Navigating property transfers can often feel like a daunting task, filled with complex legal jargon and endless paperwork. However, for certain types of property transfers, a quick claim deed offers a straightforward and efficient solution. Unlike warranty deeds that come with guarantees about the property’s title, a quick claim deed simply transfers whatever interest the grantor has in the property to the grantee. This makes it a popular choice for situations like transferring property between family members, adding or removing a spouse from a title, or clearing up minor title defects. Understanding when and how to properly use this document is crucial.

The good news is that you don’t always need to start from scratch. A well-designed quick claim deed form template can significantly simplify the process, providing a structured framework that guides you through the necessary information. This article will delve into what these templates entail, how they function, and essential tips for ensuring your property transfer is handled correctly and efficiently.

Understanding the Basics of a Quick Claim Deed

A quick claim deed, often referred to interchangeably as a quitclaim deed, is a legal instrument used to transfer an interest in real property. Its defining characteristic is that the grantor, the person transferring the property, makes no warranties about the title. They are simply conveying whatever interest they currently hold, if any, to the grantee, the person receiving the property. This means that if there are any clouds on the title or other claims against the property, the grantor is not responsible for them once the deed is signed and recorded. This lack of warranty is precisely why it’s called a “quick claim” or “quitclaim” deed; the grantor is “quitting” their claim to the property without guaranteeing its perfection.

These deeds are typically employed in scenarios where the parties already know and trust each other, and there’s no need for the grantor to provide extensive title guarantees. Common uses include transferring property between spouses during a divorce, gifting property to a child or other family member, adding a new owner to a property title, or removing an existing owner. They are also frequently used to clear up minor title issues, such as a misspelling in a previous deed, or to transfer property into a living trust. It’s a tool for specific situations, not a general-purpose real estate sales document where comprehensive title assurance is expected.

Key Components You’ll Find on a Quick Claim Deed Form Template

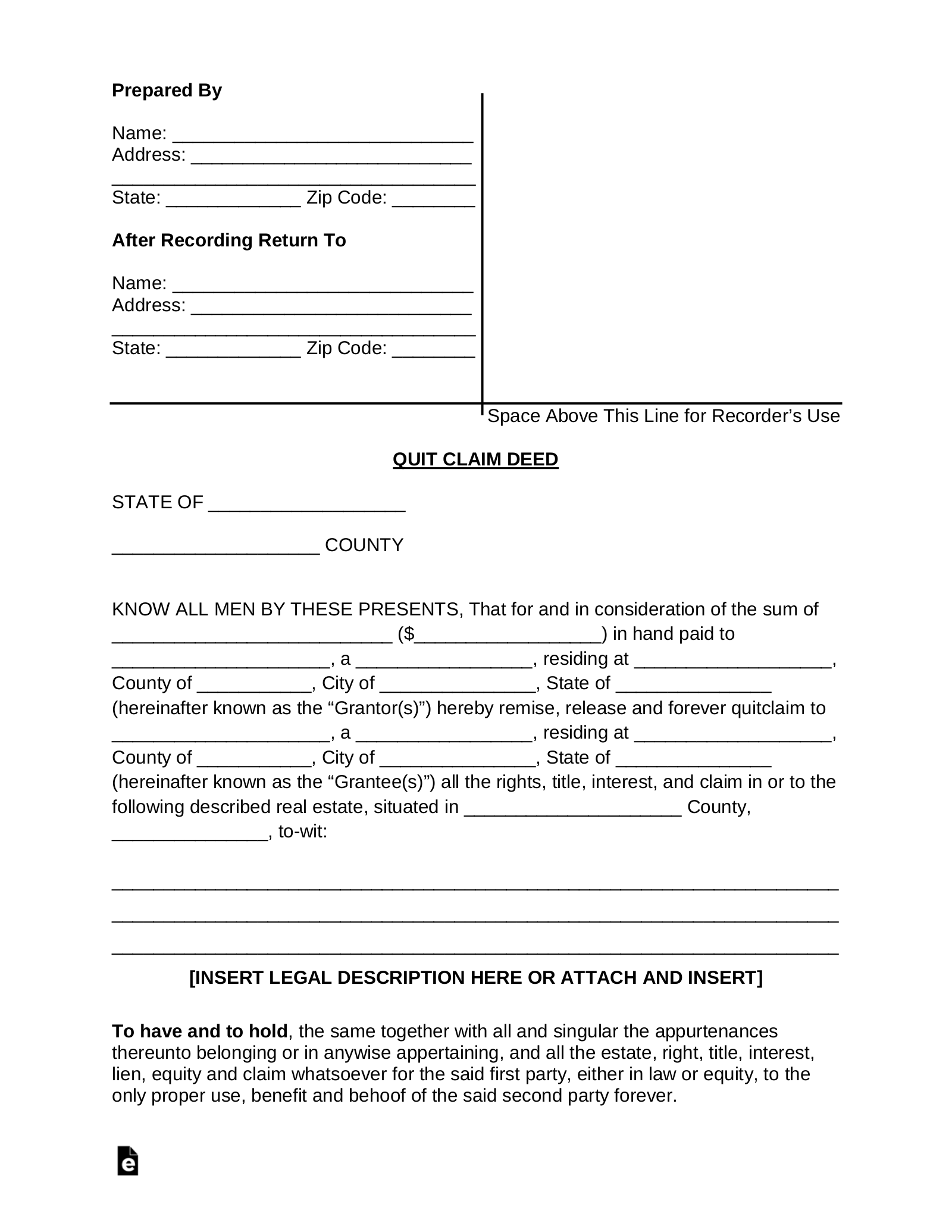

When you’re looking at a quick claim deed form template, you’ll notice several standard sections that must be accurately completed to ensure the document is legally valid and accepted by recording offices. Each piece of information serves a vital purpose in documenting the transfer and defining the property and parties involved. Missing or incorrect details can lead to delays or even invalidate the deed, so attention to detail is paramount.

- Grantor’s Name and Address: This identifies the current owner or owners who are transferring their interest. It must precisely match the name on the previous deed or the most recently recorded document.

- Grantee’s Name and Address: This identifies the person or entity receiving the interest in the property. Accuracy in spelling and address is crucial here as well.

- Legal Description of the Property: This is a detailed and precise description of the land being transferred, often found on the existing deed or obtained from the county recorder’s office. It’s not just the street address but a formal legal description that uniquely identifies the parcel.

- Consideration: While often listed as “for nominal consideration” or “$10.00 and other good and valuable consideration” in family transfers, this section technically states the value exchanged for the property.

- Witness Signatures: Depending on state law, one or more disinterested witnesses may be required to sign the deed in addition to the parties.

- Notary Acknowledgment: The grantor’s signature, and sometimes the grantee’s, must be notarized. This verifies their identity and confirms that they signed the document willingly.

It’s important to remember that while a quick claim deed form template provides a great starting point, the specific requirements for deeds can vary significantly from one state to another, and even between counties within the same state. Always verify the local recording requirements, including formatting guidelines, paper size, margin specifications, and any additional local declarations or fees. This due diligence is critical for a smooth and successful transfer that will be accepted for recording.

How to Effectively Use and Customize Your Quick Claim Deed Form Template

Once you’ve secured a reliable quick claim deed form template, the next step is accurately filling it out. This isn’t just a matter of typing in names; it requires careful attention to detail and an understanding of the information each section demands. Start by gathering all the necessary information, including the full legal names of both the grantor and grantee, their current mailing addresses, and the exact legal description of the property you intend to transfer. This legal description is paramount and can usually be found on the property’s previous deed or through your county’s assessor or recorder’s office. Do not use just the street address, as that is often insufficient for legal purposes and can lead to rejection by the recording office.

When inputting the property details, double-check every character of the legal description. A single typo could render the deed invalid or cause confusion regarding the property boundaries. Similarly, ensure the names of all parties are spelled correctly and match exactly with how they appear on other legal documents. If the property is being transferred as a gift, you might state “for nominal consideration” or “$1.00 and other good and valuable consideration,” but always be mindful of potential tax implications or local requirements regarding stated consideration. Some jurisdictions may have specific language requirements for gift transfers to avoid transfer taxes.

After completing the template, the grantor must sign the deed in the presence of a notary public. Many states also require witnesses in addition to notarization, so be sure to check your specific state laws. The notary will verify the identity of the signer and attest that the signature is authentic. Once signed and notarized, the deed must be recorded with the county recorder’s office, or equivalent body such as the Register of Deeds or County Clerk, in the county where the property is located. Recording the deed provides public notice of the transfer and protects the grantee’s interest against future claims. There will typically be a recording fee, which varies by jurisdiction and is usually paid at the time of submission.

While using a quick claim deed form template can be incredibly convenient, it’s vital to recognize its limitations and the specific scenarios for which it’s best suited. Because it offers no warranties about the title, the grantee assumes all risks regarding any potential defects or encumbrances on the property’s title. For complex transactions, those involving significant financial value, or when parties do not have a pre-existing relationship of trust, consulting with a real estate attorney is always the wisest course of action. An attorney can provide legal advice tailored to your unique situation, ensure compliance with all state and local laws, and help you understand any potential tax implications or other legal ramifications of the transfer.

Taking the time to understand the nuances of this type of deed and meticulously completing all required fields will ensure your property transfer is smooth and legally sound. Remember, while a template simplifies the structure, the responsibility for accuracy and adherence to legal requirements lies with the parties involved. Properly executed, a quick claim deed is an invaluable tool for certain property transfers, offering a streamlined path when used appropriately.