Losing an important document like a share certificate can feel like a sudden jolt, bringing with it a wave of worry about your valuable assets. It is a surprisingly common occurrence, whether due to misplacement during a move, accidental destruction, or simply falling through the cracks of your filing system. The immediate concern is often how to prove your ownership and prevent any unauthorized use of your shares. Thankfully, there is a clear and well-established process to safeguard your investment and reclaim your official documentation.

This situation, while stressful, is entirely manageable with the right steps. The key to resolving it lies in understanding and utilizing a specific legal document: the indemnity form. This article will walk you through what an indemnity form entails, why it is so crucial, and how to navigate the process of replacing your lost certificate, ensuring your peace of mind and the security of your shares.

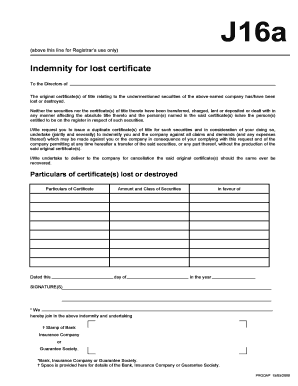

Understanding the Lost Share Certificate Indemnity Form

When a share certificate goes missing, the company whose shares you own, or their registrar, needs a robust guarantee that they will not face future liabilities should the original certificate resurface and be misused. This is precisely where a lost share certificate indemnity form template comes into play. It is a legally binding document signed by the shareholder, indemnifying the company against any losses, damages, or claims that may arise from issuing a duplicate certificate. Essentially, you are promising to protect them if the original certificate ever turns up and causes a problem.

The form acknowledges that while you claim the original is lost, there is always a remote possibility it could be found later. If that were to happen and someone tried to fraudulently use the original certificate, the indemnity form ensures the company is not held responsible. It is a critical safeguard for the company, allowing them to issue a new certificate with confidence, knowing their interests are protected.

Why is an Indemnity Form Necessary?

The necessity of an indemnity form stems from the legal nature of share certificates as documents of title. They represent ownership. Without the original in hand, the company faces a risk. If they simply issued a duplicate without proper assurances, they could potentially have two valid certificates circulating for the same shares, leading to significant legal and financial complications. The indemnity form mitigates this risk entirely.

Moreover, it encourages shareholders to exercise due diligence in safekeeping their certificates. By making the replacement process contingent on this formal indemnity, companies ensure that shareholders understand the importance of these documents. It’s not just a formality; it’s a vital part of maintaining the integrity of share registers and preventing potential fraud.

- Your full name and address

- Details of the company and the specific shares (number of shares, certificate number if remembered)

- A clear declaration that the original certificate is lost, stolen, or destroyed

- An undertaking to indemnify the company against any claims

- An agreement to return the original certificate if found

- Witness signatures

- Sometimes, a surety or guarantor may also be required, especially for large shareholdings.

Navigating the Process of Replacing Your Lost Certificate

Once you realize your share certificate is lost, the first step is to inform the company or its share registrar immediately. Do not delay, as prompt action can prevent potential misuse. They will likely send you the specific lost share certificate indemnity form template they require, along with instructions. It is crucial to read these instructions carefully, as the exact process and required supporting documents can vary slightly from one company to another.

Filling out the form itself requires accuracy. You will need to provide precise details about your identity and the shares in question. If you remember the certificate number, include it. If not, don’t worry, as the registrar can usually trace your shareholding through your name and address. Pay close attention to sections requiring witness signatures or, in some cases, a co-indemnifier or surety. This extra layer of security is often requested for higher value shareholdings to provide an additional guarantee to the company.

After completing the form, it needs to be returned to the company or registrar, often accompanied by a processing fee. Some companies might also require an affidavit confirming the loss, notarized by a public notary. Always keep a copy of the completed indemnity form and any correspondence for your records. This paper trail is vital should any questions arise later.

The final step is patience. Once the form and any required fees or additional documents are received and verified, the company will process your request and issue a duplicate share certificate. This process can take some time, typically a few weeks, as they perform their due diligence. Rest assured, once the new certificate is in your possession, your ownership is officially reaffirmed, and you can breathe a sigh of relief knowing your investment is secure once more.

Dealing with a lost share certificate might seem daunting at first, but with the correct approach and the use of the proper indemnity form, it is a straightforward process. By promptly notifying the relevant parties, diligently completing the required paperwork, and understanding the purpose of each step, you can effectively safeguard your valuable assets. Remember, these procedures are designed to protect both your interests as a shareholder and the integrity of the company’s records.

Taking these steps ensures that despite the initial inconvenience, your ownership remains undisputed, and your investment secure for the future. Being prepared and knowing how to navigate this situation provides invaluable peace of mind, confirming your rightful place on the shareholder register.