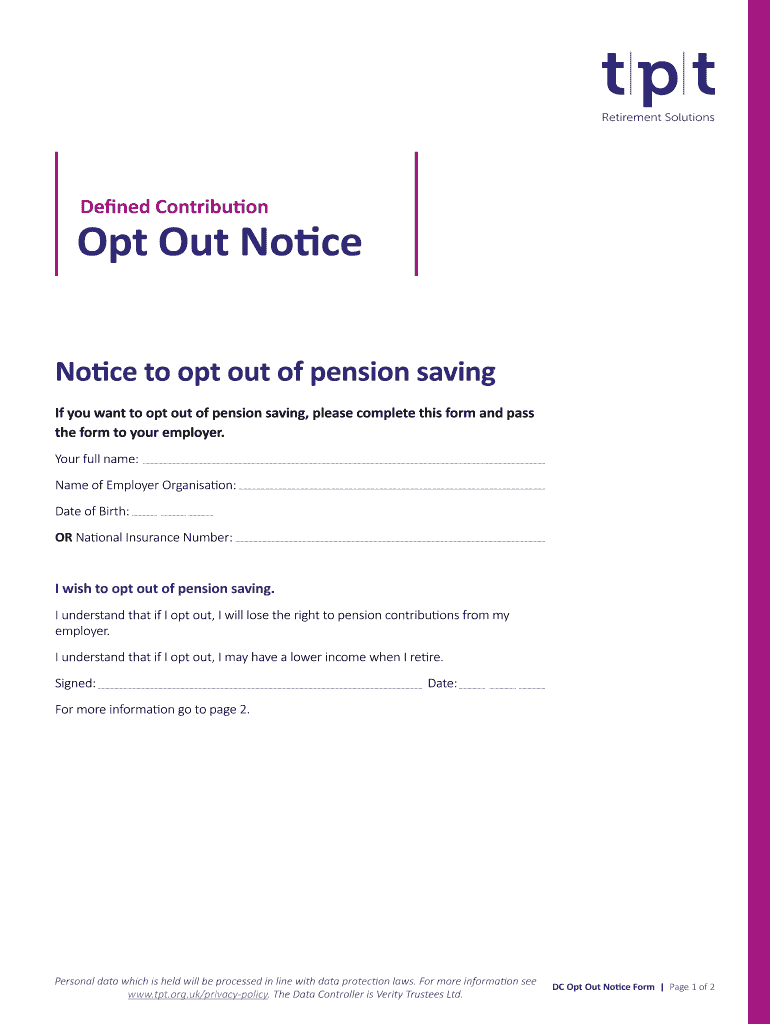

Navigating the world of workplace pensions can sometimes feel like stepping into a maze of acronyms and regulations. For employees, understanding how to actively participate in their company’s pension scheme is a crucial step towards securing their financial future. And for employers, providing a clear, straightforward path for this participation is not just good practice, it’s often a legal requirement. That’s where a reliable form comes into play, simplifying what might otherwise be a complex process.

An effective pension opt in form template serves as the bridge between an employee’s desire to save for retirement and the company’s system for facilitating those savings. It ensures all necessary information is captured accurately, from personal details to consent and understanding of the scheme’s terms. This document isn’t just a piece of paper; it’s a vital tool for compliance, clarity, and empowering individuals to take control of their long-term financial well-being.

Why a Standardized Pension Opt-In Form Matters

Having a well-designed and standardized form for employees to opt into their pension scheme is far more than just administrative tidiness; it’s a cornerstone of good governance and employee relations. Imagine the confusion if every employee had to verbally communicate their decision or if the necessary information varied from one person to the next. A consistent form removes ambiguity, ensuring that both the employee understands what they are signing up for, and the employer has a clear, documented record of consent.

Beyond just clarity, a proper pension opt in form template provides a layer of legal protection for employers. It demonstrates that the organization has provided a clear mechanism for employees to join the pension scheme, fulfilling their duties in areas like automatic enrolment and offering a pathway to participation for those who were previously opted out or not automatically enrolled. This documented process can be invaluable if ever questions arise regarding an employee’s pension status or contributions.

Furthermore, a professional and easy-to-understand form empowers employees. When faced with clear sections, plain language, and all necessary fields neatly laid out, an employee feels more confident in making an informed decision about their future savings. It reduces the likelihood of errors, missed information, or misunderstandings that could lead to frustration or administrative headaches down the line for all parties involved.

Ultimately, standardizing this crucial document streamlines the administrative workload significantly. New hires, re-enrolments, or those simply choosing to join the scheme can all follow the same clear process. This efficiency saves time, reduces the potential for human error, and allows HR and payroll teams to focus on other important tasks rather than constantly clarifying or re-collecting missing information.

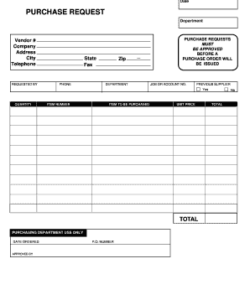

Key Elements to Include in Your Pension Opt-In Form

- Employee Personal Details: Full name, employee ID, contact information.

- Scheme Information: Name of the pension scheme, provider details.

- Opt-In Declaration: Clear statement of the employee’s intention to join the scheme.

- Understanding of Contributions: Information on employee and employer contribution rates.

- Consent and Authorization: Acknowledgment of terms, privacy consent for data processing.

- Date and Signature: Space for the employee’s signature and the date of their decision.

- Employer Information: Company name, contact, and perhaps a designated HR representative.

Designing Your Effective Pension Opt-In Form

Crafting a form that truly works for both your organization and your employees means thinking beyond just the required fields. The goal is to create a user-friendly experience that encourages participation and minimizes any friction points. Begin by considering the perspective of someone who might not be an expert in financial jargon. Is the language simple and direct? Are instructions clear without being patronizing? A good design makes the process feel approachable, not daunting.

Consider the format and accessibility of your form. While a physical paper form might still be preferred by some, offering a digital version can significantly enhance convenience and efficiency. A digital pension opt in form template, perhaps fillable PDF or an online portal, can streamline submission, reduce paper waste, and even automate parts of the data capture process, integrating directly with HR or payroll systems. Ensure it’s accessible across different devices and browsers.

Clarity in language cannot be overstressed. Avoid overly technical terms, or if they are necessary, provide clear explanations. For instance, rather than just stating “Defined Contribution Scheme,” you might add a brief sentence explaining what that means for the employee’s savings. The less ambiguity, the more confident an employee will feel about making this important financial decision. Think of it as a helpful guide rather than just a bureaucratic hurdle.

Finally, think about the distribution and storage of your completed forms. How will employees receive it? How will they submit it? And once submitted, how will it be securely stored and accessed for future reference, adhering to data protection regulations? A well-thought-out process from start to finish ensures that this crucial document serves its purpose effectively and remains compliant with all relevant legal requirements.

Implementing a well-crafted form is a subtle yet powerful way to demonstrate your organization’s commitment to employee well-being and financial security. It helps to demystify an important aspect of future planning, making it easier for everyone to take proactive steps towards retirement. By providing such a clear pathway, you’re not just handling paperwork; you’re fostering a culture of support and responsibility.