In the bustling world of business, it’s easy to overlook the small stuff. Yet, those seemingly insignificant everyday expenditures – a quick coffee run for an impromptu client meeting, a few stamps for urgent mail, or office supplies needed in a pinch – can quickly add up. These are the lifeblood of petty cash, the small fund kept on hand for minor expenses that don’t warrant a full check or bank transfer. While crucial for smooth operations, managing this fund without a proper system can lead to headaches, lost receipts, and even financial discrepancies.

That’s where a reliable petty cash bookkeeping form template comes into play. It’s not just about tracking money; it’s about bringing clarity and accountability to every small outflow. Imagine a world where every penny is accounted for, every transaction is transparent, and reconciling your petty cash fund is a breeze. This isn’t just wishful thinking; it’s entirely achievable with the right tools and a little organizational effort.

Why Every Business Needs a Solid Petty Cash Tracking System

Without a structured approach, petty cash can become a black hole. Receipts vanish, amounts are forgotten, and before you know it, you’re scratching your head trying to figure out where a significant portion of your cash went. This lack of oversight isn’t just an administrative nuisance; it can create serious problems during audits, lead to internal control weaknesses, and make financial reporting a nightmare. Every business, regardless of size, stands to benefit immensely from a dedicated system for tracking these small but frequent expenditures.

The beauty of implementing a structured system lies in the transparency and accountability it brings. When every petty cash transaction is meticulously recorded, it fosters trust, minimizes errors, and makes it incredibly simple to reconcile your fund at any given moment. This means less time spent scrambling for information and more time focusing on what truly matters: growing your business. It also provides a clear paper trail, essential for both internal reviews and external audits, ensuring that your financial records are always clean and compliant.

So, what exactly makes a good petty cash bookkeeping form template effective? It’s all about capturing the right information in a clear, consistent manner. A well-designed template acts as a comprehensive log, ensuring no detail is missed and every transaction is justified. It should be user-friendly enough for anyone to fill out, yet robust enough to provide all the necessary data for accurate accounting. Think of it as your petty cash diary, detailing every entry and exit from your small fund.

Key Elements of an Effective Petty Cash Form

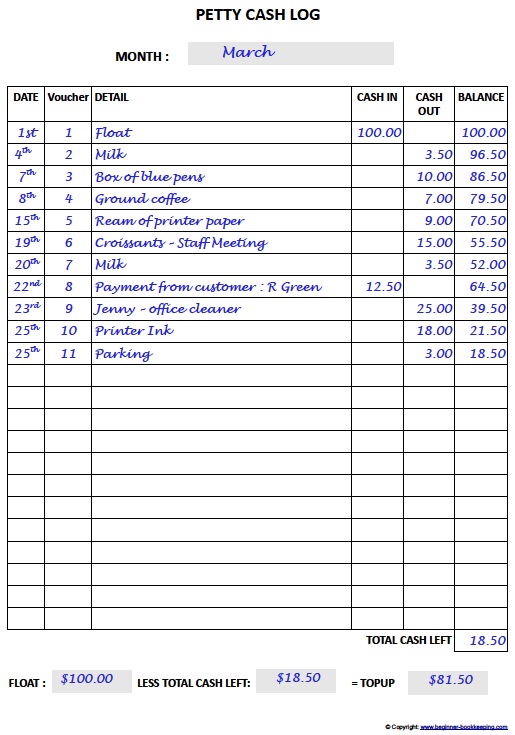

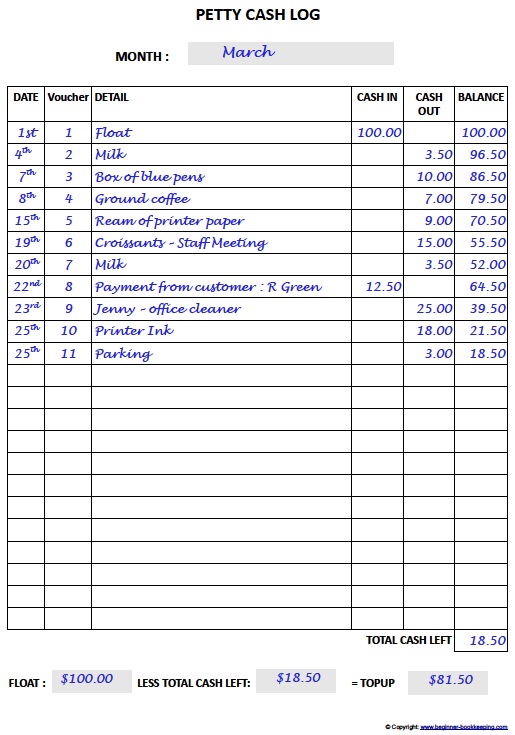

- Clear date and time of transaction: Pinpointing exactly when the expenditure occurred.

- Detailed description of expenditure: What was purchased or for what purpose was the cash used? Specificity here is key.

- Amount spent: The exact monetary value of the transaction.

- Recipient or vendor name: Who received the cash, or from where was the item purchased?

- Account or expense category: Classifying the expense (e.g., office supplies, travel, postage) for easier budgeting and tax purposes.

- Signature of recipient and/or approver: Crucial for accountability and verifying the transaction.

- Running balance: A live tally of the remaining cash in the fund after each transaction.

By including these essential elements, a petty cash bookkeeping form template transforms a simple piece of paper into a powerful financial tool. It helps prevent miscommunications, reduces the potential for fraud or misuse, and ensures that your financial records are always up-to-date and accurate. This level of detail isn’t just for large corporations; even the smallest startup will find immense value in maintaining such meticulous records for their minor cash outflows.

Implementing Your Petty Cash Bookkeeping Form Template with Ease

Getting started with a new petty cash system doesn’t have to be complicated. The first step is to establish a clear policy for how petty cash will be used, who will manage it, and what the limits are for individual transactions. Once these guidelines are in place, introducing a standardized petty cash bookkeeping form template becomes a natural progression. You’ll want to ensure that everyone who might need to use the petty cash fund understands the new process and the importance of filling out the form completely and accurately for every withdrawal.

When it comes to the petty cash bookkeeping form template itself, you have several options. You might opt for a physical ledger or pre-printed forms for a more traditional, hands-on approach. Alternatively, many businesses find success with digital templates, such as a spreadsheet in Excel or Google Sheets, which offers easy calculations and digital storage. Some even integrate it into their existing accounting software for seamless tracking. The best choice often depends on your business’s size, the volume of petty cash transactions, and your existing technological infrastructure.

Consistency is key to the success of any petty cash system. Make it a routine to reconcile your petty cash fund regularly – daily or weekly, depending on usage. This involves counting the physical cash, comparing it to the running balance on your petty cash bookkeeping form template, and ensuring all receipts are attached to their corresponding entries. Any discrepancies should be investigated immediately. Establishing a petty cash custodian who is responsible for the fund’s management and reconciliation can also greatly improve oversight and accountability within your organization.

By diligently using your chosen petty cash bookkeeping form template and adhering to your established policies, you’ll find that managing small expenses becomes an efficient and stress-free part of your financial routine. This streamlined approach not only simplifies daily operations but also significantly eases the burden of month-end closing procedures and prepares your business for any financial review or audit with confidence. It’s a small investment of time that yields substantial dividends in financial accuracy and peace of mind.

Adopting a well-structured approach to managing those everyday expenditures is more than just good practice; it’s a fundamental aspect of sound financial management. By bringing order to the often-chaotic world of small cash transactions, you gain unparalleled clarity over your operational costs and ensure every penny is accounted for. This systematic discipline translates directly into stronger financial controls and a clearer picture of your business’s true financial health.

Ultimately, the effort invested in setting up and consistently utilizing a proper petty cash tracking system empowers your business with greater control and insight. It eliminates guesswork, minimizes errors, and ensures that even the smallest financial movements contribute positively to your overall organizational efficiency. This level of meticulousness strengthens your foundational accounting practices, paving the way for more informed decision-making and sustainable growth.