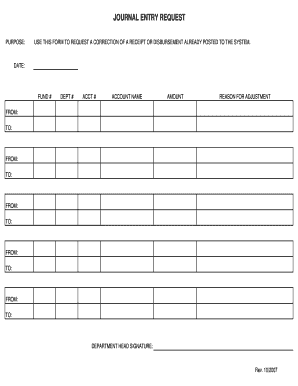

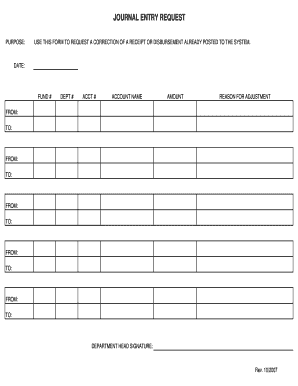

In the bustling world of business and finance, accuracy and clarity are paramount. Every transaction, every shift in an account, needs to be meticulously recorded to maintain healthy financial records. Sometimes, however, an adjustment or a new entry is required that isn’t part of the routine automated processes, necessitating a manual journal entry. This is where a standardized approach becomes not just helpful, but essential for smooth operations.

Without a clear system, requesting such entries can lead to misunderstandings, delays, and even errors that could ripple through your accounting system. Imagine different departments trying to communicate complex financial adjustments without a common language or structure. It’s a recipe for confusion. This is precisely why having a robust journal entry request form template at your disposal is a game-changer for any organization aiming for financial precision and efficiency.

The Indispensable Role of Structured Financial Communication

Ensuring that all financial adjustments are properly documented and approved is a cornerstone of good accounting practice. In many organizations, a significant number of journal entries are initiated outside of the core accounting department. This could be for various reasons: correcting errors, reclassifying expenses, accruing revenue, or adjusting inventory values. When these requests come in a disorganized fashion—perhaps through emails, handwritten notes, or even verbal instructions—the likelihood of mistakes increases dramatically. A lack of standardized information means the accounting team spends valuable time chasing details, clarifying intentions, and verifying authorizations. This not only slows down the entire financial close process but also introduces a higher risk of discrepancies that could impact financial reporting accuracy.

A well-designed journal entry request form, however, transforms this chaotic potential into a streamlined and reliable process. It acts as a clear communication bridge between the department requesting the entry and the finance team responsible for executing it. By providing dedicated fields for all necessary information, it eliminates guesswork and ensures that every detail, from the accounts affected to the reason for the entry, is explicitly stated. This level of clarity significantly reduces back-and-forth communication, allowing finance professionals to process entries more quickly and confidently. Furthermore, it inherently builds in a layer of accountability, as the requestor must provide specific details and, ideally, obtain the necessary approvals before submission.

Think about the benefits extending beyond mere efficiency. With a standardized form, your organization establishes a consistent audit trail. Every entry request is documented, approved, and filed in a uniform manner, making it far easier to trace transactions, comply with internal policies, and satisfy external audit requirements. It strengthens your internal controls by ensuring that no entry goes unverified and that all adjustments are properly authorized before impacting the financial statements. This systematic approach also aids in training new staff members, providing a clear protocol for how these crucial adjustments are to be handled.

In essence, adopting a comprehensive journal entry request form template isn’t just about filling out papers or digital fields; it’s about embedding a culture of precision and control within your financial operations. It elevates your accounting practices from reactive problem-solving to proactive, structured management, fostering a more transparent and reliable financial environment for everyone involved.

What to Include in Your Form

- Requestor information (name, department, date of request)

- Transaction date or period the entry applies to

- Detailed description of the journal entry (why it’s needed)

- Account numbers and names for both debits and credits

- Amount for each debit and credit

- Supporting documentation references (e.g., invoice numbers, report names)

- Approval section with signatures/dates for designated approvers

Optimizing Your Template for Seamless Financial Workflows

Once you’ve embraced the idea of a structured approach, the next step involves refining your chosen journal entry request form template to perfectly suit your organization’s unique needs. While there are common elements, the beauty of a template lies in its adaptability. Consider your specific accounting software, internal approval hierarchies, and the common types of manual entries your business typically processes. For instance, a small startup might need a simpler form than a large corporation with multiple subsidiaries and complex intercompany transactions. Tailoring the template means incorporating fields that are relevant to your operations and omitting those that are not, thereby making the form intuitive and less cumbersome to complete.

The implementation phase is just as critical as the design. It’s not enough to simply create a form; you need to ensure everyone who might need to request a journal entry understands how to use it correctly. This involves clear communication and perhaps even a brief training session for relevant departments. Explaining the “why” behind the form – how it benefits them by speeding up processing and reducing errors – can foster greater adoption. Providing clear instructions, examples of correctly filled forms, and easily accessible points of contact for questions will empower users to utilize the template effectively, ensuring consistent data quality from the outset.

Beyond paper forms, consider leveraging technology to further enhance your process. A digital journal entry request form template, perhaps integrated with your enterprise resource planning (ERP) system or a dedicated workflow management tool, can unlock significant efficiencies. Digital forms can incorporate dropdown menus for account codes, automate calculations, and route requests electronically to the appropriate approvers based on predefined rules. This not only accelerates the approval process but also reduces manual data entry errors and ensures that all supporting documents can be easily attached and retrieved, creating a fully digital and searchable audit trail that saves time and resources.

Finally, remember that your journal entry request form isn’t a static document; it’s a living tool that should evolve with your business. Regularly solicit feedback from both the requestors and the finance team. Are there fields that are consistently confusing? Are certain required details often missing? Do your internal controls or regulatory requirements change? Periodically reviewing and updating the template based on this feedback will ensure it remains relevant, efficient, and continues to serve as an invaluable asset in maintaining accurate and reliable financial records for your organization, adapting to new challenges and opportunities as they arise.

Establishing clear, consistent channels for all financial adjustments is a non-negotiable step towards superior financial management. By implementing a well-designed and properly utilized structured form, businesses can significantly reduce the potential for errors, accelerate their financial reporting cycles, and build a more robust system of internal controls.

The effort invested in standardizing your journal entry request process ultimately pays dividends in greater accuracy, improved accountability, and a more confident approach to navigating your organization’s financial landscape. It’s about empowering your teams with the right tools to ensure every financial detail is captured with precision and handled with care.