Generating quality leads is often the lifeblood of any successful life insurance agency. In a digital world overflowing with information, reaching potential clients and getting them to engage with your services can feel like finding a needle in a haystack. This is where a meticulously designed life insurance sales lead form template becomes an indispensable tool, acting as your first digital handshake with a prospective policyholder. It’s not just about collecting names and email addresses; it’s about initiating a meaningful conversation.

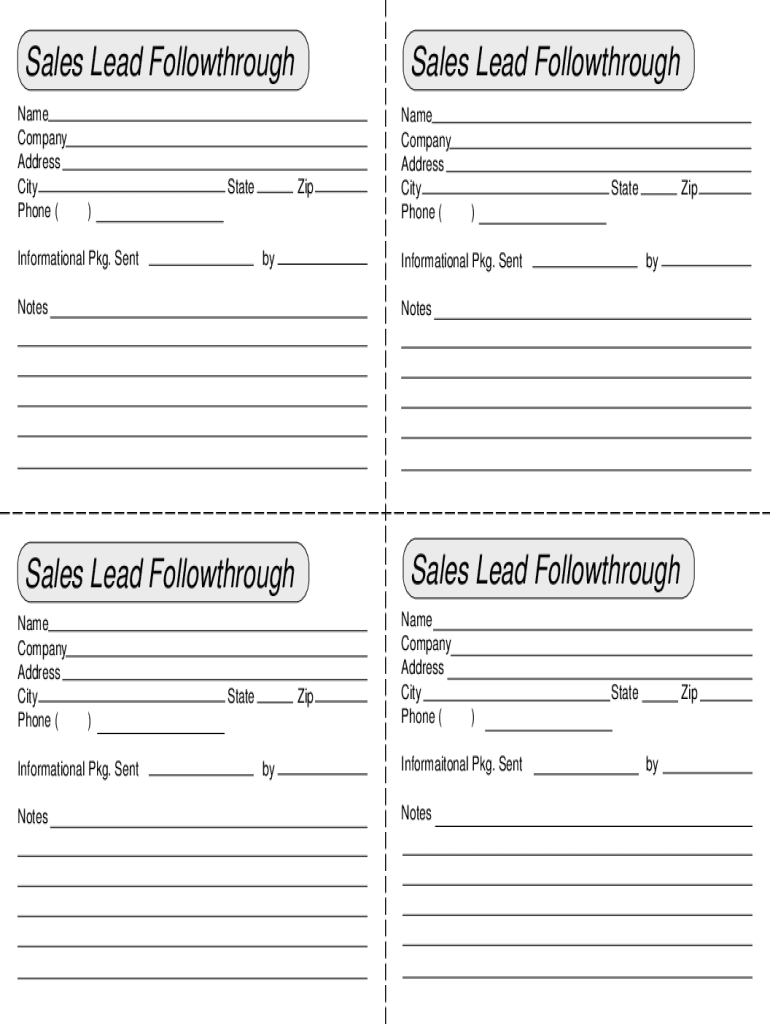

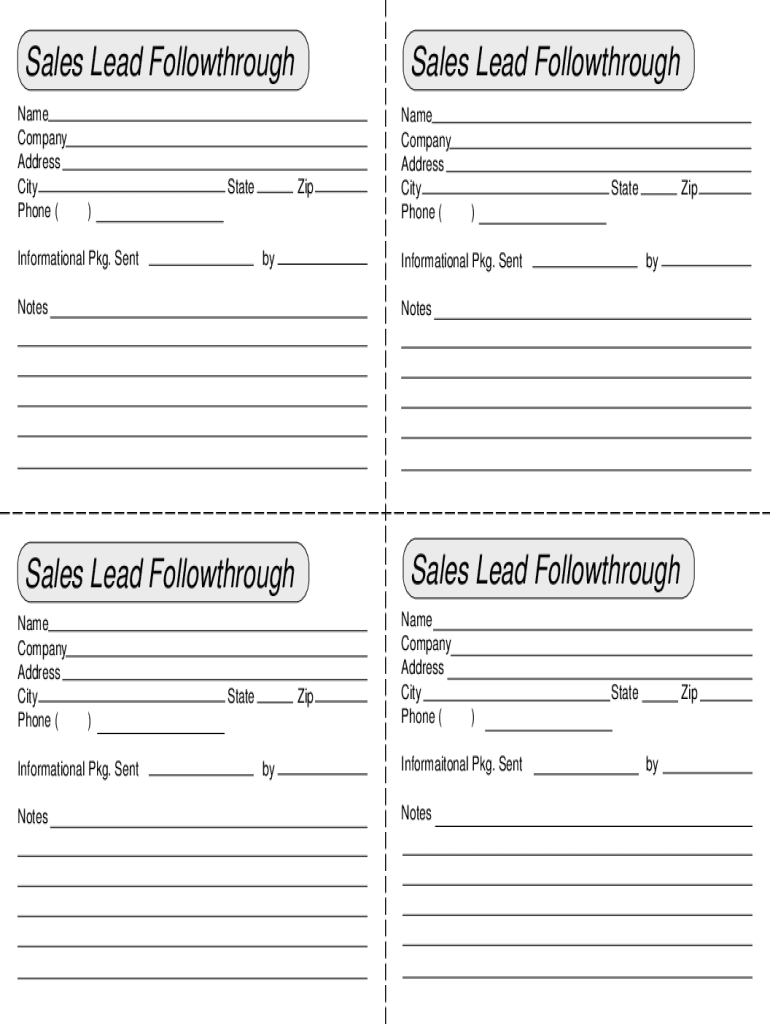

Think of your lead form as the digital front door to your business. A well-constructed form doesn’t just capture data; it acts as a preliminary qualifier, helping you understand the needs and intentions of your visitors. It sets the tone for future interactions, ensuring that when you do reach out, you’re already equipped with valuable insights that can transform a cold lead into a warm, interested prospect ready to discuss their life insurance needs.

Crafting Your Ideal Life Insurance Sales Lead Form

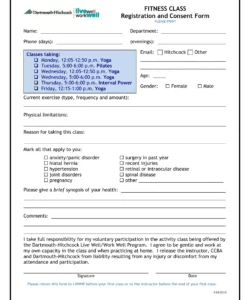

Designing an effective lead form for life insurance sales involves a careful balance between gathering necessary information and ensuring a smooth, non-intrusive user experience. The primary goal is to collect enough data to qualify a lead without overwhelming them with too many questions right off the bat. Imagine someone just browsing; they might be willing to share their name and email, but asking for their detailed medical history at the first touchpoint is likely to scare them away.

It’s crucial to think about the different stages of your sales funnel. For initial interest, a concise form that captures essential contact details and a broad indicator of their interest (e.g., “Looking for family coverage” or “Exploring retirement planning”) is ideal. As prospects move further down the funnel and demonstrate more engagement, you can then employ more comprehensive forms or conduct discovery calls to gather deeper, more specific information. This progressive profiling approach ensures you don’t deter early-stage leads while still getting the data you need for serious inquiries.

Another vital aspect is ensuring that your form explicitly addresses privacy concerns. People are increasingly wary of sharing personal information online. Including a clear, concise privacy statement or a link to your full privacy policy directly on the form can significantly boost trust and conversion rates. Reassure potential clients that their data will be handled with the utmost care and used only for the purpose of helping them with their insurance needs.

Furthermore, consider the language used on your form. It should be clear, jargon-free, and convey a sense of helpfulness rather than sales pressure. Each field should have a clear purpose, and the overall design should guide the user effortlessly through the process. A confusing or lengthy form is a barrier to entry, no matter how great your services are.

Essential Fields to Consider

- Full Name: For personalized communication.

- Email Address: The primary digital contact point.

- Phone Number: An alternative contact method, especially for direct conversations.

- Best Time to Contact: Shows respect for their schedule.

- General Inquiry Type: A simple dropdown (e.g., “Term Life”, “Whole Life”, “Estate Planning”) helps categorize their interest.

Advanced Fields for Qualification

- Age Range: Helps in policy suitability and pricing estimates.

- Number of Dependents: Indicates family protection needs.

- Current Employment Status: Provides insight into income stability.

- Rough Budget or Desired Coverage Amount: Helps in tailoring initial recommendations.

Maximizing Conversions with a User-Friendly Design

Beyond the questions asked, the actual design and user experience of your lead form play a monumental role in its effectiveness. A visually appealing, intuitive form isn’t just nice to have; it directly impacts how many visitors complete it and become a lead. Cluttered layouts, tiny text, or a lack of clear navigation can instantly deter a prospective client, no matter how interested they were initially in a life insurance sales lead form template.

One of the foremost considerations is mobile responsiveness. A significant portion of your website traffic likely comes from smartphones and tablets. If your form isn’t perfectly optimized for smaller screens, with large clickable fields and easy-to-read text, you’re essentially closing the door on a vast segment of potential leads. Test your form on various devices to ensure a seamless experience for everyone, everywhere.

Clear, compelling calls to action (CTAs) are another non-negotiable element. The button that submits the form should use action-oriented language that encourages completion. Instead of a generic “Submit,” consider “Get My Personalized Quote,” “Discover My Options,” or “Connect With An Advisor.” This clarifies what happens next and reinforces the value proposition.

Think about the psychological impact of form design. Break longer forms into multiple steps with a progress bar if necessary, making the task seem less daunting. Use clear validation messages that guide users when they make an error, rather than just showing a generic error message. Every element, from the font choice to the color of the submit button, contributes to the overall perception of your brand and the ease of interaction.

Finally, don’t forget the post-submission experience. What happens after someone clicks “Submit”? A customized thank-you page confirms their submission, provides immediate value (like a downloadable guide or a link to an informative blog post), and sets expectations for what comes next. This small detail can significantly enhance the user’s perception of your professionalism and commitment to service.

Investing time in refining your life insurance lead form is a powerful strategy for any agency aiming to grow its client base. It transforms a passive website visitor into an active prospect, providing you with the essential information to initiate personalized and effective outreach. By focusing on a user-centric design and thoughtful question selection, you’re not just collecting data; you’re cultivating relationships from the very first click. Continual testing and optimization based on performance data will ensure your forms remain highly effective tools in your ongoing lead generation efforts, driving sustained growth and success for your life insurance business.