Managing donations can sometimes feel like a juggling act, especially when it comes to non-monetary contributions. These valuable gifts, known as “gifts in kind,” can range from office supplies and professional services to donated real estate or artwork. While incredibly beneficial to any organization, tracking and acknowledging them properly is crucial for both the donor and the recipient. This is where having a reliable system comes into play, ensuring every contribution is documented accurately and efficiently.

You might be wondering, “Do I really need a special form for this?” The short answer is a resounding yes! A well-structured gift in kind form template isn’t just about good record-keeping; it’s about transparency, legal compliance, and fostering trust with your generous donors. It simplifies the often-complex process of valuing and acknowledging non-cash gifts, making sure everyone involved has a clear understanding of the contribution. Imagine the peace of mind knowing all your in-kind donations are properly recorded without a hitch.

Understanding Gifts In Kind and Their Documentation Needs

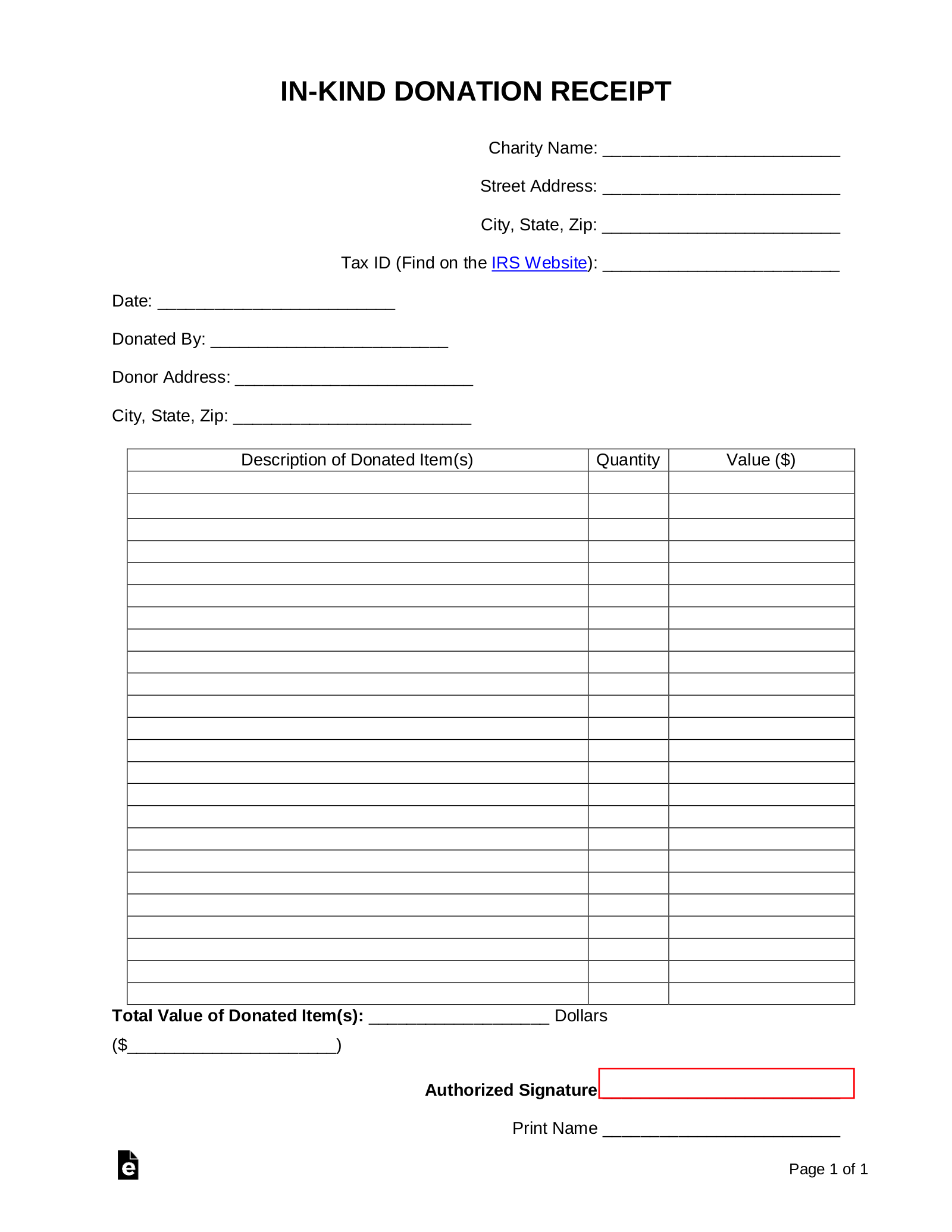

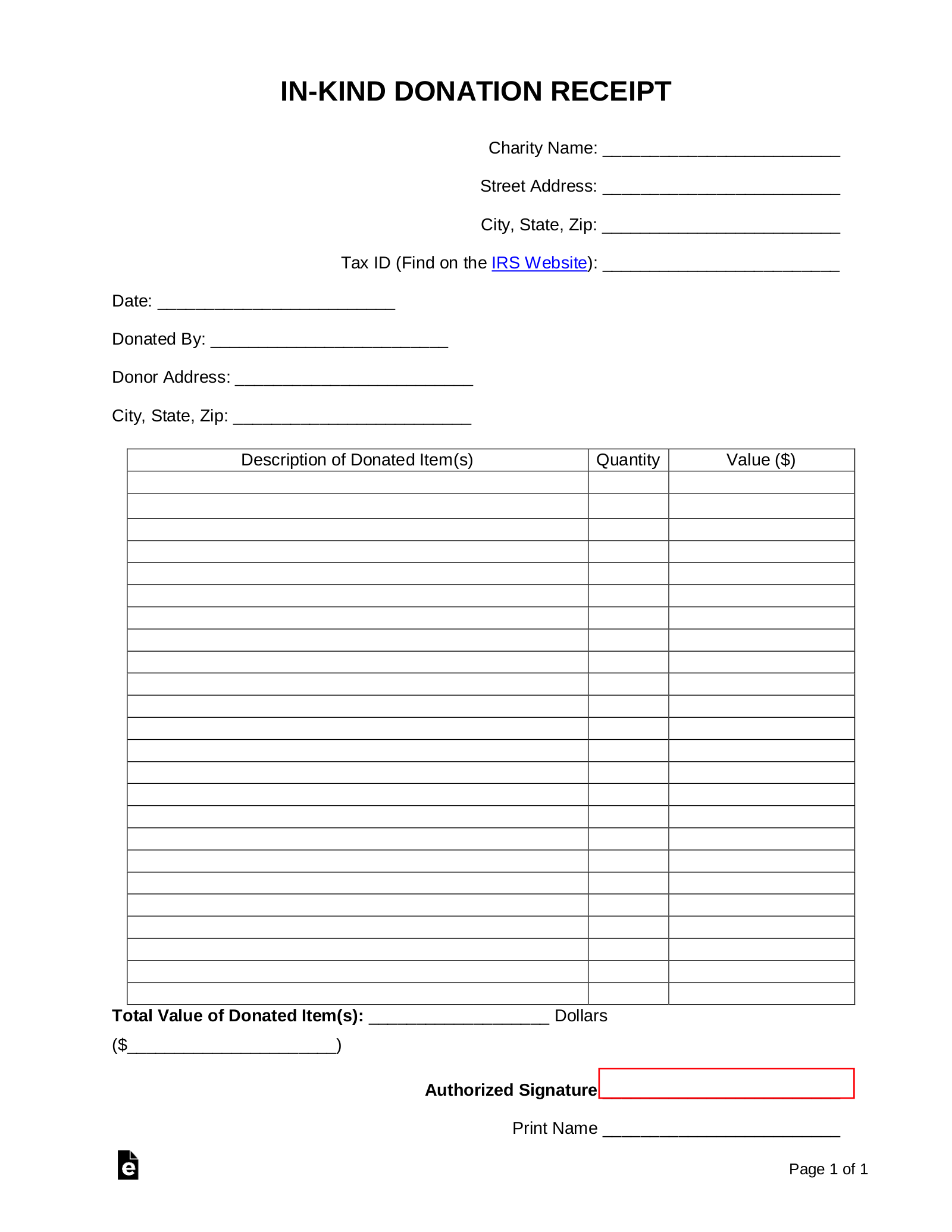

A gift in kind, or GIK, is essentially a non-cash contribution made to a charitable organization. Think of it as anything of value that isn’t money. This could be anything from a local restaurant donating food for an event, a graphic designer offering pro bono services, or a store donating merchandise for a raffle. These contributions are incredibly valuable because they help organizations reduce expenses, acquire necessary resources, and extend their reach without dipping into their financial reserves. However, unlike cash, their value isn’t immediately obvious, and their tracking requires a different approach.

The importance of robust documentation for gifts in kind cannot be overstated. For the donor, accurate records are essential for tax purposes. They often need a formal acknowledgment from the recipient organization to claim their charitable deduction. For the organization, proper documentation ensures compliance with accounting standards, helps in budgeting and financial reporting, and provides a clear audit trail. Without a standardized form, you risk inaccuracies, confusion, and potentially losing out on valuable information that could benefit both parties.

Beyond legal and accounting necessities, detailed documentation also plays a vital role in donor relations. Acknowledging a gift in kind with a professional and accurate form shows your donors that you value their contribution, regardless of its form. It demonstrates your organization’s commitment to transparency and good governance, reinforcing their trust and encouraging future support. It’s a simple yet powerful way to say “thank you” and confirm their generosity has been received and properly recorded.

This is precisely why a comprehensive gift in kind form template is not just a nice-to-have, but a must-have tool for any organization regularly receiving non-cash donations. It provides a consistent framework for capturing all necessary details, ensuring nothing is overlooked.

Key Elements of an Effective Gift In Kind Form Template

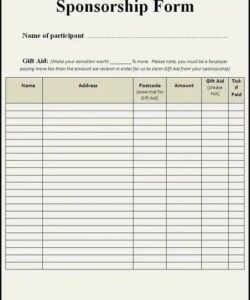

- Donor Information: Full name, address, contact details, and sometimes their tax ID.

- Item Description: A clear and detailed explanation of the donated item or service.

- Estimated Value: A reasonable estimate of the fair market value of the donation at the time of contribution.

- Date of Donation: The exact date the gift was received by the organization.

- Purpose of Donation: How the item or service will be used by the organization.

- Donor Signature: To confirm the accuracy of the provided information.

- Organization Representative Signature: To acknowledge receipt of the gift.

Streamlining Your Donation Process with a Gift In Kind Form Template

Implementing a standardized gift in kind form template can significantly streamline your organization’s donation management process. Imagine no more scrambling to create a receipt from scratch every time a non-cash gift comes in, or trying to remember what details you need to capture. A template ensures consistency across all your in-kind donations, making record-keeping simpler, faster, and much less prone to errors. It’s a proactive step that saves valuable time and resources for your staff and volunteers.

One of the biggest benefits of using a template is the ease of training new team members or volunteers. Instead of lengthy instructions on what information to gather, you can simply hand them a pre-designed form. This reduces training time, minimizes mistakes, and ensures that even temporary staff can accurately process donations. It also provides a clear, professional document that can be shared with donors immediately, fostering a sense of efficiency and trustworthiness from the very first interaction.

Furthermore, a well-designed template can be easily customized to fit your specific organizational needs. Whether you need additional fields for specific types of donations, want to include your organization’s logo, or prefer a particular layout, a template offers the flexibility to adapt. This adaptability means your form can grow and evolve with your organization, always remaining relevant and effective. It eliminates the need to reinvent the wheel for every donation, allowing you to focus on your mission rather than administrative hurdles.

Ultimately, by integrating a reliable gift in kind form template into your operations, you are investing in clarity, compliance, and stronger donor relationships. It transforms a potentially complex task into a straightforward, systematic process. This allows your team to dedicate more time to their core activities, confident that all donations, monetary or otherwise, are managed with the utmost professionalism and precision. It’s about building a robust foundation for sustainable generosity.

In a world where every contribution counts, having a clear and consistent method for managing all forms of giving is paramount. Embracing a structured approach not only simplifies internal processes but also reinforces donor confidence, showing them their invaluable support is handled with care and accuracy. By implementing efficient tools, organizations can fully leverage the generosity of their community, transforming non-cash gifts into powerful resources for their mission.

This systematic approach ensures that every thoughtful donation is properly acknowledged and accounted for, allowing your organization to focus on making a real difference. It builds a foundation of trust and transparency, encouraging continued support from those who believe in your cause. Embrace the simplicity and power of organized giving, and watch your impact grow.