You might be wondering if it is still possible to claim back Payment Protection Insurance (PPI) and if there is a specific form or process to follow, especially one advocated by consumer champion Martin Lewis. While the main deadline for PPI claims passed in August 2019, it is important to understand that not all avenues for seeking redress have disappeared. Many people were able to successfully reclaim mis-sold PPI due to the widespread awareness created by financial experts.

Even though the primary window for mis-selling claims has closed, certain circumstances, particularly those related to unfair commission under what is known as the Plevin ruling, still allow for claims. The key now is understanding if your situation fits these specific criteria and how to approach your bank or lender effectively, even if a simple, universally applicable martin lewis ppi claims form template is no longer the primary tool for new claims.

Understanding Your PPI Claim Post-Deadline

The nationwide push for PPI claims, heavily supported by campaigns and advice from figures like Martin Lewis, culminated in a final deadline for new complaints on 29 August 2019. This deadline applied to claims based on PPI being mis-sold, for example, if you were pressured into buying it, told it was compulsory, or it was completely unsuitable for you. However, the story did not entirely end there for everyone. A significant development, the Plevin ruling from the Supreme Court, opened up a new avenue for complaints.

The Plevin ruling states that if more than 50% of your PPI premium was paid as commission to the lender and this was not adequately disclosed to you, then the policy may be deemed unfair. This is not about whether the policy was mis-sold in the traditional sense, but rather about the fairness of the contract due to undisclosed high commission. Many people are unaware that they might still have a legitimate complaint under Plevin, as it falls outside the direct scope of the original mis-selling deadline.

Therefore, if you had PPI and believe a significant portion of your premium went to commission without your knowledge, you might still have a case. It is crucial to approach this with accurate information and a structured method, as there might not be a specific martin lewis ppi claims form template specifically designed for every Plevin scenario. Your complaint needs to be clear and focused on the unfairness of the commission rather than mis-selling.

What You Need Before Starting

When pursuing a claim, particularly a Plevin-related one, gathering all relevant information beforehand is paramount. This preparation helps the bank locate your records quickly and ensures your complaint is robust.

- Bank or lender name: Identify all institutions you had PPI with.

- Account numbers: Have your credit card, loan, or mortgage account numbers handy.

- Dates the PPI policy was active: Approximate start and end dates are helpful.

- Evidence of unfair commission: While the bank should provide commission details, any relevant correspondence you have can be useful.

- Any correspondence you have: Old policy documents, statements, or letters relating to the PPI.

Having these details ready makes the process smoother for both you and the bank, increasing the chances of a swift and accurate response. Without them, the bank may struggle to identify your policy and assess your claim effectively.

Crafting Your Own Effective PPI Complaint

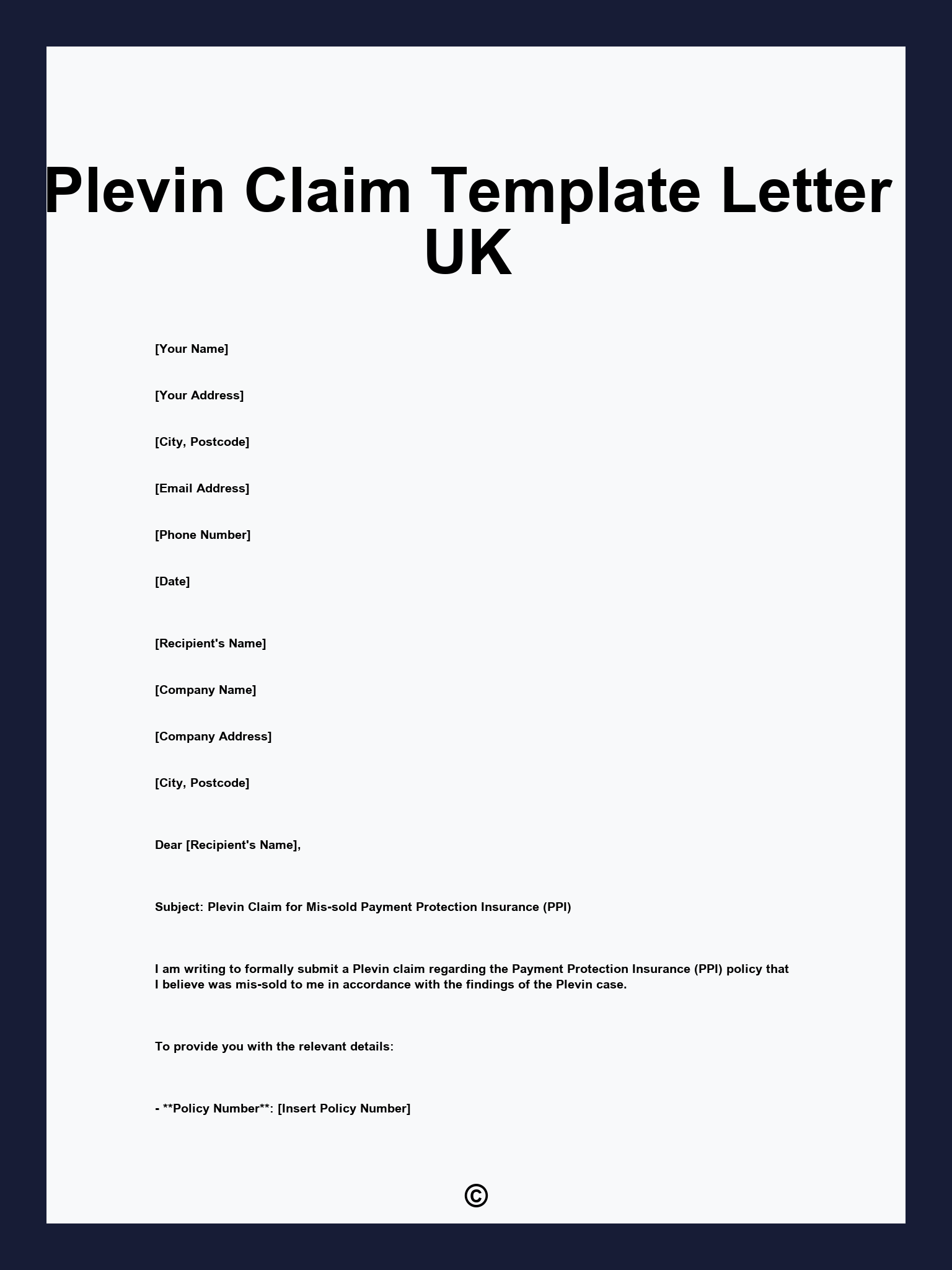

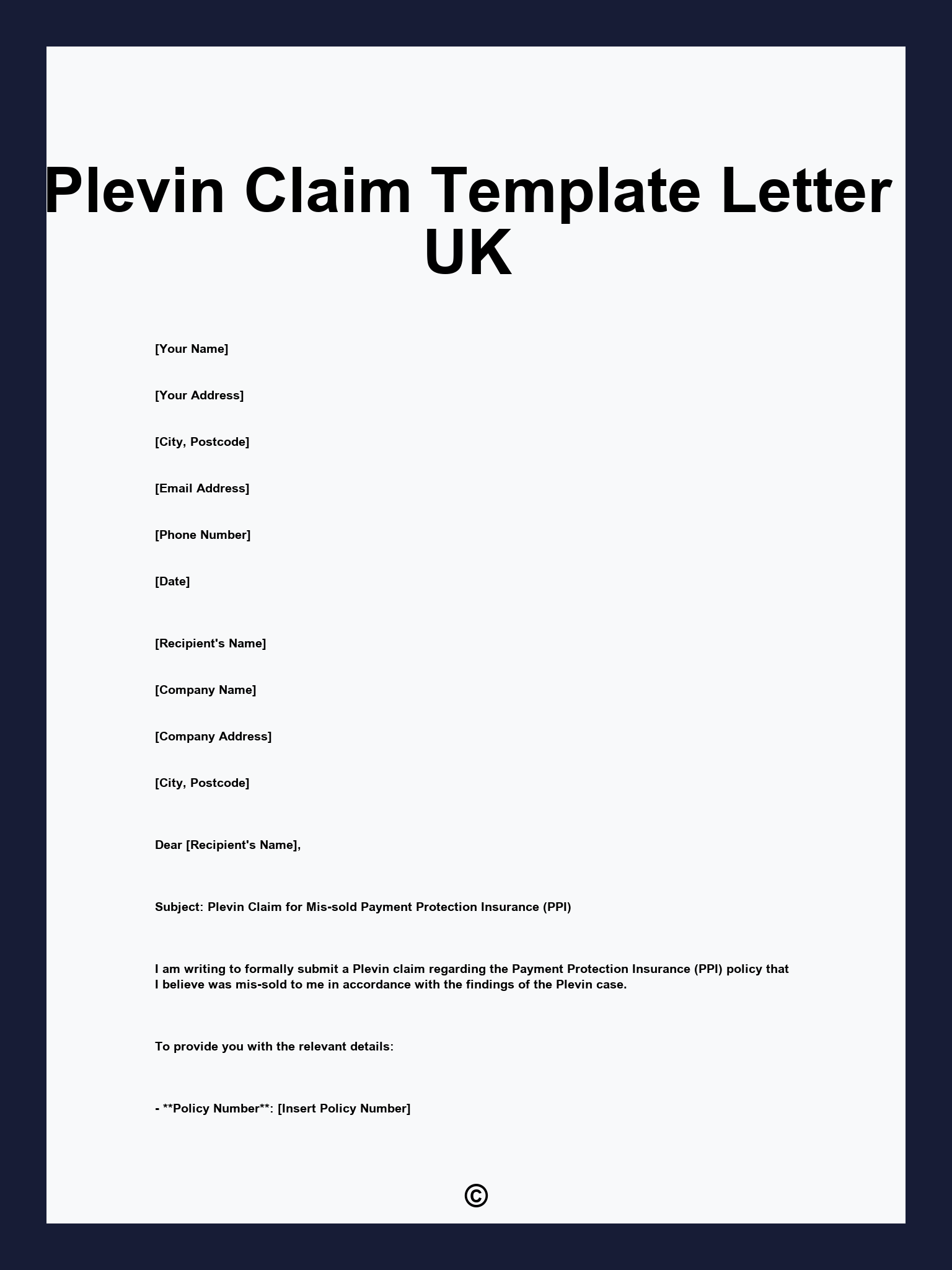

Given that a universal martin lewis ppi claims form template for post-deadline Plevin cases is not widely available, you will likely need to construct your own complaint letter. This might seem daunting, but a well-written, concise letter can be highly effective. The key is to be clear, factual, and to the point, outlining your specific complaint based on the Plevin ruling. Avoid emotional language and stick to the facts of your case.

Start your letter by clearly stating that you are making a complaint regarding Payment Protection Insurance (PPI) under the Plevin ruling. Include all your personal details, along with the relevant account numbers and the name of the bank or lender. Explicitly state that you believe the commission paid on your PPI policy was unfairly high and undisclosed, making the policy unfair. You should ask the bank to investigate your policy for commission levels and refund any portion deemed unfair, plus interest.

It is always advisable to send your complaint via recorded delivery or an equivalent method that provides proof of postage and receipt. Keep a copy of the letter for your records. Most financial institutions have a set timeframe within which they must respond to a complaint, typically eight weeks. If you do not receive a satisfactory response within this period, or if your complaint is rejected, you then have the right to take your case to the Financial Ombudsman Service (FOS).

The Financial Ombudsman Service is an independent body that helps resolve disputes between consumers and financial businesses. They will review your case impartially and make a decision. While Martin Lewis provided invaluable general guidance on PPI claims during the main period, the specific nuances for post-deadline or Plevin-related claims often require a more tailored approach in your communication with the bank rather than a generic template.

Ultimately, even with the passing of the official deadline, possibilities remain for legitimate PPI claims, particularly concerning undisclosed high commission under the Plevin ruling. Preparing a clear and concise complaint, backed by any relevant information you can gather, is crucial for presenting your case effectively to the bank or lender.

Should your initial complaint to the bank not yield a satisfactory outcome, remember that the Financial Ombudsman Service is there to provide an independent review of your case. Persistence and an informed approach can still lead to a successful resolution for eligible claims, ensuring you receive the redress you are entitled to.