Navigating the world of healthcare can feel like a maze, especially when it comes to understanding bills and getting reimbursed for your hard-earned money. Whether it is a visit to the doctor, a prescription, or a hospital stay, the financial side often brings an added layer of stress. You have paid for services, and now you need to make sure you get back what you are owed, or at least properly document everything for tax purposes or insurance claims.

This is where having a reliable tool comes in handy. Imagine having a straightforward way to record all your medical expenditures, ready to be submitted to your insurance provider, your employer, or even used for personal financial tracking. A well-designed medical expenses claim form template can be your best ally in cutting through the confusion and making the process as smooth and efficient as possible. It is all about empowering you to take control of your health finances.

Why a Medical Expenses Claim Form Template is Your Go-To Solution

Let’s face it, the administrative side of healthcare can be overwhelming. From deciphering explanation of benefits (EOBs) to tracking various co-pays, deductibles, and out-of-pocket expenses, it is easy to miss something crucial. Without a structured approach, you might find yourself scrambling for receipts and details when it is time to file a claim, leading to delays or even missed opportunities for reimbursement. This is exactly why a dedicated template is so invaluable.

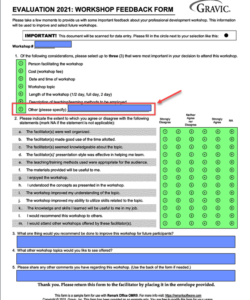

Using a standardized medical expenses claim form template brings a sense of order to what can often feel like chaos. It prompts you to capture all the necessary information consistently, ensuring that no vital detail is overlooked. This systematic approach not only saves you time and frustration but also significantly reduces the chances of errors that could lead to your claim being rejected. Think of it as your personal financial assistant for health-related costs.

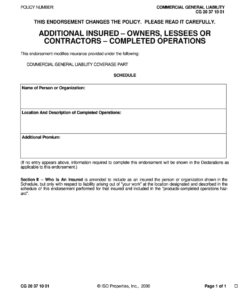

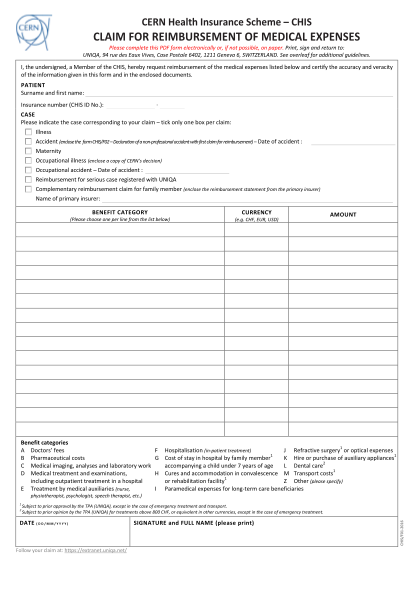

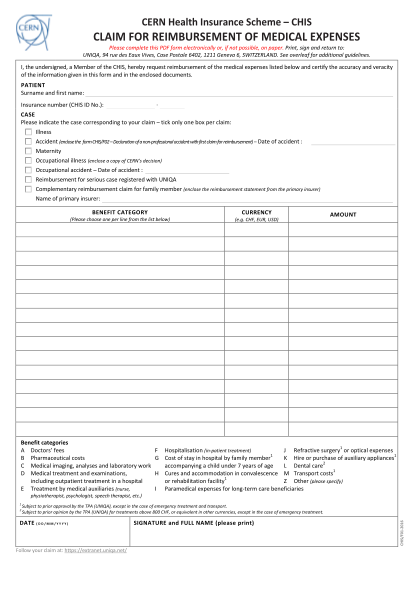

A good template acts as a comprehensive checklist, guiding you through each piece of information required for a successful claim. It typically includes dedicated sections for patient details, healthcare provider information, dates of service, a description of the services rendered, and the associated costs. Some even include fields for diagnosis codes or procedure codes, which are often vital for insurance processing, though you might need your provider’s help to fill those in accurately.

By preparing all this information in advance using a template, you streamline the entire submission process. Whether you are submitting to a private insurer, a government program, or an employer’s flexible spending account (FSA) or health savings account (HSA), having your data organized and ready makes a world of difference. It transforms a potentially daunting task into a manageable series of steps, ensuring you get the most out of your health benefits and expense tracking.

Key Sections to Look For in Your Template

- Patient Information: Your name, address, date of birth, and policy number.

- Provider Information: Name of the doctor or facility, their address, and contact details.

- Service Details: Dates of service, type of service (e.g., office visit, lab test, prescription).

- Diagnosis Code (ICD-10): The code representing your medical condition.

- Procedure Code (CPT): The code for the medical procedure or service performed.

- Amount Billed: The total cost of the service.

- Amount Paid by You: How much you have already paid out-of-pocket.

- Reason for Claim: A brief explanation, if needed (e.g., “annual check-up,” “flu treatment”).

- Supporting Documentation Checkbox: A reminder to attach receipts, EOBs, or prescriptions.

Maximizing Your Reimbursement: Tips for Using Your Medical Expenses Claim Form Template Effectively

Having a fantastic medical expenses claim form template is only half the battle; knowing how to use it effectively is the other. Before you even begin filling in the blanks, gather all your supporting documents. This means collecting every receipt, explanation of benefits (EOB) from your insurance company, prescription details, and any referral forms related to the medical service. Having everything at your fingertips prevents last-minute scrambles and ensures accuracy.

When you start populating the template, focus on accuracy and clarity. Ensure all names, dates, and numbers are correctly entered. Double-check policy numbers and provider details. If a field asks for a specific code, like an ICD-10 diagnosis code or a CPT procedure code, make sure you get these directly from your healthcare provider’s office or your EOB. Mistakes in these codes are a common reason for claims being delayed or denied, so precision is paramount.

Once your medical expenses claim form template is fully filled out, review it thoroughly. Read through every field as if you were the person processing it on the other end. Are there any ambiguities? Is all the necessary information present? It’s often helpful to have another set of eyes look it over too. Before submission, always, and we mean always, make a copy of the completed form and all attached supporting documents for your personal records. This simple step can save you a lot of headaches down the road if there are any discrepancies or if the original gets lost.

Finally, understand the submission process for your particular insurer or employer. Some prefer online submissions, while others require physical mail. Be mindful of any deadlines for filing claims. Prompt submission is key to timely reimbursement. By meticulously preparing your claim using your template and following these tips, you’re not just filling out a form; you’re actively managing your healthcare finances and ensuring you receive the maximum benefits you are entitled to.

Taking proactive steps to manage your medical expenses is a smart financial move. By embracing the simplicity and efficiency that a structured form provides, you are not just tracking costs; you are empowering yourself with clear, organized records. It transforms a potentially confusing financial chore into a straightforward task, giving you peace of mind.

Ultimately, having your financial health in order, especially concerning healthcare, provides a significant sense of security. With a reliable system for documenting and claiming your expenses, you are better equipped to navigate any health-related financial situation that comes your way, ensuring you can focus more on your well-being and less on the paperwork.