Navigating the complexities of estate planning can feel like deciphering a secret code, especially when you want to ensure your property passes smoothly to your loved ones without the hassle of probate. In Florida, one popular tool that helps achieve this goal is the Enhanced Life Estate Deed, more commonly known as a Lady Bird Deed. This type of deed offers a unique way to retain control over your property during your lifetime while setting up an automatic transfer upon your passing, saving your beneficiaries significant time and money.

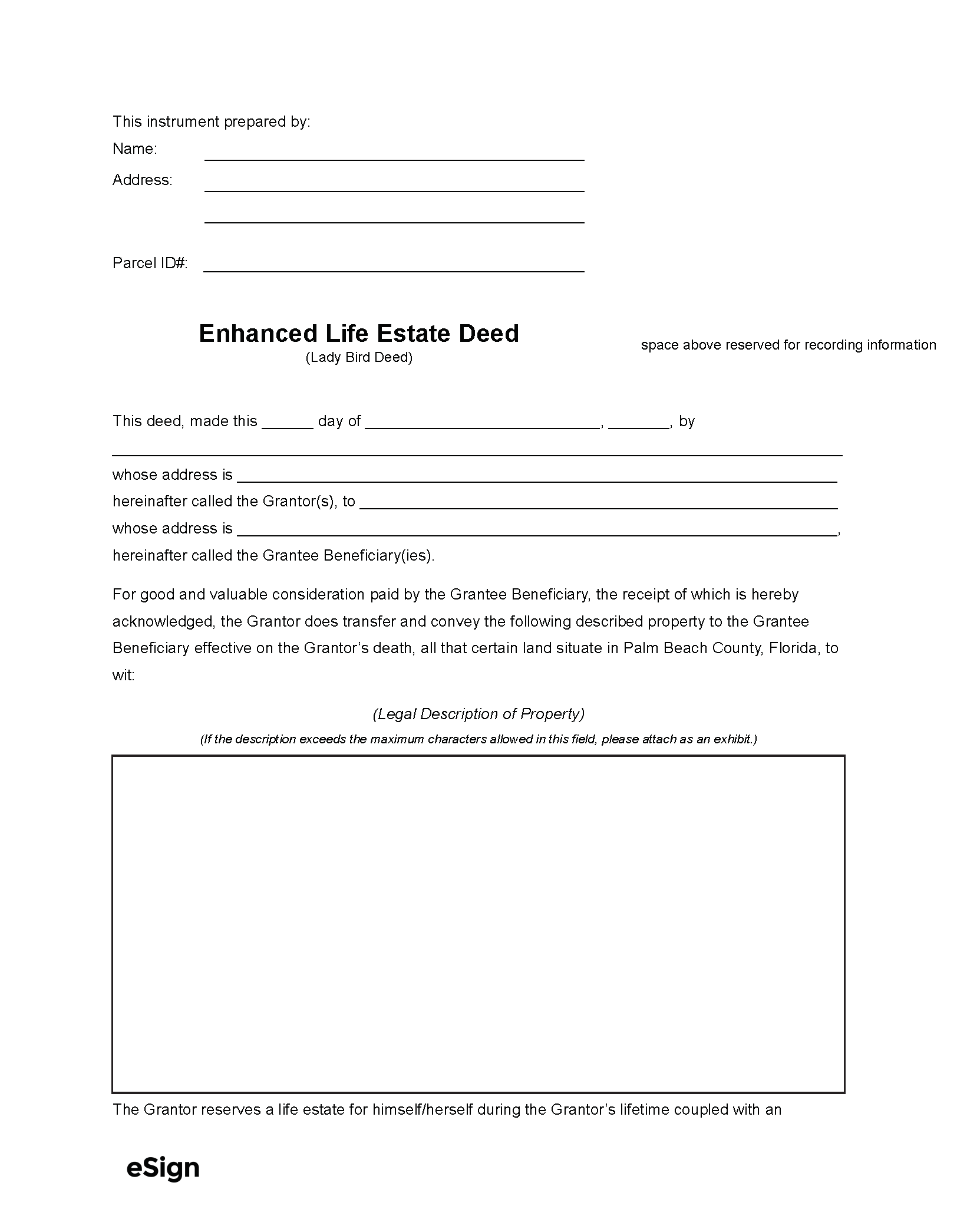

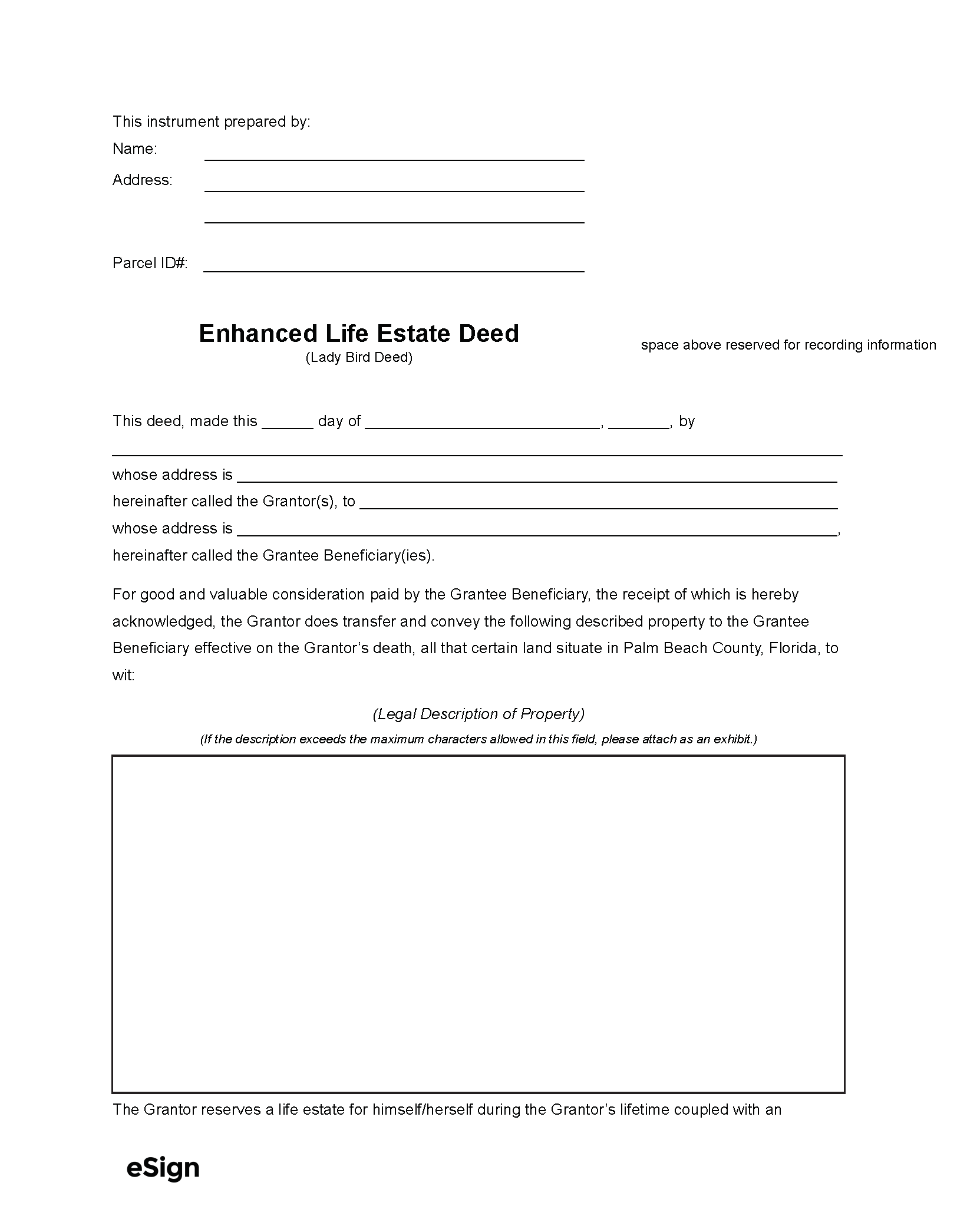

Many people look for a lady bird deed florida form template to simplify the process. While a template can be a helpful starting point, understanding what goes into this crucial document and how it impacts your estate plan is essential. Getting it right is key to enjoying the benefits this deed provides, so let’s explore what makes a Lady Bird Deed so useful and what you should consider when preparing one.

Understanding the Florida Lady Bird Deed and Its Advantages

A Florida Lady Bird Deed, formally known as an Enhanced Life Estate Deed, is a powerful estate planning tool that allows a property owner to transfer their property to a designated beneficiary upon their death, while retaining full control over the property during their lifetime. Unlike a traditional life estate deed, which limits your ability to sell, mortgage, or otherwise manage your property without the consent of the remainder beneficiaries, a Lady Bird Deed gives you the “enhanced” ability to do all of these things. You can even revoke the deed entirely or name new beneficiaries without needing their permission.

This flexibility is a significant advantage, as it means you aren’t locked into your decision. Should your circumstances change – perhaps you decide to sell your home, or you wish to change who inherits it – you have the freedom to do so without any complications. This control is maintained right up until the moment of your passing. At that point, the property automatically transfers to your named beneficiaries outside of probate court, which is a major benefit for your loved ones.

Avoiding probate is one of the primary reasons Floridians choose a Lady Bird Deed. Probate is the legal process of validating a will and distributing assets after someone dies, and it can be time-consuming, expensive, and public. By using a Lady Bird Deed, your property avoids this process entirely, allowing your beneficiaries to take ownership quickly and privately, often with just the filing of your death certificate in the county records. This significantly reduces stress and costs for your family during an already difficult time.

Moreover, a Lady Bird Deed can also offer protection against Medicaid recovery. If you ever need long-term care and apply for Medicaid benefits, the state might try to recover the cost of your care from your estate after you pass away. Because a Lady Bird Deed transfers the property outside of probate, it can sometimes shield the property from these recovery claims, preserving it for your intended heirs. It’s a nuanced area, though, and professional advice is always recommended if Medicaid planning is a concern.

Key Elements of a Florida Lady Bird Deed Form

- Grantor: The current property owner who is creating the deed.

- Grantee: The person or people who will inherit the property upon the grantor’s death.

- Legal Description: A precise and accurate description of the property, as found on the existing deed.

- Enhanced Life Estate Language: Specific legal phrasing that grants the owner the right to sell, mortgage, or revoke the deed without the beneficiary’s consent.

- Signatures: The grantor’s signature, witnessed by two individuals.

- Notarization: The grantor’s signature must be acknowledged by a notary public.

Navigating the Lady Bird Deed Florida Form Template and Potential Pitfalls

When searching for a lady bird deed florida form template, you’ll likely find various options available online. While these templates can offer a starting point, it’s crucial to approach them with caution. Florida real estate law has specific requirements, and a generic template might not include all the necessary language or might contain provisions that are not entirely suited to your specific situation. The exact wording and proper formatting are paramount for the deed to be legally valid and effective in Florida.

One of the biggest pitfalls of using a do-it-yourself template without proper guidance is the risk of errors in the legal description of the property or the specific language creating the enhanced life estate. An incorrect legal description can render the deed invalid, meaning the property might still go through probate. Similarly, if the “enhanced” language isn’t precisely drafted, the deed could inadvertently be interpreted as a traditional life estate, stripping you of the control you desired. This defeats the primary purpose of choosing a Lady Bird Deed in the first place.

Another consideration is ensuring the document complies with all Florida Statutes regarding deeds, including proper witnessing and notarization. Florida law requires that deeds be signed in the presence of two subscribing witnesses, and the grantor’s signature must be acknowledged by a notary public. Missing these crucial steps, or not recording the deed in the public records of the county where the property is located, can invalidate the transfer. A template might not explicitly walk you through these procedural requirements, leading to potential issues down the line.

Even with a seemingly perfect template, every individual’s circumstances are unique. Factors such as homestead status, marital status, existing mortgages, or other complex estate planning goals (like special needs trusts or tax considerations) can all influence how a Lady Bird Deed should be structured. What works for one person may not be ideal for another. Therefore, while a template might give you an idea of the document’s structure, it can’t replace tailored advice.

After you’ve carefully prepared your Lady Bird Deed, whether with a template or professional help, the final step is to record it. The deed must be filed with the Clerk of the Court in the county where the property is located. Recording the deed provides public notice of the transfer and ensures its legal effectiveness. Until it’s recorded, the deed might not be fully binding, even if properly signed and witnessed. It’s a small but vital step often overlooked by those using DIY approaches.

Ultimately, a Lady Bird Deed is a valuable instrument in Florida estate planning, offering flexibility and probate avoidance for your real property. While the idea of finding a lady bird deed florida form template might seem like an easy solution, ensuring the document is correctly drafted, executed, and recorded according to Florida law is critical. Taking the time to understand its implications and seeking appropriate guidance will ensure your wishes are carried out smoothly and your property is protected for your loved ones.