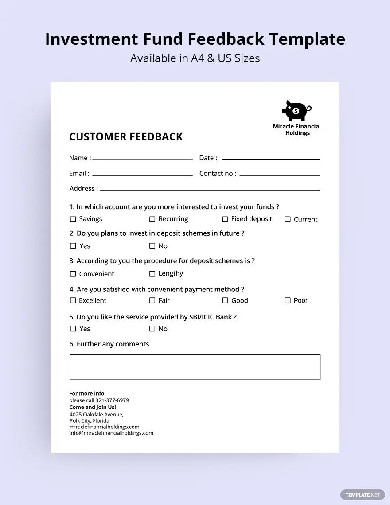

Embarking on the journey of investing is an exciting step towards financial growth and securing your future. Whether you are opening a brokerage account, a retirement fund, or a specialized investment vehicle, the process invariably begins with completing a series of forms. These documents are crucial for capturing all the necessary information, ensuring compliance with regulations, and setting up your account correctly from the start.

Navigating this initial paperwork can sometimes feel overwhelming, especially with the intricate details required for financial institutions. This is where a well-structured and comprehensive new investment account form template becomes incredibly valuable. It streamlines the onboarding process for both the investor and the financial firm, making it clearer, more efficient, and less prone to errors.

The Essentials of a Robust Investment Account Form Template

A carefully designed new investment account form template is more than just a collection of blank spaces to fill. It serves as the foundation for a successful client-advisor relationship and ensures all regulatory requirements are met. For financial institutions, it means efficient data collection, reduced processing times, and a professional image. For new investors, it offers clarity on the information needed and helps them understand what details are critical for their investment journey. This strategic approach to form design significantly improves the overall client experience right from the initial contact.

One of the primary benefits of a standardized template is the consistency it brings to data capture. In the financial sector, accurate and complete data is paramount for compliance, risk assessment, and personalized service. A template ensures that no critical piece of information is overlooked, from basic identity verification to complex financial declarations. It acts as a guide, prompting all necessary disclosures and certifications, thereby minimizing the chances of follow-up requests and delays caused by missing information. This leads to a smoother transition from prospect to active investor.

Furthermore, a well-thought-out form template contributes significantly to regulatory compliance. Financial institutions operate under strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, along with suitability requirements that mandate understanding a client’s risk tolerance and investment objectives. A robust new investment account form template integrates these requirements seamlessly, ensuring all necessary checkboxes are ticked and declarations are obtained. It acts as an audit trail, demonstrating due diligence in the client onboarding process.

Beyond the practical and regulatory aspects, the design of the form itself impacts the client’s perception of the institution. A clear, logically organized, and easy-to-understand form reflects professionalism and attention to detail. Conversely, a confusing or excessively long form can frustrate potential investors and even deter them from completing the process. Therefore, investing time in creating an intuitive and comprehensive new investment account form template is an investment in client satisfaction and operational efficiency.

Key Sections to Consider for Your Investment Account Form Template

Key Components to Include in Your Investment Account Form Template

When developing your own investment account form template, thinking about the comprehensive journey a new investor undertakes is crucial. Each section of the form should serve a clear purpose, contributing to the complete profile of the investor and ensuring the institution has all the data it needs to provide appropriate advice and manage the account diligently. It’s about creating a holistic view of the individual, not just collecting isolated pieces of information.

The initial sections should focus on establishing the investor’s identity and basic contact information. This is foundational for KYC compliance and for ensuring clear communication channels are established. Including fields for previous addresses, if recently moved, can also be beneficial for identity verification purposes. It helps cross-reference information and build a more complete picture, reducing the likelihood of fraudulent activities and ensuring compliance with financial regulations.

Moving beyond basic identification, the form should delve into the investor’s financial situation. This includes details about their income, expenses, and net worth. Understanding these aspects allows financial advisors to assess the investor’s capacity to invest and whether certain investment products are suitable for their current financial standing. It’s not just about how much money they have, but how that money fits into their overall financial picture and future plans.

Equally important are sections dedicated to investment objectives and risk tolerance. These elements are highly personalized and dictate the type of investment strategy and products that are appropriate for an individual. Clear, well-phrased questions can help investors articulate their goals, whether it’s long-term growth for retirement, saving for a down payment, or generating passive income. Gauging their comfort with risk ensures that they are not placed into investments that would cause undue stress or financial hardship during market fluctuations.

Finally, incorporating comprehensive beneficiary information and necessary disclosures is paramount. Beneficiary designations ensure that assets are distributed according to the investor’s wishes upon their passing, simplifying the estate planning process. The disclosure section, while often lengthy, protects both the investor and the institution by outlining terms, conditions, risks, and privacy policies. It ensures transparency and acknowledges that the investor understands the agreement they are entering into.

Crafting a detailed and user-friendly new investment account form template significantly streamlines the onboarding process for both financial institutions and their clients. It fosters transparency, ensures regulatory compliance, and sets the stage for a positive and productive investment relationship from day one. By meticulously designing each section to capture essential information, you empower investors to confidently take control of their financial future. This thoughtful approach ultimately leads to greater efficiency and a superior experience for everyone involved.