If you were one of the millions of people in the UK who had Payment Protection Insurance, or PPI, tacked onto loans, credit cards, mortgages, or other financial products, you’ll know what a significant issue it became. For many years, people were unknowingly sold insurance they didn’t need, couldn’t use, or simply didn’t agree to. When the scale of this mis-selling came to light, it sparked the largest financial mis-selling scandal in British history, leading to billions of pounds in compensation.

During this period, navigating the world of financial claims could feel incredibly daunting, especially when faced with complex forms and legal jargon. That’s where trusted consumer advocates, particularly Martin Lewis and his MoneySavingExpert.com website, became an invaluable resource for the public. They simplified the often-confusing process, empowering individuals to make their own claims without the need for expensive third-party companies. While the official deadline for new PPI claims has passed, understanding the legacy of how people approached these claims, and the tools they used, remains a relevant part of consumer financial history.

Understanding How PPI Claims Worked and Martin Lewis’s Role

Payment Protection Insurance was often sold alongside various financial products, promising to cover repayments if the policyholder became ill, unemployed, or unable to work. However, in countless cases, it was mis-sold. This could mean it was added without consent, the customer was ineligible to claim (e.g., self-employed), or they already had similar cover elsewhere. The sheer volume of these mis-sales meant millions were entitled to a refund, plus interest.

When the Financial Conduct Authority (FCA) set a final deadline for PPI claims in August 2019, it created a huge push for people to get their claims in before time ran out. Many consumers felt overwhelmed by the prospect of contacting their banks or lenders directly, fearing complicated procedures or being turned down. This is precisely where Martin Lewis stepped in, transforming what seemed like a complex battle into a manageable task for the average person. He consistently advised against using claims management companies, which often took a significant percentage of any successful claim, sometimes as much as 30-40%. His core message was clear: you could do it yourself, and it wouldn’t cost you a penny.

MoneySavingExpert.com provided comprehensive guides, advice, and crucially, free templates and tools to help people make their claims. This meant individuals could bypass the fees of claims companies and keep 100% of their compensation. The impact of this free, accessible information was immense, helping countless people reclaim what was rightfully theirs. His approach demystified the process, explaining in plain English what PPI was, how to check if you had it, and the exact steps to follow to get your money back.

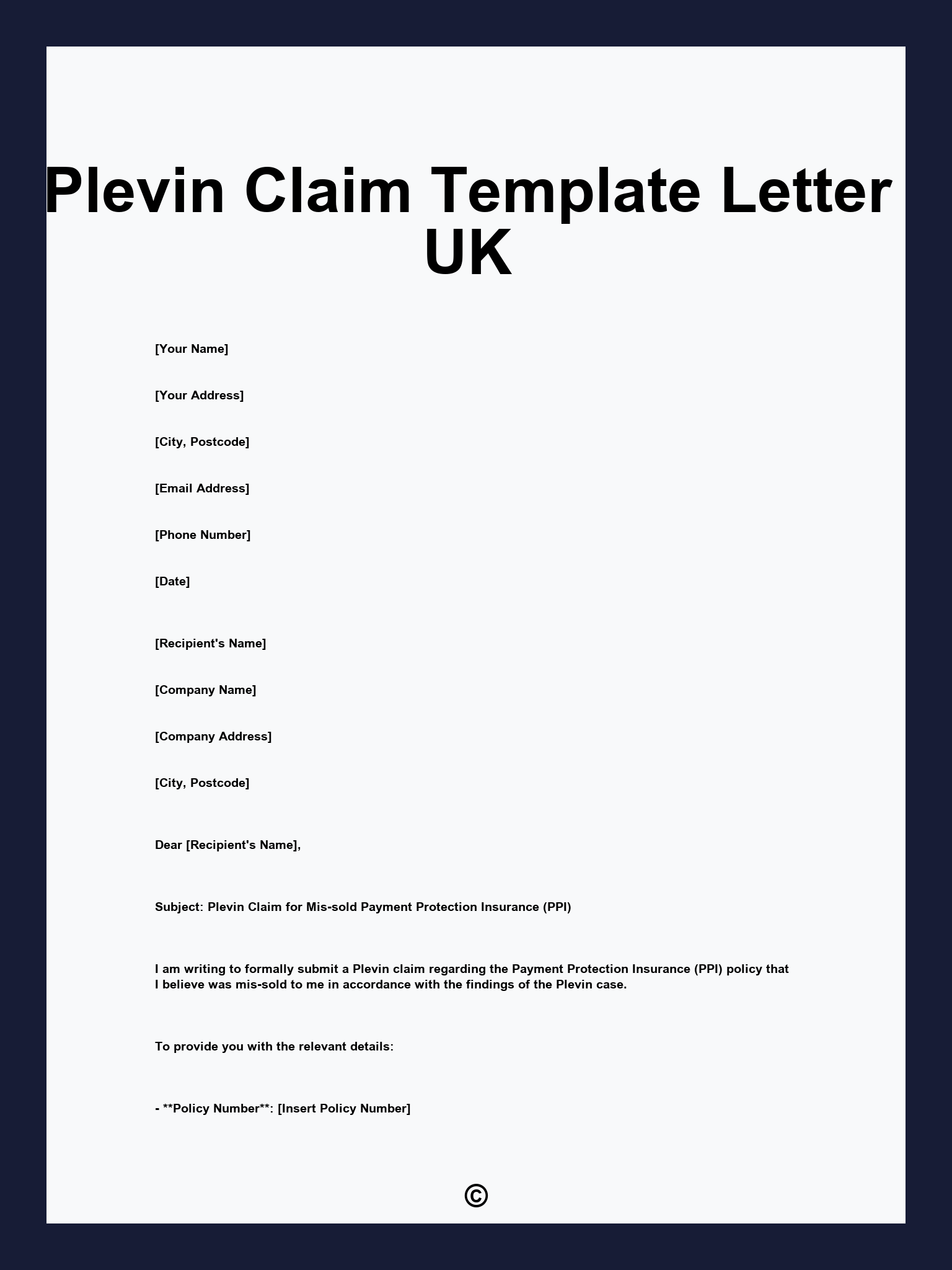

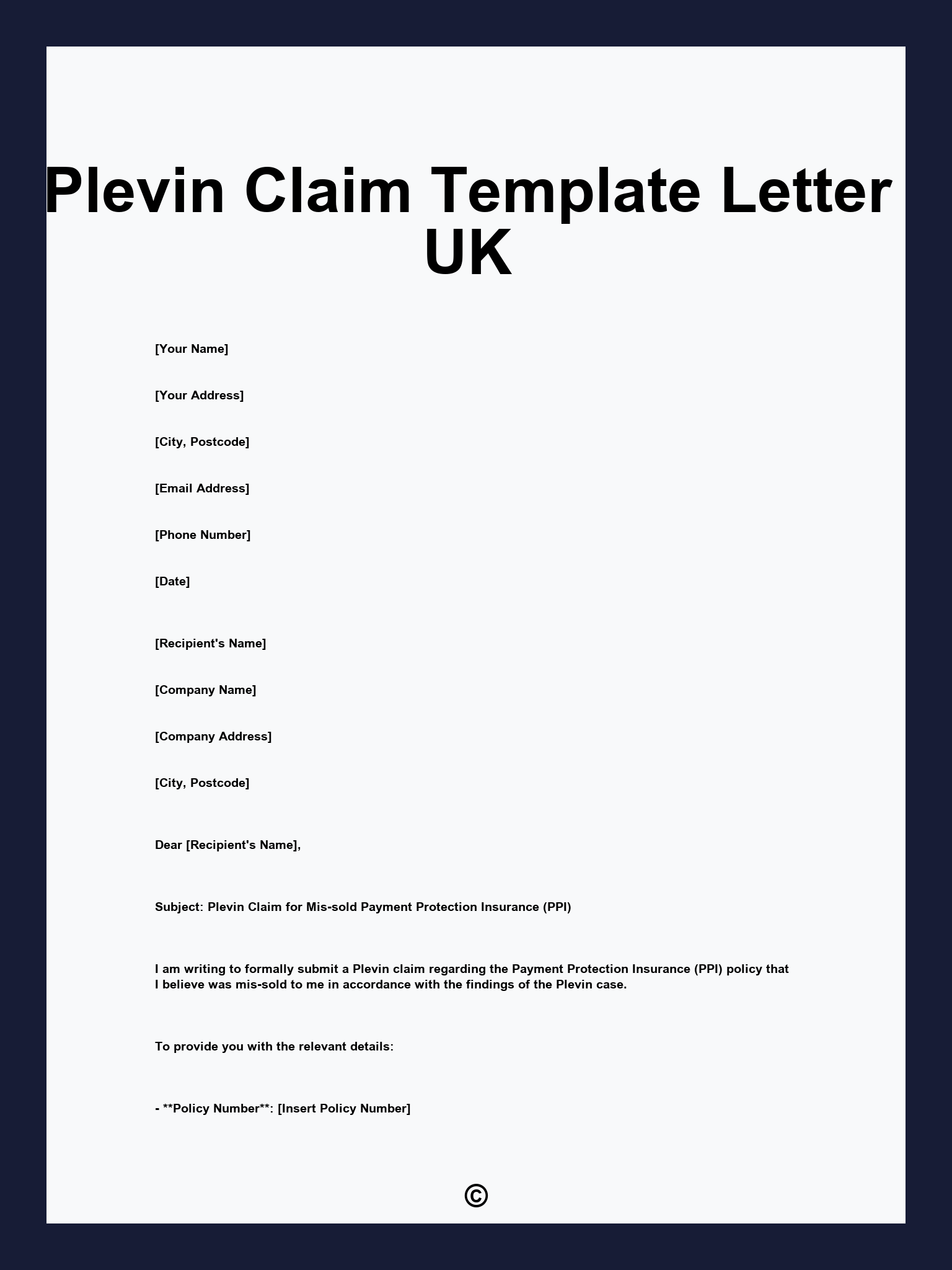

The availability of a robust martin lewis ppi claim form template meant that even those who felt least confident about financial paperwork had a starting point. It standardized the process, ensuring all necessary information was included to give the claim the best chance of success. It truly was a testament to consumer empowerment.

Key Reasons Why a Direct Claim Was Often the Preferred Method

- You kept 100% of any compensation received, unlike using a claims management company that would charge a significant fee.

- The process, while it required some effort, was simplified by comprehensive free guides and templates.

- It provided a sense of empowerment, allowing individuals to understand their rights and take control of their financial situation.

- Access to reliable, free resources meant there was no financial risk in pursuing a claim.

- It encouraged financial literacy and awareness about how financial products were sold.

The Practicalities of Using a Claim Template and What Followed

For those looking to make a PPI claim, the initial hurdle was often identifying which banks or lenders they might have had PPI with. Many people simply couldn’t remember, especially if the policy was taken out years or even decades ago. Martin Lewis’s guides advised contacting every bank you’d ever had a loan, credit card, or mortgage with, simply asking them to check for PPI. This proactive approach was crucial for many, uncovering policies they never knew existed.

Once a potential PPI policy was identified, the next step was to formally make the claim. This is where a well-structured martin lewis ppi claim form template proved invaluable. These templates typically asked for key details like account numbers, the type of product (loan, credit card, etc.), and the reasons why you believed the PPI was mis-sold. Common reasons included not being asked if you wanted the insurance, being told it was compulsory, not being told about exclusions, or being unable to claim due to your employment status. The template ensured all these crucial points were addressed clearly and concisely.

After submitting your claim, lenders were required to investigate and respond within a set timeframe, typically eight weeks. If they found evidence of mis-selling, they would offer compensation, which usually included a refund of the premiums paid plus statutory interest. If the lender rejected the claim, or if you were unhappy with their offer, the next step was to escalate the complaint to the Financial Ombudsman Service (FOS). The FOS is an independent body that resolves disputes between consumers and financial firms. They would review your case and the lender’s response, making a final, binding decision. This multi-stage process, while potentially lengthy, was designed to give consumers every opportunity to get a fair outcome.

The success rate of direct claims, especially those following the guidance and templates provided by Martin Lewis, was remarkably high. It demonstrated that with the right information and tools, individuals could stand up to large financial institutions and secure justice. The PPI scandal and its resolution became a landmark example of consumer power and the importance of clear, accessible financial advice.

The legacy of the PPI claims era highlights the importance of consumers being vigilant about the financial products they purchase and understanding their rights. It also underscores the significant role that independent consumer champions play in leveling the playing field between individuals and large corporations. While the claim window has closed, the lessons learned from this period continue to shape how we approach financial services and consumer protection.