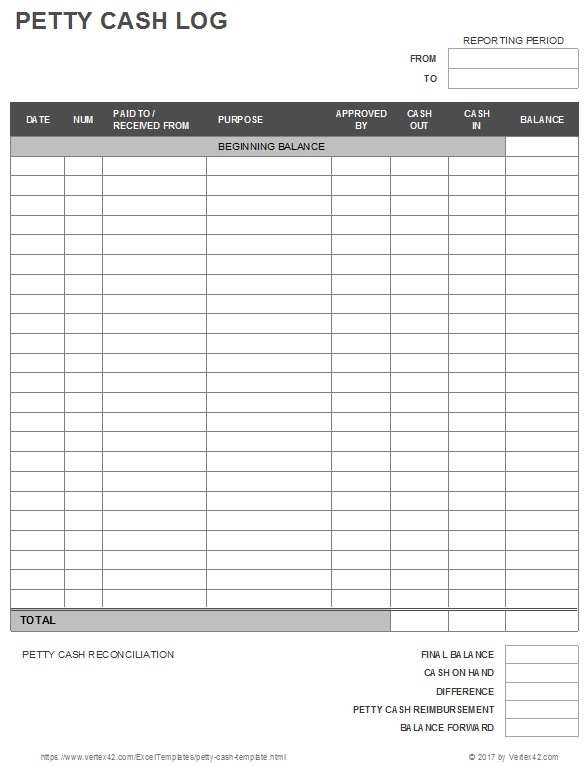

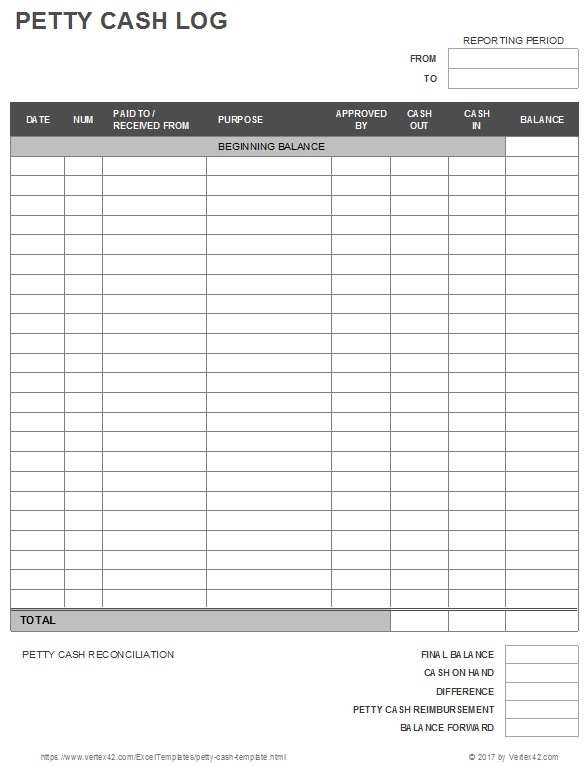

Managing small, everyday cash expenses in any business, big or small, can sometimes feel like trying to catch smoke. Whether it’s for office supplies, postage, an impromptu team lunch, or a quick reimbursement, these minor outgoings can quickly add up and become surprisingly difficult to track. Without a proper system in place, you might find yourself scratching your head at the end of the month, wondering where all the petty cash went and how to accurately account for it. It’s a common challenge, but thankfully, there’s a straightforward solution that brings clarity and control to your cash flow.

This is where a well-designed petty cash summary form template becomes an absolute lifesaver. Instead of relying on scraps of paper, mental notes, or vague receipts, a dedicated form provides a structured way to document every single transaction. It’s not just about tracking expenses; it’s about ensuring accountability, simplifying reconciliation, and providing a clear audit trail. With a standardized template, anyone can easily log transactions, making the process consistent and much less prone to errors or forgotten details.

Why a Petty Cash Summary Form is Your Best Financial Friend

A petty cash summary form is essentially a detailed record-keeping tool that helps you manage the small amounts of cash kept on hand for minor, day-to-day expenditures. Think of it as a mini-ledger specifically for your petty cash fund. Its primary purpose is to provide a transparent and accurate account of every dollar that goes in and out, preventing discrepancies and making financial reporting a breeze. Without it, you might find your petty cash drawer looking like a black hole, with money disappearing without a trace, leading to frustration and potential financial inaccuracies.

This form serves multiple crucial functions. Firstly, it ensures accountability. Every time cash is disbursed, the transaction is logged, detailing who received the money, for what purpose, the amount, and the date. This creates a clear trail that can be easily reviewed. Secondly, it simplifies the process of reconciling your petty cash fund. At the end of a period, or when the fund needs replenishing, you can quickly total the expenses recorded on the form and compare it to the remaining cash, ensuring everything balances out. This proactive approach helps identify errors or discrepancies much faster than waiting until month-end.

Moreover, using a consistent petty cash summary form template brings a sense of order and professionalism to your financial operations, no matter how small your business. It transforms what could be a messy, confusing task into a streamlined, routine procedure. This consistency is invaluable when it comes to financial audits, tax preparations, or simply understanding your spending habits better. It’s a foundational piece of good financial hygiene that every organization should adopt to maintain control over its resources.

Key Elements of a Good Petty Cash Summary

A truly effective petty cash summary form template should include specific fields to capture all necessary information. Here are the crucial components you should look for:

- **Date of Transaction:** When the cash was disbursed.

- **Recipient/Payee:** Who received the money.

- **Description of Expense:** A brief but clear explanation of what the money was used for (e.g., “stamps,” “coffee supplies,” “courier service”).

- **Category of Expense:** If applicable, categorize the expense for easier accounting (e.g., “Office Supplies,” “Travel,” “Meals”).

- **Amount Disbursed:** The exact amount of cash handed out.

- **Receipt Attached (Yes/No):** A checkbox to confirm if a supporting receipt was provided and attached.

- **Balance Forward/Remaining:** To track the running total of the petty cash fund.

- **Prepared By/Authorized By:** Spaces for signatures to ensure accountability.

Having these fields ensures that all vital details are captured, making the form comprehensive and useful for financial tracking.

Making Your Petty Cash Summary Work for You

Implementing a petty cash summary form template into your daily operations is a straightforward process that yields significant benefits. The key is consistency and accuracy. Every time cash is taken from the petty cash fund, the corresponding entry should be made immediately. Don’t wait until the end of the day or week, as details can easily be forgotten or receipts misplaced. This real-time logging is crucial for maintaining an accurate and reliable record of all petty cash movements.

Beyond just filling out the form, ensure that all supporting documentation, such as receipts or invoices, are attached to the corresponding entry. This practice provides tangible proof for each expense and is vital for auditing purposes. Think of the form as the index and the receipts as the detailed chapters of your petty cash story. If a receipt isn’t available, make a clear note on the form explaining why and ensure the description of the expense is as detailed as possible.

Regular reconciliation is another vital step in making your petty cash system effective. Periodically, perhaps weekly or bi-weekly, or whenever the fund needs replenishing, take the time to count the remaining cash and compare it to the running balance on your summary form. The sum of the cash on hand plus the total of recorded expenses should always equal the initial petty cash float. If there’s a discrepancy, this immediate reconciliation allows you to investigate and resolve it quickly, preventing small errors from snowballing into larger problems.

Adopting a robust petty cash summary form template is more than just good practice; it’s a smart financial move. It simplifies the often-tedious task of tracking minor expenditures, freeing up your time and mental energy for more significant business matters. By maintaining meticulous records, you not only ensure accurate financial reporting but also foster a culture of transparency and accountability within your organization, no matter its size.

Taking control of your petty cash today with a clear, easy-to-use system will undoubtedly lead to greater financial clarity and peace of mind down the line. It’s a small change that makes a big difference in the grand scheme of your financial health.