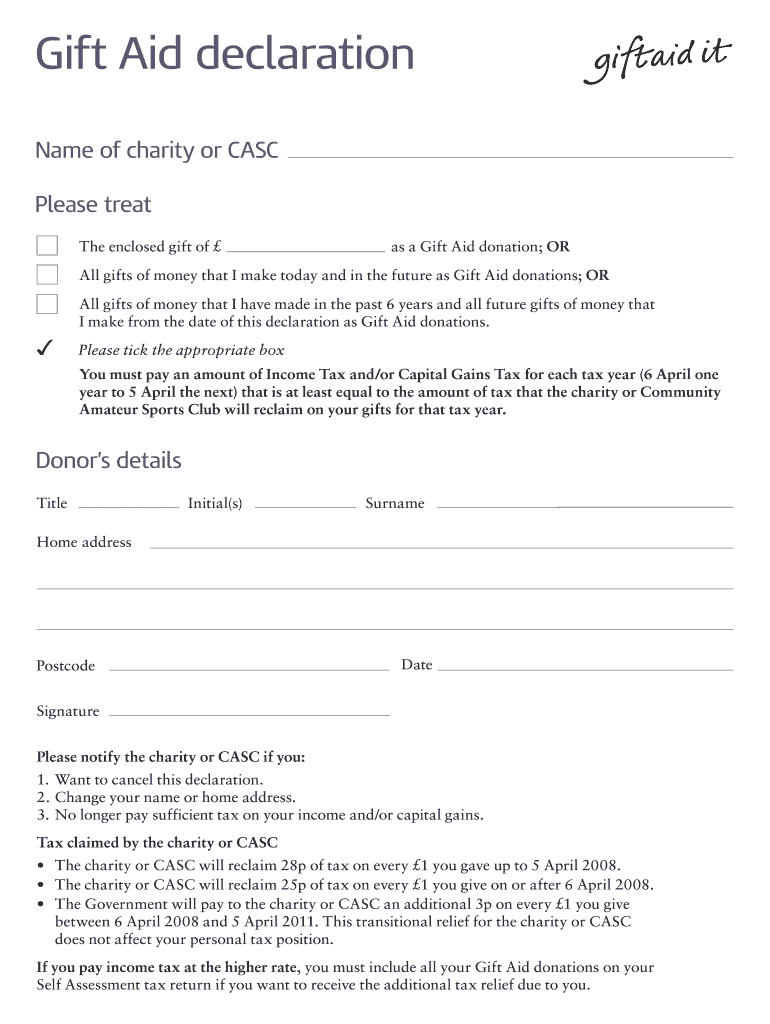

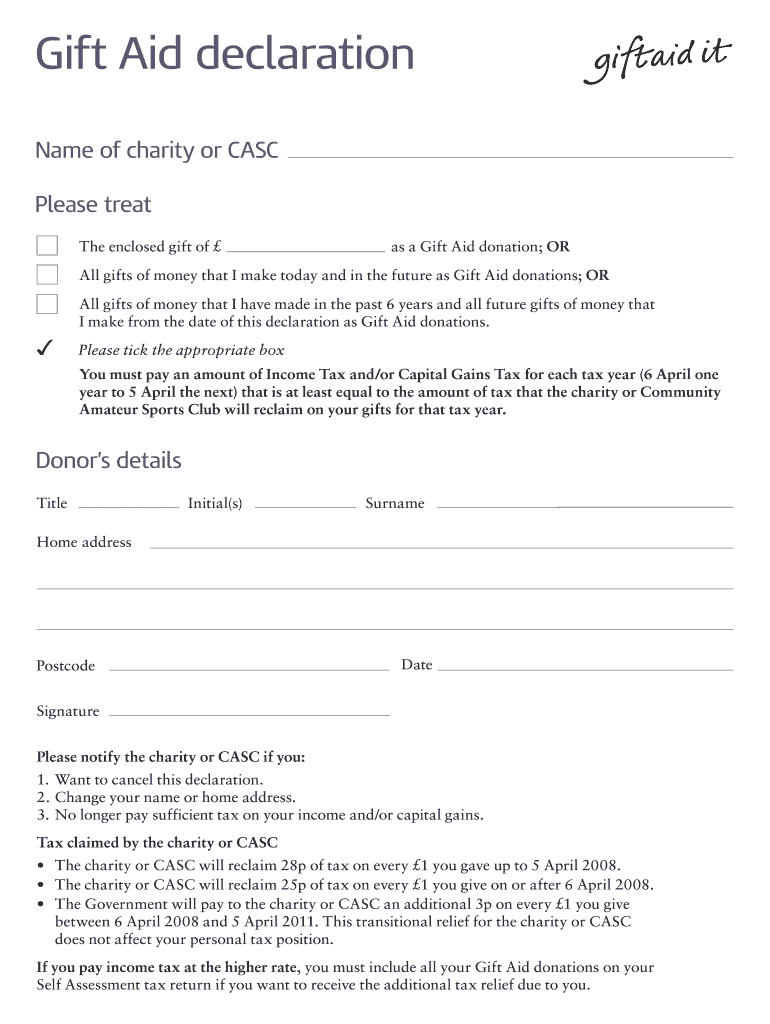

Have you ever made a donation to a charity in the UK and wondered if you could make your generosity go even further? That’s where Gift Aid comes in! It’s an incredible scheme run by HM Revenue & Customs (HMRC) that allows charities to reclaim an extra 25p for every £1 you donate, at no extra cost to you. All it takes is a simple declaration, and suddenly your £10 donation becomes £12.50 to the charity.

To unlock this extra funding for charities, donors need to complete a Gift Aid declaration. While many charities provide their own versions, understanding the core elements and potentially having access to a reliable hmrc gift aid form template can be incredibly useful. This article will guide you through everything you need to know about these declarations, why they’re so important, and how you can ensure your charitable giving has the biggest possible impact.

Understanding Gift Aid and What Goes Into a Declaration

At its heart, Gift Aid is a government scheme designed to boost charitable donations. When you, as a UK taxpayer, donate to a charity, you’ve already paid tax on that money. Through Gift Aid, the charity can reclaim the basic rate of tax that you’ve already paid on your donation. For example, if you donate £100, the charity can claim an additional £25 from HMRC, making your donation worth £125. It’s a win-win: charities get more funds, and it costs the donor nothing extra.

A valid Gift Aid declaration is crucial for a charity to claim this extra money. It’s essentially a statement from you confirming that you are a UK taxpayer and wish for the charity to reclaim the tax on your donation. Without this specific declaration, the charity simply cannot claim the additional funds, leaving potential support unclaimed. This is why having a clear and correct declaration process is so vital for charitable organizations.

So, what exactly needs to be on one of these declarations? Whether you’re using a charity’s bespoke form or looking for a general hmrc gift aid form template, certain pieces of information are non-negotiable to ensure the declaration is valid for HMRC’s purposes. Missing even one key detail could invalidate the claim, causing administrative headaches for the charity and lost income.

Key Elements of a Gift Aid Declaration

For any Gift Aid declaration to be effective and compliant with HMRC regulations, it must clearly contain the following information:

- Your full name and title: This allows HMRC to identify you as the donor.

- Your home address, including postcode: Essential for verification purposes and linking you to your tax records.

- Confirmation that you are a UK taxpayer: This is the absolute core requirement. You must confirm that you pay enough UK Income Tax or Capital Gains Tax in each tax year (from 6 April to 5 April) to cover the Gift Aid that all charities you donate to will reclaim on your donations. If you don’t, you could end up having to pay the difference back to HMRC.

- The name of the charity you are donating to: So HMRC knows who is making the claim.

- A clear statement that you want the charity to treat your donation(s) as Gift Aid: This can apply to a single donation, past donations (up to four years), or future donations.

- The date of your declaration: For record-keeping and to establish when the declaration becomes active.

Understanding these elements helps not only when filling out a form but also if you’re a charity looking to design your own compliant declaration. Getting these details right ensures a smooth process for both donors and charities, maximizing the impact of every donation.

Finding and Utilizing an HMRC Gift Aid Form Template

When it comes to actually making a Gift Aid declaration, many charities will provide their own ready-made forms, often available online, in leaflets, or through direct mail. However, if you’re looking for a generic hmrc gift aid form template, the best place to start is often the HMRC website itself or reliable charity support websites. These templates are designed to be compliant with all the necessary regulations, ensuring that any declaration made using them will be valid.

Utilizing a standard template, especially for charities setting up their processes, can be incredibly beneficial. It provides a consistent format, reduces the risk of errors, and ensures all the legally required information is collected. For donors, while you’ll usually use the charity’s specific form, understanding the template’s structure means you’ll know exactly what information to provide and why it’s needed, making the process smoother and quicker.

Charities typically manage these declarations digitally or in paper format, keeping them securely for their records. It’s important for them to maintain a clear audit trail, as HMRC may request to see these declarations during compliance checks. This diligence ensures that the Gift Aid claims are legitimate and properly substantiated, reinforcing the integrity of the scheme and safeguarding charitable funds.

As a donor, your responsibility doesn’t end after you’ve signed the form. It’s crucial to inform the charity if your tax status changes and you no longer pay enough UK income or capital gains tax to cover the Gift Aid. For example, if you stop working, your income falls below the personal allowance, or you move abroad and are no longer a UK taxpayer. Not doing so could mean you end up owing money to HMRC. Most declarations include a clause advising you to do this, highlighting the ongoing nature of your commitment.

Additionally, remember that you can cancel a Gift Aid declaration at any time simply by contacting the charity. This might be necessary if your tax circumstances change or if you simply no longer wish for a specific charity to claim Gift Aid on your donations. It’s always good practice to keep track of which charities you’ve made declarations to, just in case you need to update them.

The Gift Aid scheme is a truly powerful tool for boosting the impact of charitable giving in the UK. By simply completing a declaration, donors enable charities to increase the value of their contributions significantly, without dipping any further into their own pockets. It’s a testament to how a small administrative step can lead to substantial additional funding for vital causes, helping organizations continue their invaluable work.

Whether you’re a regular donor or a charity looking to maximize your fundraising, understanding the ins and outs of Gift Aid declarations is essential. By ensuring declarations are correctly filled out and managed, we collectively contribute to a more robust and effective charitable sector, making every pound donated stretch further for the causes we care about most. So next time you donate, remember the power of Gift Aid!