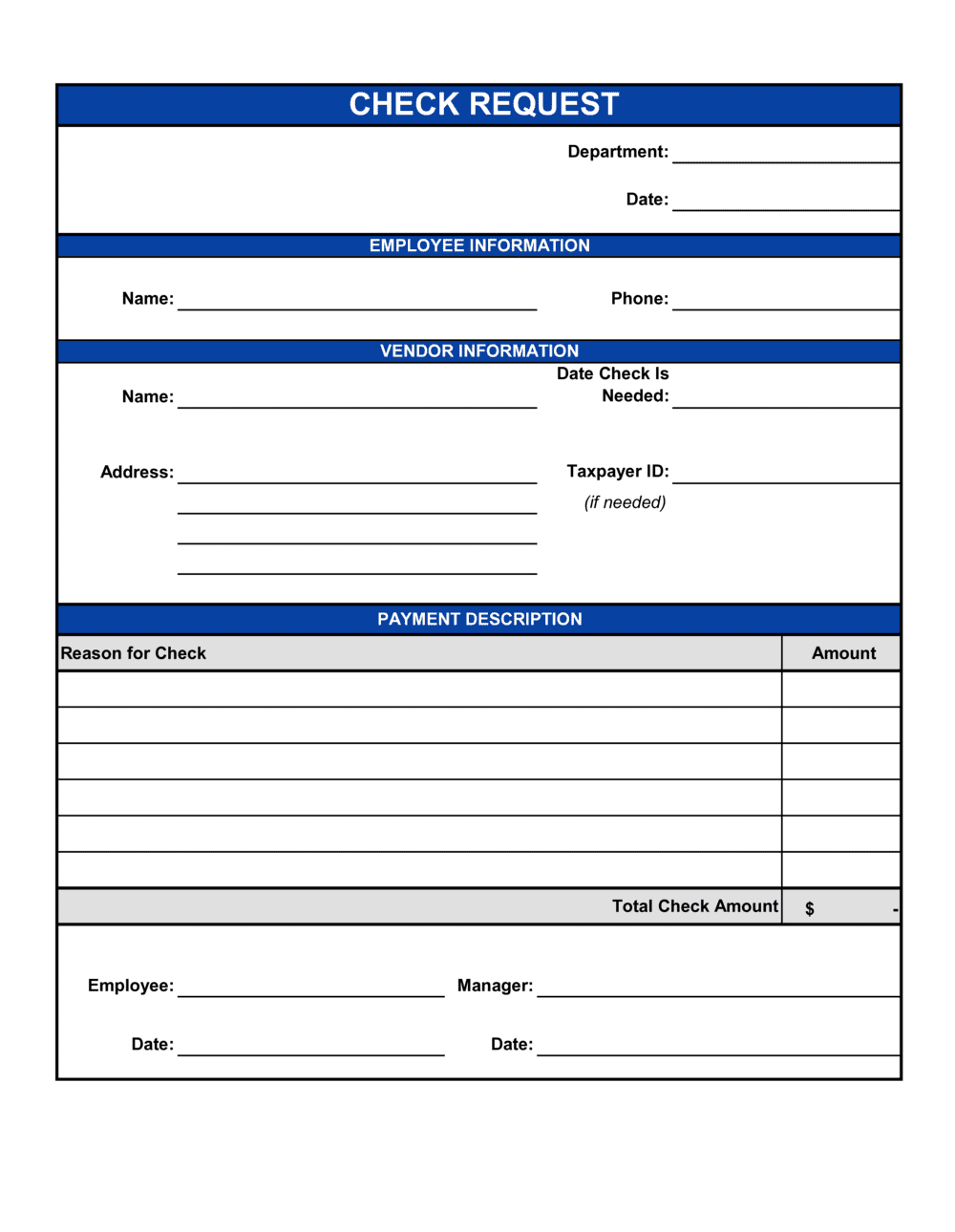

Key Components of an Effective Check Request Form

- Payee Information: Full legal name or company name, mailing address, and contact details to ensure the check reaches the correct recipient.

- Amount Requested: Clearly stated numerical and written amounts to prevent discrepancies and errors.

- Purpose of Payment: A detailed description of why the payment is needed, including what goods or services were provided. This is crucial for financial tracking and auditing.

- Account/Department to Charge: Designation of the specific budget line or department responsible for the expense, vital for accurate internal accounting.

- Required By Date: The date by which the check is needed, allowing the finance department to prioritize and manage their workload effectively.

- Supporting Documentation: A clear indication of what receipts, invoices, or contracts should be attached to validate the request.

- Approval Signatures: Designated fields for all necessary approvers, from the immediate supervisor to the finance department head, ensuring proper authorization.

- Requestor Information: Name, department, and contact information of the person submitting the request, for any follow-up questions.

Ultimately, a robust request for check form template acts as a central hub for all outgoing payments, transforming a potentially disorganized task into a streamlined, efficient, and auditable process. It provides clarity for the requestor, efficiency for the finance team, and peace of mind for leadership knowing that financial controls are in place and adhered to consistently.

Crafting Your Own Request For Check Form Template: Best Practices

Designing your own custom check request form template doesn’t have to be daunting. The key is to start by identifying the specific needs and unique workflows of your organization. Consider who will be submitting these requests, who needs to approve them, and what information is absolutely critical for your accounting team to process payments accurately. Will it be a physical paper form, or will you opt for a digital solution using spreadsheets, PDF forms, or online form builders? Each approach has its merits, but digital forms often offer greater efficiency in terms of submission, tracking, and storage.

When designing the layout, prioritize user-friendliness. The form should be intuitive and easy to fill out, even for those who are not financially savvy. Use clear headings, simple language, and logical sequencing of fields. Group related information together, for instance, all payee details in one section, and all expense details in another. Including brief instructions for each section can also prevent common errors and reduce the need for clarifications later on. Remember, a form that is easy to understand and complete is more likely to be adopted and used correctly by everyone.

A critical aspect of any check request form is the integrated approval workflow. Think about the chain of command for different types of payments. Do requests above a certain amount require higher-level approval? Clearly define who needs to sign off on what, and ensure these approval fields are prominent on the form. For digital forms, this often translates to automated routing based on predefined rules, which can significantly expedite the approval process. Proper documentation of the approval trail is essential for compliance and auditing purposes, making a robust template invaluable.

Once your template is designed, consider a pilot phase before a full rollout. Test it with a small group of users and gather their feedback. Are there any ambiguities? Is anything missing? Are there sections that can be simplified? This iterative process ensures that the final template is truly effective and meets the practical needs of your team. Provide clear guidelines and training on how to use the new template, emphasizing its benefits in simplifying their work and ensuring timely payments. This proactive approach helps in smooth adoption and fosters a culture of consistent financial management.

Implementing a standardized approach to check requests revolutionizes how an organization manages its outgoing funds. It instills discipline, enhances transparency, and ultimately contributes to a healthier financial operation by minimizing errors and maximizing efficiency. This systematic handling of payments ensures that every dollar spent is properly authorized and accounted for.