Navigating the world of charitable donations can sometimes feel like a maze, especially when you want to ensure your good intentions go as far as possible. For charities in the UK, Gift Aid is an incredible scheme that allows them to claim an extra 25p for every 1 pound donated, turning a 10 pound donation into 12.50 pounds at no extra cost to the donor. This means your generosity is amplified, making a bigger impact on the causes you care about. But to unlock this extra funding, charities need a proper declaration from the donor, which is where a well-designed form comes into play.

Creating or finding the right gift aid form template HMRC compliant can seem like a daunting task, but it is absolutely essential for any charity looking to maximize its income from donations. A compliant template simplifies the process for both the donor and the charity, ensuring all necessary information is captured accurately and efficiently. Without the correct details, HMRC cannot process the claim, and your charity might miss out on vital funds. So, let us explore what makes an effective and compliant template and how you can ensure your charity is making the most of this valuable scheme.

Understanding the Essentials of Gift Aid Declarations

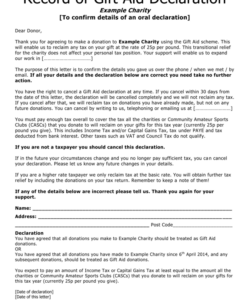

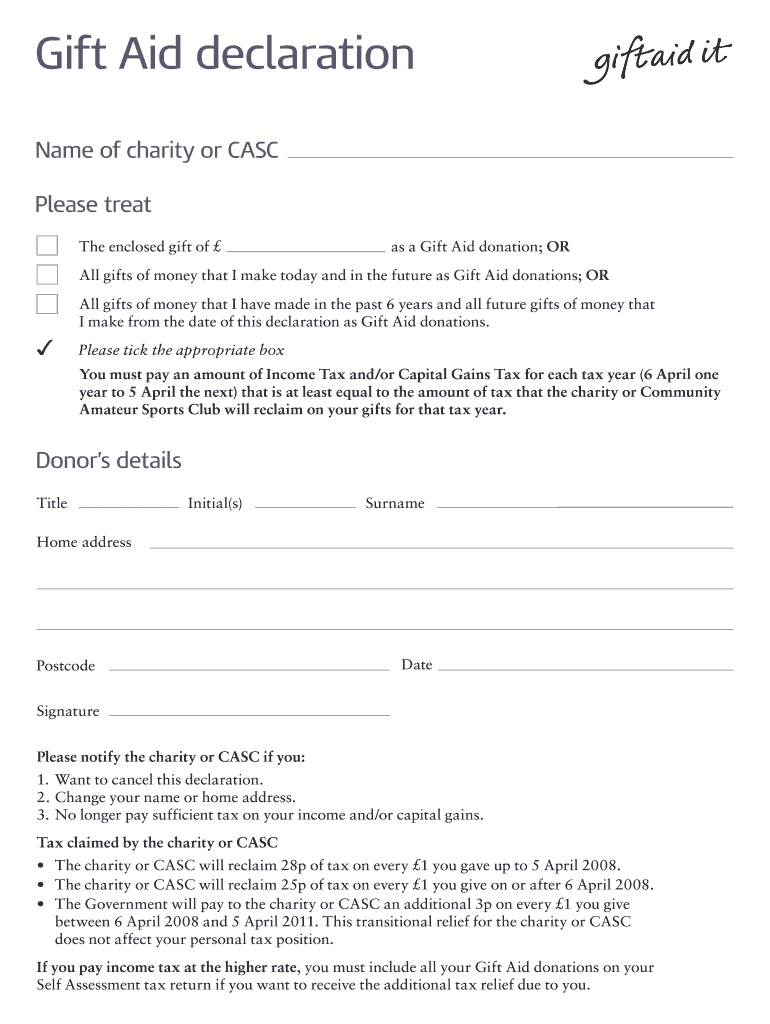

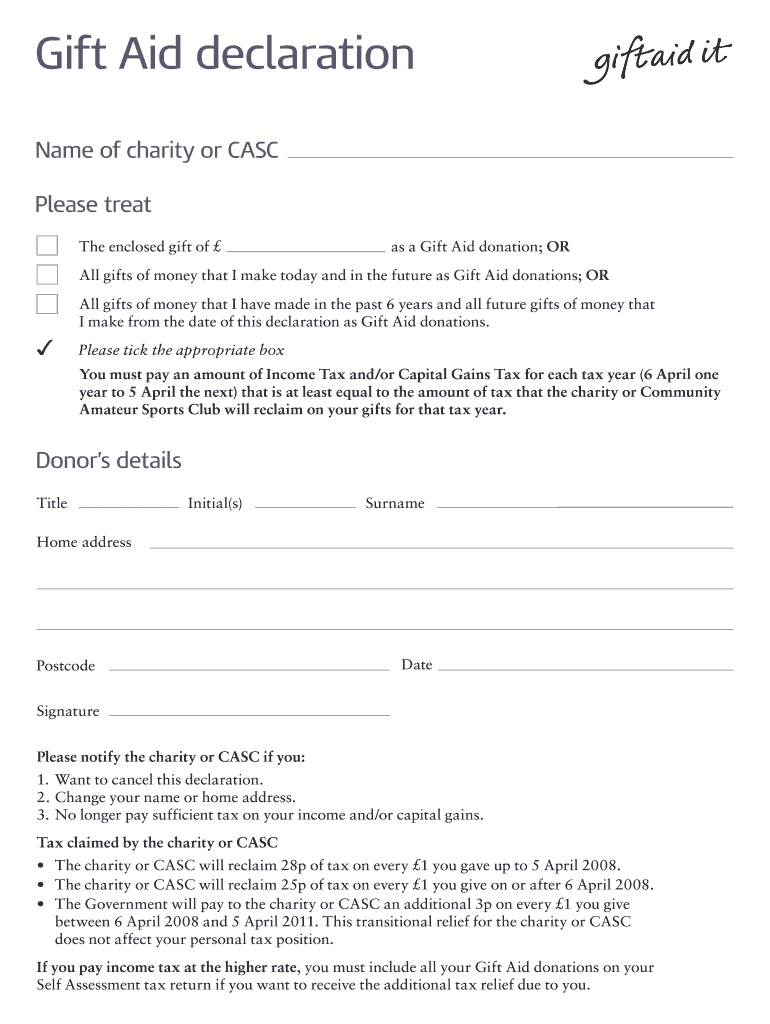

A Gift Aid declaration is a crucial document that confirms a donor is a UK taxpayer and wishes for their donation to be treated as a Gift Aid donation. This declaration allows the charity to reclaim the basic rate of tax on the donation from HMRC. It is important for donors to understand that they must pay enough income tax or capital gains tax in the tax year to cover the tax reclaimed by all charities on their donations. If not, they may be required to pay back any shortfall to HMRC. This part is critical for the donor to acknowledge and for the charity to communicate clearly.

The declaration itself can be a one-off statement for a single donation, or it can cover past, present, and future donations. Many charities opt for a ‘standing’ declaration that covers a period, simplifying the process for regular donors. Regardless of the type, the core principle remains the same: it is the donor’s confirmation that they are eligible and wish for the charity to claim Gift Aid on their behalf. Clarity and simplicity in the wording are paramount to ensure donors understand what they are signing.

Key Information to Include

For a Gift Aid declaration to be valid and accepted by HMRC, it must contain specific information. Missing even one piece of data can invalidate the claim, leading to administrative headaches for the charity. Therefore, when designing or choosing your gift aid form template hmrc, pay close attention to these non-negotiable elements. These details enable HMRC to match the donation with the donor’s tax record and process the reclaim correctly.

- The donor’s full name and current home address, including postcode.

- Confirmation from the donor that they are a UK taxpayer and understand they must pay enough income tax or capital gains tax in each tax year to cover the Gift Aid claimed on all their donations.

- A clear statement that the donor wants the charity to treat the specified donation(s) as Gift Aid donations.

- The date the declaration is made. For declarations covering past donations, the date of the earliest donation should also be noted if within the four-year limit.

- A statement that the donor understands if they pay less Income Tax or Capital Gains Tax than the amount of Gift Aid claimed on all their donations in that tax year, it is their responsibility to pay any difference.

Ensuring all these details are collected accurately is the cornerstone of a successful Gift Aid claim. A well-structured template will prompt donors for this information, reducing errors and saving time for both parties. Remember, the simpler and clearer the form, the more likely donors are to complete it correctly and enthusiastically.

Crafting Your Own Gift Aid Form Template HMRC Compliant

When you set out to create your own Gift Aid form, think about it from the donor’s perspective. Is it easy to understand? Is it quick to fill out? Does it clearly explain what Gift Aid is and what it means for them? A user-friendly design encourages completion and helps build trust between the donor and the charity. You might choose a paper form for events, or an online digital form for website donations, but the fundamental information requirements remain consistent for both.

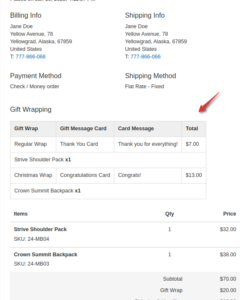

Consider the different ways donations are made. Is it a one-off donation via a collection bucket? A regular direct debit? Or perhaps a sponsorship form for a fundraising event? Each scenario might benefit from a slightly tailored declaration wording, though the core information remains the same. For instance, a sponsorship form needs space for multiple donors, each providing their details and confirmation. A digital form integrated into your online donation platform should seamlessly capture the required fields as part of the payment process.

Beyond simply collecting data, a good template also serves as an important record-keeping tool. It should allow for easy storage and retrieval of declarations, whether physically in a secure filing system or digitally in a robust database. HMRC may request to see declarations as part of an audit, so having an organized system is not just good practice but a regulatory necessity. This long-term view helps in maintaining compliance and streamlining future claims.

Finally, regularly review your gift aid form template HMRC guidelines. Tax rules and regulations can change, and what was compliant yesterday might need a slight tweak tomorrow. Staying informed ensures your template remains effective and your charity continues to benefit fully from the Gift Aid scheme. Engaging with professional advice or utilizing resources from HMRC and charity support organizations can provide peace of mind that your processes are up to date.

Having a robust and compliant Gift Aid declaration process is truly invaluable for charities. It is not just about paperwork; it is about maximizing every single act of generosity, turning a simple donation into an even greater contribution to your cause. By making it easy for donors to declare Gift Aid, you empower them to amplify their support without opening their wallets any further, fostering a stronger connection and encouraging continued giving.

Ultimately, investing time in creating or refining your Gift Aid form ensures your charity can confidently claim the tax relief it is entitled to, boosting your financial capacity to achieve your mission. It simplifies administration, reduces the risk of errors, and most importantly, makes the most of the incredible support you receive from your dedicated donors. Embrace the clarity and efficiency that a well-designed template brings, and watch your donations go further.