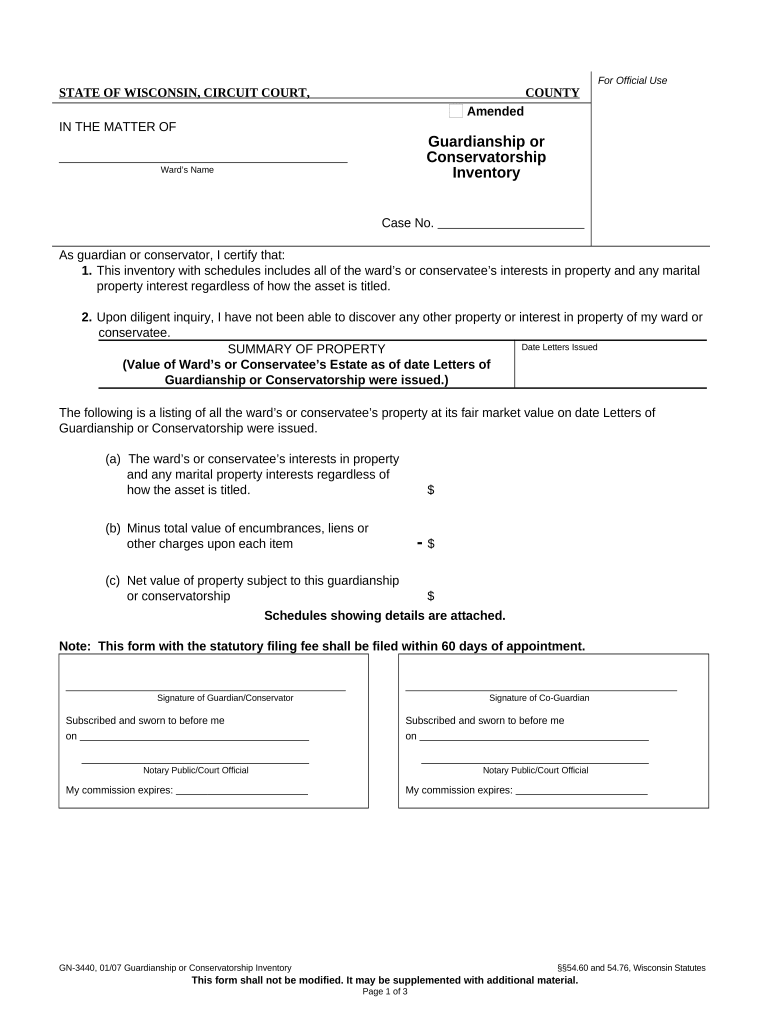

Taking on the role of a guardian is a significant responsibility, one that involves making crucial decisions for another individual, often referred to as the ward. A core part of this duty in Illinois, as in many states, involves meticulously managing and accounting for the ward’s assets. This isn’t just a good practice; it’s a legal requirement designed to protect the ward’s financial well-being and ensure transparency.

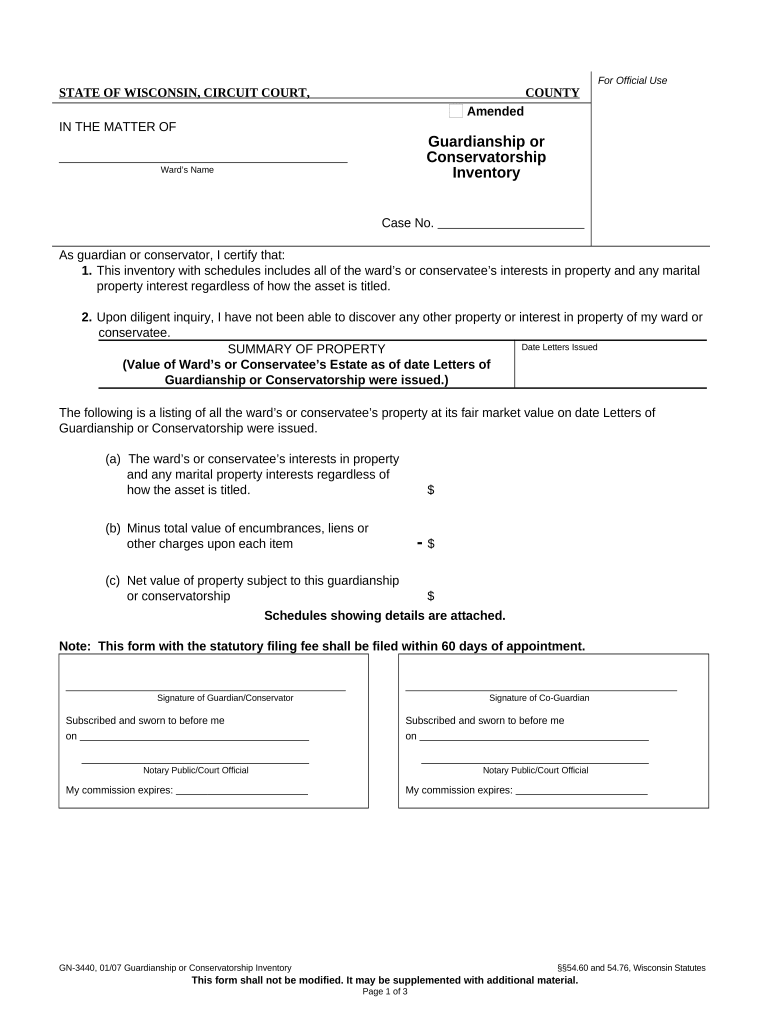

The process of inventorying these assets can seem daunting, especially for those new to guardianship. Understanding what needs to be included, how it should be presented, and the deadlines involved can be overwhelming. This is where having a clear understanding of the requirements and potentially utilizing an illinois guardian inventory form template can be incredibly helpful in streamlining the process and ensuring compliance with state regulations.

Understanding the Illinois Guardian Inventory Requirement

When you become a guardian in Illinois, one of your first and most critical tasks is to file an inventory of the ward’s assets with the court. This inventory serves as a comprehensive snapshot of everything the ward owns at the time guardianship is established. It’s a fundamental step for several reasons: it establishes a baseline for all future financial reporting, prevents potential mismanagement or misappropriation of funds, and provides a clear record for the court to review. Think of it as opening statement of accounts for the ward’s entire estate.

This inventory isn’t just about listing bank accounts. It encompasses a wide range of assets, both tangible and intangible. This includes any real estate the ward owns, vehicles, personal belongings of significant value, and all financial instruments. Even if an asset seems small or insignificant, if it has any value, it generally needs to be documented. This comprehensive approach ensures that every aspect of the ward’s financial situation is accounted for and protected under your guardianship.

Key Components of the Inventory

While the specific layout might vary slightly, any reliable illinois guardian inventory form template will guide you to include several key categories of assets. Accuracy is paramount, and you’ll often need to provide supporting documentation for the values you report. This might include recent bank statements, property appraisals, or investment account summaries.

- Cash and Bank Accounts: All checking, savings, money market, and certificate of deposit accounts, along with their balances as of the date of guardianship appointment.

- Investments: Stocks, bonds, mutual funds, retirement accounts (IRAs, 401ks), and any other investment portfolios.

- Real Estate: Any property owned by the ward, including residential homes, commercial properties, or vacant land, along with their estimated fair market value.

- Personal Property: High-value items such as vehicles, jewelry, art collections, antiques, and other significant tangible assets.

- Debts and Liabilities: While primarily an asset inventory, it’s also crucial to note any significant outstanding debts, such as mortgages, loans, or credit card balances, as these impact the net worth of the estate.

Failing to properly complete and file the inventory can lead to serious consequences, including court reprimands, legal challenges, or even removal as a guardian. It’s a clear signal to the court that you are taking your fiduciary duties seriously and are committed to managing the ward’s affairs responsibly.

Navigating the Process with an Illinois Guardian Inventory Form Template

Using an Illinois guardian inventory form template can significantly simplify what might otherwise be a complex and intimidating task. These templates are typically designed to walk you through each required section, prompting you for the necessary information and ensuring that you don’t overlook any critical details. They act as a structured guide, allowing you to systematically gather and input the ward’s financial information in a format that the court expects to see.

While an official template might be available through the Illinois court system’s website or local circuit clerk’s office, various legal aid organizations or specialized elder law attorneys might also offer versions. It is always wise to seek out the most current version available, as legal forms can sometimes be updated. Even if you don’t use a strict template, understanding its structure is key. It helps you organize your thoughts and documents before you even begin to fill out the official paperwork.

Before you start filling out any form, gather all pertinent documents. This includes bank statements, investment account summaries, property deeds, vehicle titles, and any other financial records. Having these readily accessible will make the process much smoother and reduce the chances of errors. If you encounter any ambiguities or complexities regarding the valuation of certain assets or legal implications, consulting with an attorney specializing in guardianship can provide invaluable guidance and peace of mind.

Remember, filing the initial inventory is just the beginning of your financial reporting obligations. Guardians are typically required to file regular accountings with the court, often annually, to show how the ward’s assets have been managed, what income has been received, and what expenses have been paid. The initial inventory forms the baseline for all these future reports, making its accurate and thorough completion absolutely essential for maintaining proper records and fulfilling your long-term duties.

Effectively managing the financial affairs of a ward is a cornerstone of responsible guardianship. The inventory form, while a detailed undertaking, is a vital tool in ensuring transparency and protecting the ward’s assets. Approaching this task with diligence, possibly with the aid of a well-structured template, sets a strong foundation for fulfilling your duties.

By carefully documenting all assets and presenting them clearly to the court, you not only meet legal obligations but also demonstrate your commitment to the ward’s well-being. This meticulous approach provides a clear financial roadmap, allowing for informed decisions and safeguarding the ward’s estate throughout the duration of the guardianship.