Running a business, no matter the size, comes with its own set of challenges and rewards. One of the most fundamental aspects of keeping your enterprise healthy and thriving is understanding its financial pulse. This often boils down to grasping what money is coming in and what’s going out. For many small business owners and startups, the mere mention of financial statements can conjure up images of complex spreadsheets and intimidating jargon. But what if there was a simpler way?

Indeed, understanding your financial performance doesn’t have to be a headache. The key lies in utilizing the right tools, and among the most valuable is a well-structured Profit and Loss statement, often simply called a P&L. If you’ve been looking for a straightforward approach to track your income and expenses, you’re in the right place. We’ll explore how an intuitive profit and loss easy form template can be your best friend in navigating the financial landscape of your business with clarity and confidence.

Demystifying Your Finances: The Power of a P&L Statement

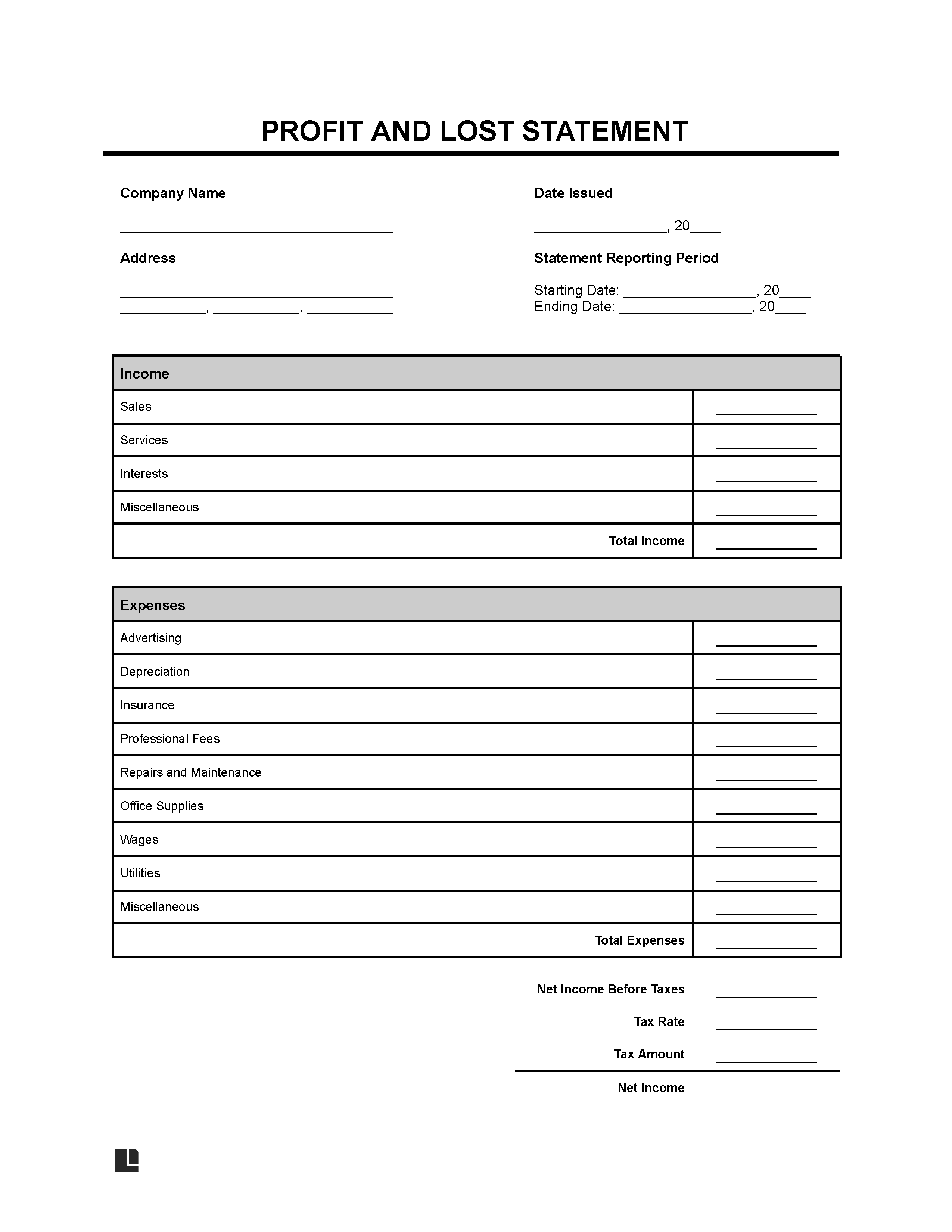

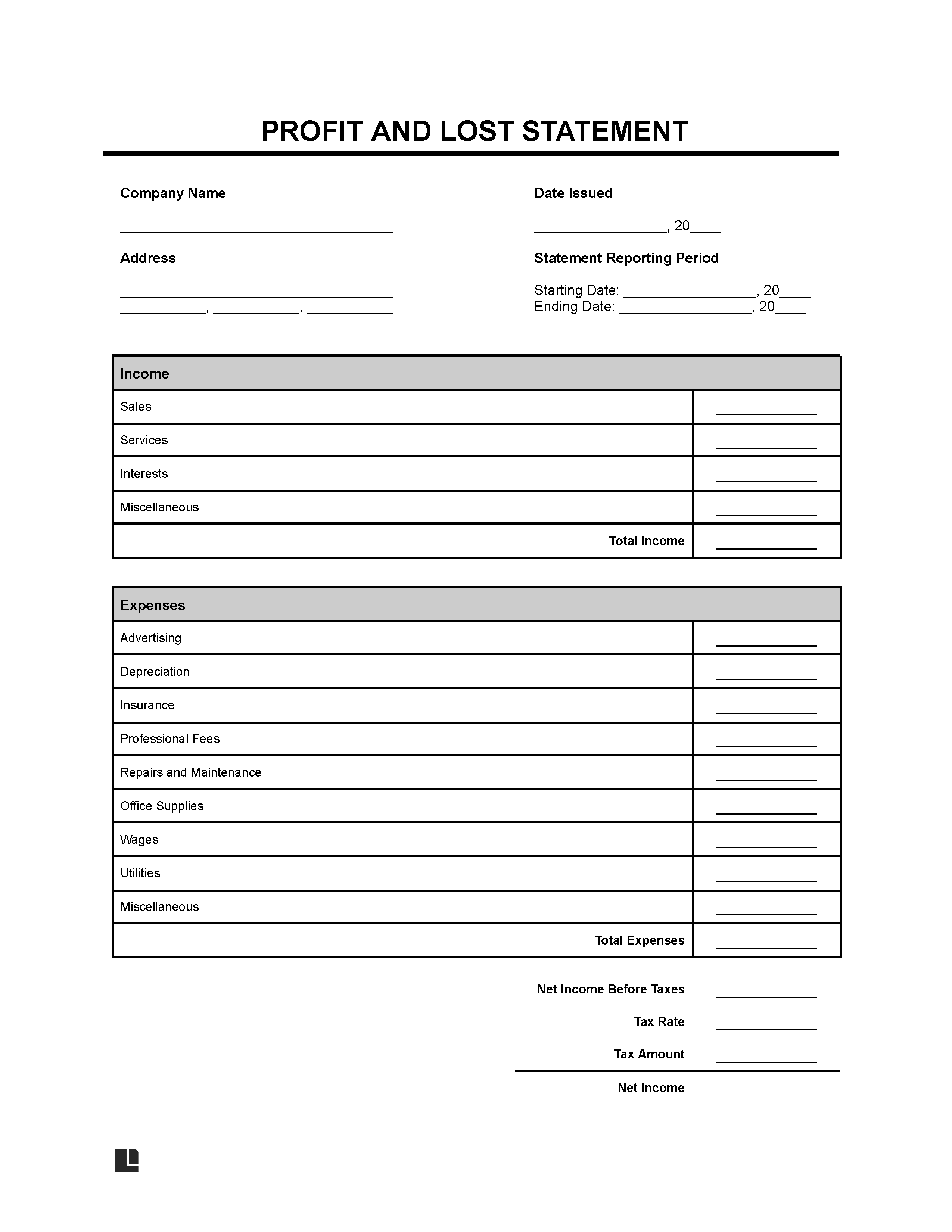

At its core, a Profit and Loss statement, also known as an Income Statement, is a financial report that summarizes the revenues, costs, and expenses incurred during a specific period—usually a quarter or a fiscal year. It provides a clear picture of a company’s financial performance by showing how net income (profit or loss) is derived. Think of it as a scorecard for your business’s financial health during that given time frame.

The importance of regularly reviewing your P&L cannot be overstated. It’s not just a document for tax season; it’s a vital tool for making informed business decisions. By examining your P&L, you can identify revenue trends, pinpoint areas where expenses are higher than expected, assess the profitability of different products or services, and even make crucial adjustments to your pricing strategy or operational costs. Without this insight, you’re essentially flying blind in the competitive market.

Key Components of a P&L

While the overall concept is simple, a P&L statement is built from several crucial components that work together to reveal your true financial standing. Understanding each part is essential for interpreting the final numbers correctly and making effective business decisions.

- Revenue: This is the total amount of money your business earns from its sales of goods or services before any expenses are deducted. It’s the top line of your statement.

- Cost of Goods Sold (COGS): These are the direct costs attributable to the production of the goods or services sold by a company. This might include the cost of materials and direct labor.

- Gross Profit: Calculated by subtracting COGS from Revenue. This figure shows how much profit your business makes from its core operations before other expenses are taken into account.

- Operating Expenses: These are the costs incurred in the day-to-day running of your business that are not directly related to producing your goods or services. Examples include rent, utilities, salaries, marketing, and administrative costs.

- Net Income: This is your final profit or loss. It’s calculated by taking your Gross Profit and subtracting all operating expenses, interest, and taxes. A positive net income means profit, while a negative one indicates a loss.

Each of these components plays a critical role in painting the complete picture of your financial performance. By breaking down your finances into these distinct categories, you gain clarity that helps you understand where your money is going and where your profits are coming from. Having a clear **profit and loss easy form template** makes this entire process intuitive and less intimidating, allowing you to focus on growing your business rather than wrestling with complicated numbers.

A consistent review of these elements empowers you to identify inefficiencies and capitalize on strengths, ultimately leading to better strategic planning for the future of your enterprise. It’s about turning raw financial data into actionable insights.

Practical Steps to Utilizing an Easy P&L Template

Now that you understand the importance and components of a P&L, let’s talk about putting it into practice with an easy template. The good news is you don’t need expensive software or an accounting degree to get started. Many effective profit and loss templates are built right into common spreadsheet programs like Microsoft Excel or Google Sheets, offering a familiar and user-friendly environment.

Begin by choosing a template that aligns with your business’s complexity. For most small businesses, a straightforward layout with clear sections for income and various expense categories will suffice. You can find numerous free templates online, or even create your own simple version by setting up columns for dates, descriptions, income, and various expense types.

The key to making your P&L template effective is consistency and accuracy. Make it a habit to record every transaction, no matter how small. Whether it’s a sale, an invoice paid, or a utility bill, enter it into the appropriate category. Doing this regularly, perhaps weekly or monthly, prevents a backlog of data entry and ensures your figures are always up-to-date and reliable. The more accurate your input, the more valuable your P&L insights will be.

Once you’ve diligently populated your profit and loss easy form template for a period, the real magic happens during the review process. Don’t just look at the final profit or loss number. Dive deeper. Are your sales growing? Are certain expenses unexpectedly high? Can you identify any seasonal trends in your revenue or costs? This analysis helps you spot opportunities for improvement, such as negotiating better deals with suppliers, cutting unnecessary spending, or even re-evaluating your product pricing.

Moreover, comparing your P&L statements over different periods—month-over-month or quarter-over-quarter—can reveal significant patterns. Are you consistently profitable, or do you have periods of loss? Identifying these patterns allows you to forecast future financial performance and plan accordingly, perhaps by building up reserves during strong periods to cushion weaker ones.

Embracing a simple P&L template transforms financial management from a daunting task into an accessible and empowering routine. It provides the clarity needed to make confident decisions and steer your business toward sustained growth and profitability.

Taking control of your business’s financial health doesn’t have to be overwhelming. By utilizing a clear and easy-to-understand Profit and Loss template, you gain invaluable insights into where your money comes from and where it goes. This essential financial tool empowers you to track performance, identify trends, and make informed decisions that drive your business forward.

With a simplified approach to tracking income and expenses, you can spend less time worrying about complex accounting and more time focusing on what you do best: building a successful and thriving enterprise. Start today, and watch your understanding of your business’s financial heartbeat grow.