There’s a unique feeling that washes over you when that first official-looking envelope lands in your mailbox or an email notification pops up, announcing the arrival of your annual tax forms. For many, it’s a mix of slight dread and a nudge that tax season is indeed upon us. These aren’t just pieces of paper; they are crucial summaries of your financial activities over the past year, laying the groundwork for your tax return.

Navigating these documents, understanding what each one means, and ensuring you have everything you need can feel like a daunting task. However, with a bit of organization and a clear approach, the process can be much smoother. Think of it less as a chore and more as gathering the pieces of a puzzle, where each form is a vital component. Being prepared is half the battle, and having a system in place can transform potential confusion into confident compilation.

Decoding Your Annual Tax Documents

As the new year gets underway, you’ll likely start receiving various tax documents from employers, banks, investment firms, and other entities. These forms are not just for your records; they are also sent to the Internal Revenue Service (IRS) or your equivalent national tax authority, providing a mirror image of the income you earned or the transactions you conducted. It’s essential to understand that each form serves a specific purpose, reporting different types of income or financial activity that impact your tax liability.

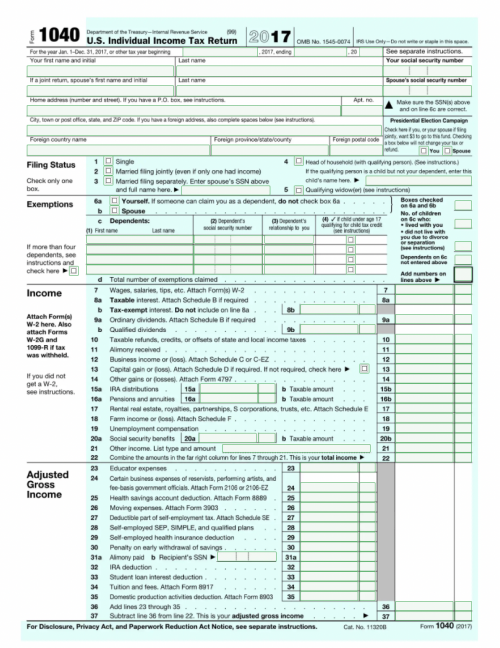

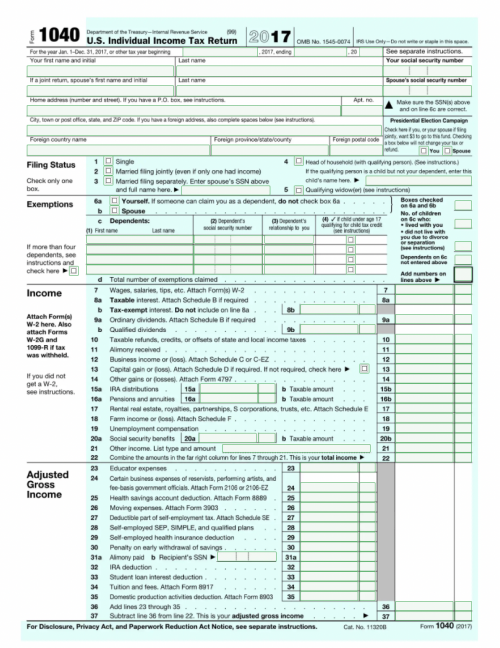

For instance, your employer sends you a W-2, detailing your wages and the taxes withheld from your paychecks. If you have non-employee compensation, such as income from freelancing or contract work, you might receive a Form 1099-NEC. Interest earned on savings accounts usually comes on a Form 1099-INT, while dividends from investments are reported on a Form 1099-DIV. Each piece of mail, or digital notification, is a key component in accurately reporting your financial picture to the government.

It’s not enough to simply collect these forms; you need to review them carefully. Mistakes, though rare, can happen, and it’s your responsibility to ensure the information reported is accurate. Discrepancies could lead to delays in processing your return or, worse, audits down the line. Take the time to compare the figures on the forms with your own records, like pay stubs or bank statements, to catch any errors before you begin preparing your return.

Common Forms You Might Encounter

Understanding the common types of tax forms you might receive can significantly reduce the anxiety associated with tax season. Knowing what to expect and what each form reports helps you anticipate your tax situation and ensure you have all necessary documentation. Here are some of the most frequently seen forms:

- W-2: Wage and Tax Statement from your employer.

- 1099-NEC: Nonemployee Compensation, typically for independent contractors.

- 1099-INT: Interest Income from banks and financial institutions.

- 1099-DIV: Dividends and Distributions from investments.

- 1098: Mortgage Interest Statement from your mortgage lender.

- 1098-T: Tuition Statement from educational institutions.

- 1095-A, B, or C: Health Coverage forms, depending on how you received health insurance.

Keep a watchful eye out for these documents. They usually start arriving in late January and continue through mid-March. If you believe you should have received a form but haven’t, it’s crucial to contact the issuing entity directly to request it. Having a complete set is vital for an accurate filing.

Leveraging an Organizational Template for Tax Season

Once you’ve got a handle on the types of forms you’ll be receiving, the next logical step is to get organized. It can be surprisingly easy to misplace a crucial document amidst the flurry of daily mail, or to forget about a minor income stream. This is precisely where a systematic approach, often in the form of an organizational template, becomes invaluable. It transforms the overwhelming pile of papers into a manageable checklist, ensuring nothing gets overlooked.

When you exclaim “i received my tax form template” as you pull those envelopes from the mailbox, you’re not just getting a blank form; you’re gaining a starting point for compilation. Think of this template not as a tax form itself, but as a personal checklist or a data tracker. It’s a structured way to log each document as it arrives, noting details like the sender, the type of form, and the key figures reported. This centralized record keeps all your critical tax information neatly summarized and easily accessible, saving you time and stress when you eventually sit down to prepare your return.

The benefits of using such an organizational tool are manifold. Firstly, it provides a clear overview of all the documents you’ve received and highlights any outstanding ones you might still be waiting for. This reduces the risk of forgetting an income source or a deductible expense. Secondly, it streamlines the data entry process, whether you’re using tax software or working with a tax professional, as all the necessary information is at your fingertips. Lastly, it instills a sense of calm and control over a process that often feels chaotic, allowing you to approach tax season with confidence.

Creating your own tax form template doesn’t have to be complicated. A simple spreadsheet or even a dedicated folder with a checklist taped inside can work wonders. What’s important is that it serves as your personal command center for all incoming tax-related mail and digital notifications. Consider including columns for the date received, the form type (e.g., W-2, 1099-INT), the issuer (e.g., your employer, bank name), and a brief note about the key amount or purpose of the form. You might even add a checkbox to mark whether the information has been verified or if the form has been entered into your tax software.

This proactive step of systematically managing your tax documents as they arrive transforms a potentially frantic last-minute scramble into a smooth, organized process. By keeping track of everything from the moment it lands in your hands, you’re not just preparing for tax season; you’re ensuring accuracy, minimizing stress, and setting yourself up for a successful filing experience. It’s all about taking control of your financial information and making tax time less of a burden and more of a routine administrative task.