In the bustling world of business, efficiency is key, and managing employee paychecks is no exception. While direct deposit has become the norm for many, there are still countless situations where a physical paycheck needs to be picked up. Perhaps an employee doesn’t have a bank account, prefers a physical check, or is a temporary worker. In such instances, ensuring a smooth and secure handover is paramount, not just for the employee’s peace of mind but for the company’s financial integrity and audit trail.

This is precisely where a well-designed paycheck pick up form template becomes an invaluable asset. It’s more than just a piece of paper; it’s a safeguard, a record, and a professional tool that streamlines the entire process. By having a standardized form, businesses can ensure consistency, accountability, and proper documentation every time a paycheck changes hands, preventing potential disputes or lost wages.

The Indispensable Role of a Paycheck Pick Up Form

Think about the everyday operations of a busy office. Payday arrives, and suddenly, there’s a queue of employees, some perhaps sending a friend or family member, all looking to collect their hard-earned wages. Without a clear system, this can quickly descend into chaos, raising concerns about who received what, when, and from whom. A paycheck pick up form template eliminates this ambiguity by creating a clear, auditable trail from the moment the check is prepared to the instant it’s delivered.

Beyond simply tracking, these forms offer a layer of security that protects both the employer and the employee. They verify the identity of the person collecting the check, ensuring it doesn’t fall into the wrong hands. This is particularly crucial when an employee authorizes someone else to pick up their check on their behalf. The form acts as a legal authorization, releasing the company from liability once the check has been signed for by the authorized individual.

Furthermore, having a standardized template promotes consistency across the organization. Every department, every manager, and every employee understands the protocol, reducing confusion and miscommunication. It’s a professional touch that reflects an organized and responsible management style, showing employees that their compensation is handled with the utmost care and professionalism.

The benefits extend to compliance and record-keeping as well. Should there ever be a dispute regarding a paycheck, or an audit conducted by internal or external parties, these signed forms serve as irrefutable proof of delivery. They are a vital component of a robust payroll system, safeguarding against fraud and ensuring that all financial transactions are transparent and accounted for.

Key Advantages of Using a Standard Form

- Enhanced Security: Prevents unauthorized collection of paychecks.

- Clear Documentation: Provides an audit trail for every paycheck disbursed.

- Legal Protection: Acts as proof of delivery in case of disputes.

- Operational Efficiency: Streamlines the pickup process, reducing wait times and errors.

- Professional Image: Demonstrates an organized and meticulous approach to payroll.

Crafting Your Own Effective Paycheck Pick Up Form

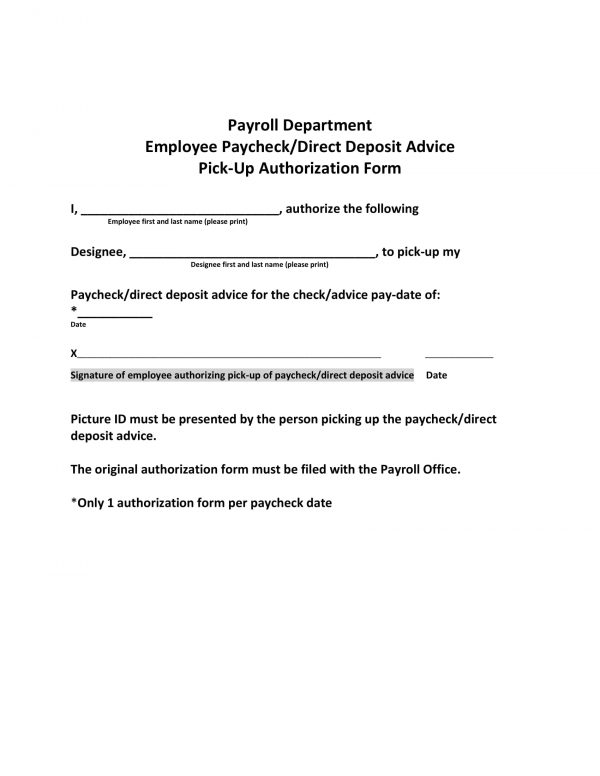

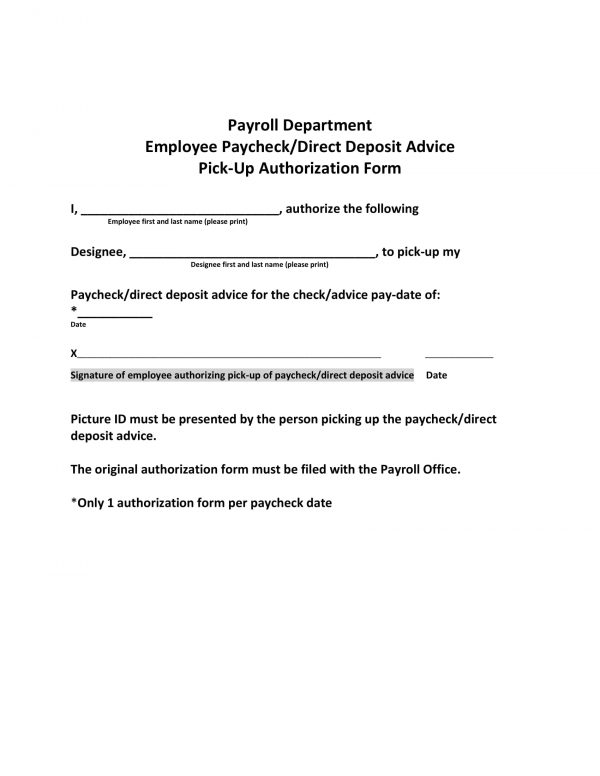

Creating an effective paycheck pick up form template doesn’t have to be complicated, but it does require including a few essential elements to ensure its utility and legal soundness. The goal is to capture all necessary information without making the form overly cumbersome. Start with the basics: identifying the employee whose paycheck is being collected. This should include their full name and employee ID number, ensuring there’s no confusion, especially in larger organizations with similar names.

Next, you’ll need a section for the person picking up the check. If it’s the employee themselves, they’ll simply sign and date it. However, if an authorized individual is collecting on their behalf, the form must clearly state this. This section should include the authorized person’s full name, their relationship to the employee (e.g., spouse, parent, friend), and a requirement for them to present a valid government-issued ID. You might even want to include a space for their ID number and issuing authority for an added layer of security and verification.

Crucially, the form needs to record details about the paycheck itself. This includes the pay period it covers and the date the paycheck is being picked up. A signature line for the recipient is absolutely non-negotiable; this is the core element that validates the handover. Additionally, a space for the company representative who hands over the check to sign and date provides further accountability, documenting who facilitated the transaction from the employer’s side.

Finally, consider including a brief disclaimer or authorization statement. This statement, often placed at the top or bottom of the form, can stipulate that by signing, the recipient acknowledges receipt of the paycheck and releases the company from further liability. This simple addition can significantly bolster the legal standing of your paycheck pick up form template, making it a comprehensive and reliable document for all your payroll needs.

- Employee Name and ID

- Pay Period Date

- Date of Pick Up

- Recipient’s Full Name

- Recipient’s Relationship to Employee (if not employee)

- Recipient’s Signature

- Company Representative’s Signature

- Space for ID Verification (e.g., Driver’s License Number)

Implementing a clear, standardized procedure for paycheck collection is a simple yet powerful step towards better business management. It significantly reduces the potential for errors, disputes, and security breaches, creating a more professional and trustworthy environment for everyone involved. By providing a consistent framework, companies can ensure that every employee receives their compensation securely and efficiently, building confidence and trust.

Ultimately, investing a little time into developing or adopting an effective form pays dividends in peace of mind, operational smoothness, and robust record-keeping. It’s a fundamental best practice for any organization that values precision, security, and a positive employee experience, ensuring that one of the most important aspects of employment is handled with the diligence it deserves.