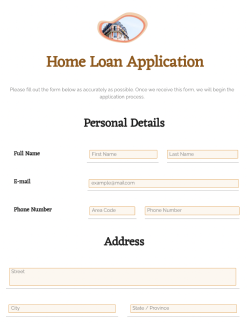

Embarking on the journey to homeownership is an exciting milestone. The dream of having your own space, decorating it just the way you like, and building a life within its walls is a powerful motivator. However, before you can pick out paint swatches and furniture, there’s a crucial step: securing a housing loan. This process often begins with an application form, a comprehensive document that serves as your financial introduction to potential lenders. It might seem daunting at first, but with the right approach, it becomes a clear path forward.

Preparing a thorough and accurate application is paramount to a smooth approval process. A well-organized submission not only impresses lenders but also saves you time and reduces the back-and-forth often associated with incomplete paperwork. This is where a ready-to-use housing loan application form template can be incredibly useful, providing a clear roadmap of the information you’ll need to gather and present. It helps you anticipate questions and assemble your financial story in a structured manner, ensuring you don’t miss any critical details.

What Exactly Goes into a Housing Loan Application Form?

A typical housing loan application form is designed to give lenders a holistic view of your financial health, your personal circumstances, and the property you intend to purchase. It’s more than just a few lines about your income; it delves into various aspects of your life that demonstrate your ability and willingness to repay the loan. Think of it as putting together a detailed financial resume for your dream home. Every section is important and contributes to the overall picture the lender forms of you as a borrower.

The initial sections often focus on your personal identification and contact information. This is foundational, ensuring the lender knows exactly who they are dealing with and how to reach you throughout the application process. Accuracy here is key, as any discrepancies could cause delays or raise red flags.

Personal and Contact Details

- Full Legal Name

- Current and Previous Residential Addresses

- Contact Phone Numbers

- Email Address

- Date of Birth

- Marital Status and Dependents

- Identification Document Details (e.g., Passport, National ID)

Following your personal information, the form will pivot to your financial standing. This is perhaps the most critical part, as it directly assesses your capacity to handle the loan. Lenders want to see a stable income, a responsible approach to debt, and a clear understanding of your financial commitments. This section often requires supporting documents like payslips, bank statements, and tax returns to verify the information provided.

Financial Overview

- Employment History and Current Employer Details

- Sources of Income (Salary, Business Income, Rental Income, etc.)

- Details of Assets (Savings Accounts, Investment Portfolios, Other Properties)

- Details of Liabilities (Other Loans, Credit Card Debts, Mortgages)

- Bank Account Information

Finally, there will be sections dedicated to the property you wish to finance, including its address, purchase price, and any details about the seller. The form also includes important declarations, where you confirm the accuracy of the information provided and authorize the lender to conduct credit checks. This comprehensive approach ensures that lenders have all the necessary data to make an informed decision on your loan eligibility.

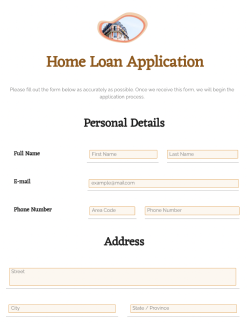

Why Bother with a Housing Loan Application Form Template?

Navigating the complexities of a housing loan application can feel like preparing for a marathon. There’s a vast amount of information to gather, forms to fill, and documents to organize. This is precisely where a dedicated housing loan application form template becomes an invaluable tool. It’s not just about having a blank sheet; it’s about having a pre-structured guide that anticipates what lenders will ask for, allowing you to prepare proactively rather than reactively.

Using a template ensures that you cover all the bases. Instead of staring at a blank form and wondering what comes next, you have a clear outline. This structured approach helps prevent omissions, which are often the leading cause of application delays. When you submit a complete package from the outset, you signal to the lender that you are organized and serious about your application, which can significantly speed up the review process.

Moreover, a template serves as an excellent checklist. As you gather your personal, employment, and financial data, you can simply tick off items on the template. This reduces stress and helps you maintain focus, ensuring that when it’s time to actually fill out the official bank form, you have all the information readily accessible and accurately presented. It transforms a potentially overwhelming task into a series of manageable steps.

Ultimately, a housing loan application form template empowers you with preparation. It allows you to understand the full scope of the application process before you even step into a bank. This foresight not only makes the application process more efficient but also gives you a sense of control and confidence. By streamlining your preparation, you’re not just filling out a form; you’re building a strong case for your financial future.

Taking the time to meticulously prepare your application documents before submitting them can genuinely make a difference in your home buying journey. It sets a positive tone with lenders, demonstrating your readiness and responsibility. This proactive step can pave the way for a smoother approval process, allowing you to focus on the exciting aspects of moving into your new home sooner.

Embrace the power of organization and preparedness. With a clear understanding of what’s required and the tools to gather it efficiently, you’ll find the path to homeownership much less daunting and significantly more attainable. Your dream home awaits, and a well-prepared application is your first confident stride towards it.