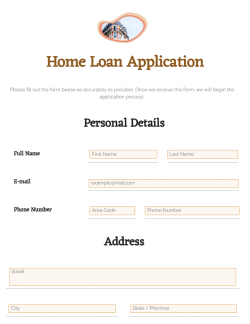

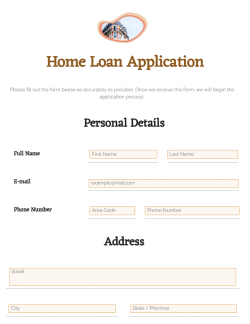

Navigating the path to homeownership can feel like a labyrinth, with forms, documents, and disclosures at every turn. One of the most critical pieces of this puzzle is the home loan application itself. It’s the primary document that tells your financial story to a potential lender, and having a clear, comprehensive home loan application form template can make a world of difference for both applicants and the institutions reviewing their requests. It sets the stage for a smooth, efficient process, ensuring all necessary information is gathered from the outset.

Think of this template not just as a set of blank spaces to fill, but as a guided journey through the information lenders need to make an informed decision about your eligibility. It standardizes the collection of crucial details, minimizes back-and-forth requests for missing items, and ultimately helps everyone involved move closer to that exciting closing day. Whether you’re a prospective homeowner preparing your documents or a lending professional aiming to streamline your intake process, understanding the anatomy of an effective template is invaluable.

What Goes Into a Comprehensive Home Loan Application Form Template?

A robust home loan application form template isn’t just about asking for a name and an income. It’s a meticulously designed document that systematically collects a wide array of personal, financial, and property-specific data points. Every section serves a purpose, contributing to the lender’s overall assessment of your creditworthiness and the risk associated with the loan. From your identifying details to the specifics of the property you wish to purchase, accuracy and completeness are paramount.

The template typically begins with personal information, establishing who you are and how to contact you. This then transitions into your financial history, which is arguably the most scrutinised section. Lenders need to understand your income stability, your current debts, and your assets, which together paint a picture of your financial health. This part of the application helps them determine your debt-to-income ratio, a key metric in loan approval.

Next, the form delves into your employment history. Lenders want to see stable employment, as it’s a strong indicator of your ability to make consistent mortgage payments. Details like your employer’s name, your position, how long you’ve been there, and your salary are all critical. If you’ve had multiple jobs recently, the template should accommodate this, allowing you to provide a clear timeline of your work experience.

Finally, a good home loan application form template will include sections dedicated to the property itself, if it’s already identified, and any declarations relevant to your financial or legal history. This holistic approach ensures that lenders have all the pieces of the puzzle before they even begin their in-depth underwriting process, significantly cutting down on follow-up questions and speeding up the overall application timeline.

Key Sections to Include in Your Template

When putting together or reviewing a home loan application form template, ensure these core components are clearly defined and easy to complete. Overlooking any of these could lead to delays or even a rejected application.

- Applicant Information: Full legal name, current and previous addresses, contact details, social security number, date of birth, and marital status.

- Employment Information: Current and past employers, job titles, start and end dates, and details of your income.

- Income and Assets: Breakdown of all income sources (salary, bonuses, commissions, other income), bank accounts, investment accounts, and other valuable assets.

- Debts and Liabilities: Credit card balances, auto loans, student loans, other mortgages, and any other outstanding debts.

- Property Information: If applicable, the address of the property, purchase price, and the amount of down payment.

- Declarations: Questions regarding bankruptcy, foreclosures, outstanding judgments, and other legal or financial matters.

The Benefits of Using a Well-Designed Template

The advantages of utilizing a meticulously crafted home loan application form template extend far beyond mere organization. For the applicant, it transforms what can be an overwhelming task into a structured, manageable process. Instead of wondering what information is needed, you’re guided step-by-step, ensuring you gather all necessary documents and details before you even begin filling out the official forms. This proactive approach minimizes errors and omissions, which are common culprits for application delays.

From a lender’s perspective, a standardized template is a godsend for efficiency and consistency. It ensures that every application received follows the same format, making it easier for loan officers and underwriters to review and compare information. This consistency drastically reduces the time spent sifting through disparate data presentations and allows them to focus on the core assessment rather than administrative reordering. Ultimately, this can lead to faster approval times and a more streamlined internal workflow.

Moreover, a well-structured template acts as a compliance safeguard. It can be designed to prompt for all legally required disclosures and acknowledgments, helping lenders meet regulatory obligations. This not only protects the institution from potential legal issues but also ensures transparency for the applicant, providing them with all the necessary information about the loan terms and conditions upfront. It’s about building trust through clear communication and adherence to standards.

In essence, a thoughtful home loan application form template serves as a common language between the applicant and the lender. It demystifies the process, making it more accessible for individuals pursuing homeownership and more efficient for the professionals facilitating it. Its value lies in its ability to simplify complexity, enhance accuracy, and accelerate a process that is often perceived as lengthy and arduous.

- Time Savings: Reduces the time applicants spend figuring out what to include and lenders spend chasing missing information.

- Reduced Errors: Guides applicants to provide complete and accurate data, minimizing mistakes that could cause delays.

- Improved Clarity: Presents information in a consistent, easy-to-read format for lenders, streamlining the review process.

- Enhanced Compliance: Helps ensure all regulatory requirements and necessary disclosures are addressed within the application.

- Better Decision Making: Provides a comprehensive overview of the applicant’s financial situation, aiding lenders in making informed decisions.

Having a well-constructed template at your disposal can dramatically simplify the initial steps of securing a home loan. It transforms a potentially confusing and intimidating process into a clear, actionable series of steps. By meticulously organizing the required information, it benefits everyone involved, fostering a more efficient, transparent, and ultimately faster journey towards achieving your homeownership dreams.

Embracing such a structured approach ensures that you or your clients are well-prepared for the rigorous financial assessment that lies ahead. It’s a fundamental tool that paves the way for a smoother transition from application to approval, bringing the keys to your new home within closer reach.