Understanding mineral rights can feel like navigating a maze, especially when it comes to transferring ownership. These rights, which pertain to the subsurface minerals beneath a property, are often separate from the surface rights and can hold significant value, particularly in areas rich in oil, gas, or other resources. Whether you are buying, selling, inheriting, or gifting these valuable assets, the process requires careful attention to detail to ensure a smooth and legally sound transfer.

The complexity arises because mineral rights are considered real property, much like land itself, and their transfer must comply with specific state laws governing real estate transactions. This means that a simple handshake or informal agreement simply won’t suffice. You need proper documentation, typically in the form of a deed, to legally convey these rights from one party to another. The good news is that with the right guidance and a well-structured approach, managing this process becomes much more manageable.

Understanding the Essentials of Mineral Rights Transfer Documentation

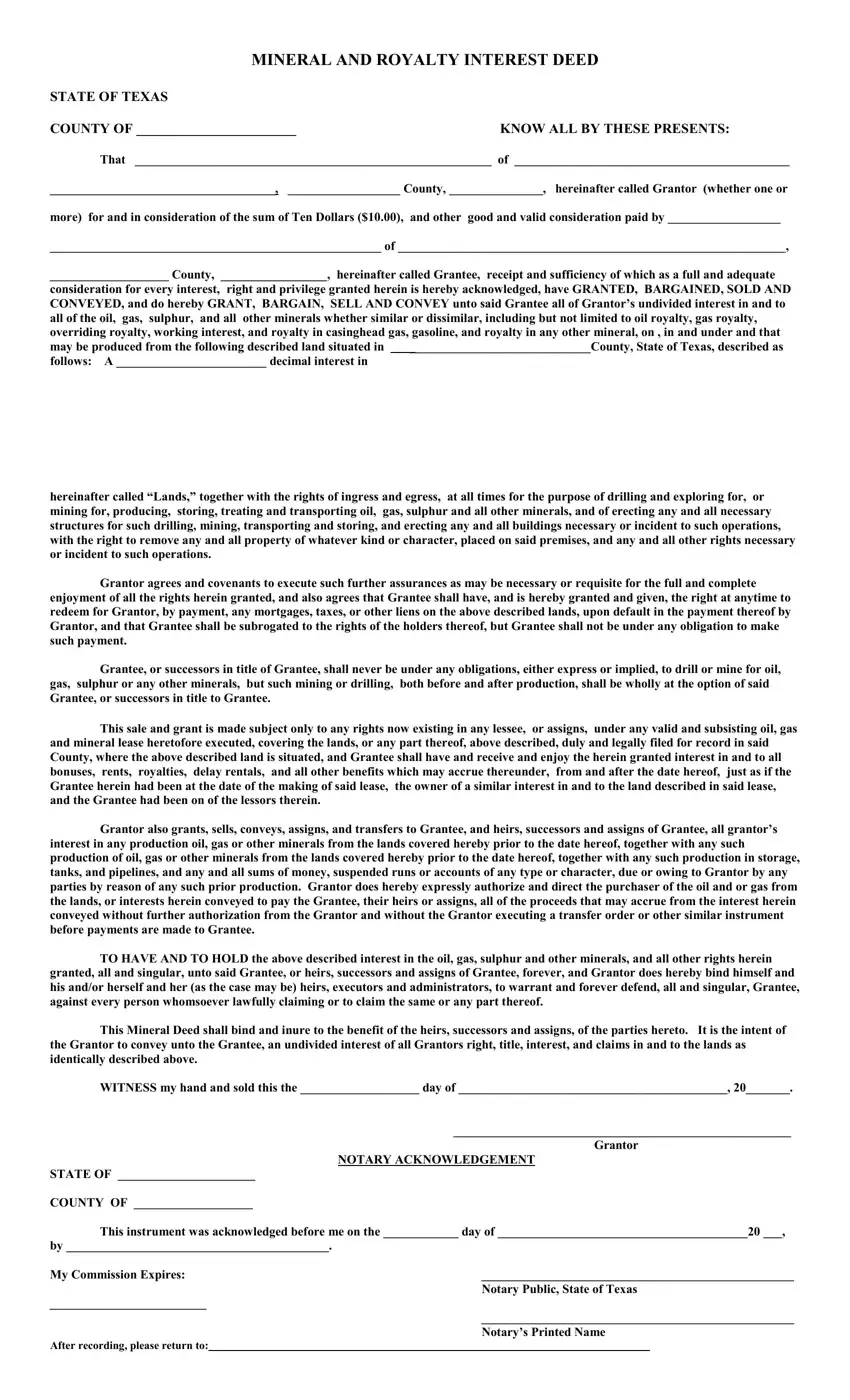

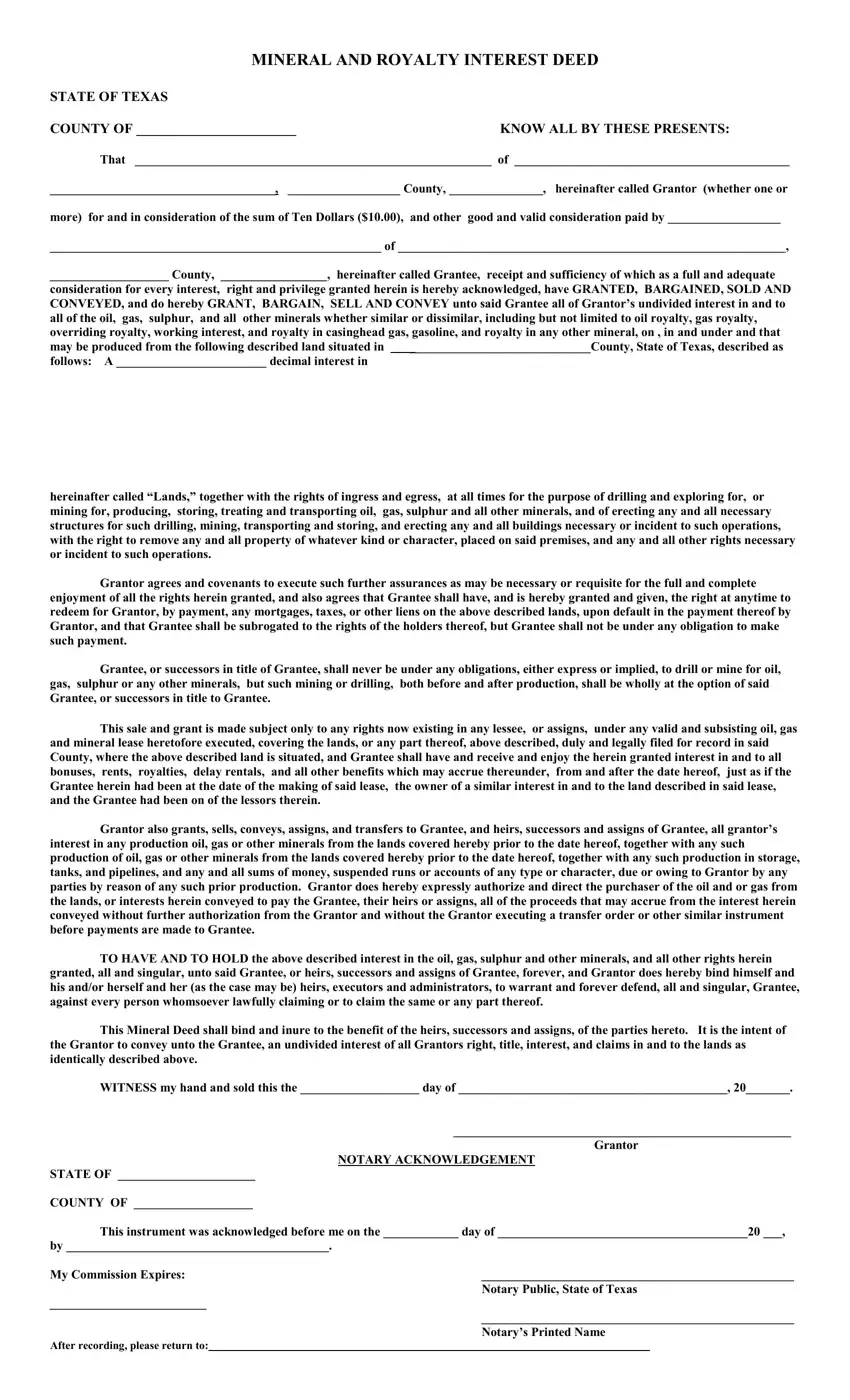

When it comes to transferring mineral rights, the foundational document you’ll need is a deed. This isn’t just any piece of paper; it’s a legal instrument that formally conveys ownership. Think of it as the ultimate proof of who owns what, beneath the surface. Without a properly executed deed, any attempted transfer might not be legally recognized, potentially leading to disputes and complications down the line, especially if oil and gas production is involved. The document needs to be precise, clear, and comprehensive to avoid ambiguities.

The deed itself serves multiple critical functions. It identifies the grantor (the current owner transferring the rights) and the grantee (the new owner receiving the rights), clearly defines the property where the mineral rights are located, specifies the percentage or portion of mineral rights being transferred, and includes language that signifies the intent to convey these rights. Each of these elements must be accurately stated to ensure the deed is legally binding and effective.

Beyond the basic identification, there are often specific clauses and provisions that need to be included. For instance, a deed might specify whether the transfer includes all minerals or only certain types, or if it reserves any rights for the grantor. These details are crucial for both parties to understand exactly what is being transferred and what is being retained. Given the financial implications, taking shortcuts here is highly discouraged, as even a small error could have significant consequences.

Key Elements of a Valid Mineral Rights Deed

For a mineral rights deed to be legally sound and enforceable, it must contain several core components. Missing any of these could invalidate the transfer or create a cloud on the title, making future transactions difficult.

- Grantor and Grantee Identification: Full legal names and addresses of both parties.

- Legal Description of the Property: A precise and unambiguous description of the land where the mineral rights are located. This often includes lot and block numbers, section, township, and range, or metes and bounds descriptions.

- Granting Clause: Language clearly stating the intent to transfer the mineral rights.

- Reservation Clause (if applicable): Any rights that the grantor wishes to retain.

- Consideration: The amount of money or other value exchanged for the transfer, even if it’s nominal.

- Habendum Clause: Defines the extent of the ownership being granted (e.g., "to have and to hold forever").

- Warranty Clause (if applicable): Guarantees from the grantor regarding their ownership and the property’s title.

- Signatures: The grantor’s signature, often requiring witnesses.

- Notarization: A notary public’s seal and signature verifying the grantor’s identity.

Navigating the Process and Pitfalls of Mineral Rights Transfer

Once you have a good understanding of what needs to be on the deed, the next step is to navigate the actual process of transfer. This involves more than just filling out a form; it requires a series of deliberate actions to ensure the transfer is legally recognized and recorded. The steps can vary slightly by state, but generally follow a similar pattern, emphasizing the need for precision at every turn. It is here that having access to a reliable mineral rights deed transfer form template can be incredibly useful, providing a structured starting point for drafting your document.

The first major step after drafting the deed is the execution. This means the grantor must sign the deed in the presence of witnesses, if required by state law. Following this, the deed typically needs to be notarized. Notarization is a critical step as it verifies the identity of the person signing the document, adding a layer of authenticity and preventing fraud. A notary public will confirm the grantor’s identity and witness their signature, then apply their official seal.

After the deed is signed and notarized, it must be recorded. Recording the deed means filing it with the county clerk or recorder’s office in the county where the mineral rights are located. This step is paramount because it provides public notice of the change in ownership, protecting the grantee’s interest against future claims and ensuring the transfer is recognized by all third parties, including potential oil and gas lessees. Without recording, the transfer might be valid between the grantor and grantee but not against third parties who have no knowledge of the transfer.

Common pitfalls to avoid include using outdated forms, failing to include a complete and accurate legal description, or neglecting to properly record the deed. An improperly drafted or unrecorded deed can lead to significant legal headaches, including challenges to ownership, title defects, and difficulties in selling or leasing the mineral rights in the future. Consulting with a legal professional specializing in mineral rights or real estate is often advisable to ensure all nuances are covered and the transfer is executed flawlessly.

Transferring mineral rights is a significant legal undertaking that demands precision and adherence to established legal procedures. While the idea of a mineral rights deed transfer form template can provide a helpful starting point, it is crucial to remember that these are legal documents with real-world implications. Ensuring all details are accurate, properly executed, and officially recorded is paramount to securing the interests of all parties involved and preventing future complications.

By carefully preparing and recording the necessary documentation, you can confidently transfer mineral rights, knowing that the process has been handled with the diligence it deserves. This proactive approach not only safeguards your investment but also ensures clarity and legal validity for all future dealings concerning these valuable subsurface assets.