You’ve worked hard to save for retirement in your Individual Retirement Account (IRA), building a nest egg that will support you in your golden years. But have you thought about what happens to those funds if something unexpected occurs? It’s a question many people overlook, yet it’s one of the most important aspects of managing your retirement savings. Ensuring your legacy is protected and distributed according to your wishes requires a crucial step: properly designating beneficiaries.

This isn’t just about ticking a box; it’s about safeguarding your financial legacy and providing for your loved ones. Understanding the process and having access to the right tools, like an ira beneficiary designation form template, can make all the difference. Without a clear designation, your hard-earned savings could end up in probate court, causing delays, added expenses, and potential disagreements among family members. Let’s explore why this form is so vital and how to handle it effectively.

Why Your IRA Beneficiary Designation is Non-Negotiable

Imagine a scenario where, after years of diligent saving, your IRA funds are tied up in a legal battle, or worse, distributed in a way you never intended. This is a common, yet entirely avoidable, pitfall of not having a proper beneficiary designation in place. An IRA, unlike a regular bank account or property, passes outside of your will directly to the named beneficiaries. This means your will, no matter how carefully crafted, doesn’t dictate who inherits your IRA unless no beneficiaries are named or they’ve all passed away.

One of the most significant benefits of a clear IRA beneficiary designation is avoiding the often lengthy and costly probate process. When you name specific individuals or entities, the IRA custodian can directly transfer the funds to them upon your passing, significantly streamlining the distribution process. This not only saves your heirs time and money but also reduces potential stress during an already difficult period. It’s a simple step that offers immense peace of mind for both you and your loved ones.

It’s not enough to just name a primary beneficiary; thinking about contingent beneficiaries is equally important. A primary beneficiary is the first in line to receive the assets. However, if your primary beneficiary predeceases you, or for some reason cannot inherit, your contingent beneficiary steps in. Without a contingent beneficiary, your IRA assets might default back to your estate, subjecting them to probate and distribution according to your will or state intestacy laws. This underscores the need for thorough planning.

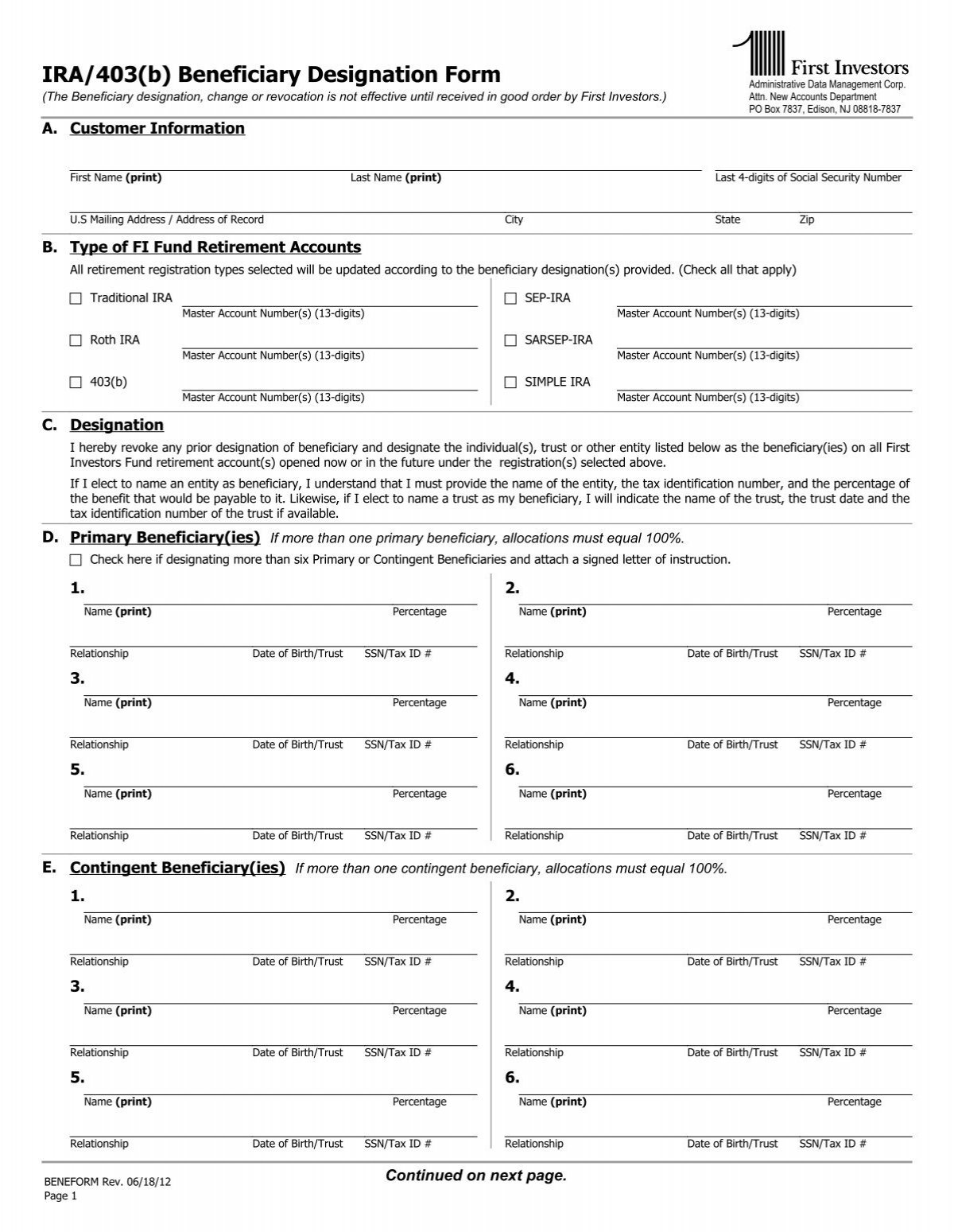

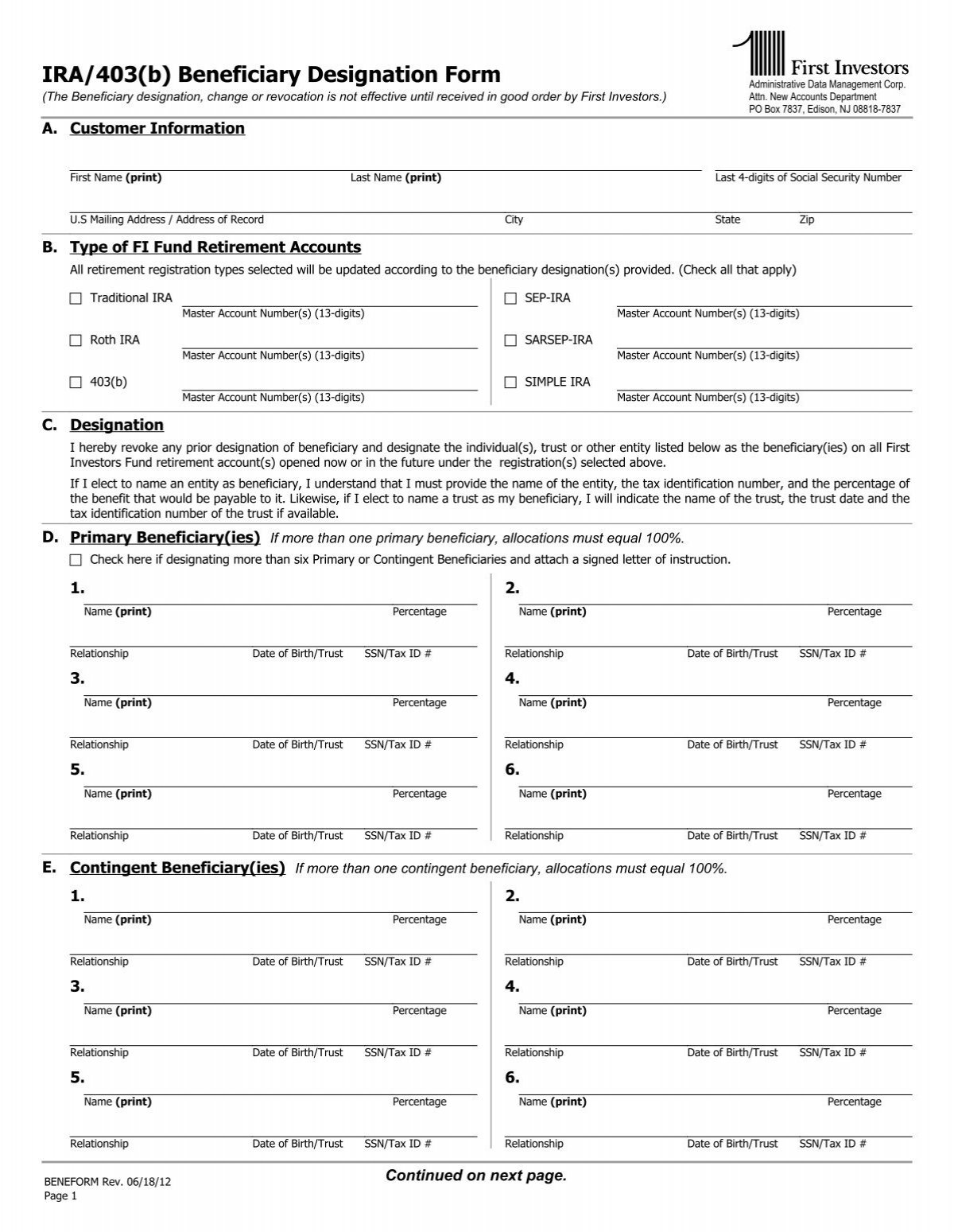

Key Beneficiary Types to Consider

- Primary Beneficiary: The first person or entity designated to receive your IRA assets. You can name multiple primary beneficiaries and specify their percentages.

- Contingent Beneficiary: The person or entity who inherits your IRA assets if all primary beneficiaries are unable to do so. This acts as a crucial backup plan.

- Per Stirpes vs. Per Capita: This specifies how assets are divided if a named beneficiary predeceases you and has their own heirs. “Per stirpes” means the deceased beneficiary’s share passes to their direct descendants, while “per capita” means the share is divided equally among the surviving named beneficiaries. Understanding this distinction is vital for ensuring your wishes are precisely met.

While naming individuals is common, you can also designate entities like trusts or charities as beneficiaries. Naming a trust can provide more control over how and when the funds are distributed, especially for minor children or beneficiaries with special needs. However, designating a trust is complex and usually requires the advice of an estate planning attorney. Similarly, if you wish to leave a portion of your IRA to a charitable organization, specifying them directly on the form ensures your philanthropic goals are met.

Finding and Filling Out Your IRA Beneficiary Designation Form Template

So, you’re ready to ensure your IRA is properly set up. The good news is that obtaining an ira beneficiary designation form template is usually quite straightforward. Most IRA custodians – whether it’s a brokerage firm, bank, or mutual fund company – provide these forms directly on their websites. A quick search on their site for “beneficiary designation form” or “IRA beneficiary form” should lead you to the correct document. If you can’t find it online, a simple call to their customer service line will get one mailed or emailed to you.

Once you have the form, filling it out accurately is paramount. Pay close attention to detail. You’ll typically need to provide your account number, your full legal name, and the full legal names of your primary and contingent beneficiaries. For individuals, you’ll also need their Social Security numbers and dates of birth. For trusts or organizations, you’ll need their legal name and potentially tax identification numbers. Any discrepancies or missing information could lead to delays or invalidation of your designations.

The form will also ask you to specify the percentage of assets each beneficiary should receive. If you have multiple primary beneficiaries, ensure the percentages add up to 100%. The same applies to contingent beneficiaries. If you don’t specify percentages, many custodians will assume an equal split among those named. Some forms also provide options for how beneficiaries should inherit if one passes away, such as “per stirpes” or “per capita,” as discussed earlier. Reading the instructions carefully will help you make the right choices for your situation.

After completing the ira beneficiary designation form template, sign and date it according to the custodian’s instructions. Many custodians require a “wet signature,” meaning a physical signature, though some may accept electronic signatures. Always keep a copy for your records and confirm with your IRA custodian that they have received and processed your updated designation. This step is critical; until the form is officially processed and recorded, your new designations are not legally binding.

Remember, life changes. Marriages, divorces, births, deaths, and even changing relationships can all impact your beneficiary wishes. It’s wise to review your IRA beneficiary designations periodically, perhaps every 3-5 years, or whenever a major life event occurs. This ensures your designations remain aligned with your current wishes and family circumstances, preventing unintended consequences down the line. A little vigilance goes a long way in securing your financial legacy.

Taking the time to properly designate beneficiaries for your Individual Retirement Account is a small effort that yields tremendous benefits. It ensures your assets bypass probate, are distributed efficiently, and, most importantly, go directly to the people or causes you intend to support. This proactive step not only provides financial security for your loved ones but also offers you significant peace of mind knowing your hard-earned savings are handled exactly as you wish.

Don’t let this crucial aspect of retirement planning fall by the wayside. Whether you’re setting up a new IRA or reviewing existing accounts, make sure your beneficiary designations are up-to-date and accurately reflect your current intentions. It’s a testament to your foresight and care, leaving a clear and lasting legacy for those who matter most.