Starting a fundraising event is exciting, isn’t it? Whether you’re running a marathon, baking for charity, or organizing a local fair, your efforts are making a real difference. But beyond collecting donations, there’s a powerful way to boost your fundraising even further, and that’s through Gift Aid. It’s a fantastic scheme that allows charities to claim an extra 25p for every £1 donated by UK taxpayers, at no additional cost to the donor. To make this happen effectively, especially for sponsored events, having the right tools is key.

This is where a well-designed gift aid sponsor form template becomes invaluable. It’s not just about getting signatures; it’s about capturing crucial information accurately and ensuring your charity can reclaim that extra income from HMRC. A good template streamlines the entire process, making it easy for your sponsors to declare their Gift Aid eligibility and for your charity to benefit from every single penny. Let’s explore why these forms are so important and how you can make the most of them.

Understanding the Power of Gift Aid for Charities

Gift Aid is truly a cornerstone of charity fundraising in the UK. When a UK taxpayer contributes to a charity, the charity can claim an additional 25% of that donation from the government. So, a £10 donation effectively becomes £12.50. This incredible boost comes at no extra cost to the donor, as it’s money that the government would have otherwise collected in tax. It’s a win-win situation, transforming every generous contribution into an even larger impact, amplifying the good work charities do.

For charities, this means a substantial increase in their overall income, often without needing to find new donors or launch new campaigns. Imagine the collective power of hundreds, or even thousands, of donations being uplifted by an extra quarter of their value. This additional funding can be channeled directly into vital services, operational costs, or specific projects, significantly extending the reach and effectiveness of the charity’s mission. Neglecting Gift Aid is akin to leaving money on the table, money that could be helping those in need.

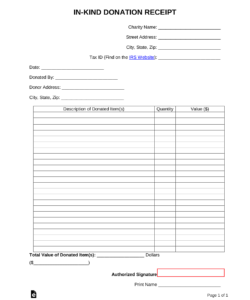

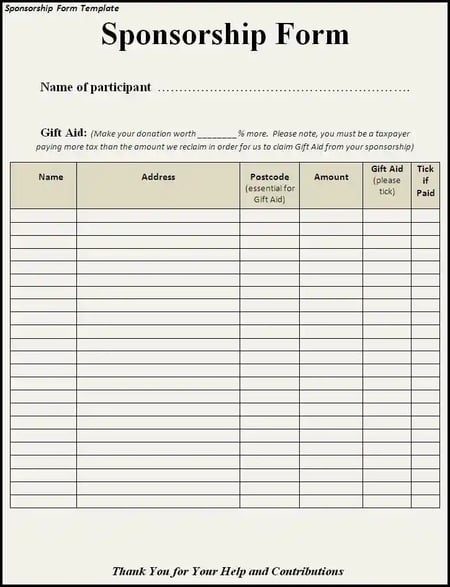

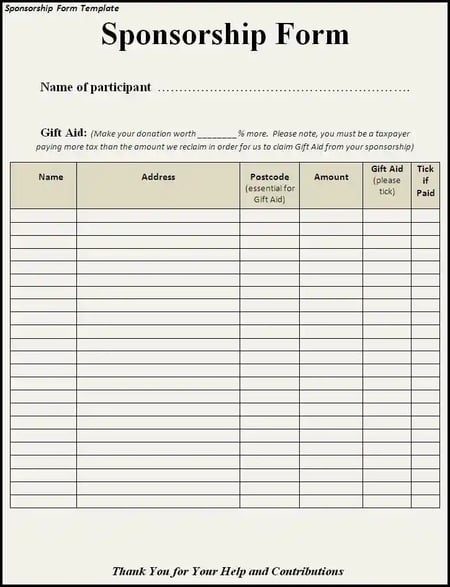

The mechanism for capturing this vital information is primarily through a sponsor form or donation declaration. For sponsored events like runs, walks, or challenges, a sponsor form serves a dual purpose: it records the individual pledges from supporters and, crucially, it captures the necessary Gift Aid declaration from each eligible donor. This declaration is a simple statement from the donor confirming they are a UK taxpayer and understand that the charity will reclaim tax on their donation. Without this explicit consent and the required data, the charity cannot claim Gift Aid.

This is precisely why a meticulously designed gift aid sponsor form template is not just a convenience but a necessity. It ensures that all the legally required information – like the donor’s name, home address, and postcode – is collected clearly and correctly. Beyond the legalities, a good template also guides the donor through the declaration process, making it simple and straightforward, thereby maximizing the number of successful Gift Aid claims for the charity. It removes guesswork and standardizes the data collection process, which is essential for efficient processing later.

Key Elements of a Compliant Gift Aid Declaration

- Full Name of Donor: Essential for identification and linking to their tax records.

- Home Address: Must be a full, valid UK address for tax purposes.

- Postcode: Crucial for HMRC verification and matching donor records.

- Confirmation of UK Taxpayer Status: A clear declaration that the donor pays enough UK income tax or capital gains tax to cover the Gift Aid claimed on all their donations in that tax year.

- Date of Declaration: Important for record-keeping and accurately linking to the specific donation.

- Charity Name: Clearly states which organization is benefiting from the Gift Aid.

Crafting Your Ideal Gift Aid Sponsor Form Template

Developing or choosing the right gift aid sponsor form template is a strategic decision for any fundraiser or charity. The goal is to create a form that is easy for donors to complete, yet comprehensive enough to satisfy HMRC requirements. Think about clarity, simplicity, and accessibility. A cluttered or confusing form can deter potential Gift Aid declarations, leading to missed opportunities for your cause. Your template should be intuitive, guiding the donor effortlessly through each required field.

When designing your template, certain core elements are non-negotiable. As discussed, these include the donor’s full name, their full home address, and postcode. The Gift Aid declaration itself must be prominently displayed and easy to understand. It should clearly state what the donor is agreeing to and the implications of their declaration regarding their tax payments. You might also want to include fields for the amount donated, the date of donation, and perhaps a space for the fundraiser’s name if it’s a sponsored event, helping with internal tracking and recognition.

Consider the format of your template as well. Will it primarily be a physical, printed form that people sign at events or door-to-door, or will you offer a digital version? Physical forms are great for face-to-face interactions, providing a tangible way for sponsors to commit. Digital forms, on the other hand, offer unparalleled convenience and reach, allowing donors to declare Gift Aid from anywhere, at any time. Online forms can also automatically validate inputs, reducing errors and simplifying data entry for the charity. Many charities opt for a hybrid approach, providing both options to maximize participation.

Regardless of the format, making the form accessible and visible is crucial. For physical forms, ensure they are readily available at all fundraising events, collection points, and even online for people to print at home. For digital forms, embed them directly on your website, link them prominently in emails, and share them across your social media channels. Provide clear instructions on how to complete the form and where to return it (if physical) or submit it (if digital). The easier you make it, the more Gift Aid you’re likely to successfully claim, directly amplifying the impact of every pound raised.

Tips for Optimizing Your Template for Maximum Impact

- Keep it Concise: Only ask for essential information to avoid overwhelming donors with unnecessary fields.

- Clear Instructions: Provide simple, unambiguous guidance on how to complete each section of the form.

- Branding: Include your charity’s logo and branding to build trust and immediate recognition among donors.

- Digital Accessibility: Ensure any online forms are mobile-friendly and accessible for all users, regardless of device.

- Privacy Statement: Include a brief, clear statement on how donor data will be handled in accordance with data protection regulations like GDPR.

- Thank You Note: A small space for a thank you message can personalize the experience and show appreciation for their generosity.

Harnessing the full potential of Gift Aid is a game-changer for charities, allowing every donation to stretch further and make a greater difference. By investing time in creating or adopting a robust sponsor form template, you are not just simplifying an administrative task; you are unlocking significant additional funding that can propel your mission forward. This seemingly small detail has a profound impact on your overall fundraising strategy and ultimately, the services you can provide to those who need them most.

So, as you plan your next fundraising initiative, remember the power held within a well-structured form. It’s a testament to effective planning and a commitment to maximizing every ounce of generosity. Empower your fundraisers and donors with a clear, compliant, and easy-to-use system, and watch as your charity reaps the benefits, transforming goodwill into tangible support and lasting change.