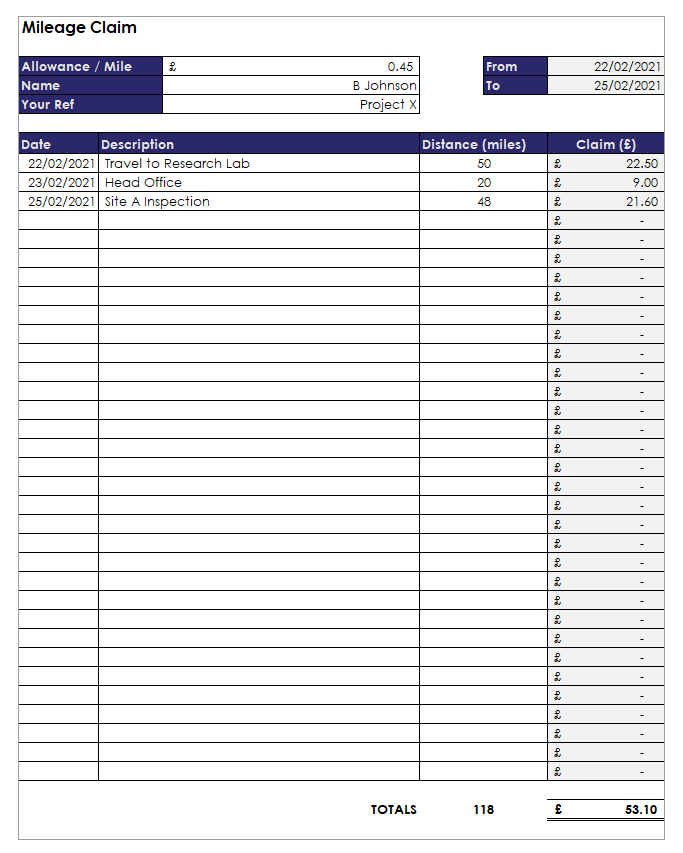

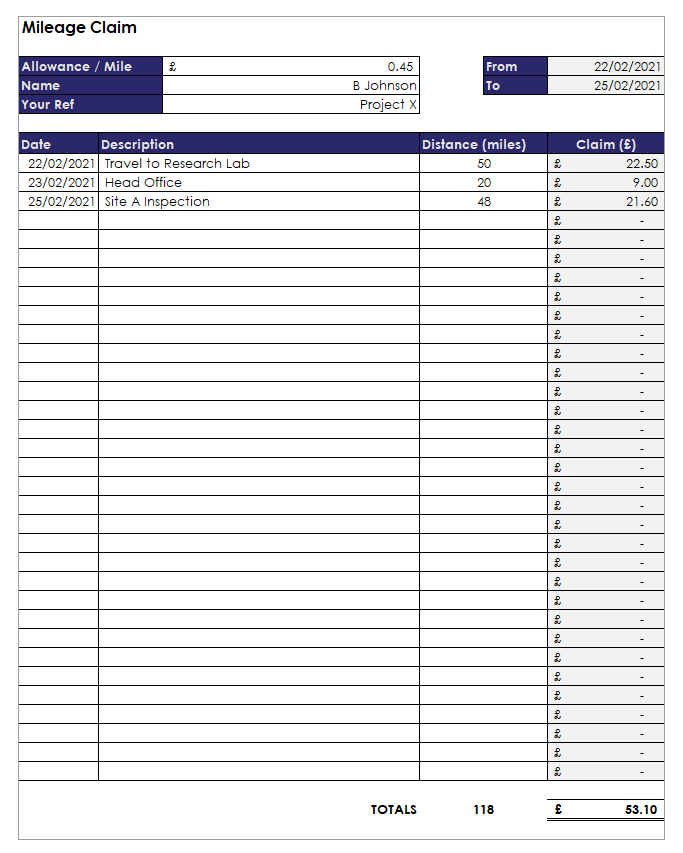

Navigating the world of business expenses can sometimes feel like deciphering a complex puzzle, and mileage claims are certainly no exception. If you are self employed or an employee who uses your personal vehicle for work related travel, understanding how to properly claim back your motoring costs from HMRC is incredibly important. It is not just about getting your money back it is also about ensuring you stay compliant with tax regulations.

Many individuals and businesses find themselves scratching their heads when it comes to keeping precise records that satisfy HMRC’s requirements. This is where a well-structured approach comes into play. Having a reliable system in place, perhaps even a dedicated template, can transform what might seem like a daunting task into a straightforward administrative process. A good template ensures you capture all the necessary details, making your claims smooth and hassle-free, and most importantly, defensible should HMRC ever decide to take a closer look.

Understanding HMRC Mileage Allowances and Your Claim

HMRC provides approved mileage allowance payments, often referred to as AMAPs, to cover the cost of using your own vehicle for business journeys. These allowances are set rates per mile, designed to cover costs like fuel, wear and tear, and servicing. For cars and vans, the rate is typically 45 pence per mile for the first 10,000 miles in a tax year, dropping to 25 pence per mile thereafter. Motorcycles have a rate of 24 pence per mile, and bicycles are set at 20 pence per mile. These rates apply whether you are an employee claiming expenses from your employer, or a self-employed individual deducting motoring costs from your profits.

However, simply knowing the rates is only half the battle. The crucial part is substantiating your claims. HMRC requires accurate and detailed records for every business journey you intend to claim for. Without proper documentation, any claim you make could be challenged, potentially leading to additional tax, interest, or even penalties. This is why a systematic approach to logging your mileage is not just helpful, it is essential for compliance and peace of mind.

For instance, consider an employee who uses their car daily for client visits across different cities. Manually scribbling down notes in a notebook might work for a day or two, but it quickly becomes disorganised and prone to errors. A structured method, perhaps a spreadsheet or a printed form, helps to capture all the relevant data consistently. It removes the guesswork and ensures that every detail HMRC expects is readily available.

Key Information for Your Mileage Log

- Date of journey

- Start and end locations including postcodes

- Purpose of the journey clearly stating its business relevance

- Total mileage covered for that specific journey

- Vehicle used including make model and registration number

- Any passenger details if you are claiming for carrying colleagues on business journeys

Maintaining these records meticulously throughout the tax year will save you significant time and potential stress when it comes to filing your tax return or preparing your accounts. It turns what could be a headache into a simple matter of pulling data from your well-maintained log.

Creating and Using Your Hmrc Mileage Claim Form Template Effectively

When it comes to tracking your mileage for HMRC, a dedicated hmrc mileage claim form template can be your best friend. This template does not have to be overly complex; its primary purpose is to provide a consistent framework for logging all the necessary information. You can create one yourself using a simple spreadsheet program like Microsoft Excel or Google Sheets, or even find pre-made printable versions online. The key is to design it in a way that is easy to use daily or weekly, ensuring you never miss a journey.

The structure of your template should reflect the essential information HMRC expects. Each entry should have clearly defined fields for the date, starting and ending points of your journey, the specific purpose of the trip (e.g., client meeting at XYZ Ltd, supplier visit, training course), and the total mileage covered for that single journey. Including a column for your vehicle registration can also be helpful, especially if you use different vehicles for business.

For many, digital templates offer an advantage due to their ease of calculation and storage. A spreadsheet can automatically tally your mileage for the month or year, apply the appropriate HMRC rates, and calculate your total claimable amount or the amount due from your employer. This automation significantly reduces the risk of manual calculation errors and frees up your time for other tasks.

Beyond just claiming, an effective mileage log also provides valuable insights into your travel patterns and associated costs. This can be beneficial for budgeting, understanding your overall business expenses, and even identifying areas where you might reduce travel or optimise routes. Remember that HMRC requires you to keep records for a certain period, usually five years after the 31 January submission deadline of the relevant tax year. Therefore, ensuring your template is easily stored and retrieved is just as important as filling it in correctly.

Keeping meticulous records of your business mileage is a fundamental aspect of managing your finances and ensuring compliance with HMRC regulations. By adopting a systematic approach, perhaps by utilising a robust template, you transform a potentially burdensome task into a streamlined and efficient process. This proactive step not only helps you accurately reclaim your legitimate business expenses but also provides clarity and control over your financial records.

Ultimately, a well-organised mileage log offers more than just financial benefits. It grants you peace of mind, knowing that your claims are accurate, compliant, and fully supported by detailed documentation. This diligent approach can save you valuable time and stress in the long run, allowing you to focus on what truly matters: growing your business or performing your role effectively.