Navigating the world of property deeds and financial documents can feel a bit like deciphering an ancient scroll, especially when you’re dealing with something as crucial as your home. In Georgia, when you pay off a mortgage or any loan secured by real estate, there’s a vital step that often gets overlooked: canceling the security deed. This isn’t just a formality; it’s a necessary legal action to clear your property title and ensure you truly own your home free and clear.

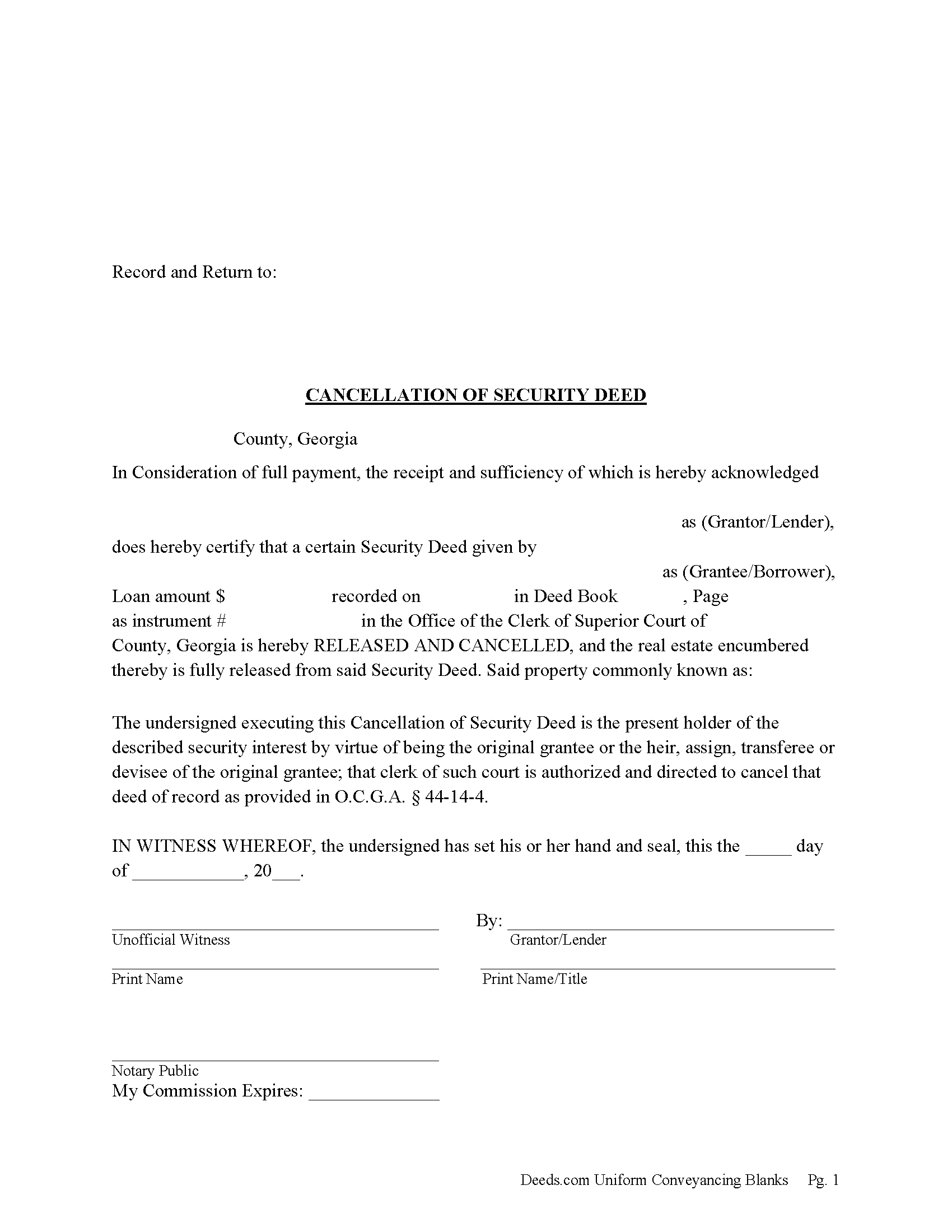

Think of a security deed as a temporary claim your lender holds on your property. Once you’ve fulfilled your part of the bargain by paying off the loan, that claim needs to be officially removed from the public records. While your lender is usually responsible for this, sometimes it falls through the cracks, or you might need a clear understanding of the process yourself. That’s where knowing about a reliable georgia security deed cancellation form template comes into play – it’s your guide to ensuring this crucial step is completed correctly.

Understanding Security Deeds and Their Release in Georgia

In Georgia, a security deed is essentially what other states might call a mortgage. It’s a legal document that transfers conditional title to your lender as collateral for a loan. This means while you live in and use the property, the lender holds a legal interest in it until the debt is fully satisfied. It’s a fundamental part of real estate transactions, ensuring lenders have a way to recover their funds if a borrower defaults.

When you successfully pay off your loan, the lender’s interest in your property is extinguished. However, simply paying off the loan isn’t enough from a legal standpoint. The public record, which shows the security deed was initially placed on your property, needs to be updated to reflect that it’s no longer active. This process is often referred to as a "satisfaction" or "cancellation" of the security deed.

Why is this cancellation so important? Without an official cancellation recorded in the county where your property is located, anyone looking up your property’s title will still see the security deed as an active encumbrance. This can create significant headaches if you try to sell, refinance, or even use your property as collateral for a new loan in the future. A clear title is paramount for any property owner.

A properly executed cancellation document confirms that the lender acknowledges the debt has been paid and releases their claim on the property. While lenders are legally obligated to provide this, having a clear template or understanding what it should contain helps ensure accuracy and completeness, making the process smoother for everyone involved.

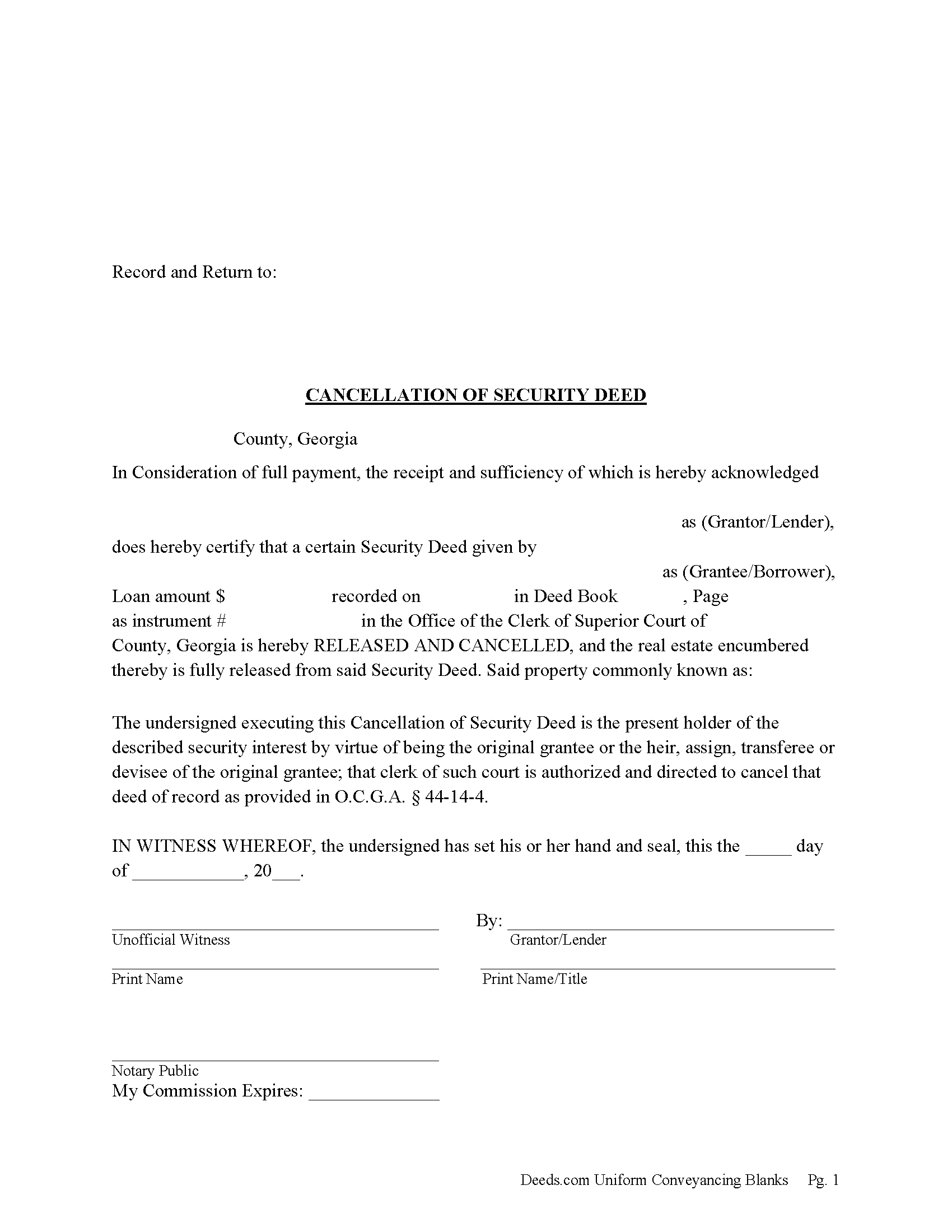

Key Elements of a Georgia Security Deed Cancellation Form

- **Grantor/Grantee Information:** This section will clearly identify the original borrower (grantor) and the lender (grantee) of the security deed being canceled.

- **Original Deed Book and Page Reference:** Crucially, the cancellation form must reference the exact book and page number where the original security deed was recorded in the county records. This links the cancellation directly to the original document.

- **Date of Original Security Deed:** The date the security deed was initially executed and recorded.

- **Brief Property Description:** While not always a full legal description, there should be enough information to identify the property, often referencing the original deed’s description.

- **Declaration of Satisfaction:** A clear statement from the lender (or their authorized representative) that the debt secured by the deed has been fully paid and satisfied.

- **Signature Lines for Lender/Representative:** The authorized signatory for the lender must sign the document.

- **Notary Public Acknowledgment:** The lender’s signature must be notarized, verifying its authenticity. This is a crucial step for legal validity.

The Process of Recording Your Cancellation

Having a georgia security deed cancellation form template filled out correctly is a fantastic first step, but it’s not the end of the journey. For the cancellation to be legally effective and visible on your property’s public record, it must be officially recorded with the Clerk of Superior Court in the county where your property is located. This recording process updates the official property records, showing that the security deed has been released and your title is now clear.

Typically, it’s the lender’s responsibility to prepare and record the security deed cancellation form once your loan is paid off. They usually send you the original or a copy of the recorded document for your records. However, sometimes due to administrative oversight, mail issues, or simply a delay, this doesn’t happen promptly. It’s wise to follow up with your lender if you don’t receive confirmation of the cancellation being recorded within a reasonable timeframe (usually 30-60 days after payoff).

If you find yourself in a situation where the lender hasn’t recorded the cancellation, or perhaps you’ve received the signed document but need to take it to the courthouse yourself, understanding the recording process is vital. You’ll need to physically take the original, properly executed, and notarized cancellation document to the Clerk of Superior Court’s office in the county where the property is situated. They will review the document for correctness and collect a recording fee.

Once recorded, the Clerk’s office will stamp the document with a recording date, book, and page number, officially making it part of the public record. They will then typically return the original document to you, or sometimes they mail it. It’s always a good idea to verify the recording online or by checking with the Clerk’s office to ensure everything is processed correctly. Neglecting this step can lead to complications down the line, so diligence is key.

- **Obtain the Form:** Ensure you have the original security deed cancellation form, usually provided by your lender.

- **Review and Verify:** Double-check that all information is accurate and that the document is properly signed by the lender’s authorized representative and notarized.

- **Locate the Clerk’s Office:** Identify the Clerk of Superior Court office in the county where your property is located.

- **File for Recording:** Present the original document to the Clerk’s office for recording. They may ask you to fill out a brief transmittal form.

- **Pay Recording Fees:** Be prepared to pay the necessary recording fees, which vary by county and document length.

- **Confirm Recording:** Obtain a copy or confirmation of the recorded document. Many counties allow you to search online for recorded documents by name or deed book/page number.

Ensuring your security deed is properly canceled and recorded is a crucial step in maintaining a clear and marketable title to your property. It’s a simple administrative task that provides significant peace of mind, knowing that your most valuable asset is truly yours, free from any lingering claims. Taking the time to understand this process now can save you potential headaches and delays in any future real estate transactions. A well-prepared and correctly filed security deed cancellation form template ensures your property records are accurate and up-to-date, reflecting your complete ownership.