Navigating the world of health insurance can feel overwhelming, can’t it? For many, the first step to finding the right coverage involves getting a quote. In today’s digital age, that often means filling out an online form. But not all forms are created equal, and a well-designed health insurance quote form template can make all the difference, both for those seeking coverage and the providers offering it.

Imagine a smooth, intuitive process that gathers all the necessary information without feeling like a tedious interrogation. That’s the power of an optimized form. It’s about simplifying a complex decision and connecting people with the plans that genuinely meet their needs. This isn’t just about collecting data; it’s about building trust and facilitating a crucial step in personal well-being.

Why a Great Health Insurance Quote Form Template is a Game-Changer

For insurance providers, a top-notch health insurance quote form template isn’t just a nice-to-have; it’s a strategic asset. Think about it: it’s often the first point of contact for a potential client. A clunky, confusing form can lead to high abandonment rates, meaning lost leads and wasted marketing efforts. On the other hand, a user-friendly template streamlines lead capture, ensuring you get the valuable information you need efficiently and accurately.

From the user’s perspective, nobody wants to spend an hour trying to figure out what information is required or repeatedly enter the same details. A good form anticipates their questions, uses clear language, and guides them through the process logically. This creates a positive initial experience, which is crucial in a competitive market where trust and convenience are paramount.

Beyond lead generation, these forms are essential data collection tools. They help providers understand the unique needs of their audience, allowing for more personalized policy recommendations. By collecting demographic information, health history, and desired coverage levels, insurers can quickly match individuals with suitable plans, speeding up the sales cycle and improving customer satisfaction.

Furthermore, a well-structured form can drastically reduce the back-and-forth communication often required to gather complete information. This saves time for both the prospective client and the insurance agent, making the entire quoting process far more efficient and less frustrating for everyone involved.

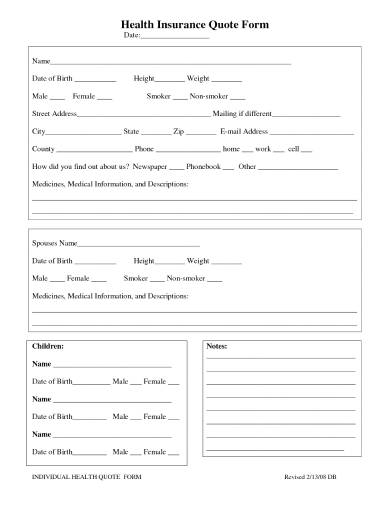

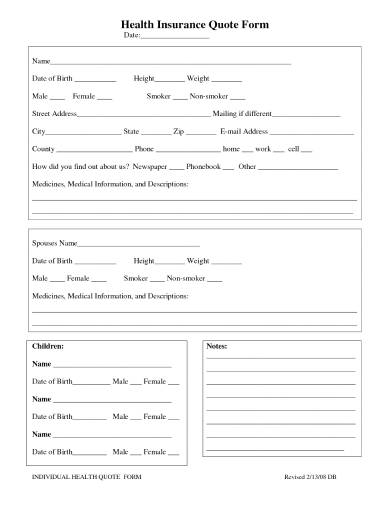

Essential Elements for Your Form

- Contact Information: Basic details like name, email, and phone number are crucial for follow-up.

- Demographics: Age, gender, and location influence policy options and pricing.

- Household Details: Information on dependents, marital status, and household income can impact eligibility for certain subsidies or family plans.

- Current Health Status: General health questions, pre-existing conditions (if applicable and legally permissible to ask), and lifestyle habits.

- Coverage Preferences: Desired deductible range, specific coverage needs (e.g., prescription drug coverage, mental health services), and preferred provider types.

- Budget Expectations: An optional field to understand their approximate monthly premium comfort zone.

Building Your Ideal Health Insurance Quote Form Template

Creating an effective health insurance quote form template involves more than just listing questions; it requires thoughtful design and a user-centric approach. Start by mapping out the absolute essential information you need to provide an accurate quote. Avoid asking for data that isn’t immediately relevant, as this can overwhelm users and make the form feel intrusive. Remember, the goal is to get them to complete the form, not deter them.

Consider the flow of your questions. Group related questions together and use conditional logic where appropriate. For example, if someone indicates they don’t have dependents, subsequent questions about dependent health information can be hidden. This makes the form dynamic and ensures users only see questions that apply to them, significantly reducing the perceived length and complexity.

When it comes to the technical side, there are various platforms available, from simple website builders with integrated form functionalities to dedicated form-building tools like Typeform, JotForm, or Google Forms. Choose a platform that allows for customization, integrates easily with your existing CRM or email marketing tools, and offers robust security features to protect sensitive client data. Mobile responsiveness is non-negotiable; ensure your form looks and functions perfectly on smartphones and tablets, as many users will access it on the go.

Finally, always test your health insurance quote form template rigorously before deploying it. Have colleagues or even external testers go through the process to identify any confusing language, technical glitches, or design flaws. Gather feedback and iterate. A well-optimized form isn’t a one-and-done project; it’s something you continually refine based on user behavior and performance metrics to ensure it remains highly effective in capturing qualified leads.

Ultimately, a thoughtfully designed quote form serves as a crucial bridge, connecting individuals with the vital health coverage they need. It transforms a potentially daunting task into a straightforward process, benefiting both the consumer seeking clarity and the provider aiming to efficiently serve their clientele. By prioritizing ease of use, clear communication, and smart data collection, you enhance the initial interaction significantly.

Investing time in creating an exceptional digital experience at this critical touchpoint pays dividends in lead quality, customer satisfaction, and operational efficiency. It simplifies the journey toward securing peace of mind through appropriate health insurance, making the entire process more accessible and less intimidating for everyone involved.