Understanding the exact amount needed to fully pay off a loan can sometimes feel like navigating a maze. Whether you are planning to refinance, sell an asset like a home or car, or simply want to achieve financial freedom by paying off your debt early, getting an accurate payoff quote from your lender is a critical first step. This isn’t just about knowing your current balance; it factors in accrued interest, any unposted payments, and potential prepayment penalties, providing you with a precise figure valid for a specific date.

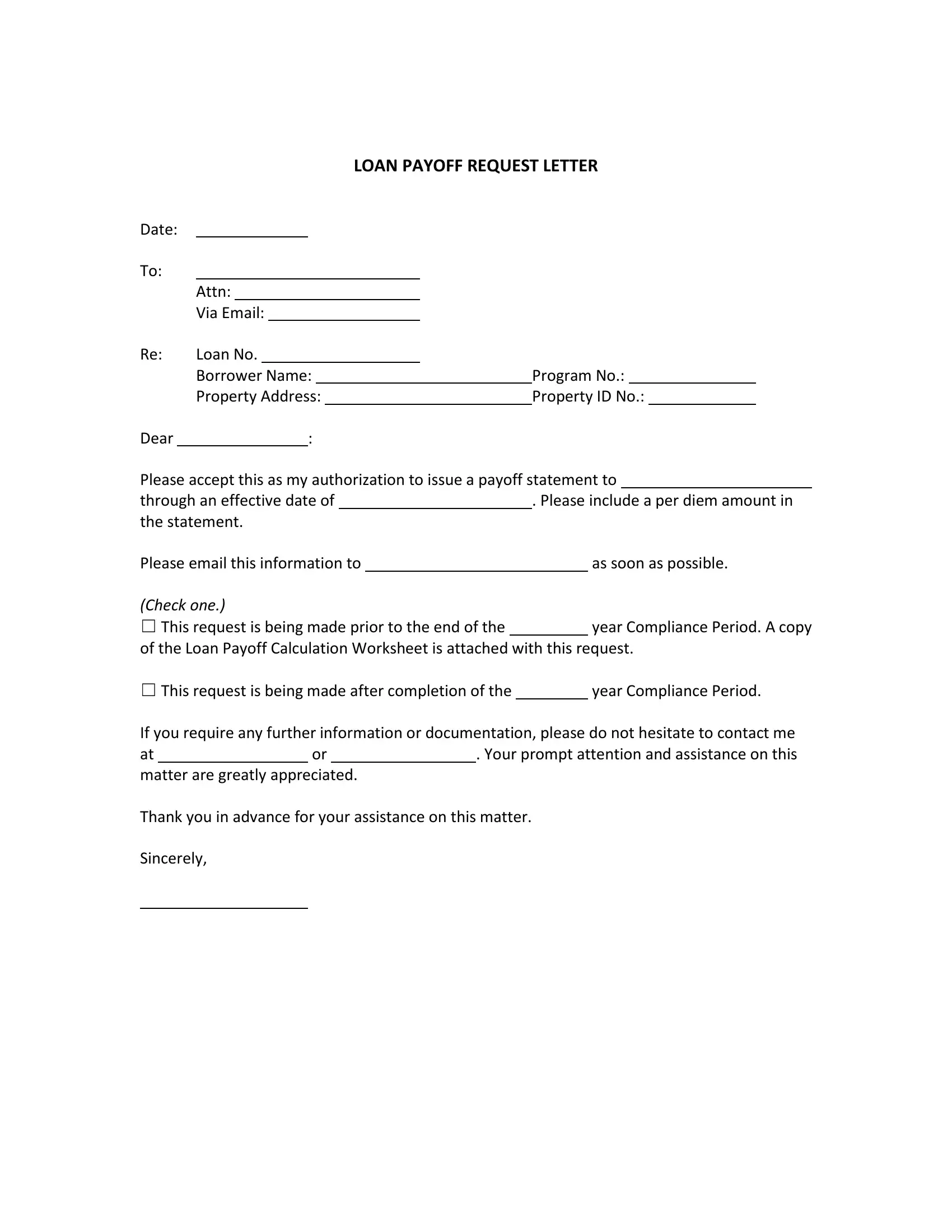

While a phone call might give you an estimate, for official purposes, or when dealing with significant sums, a formal written request is always the best practice. This ensures you have a documented record of the information provided by your lender. Having a standardized way to ask for this information, perhaps through a loan payoff request form template, can significantly streamline the process and help you avoid misunderstandings or delays in your financial plans. It empowers you to take control of your financial journey with clarity and precision.

Understanding the Importance of Your Loan Payoff Request

When you’re ready to make a significant financial move involving your debt, such as selling a property or vehicle that has an outstanding loan, or perhaps consolidating your debts through a new loan, knowing the exact payoff amount is paramount. It’s not simply your outstanding principal balance. The payoff amount includes interest that has accrued since your last payment, any fees, and potentially other charges that need to be settled for the loan to be considered fully satisfied. Without this precise figure, you could face delays in closing transactions, unexpected costs, or even issues with the transfer of title or lien release.

Think about refinancing your mortgage. Your new lender will require an official payoff statement from your current mortgage provider to ensure the old loan is completely closed out when the new one funds. Similarly, if you’re selling a car with a lien, the buyer or dealership will need that exact payoff amount to ensure the title can be transferred cleanly. Relying on an estimated balance could lead to a shortfall, leaving a small, lingering balance that prevents the lien from being released, causing a headache long after you thought the transaction was complete. This is precisely where a clear, documented loan payoff request becomes indispensable.

A well-structured template for this request ensures that all necessary information is provided to the lender upfront, reducing the back-and-forth communication that can cause delays. It prompts you to include details that the lender needs to accurately calculate the payoff, such as your loan account number, your full name, the property or asset associated with the loan, and the specific date for which you need the payoff amount calculated. This level of detail helps the lender process your request efficiently and accurately, providing you with the exact number you need to move forward.

Key Elements of an Effective Loan Payoff Request

- Your full legal name and current address.

- The complete loan account number for which you need the payoff.

- The specific payoff date you are requesting (e.g., “payoff amount as of June 30, 2024”).

- Your contact information (phone number and email) in case the lender has questions.

- Any specific instructions regarding how you would like to receive the payoff statement (e.g., via email, mail, or fax).

- A clear statement requesting a formal payoff quote, not just a balance inquiry.

By using a comprehensive loan payoff request form template, you ensure that no crucial piece of information is overlooked, paving the way for a smooth and accurate transaction. It’s a simple yet powerful tool for maintaining financial clarity and avoiding potential pitfalls.

Navigating Your Loan Payoff: Practical Steps and Benefits

Once you have your loan payoff request form template ready, the next step is to accurately fill it out. Take your time to double-check all the details, especially your loan account number and the requested payoff date. An incorrect digit or an ambiguous date can lead to delays or, worse, an inaccurate payoff quote. Remember, the payoff amount changes daily due to interest accrual, so requesting a specific future date is crucial if your transaction (like a home sale or refinance closing) is scheduled for a particular day. Being precise ensures the lender calculates the exact amount valid for your intended closing or payment date.

After completing the template, you’ll need to submit it to your lender. Most financial institutions offer several ways to do this. You might be able to mail it to a specific department, submit it through their secure online portal, or even send it via a designated email address or fax number. It’s always a good idea to check your lender’s website or contact their customer service to confirm the preferred method for submitting payoff requests. Sending it through a traceable method, such as certified mail or via a secure online portal, provides a record of your submission, which can be invaluable if any questions arise later.

Once submitted, lenders typically have a specific timeframe within which they must provide a payoff statement, often dictated by consumer protection laws. While this can vary, expect to receive the statement within a few business days to a week. The statement will clearly outline the total amount due, including the principal balance, accrued interest, any fees, and often a per diem (per day) interest amount, which tells you how much interest accrues daily after the quoted date. This per diem figure is essential if your actual payoff date ends up being different from your requested date.

The biggest benefit of using a standardized loan payoff request form template is the peace of mind it offers. It ensures consistency in your requests, minimizes the chances of errors, and provides you with a professional, documented trail of your communication with your lender. This isn’t just about administrative convenience; it’s about protecting your financial interests, ensuring that when you pay off a loan, it is truly and completely paid off, leaving no lingering surprises or issues.

Taking the initiative to secure an accurate loan payoff amount is a smart financial move. It simplifies complex transactions, prevents unexpected costs, and provides the certainty you need to make informed decisions about your financial future. Whether you’re refinancing, selling, or simply want to clear your debt, having this precise figure at your fingertips is an empowering step towards achieving your goals. It’s about ensuring a clean slate and moving forward with confidence.