In today’s fast-paced business world, understanding who you’re dealing with isn’t just a good idea; it’s a fundamental requirement. Know Your Customer, or KYC, is the cornerstone of regulatory compliance, anti-money laundering AML efforts, and protecting your business from fraud and financial crime. It’s about gathering essential information to verify the identity of your clients, assess their risk profile, and ensure they are legitimate. This crucial process helps build trust and safeguards the integrity of financial systems worldwide.

While the concept of KYC is straightforward, its execution can be complex without the right tools. That’s where a well-designed know your customer kyc form template comes into play. A standardized template not only ensures consistency in data collection but also streamlines the entire onboarding process for both your team and your customers. It acts as a clear guide, ensuring no critical piece of information is missed, and that your compliance efforts are robust and efficient.

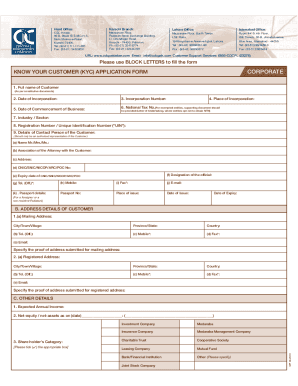

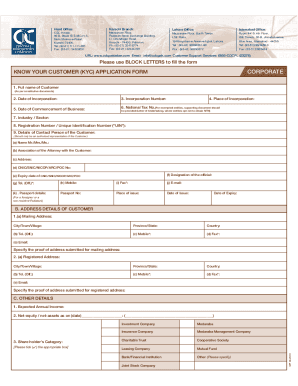

Understanding the Core Components of a KYC Form

A comprehensive KYC form is far more than just a list of questions; it’s a strategic tool designed to capture a complete picture of your client. Its structure needs to be logical, ensuring that information flows naturally and that all necessary data points for identification, verification, and risk assessment are covered. This systematic approach is vital for fulfilling regulatory obligations and for building a solid foundation of trust with your customers from the outset.

At its heart, a KYC form begins with basic identification details. This includes the customer’s full legal name, date of birth, and current residential address. For businesses, it would involve the company’s legal name, registration number, and principal place of business. These initial pieces of information form the baseline for identity verification and are usually the first step in establishing who you are interacting with.

Beyond the basics, a robust form will delve into verification details. This typically involves requesting official identification documents such as passports, national ID cards, or driver’s licenses for individuals, and incorporation documents or business registration certificates for entities. The form might also prompt for proof of address, like utility bills or bank statements. The goal here is to cross-reference the provided information with reliable, independent sources to confirm the customer’s identity and legitimacy.

Finally, a critical component of any effective KYC form is the inclusion of questions related to risk assessment. This section helps you understand the nature of the customer’s activities, their source of funds, and their anticipated transaction patterns. Questions about political affiliations, known associates, or the purpose of the business relationship can help in identifying potential high-risk profiles. The answers gathered here are instrumental in classifying customers and applying appropriate due diligence measures, ensuring your business is not inadvertently exposed to illicit activities.

Key Sections of a Comprehensive KYC Form

- Customer Identification Program CIP Information: This covers basic demographic data, contact details, and unique identifiers like tax ID numbers. It’s the primary data collection point.

- Beneficial Ownership Disclosure: For corporate clients, this section identifies the ultimate natural persons who own or control the legal entity, crucial for transparency.

- Source of Funds and Wealth: Questions to understand where the money comes from and how wealth was accumulated, particularly important for large transactions or high-risk profiles.

- Purpose of Business Relationship: Clarifying the reason for the customer’s engagement with your services helps in understanding their expected activities and flagging deviations.

- Risk Profiling Questions: These include inquiries about the customer’s occupation, industry, geographic locations of operations, and any politically exposed person PEP status, allowing for a tailored risk assessment.

Designing and Implementing Your Ideal KYC Form Template

Creating a truly effective know your customer kyc form template goes beyond merely compiling a list of necessary questions; it involves thoughtful design and strategic implementation. A well-designed template is intuitive, easy to navigate, and capable of adapting to various customer types and regulatory landscapes. Whether you opt for a digital or paper-based format, the user experience should be paramount, ensuring a smooth and efficient data collection process for both your staff and your clients. The goal is to collect comprehensive information without overwhelming the user, balancing compliance needs with operational efficiency.

Customization and scalability are key considerations when developing your template. A generic form might satisfy basic compliance, but a tailored one will cater specifically to your industry, target audience, and the unique risks your business faces. This means incorporating fields relevant to your services or products, and having the flexibility to add or remove sections as regulatory requirements evolve. Furthermore, the template should be scalable, capable of handling a growing customer base without compromising on data quality or processing speed, ensuring it remains effective as your business expands.

Integrating your KYC form template with existing operational systems is another critical step. Manually processing forms can be time-consuming and prone to errors. Leveraging digital tools that allow for direct data input, automated identity verification checks, and seamless transfer of information into your CRM or compliance software can dramatically improve efficiency. Equally important is ensuring robust data security measures are in place. Since KYC forms collect sensitive personal and financial information, protecting this data from breaches is not just a regulatory mandate but a cornerstone of maintaining customer trust.

Finally, the process of designing and implementing a KYC form is not a one-time task; it requires continuous review and updates. Regulations are constantly changing, and new risks emerge over time. Regularly assessing the effectiveness of your template, gathering feedback from users, and adapting it to reflect the latest compliance standards and best practices is essential. This proactive approach ensures that your know your customer kyc form template remains a dynamic and effective tool for ongoing compliance and risk management.

Adopting a meticulously crafted and continually refined know your customer kyc form template is a strategic imperative for any business today. It’s not merely a box-ticking exercise for regulators but a foundational element that strengthens your defenses against financial crime and builds a bedrock of trust with your clientele. A well-structured template ensures that your data collection is consistent, thorough, and compliant, making the onboarding journey smoother and more secure for everyone involved.

By investing in a robust and adaptable KYC form, businesses are not just meeting their legal obligations; they are also creating a more secure environment for their operations and fostering stronger, more reliable relationships with their customers. It’s an ongoing commitment to due diligence that ultimately contributes to the overall integrity of the financial ecosystem and the long-term success of your enterprise.