Planning for the future is one of the most thoughtful things you can do for yourself and your loved ones. Life is unpredictable, and while we hope for the best, being prepared for unexpected circumstances can provide immense peace of mind. One crucial tool in this preparation is a Power of Attorney (POA), a legal document that allows you to designate someone to make decisions on your behalf if you become unable to do so. It’s about ensuring your affairs, whether financial or medical, are handled according to your wishes, even when you can’t speak for yourself.

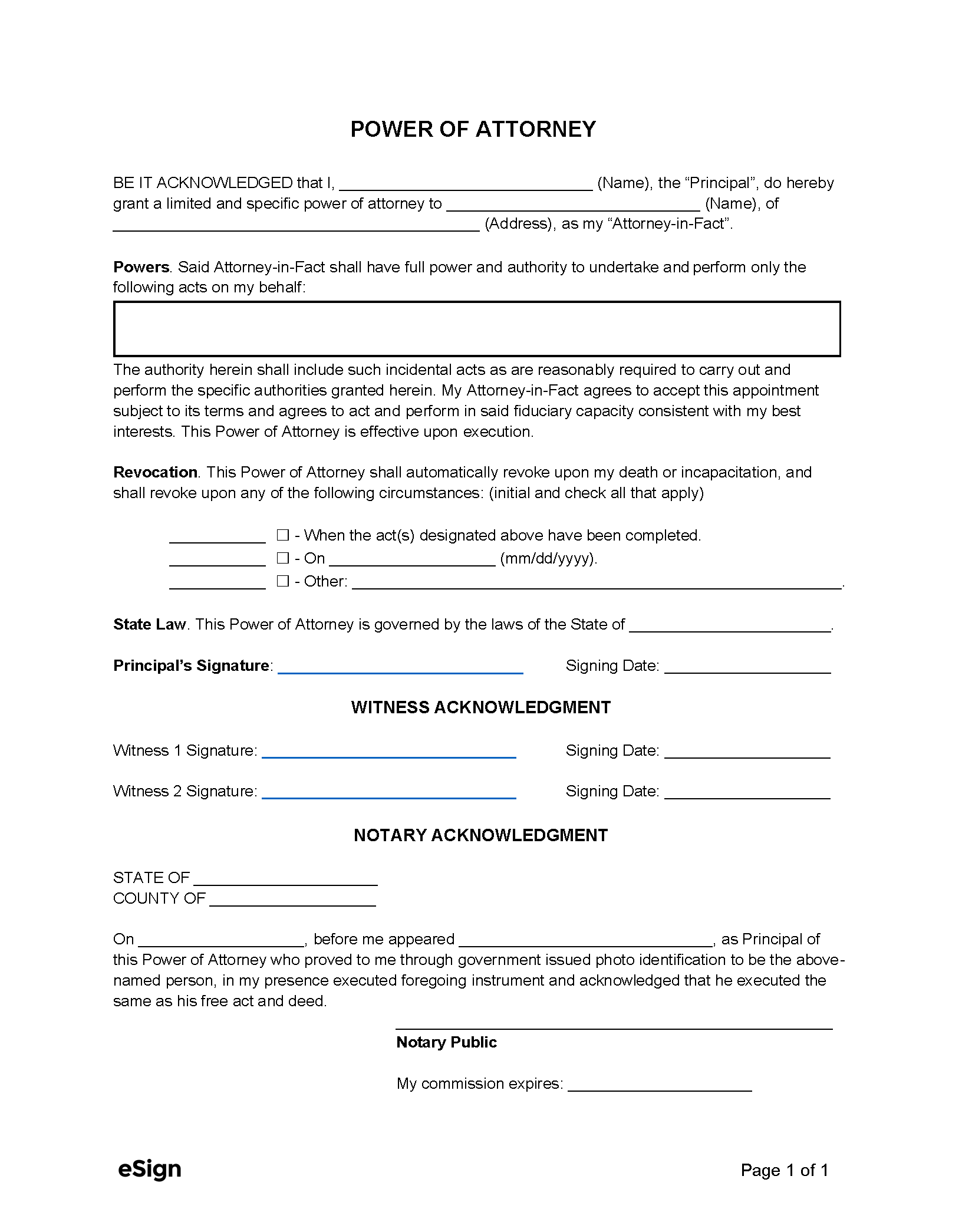

Understanding the ins and outs of creating such a document might seem daunting, but it doesn’t have to be. Many people find themselves wondering where to begin, what information is needed, and how to ensure the document is legally sound. This is where a readily available power or attorney form template can be incredibly helpful, offering a structured starting point to navigate this important legal process.

Understanding the Essentials of a Power of Attorney

A Power of Attorney is a legal instrument that grants one person (the “agent” or “attorney-in-fact”) the authority to act on behalf of another person (the “principal”) in specified matters. This authority can be broad or very specific, covering everything from managing bank accounts and paying bills to making healthcare decisions. The core purpose is to provide a legal framework for someone to step in and manage your affairs if you are incapacitated, or even if you simply need assistance with certain tasks while you are still capable.

The roles are distinct: you, as the principal, are the one granting the authority, and your agent is the person who will act on your behalf. Choosing your agent is a critical decision; it should be someone you trust implicitly, who understands your wishes, and is capable of handling the responsibilities. This person doesn’t necessarily have to be a lawyer, despite the term “attorney-in-fact.” They are simply acting as your legal representative for the specified powers.

There are different types of POAs, each designed for specific situations. A “general power of attorney” grants broad authority for a wide range of financial matters, while a “limited power of attorney” restricts the agent’s authority to specific tasks or a specific time frame, like selling a particular property. A “durable power of attorney” remains effective even if the principal becomes incapacitated, which is often the most critical type for long-term planning. Lastly, a “springing power of attorney” only becomes effective upon the occurrence of a specific event, like a doctor’s certification of your incapacity. Understanding these distinctions is vital for choosing the right path for your needs.

Navigating these different types and ensuring you include all necessary provisions can be complex. This is precisely why a reliable power or attorney form template can be an invaluable asset. It guides you through the necessary sections, ensuring you consider the scope of authority, duration, and specific conditions that align with your intentions, helping you create a document that is both comprehensive and legally sound for your state.

Key Elements to Look For

When selecting or utilizing a power or attorney form template, pay close attention to these critical components:

- Clear identification of the principal and the agent, including their full legal names and addresses.

- A precise description of the powers being granted, ensuring they are specific enough to cover all necessary areas without being overly broad if you intend a limited POA.

- The effective date of the power of attorney and any conditions under which it might terminate or become effective (as with a springing POA).

- Provisions for successor agents, in case your primary agent is unable or unwilling to serve.

- Clear clauses regarding the revocation of the power of attorney, outlining how you can cancel it if your circumstances or wishes change.

Navigating the Process with a Template

Using a power or attorney form template can significantly simplify what might otherwise feel like a daunting legal task. These templates are typically designed to cover the fundamental elements required for a valid POA, providing a framework that you can then customize to fit your unique circumstances. Instead of starting from scratch, you have a solid foundation, allowing you to focus on the specifics of your intentions rather than the structural intricacies of legal drafting.

When you obtain a template, your next step involves carefully reviewing each section. You’ll need to accurately fill in your personal details, clearly name your chosen agent and any successor agents, and meticulously define the scope of authority you wish to grant. This is where you decide if your agent can manage all financial transactions, or just specific ones, or if they are authorized to make healthcare decisions on your behalf. Take your time with this part; precision is key to ensuring your wishes are honored.

It’s crucial to remember that while a template provides a great starting point, laws regarding Powers of Attorney can vary significantly from state to state. What is valid in one state might require additional clauses or different execution formalities in another. Therefore, after you’ve customized your power or attorney form template, it’s highly recommended to have it reviewed by a legal professional in your state. This step helps ensure compliance with local laws, validates the document’s effectiveness, and can prevent potential challenges in the future.

While a power or attorney form template offers convenience and a cost-effective solution for many, it’s essential to use them wisely. Avoid making significant alterations to the core legal language without professional advice, and always ensure the document is properly executed – which typically involves signing in front of witnesses and a notary public. These steps are vital for the document to be legally recognized and enforceable when it’s needed most, safeguarding your interests and providing clear guidance for your chosen agent.

- Ensure the template is compliant with your state’s specific laws regarding Powers of Attorney.

- Have the completed document properly witnessed and notarized, as required by your jurisdiction.

- Communicate openly and thoroughly with your chosen agent about your wishes and the responsibilities involved.

- Keep the original executed document in a safe, accessible place, and provide copies to your agent and other key parties like your doctor or financial institutions.

Taking the proactive step to create a Power of Attorney is a testament to thoughtful planning and responsibility. It ensures that your affairs will be managed by someone you trust, according to your directives, should you ever be unable to manage them yourself. This foresight can prevent potential family disputes, simplify complex situations, and provide a clear path forward during challenging times.

Ultimately, having a well-drafted Power of Attorney in place is about securing peace of mind. It’s knowing that no matter what life throws your way, your healthcare wishes will be respected, your finances will be managed, and your legacy will be protected. It’s a gift of clarity and security, not just for yourself, but for those you care about most.