In many businesses, especially small to medium-sized ones, the need for quick access to a small amount of cash for minor, day-to-day expenses is a common reality. Whether it is for office supplies, postage, or an impromptu client lunch, petty cash serves as a convenient fund for these incidental costs. However, managing this physical cash can quickly become a source of confusion, potential discrepancies, and even disputes if not handled with precision and a clear process. Without a proper system in place, tracking who has what, when it was given, and for what purpose can turn into a headache for accounting and management alike.

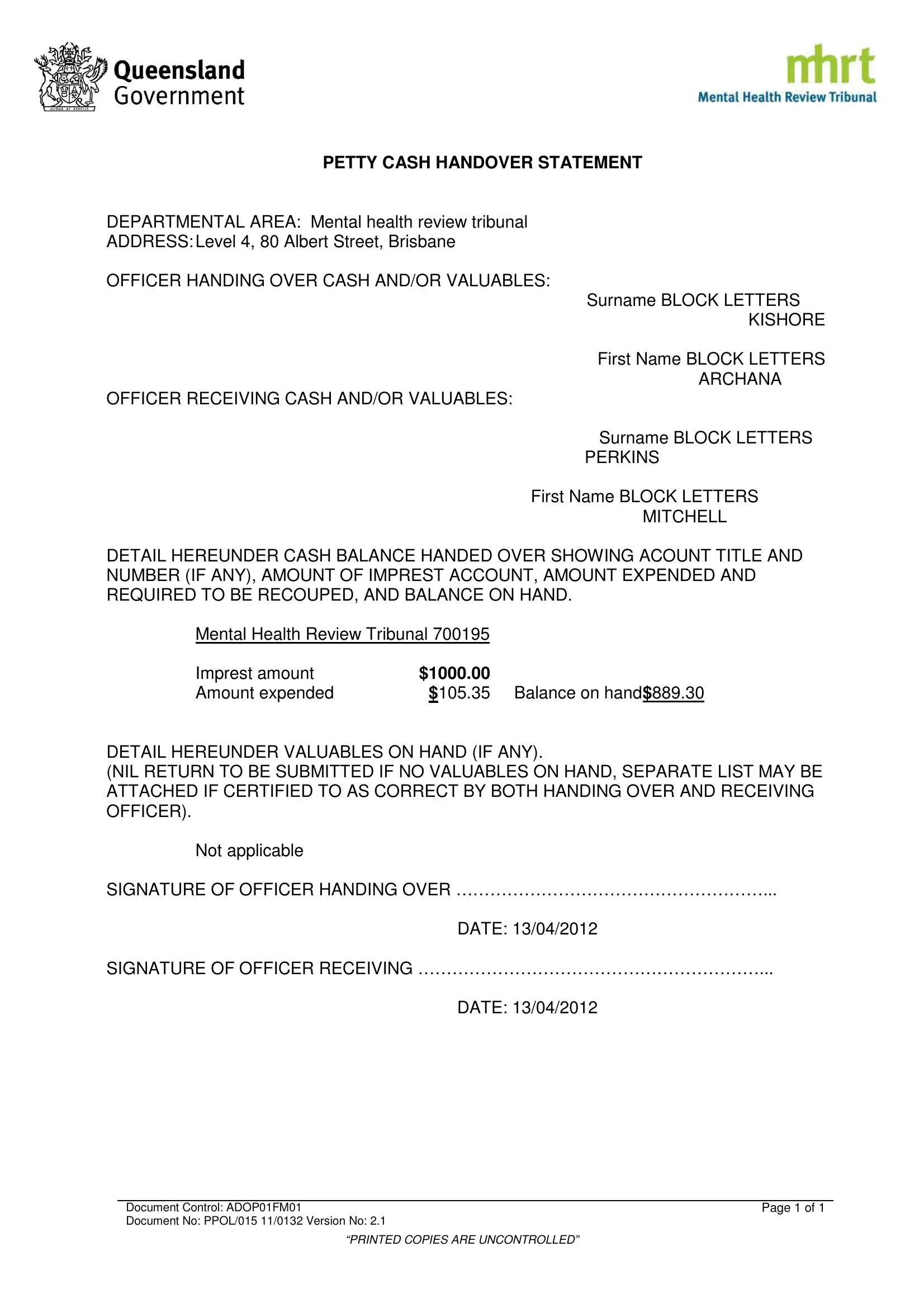

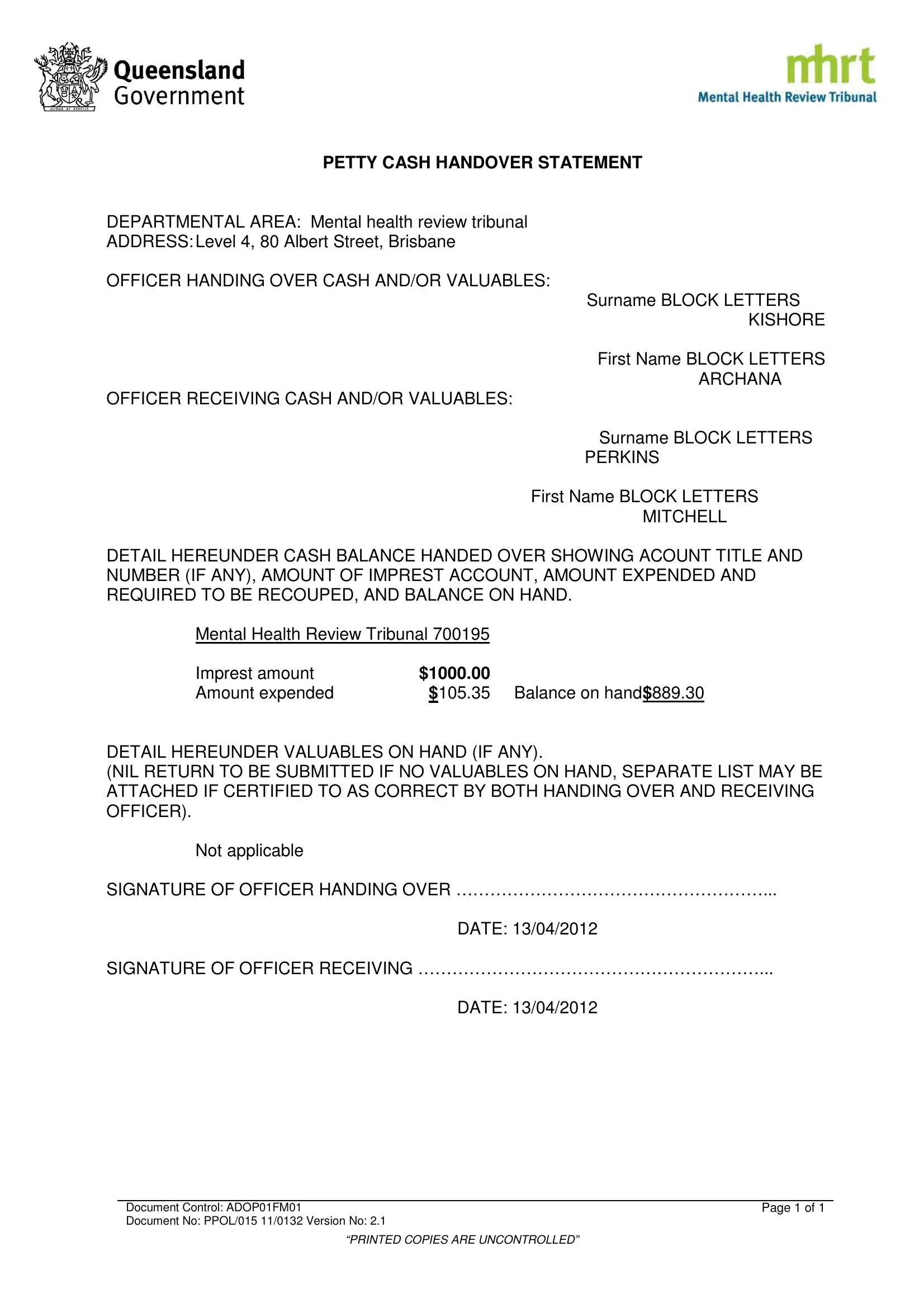

This is where a robust and reliable system comes into play, and a well-designed petty cash handover form template is the cornerstone of such a system. It provides the necessary structure and documentation to ensure that every transaction, every transfer of funds, is transparent, accountable, and easily traceable. By formalizing the process of passing petty cash from one custodian to another, or from the main fund to an employee for a specific expense, you create a paper trail that eliminates guesswork and promotes financial integrity within your organization.

Why a Petty Cash Handover Form Template is Your Best Friend

Implementing a structured approach to managing your petty cash isn’t just about ticking a box; it’s about establishing financial control and peace of mind. Think about it: without a clear record, it is incredibly easy for small amounts to go unaccounted for, leading to discrepancies that can be time-consuming and frustrating to resolve. A proper form acts as a safeguard, ensuring that all parties involved are aware of their responsibilities and the exact nature of the transaction. It brings a level of professionalism and order to what might otherwise be a chaotic aspect of your business finances.

One of the primary benefits of using a dedicated form is the immediate boost in accountability and transparency. When an employee takes a sum of petty cash, or when the fund itself changes hands, having a signed document detailing the transaction leaves no room for ambiguity. Both the giver and the receiver acknowledge the transfer, reducing the likelihood of miscommunication or accusations of misuse. This fosters an environment of trust and responsibility among staff, knowing that all financial movements are documented and reviewable.

Moreover, a well-designed form significantly reduces the potential for errors and helps prevent disputes before they even arise. Imagine trying to reconcile a petty cash fund at the end of the month with a collection of scribbled notes or, worse, no records at all. It is a recipe for frustration. With a standardized petty cash handover form template, all essential information is captured uniformly, making reconciliation a breeze. Any discrepancies can be quickly traced back to their source, allowing for swift resolution rather than prolonged investigation.

Beyond internal management, having meticulous records of petty cash transactions is crucial for compliance and audit readiness. Financial audits, whether internal or external, require clear documentation of all monetary movements. A complete set of handover forms demonstrates due diligence and adherence to sound financial practices, making the audit process smoother and less stressful. It showcases your commitment to maintaining accurate financial records, which is essential for the overall health and credibility of your business operations.

Key Elements to Look For in Your Template

- Date and Time of Handover: Essential for chronological record-keeping.

- Amount of Cash Handed Over: Clearly stating the exact numerical value.

- Purpose of Handover: A brief but clear description of why the cash is being exchanged (e.g., “for office supplies,” “fund replenishment”).

- Name and Signature of Sender/Giver: The person releasing the cash.

- Name and Signature of Recipient/Receiver: The person taking responsibility for the cash.

- Remaining Petty Cash Balance (Optional but Recommended): Helps in real-time tracking of the fund’s status.

Implementing and Maximizing Your Petty Cash Process

Once you have a fantastic petty cash handover form template in hand, the next step is to seamlessly integrate it into your daily operations. This isn’t just about printing out a stack of papers; it’s about creating a smooth, user-friendly process that encourages compliance without being overly burdensome. Start by designating a clear custodian for the petty cash fund. This individual will be responsible for maintaining the fund, disbursing cash, and ensuring the form is properly completed for every transaction. Consistency is key, so make sure everyone understands their role.

A vital part of successful implementation involves training your staff. It is not enough to simply provide the forms; employees need to understand why the forms are important and how to fill them out correctly. Hold a brief session explaining the new procedure, demonstrating how to complete the form, and emphasizing the benefits of accurate record-keeping for both the individual and the company. When staff understand the “why,” they are much more likely to embrace the “how,” leading to higher adoption rates and fewer errors in documentation.

Regular reconciliation and review of the petty cash fund are absolutely non-negotiable. This means periodically checking the physical cash against the sum of all documented transactions and the initial fund amount. This reconciliation process, ideally conducted weekly or bi-weekly, helps catch any discrepancies early on, making them easier to investigate and rectify. It also reinforces the importance of the handover form, as it serves as the primary tool for this reconciliation. Consistency in these reviews maintains the integrity of the fund.

Consider how you will store and manage these completed forms. While physical forms are great for immediate documentation, digitizing them can offer long-term benefits for accessibility and security. You might scan the completed forms and store them securely in a cloud-based system, linking them to your accounting software if possible. This not only saves physical storage space but also allows for easy retrieval during audits or when analyzing spending patterns. Regardless of whether you go digital or stick to paper, ensure the forms are stored in a secure location where they can be easily accessed by authorized personnel but protected from loss or damage.

- Keep the process simple and clear.

- Provide easy access to the forms.

- Train all relevant staff thoroughly.

- Conduct regular, scheduled reconciliations.

- Store completed forms securely for audit trails.

Adopting a systematic approach to petty cash management, especially by utilizing a well-crafted petty cash handover form template, transforms what could be a messy affair into an organized and efficient process. It instills confidence in your financial records, protects your assets, and fosters a culture of accountability throughout your organization. This small but significant step ensures that every penny is accounted for, providing clarity and accuracy for your financial statements.

Ultimately, streamlining your petty cash operations with proper documentation frees up valuable time and resources that might otherwise be spent chasing down missing receipts or reconciling confusing figures. It contributes to a more robust financial infrastructure, allowing your business to focus on its core activities with greater peace of mind, knowing that even the smallest financial transactions are handled with the utmost care and precision.