Let’s be honest, managing expenses, whether for a small business or a large corporation, can often feel like wrestling an octopus. Receipts vanish, details blur, and before you know it, what should be a straightforward reimbursement process turns into a time-consuming scavenger hunt. You’re not alone if you’ve ever felt overwhelmed trying to keep track of every coffee, taxi fare, or supply purchase. It’s a common pain point that affects everyone from the employee claiming back their funds to the finance team trying to balance the books.

But what if there was a simple, universally applicable solution to bring order to this financial chaos? Imagine a tool that standardizes the submission process, ensures all necessary information is captured, and simplifies approval workflows. That’s exactly what a robust general expense claim form template offers. It’s not just a piece of paper or a digital document; it’s your new best friend in financial organization, designed to make expense reporting clear, concise, and considerably less stressful for everyone involved.

Why a Dedicated Expense Claim Form is a Game-Changer

Without a clear system, expense claims can quickly devolve into a chaotic mess of emails, handwritten notes, and misplaced receipts. Employees might forget crucial details, leading to incomplete submissions that require constant back-and-forth communication. This not only frustrates the claimant but also creates significant bottlenecks for the accounting department, who spend valuable time chasing down missing information rather than processing claims efficiently. It’s a drain on productivity and can even lead to errors in financial records, making auditing a nightmare.

A well-designed general expense claim form template acts as a central hub for all relevant information. It provides a structured format that prompts the claimant to include every piece of data required for a smooth reimbursement. Think of it as a guided tour through the expense reporting process, ensuring nothing is overlooked. This standardization eliminates guesswork, reduces the potential for incomplete submissions, and significantly speeds up the initial review phase. It’s about building a predictable and reliable system that benefits everyone involved in the financial cycle.

Key Elements to Include in Your Template

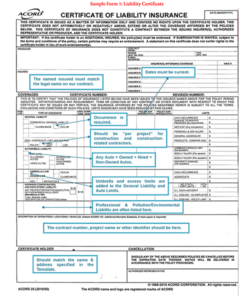

To be truly effective, a general expense claim form template needs to capture specific details that are vital for both accounting accuracy and compliance. While the exact fields might vary slightly depending on your organization’s unique needs, a core set of elements will ensure comprehensive data collection. Having these pre-defined sections removes ambiguity and ensures consistency across all submissions, no matter who is claiming or what the expense is for. It sets a clear expectation for what information is needed, right from the start of the process.

- Employee Name and Employee ID: For clear identification of the claimant.

- Department/Project Name: To allocate expenses to specific budgets or teams.

- Date of Expense: The exact date the expense was incurred.

- Category of Expense: (e.g., Travel, Meals, Office Supplies, Training) for easy categorization and financial analysis.

- Description of Expense: A brief, clear explanation of what the expense was for.

- Amount: The monetary value of the expense.

- Payment Method: How the expense was paid (e.g., Company Card, Personal Funds, Cash).

- Receipt Attached (Yes/No checkbox): A critical field to confirm documentation is provided.

- Approver Signature/Date: Space for management approval and timestamp.

By including these essential elements, your general expense claim form template ensures that all claims are submitted with the necessary context and proof. This level of detail not only simplifies the review process for finance teams but also provides a clear audit trail. It transforms what could be a messy collection of notes into a clean, verifiable record, fostering transparency and accountability throughout the organization’s financial operations. This meticulous approach pays dividends in saved time and reduced errors in the long run.

Streamlining Your Reimbursement Process with a Template

Beyond merely collecting information, a well-implemented general expense claim form template actively streamlines the entire reimbursement workflow. For employees, it provides a straightforward path to getting their money back, reducing frustration and the need for follow-up questions from finance. They know exactly what information is expected, how to present it, and where to submit it. This clarity empowers employees to complete their claims quickly and accurately, fostering a sense of efficiency and respect for their time and effort.

For the finance department, the benefits are even more pronounced. With standardized submissions, processing times can dramatically decrease. Data entry becomes less error-prone as information is consistently presented, and the need to cross-reference multiple sources is minimized. Approvals can be expedited because all supporting documentation is either attached or clearly referenced within the form. This frees up valuable accounting resources to focus on more strategic financial tasks rather than constantly correcting or chasing down missing expense details.

Furthermore, a consistent template ensures better compliance with internal policies and external regulations. When every claim follows the same structure and asks the same questions, it becomes much easier to identify discrepancies, enforce spending limits, and ensure all expenses are business-related and properly documented. This significantly strengthens your organization’s financial controls and makes it much simpler to prepare for audits, as all necessary information is organized and readily accessible in a uniform format.

Adopting a universal template also offers flexibility. While the core structure remains, it can often be adapted for specific departments or projects with minor tweaks, without losing its overall integrity. Whether you opt for a digital version that integrates with accounting software or a printable PDF, the underlying principle of a structured format remains invaluable. This adaptability ensures that as your organization grows and evolves, your expense reporting system can scale seamlessly alongside it, continuing to provide robust support.

- Faster Processing Times: Standardized data means less time spent on manual review and data entry.

- Reduced Administrative Burden: Less back-and-forth communication and fewer errors for finance teams to correct.

- Improved Financial Record-Keeping: Consistent data leads to more accurate and reliable financial reports.

- Enhanced Compliance and Audit Readiness: Easy verification of expenses against policies and simplified audit trails.

Ultimately, implementing a standardized system for expense reporting isn’t just about managing receipts; it’s about optimizing a core operational process that impacts every corner of your business. By providing a clear, comprehensive framework, you empower employees, enhance financial accuracy, and free up valuable time for your administrative teams. This strategic move transforms a potentially cumbersome task into a smooth, efficient operation, contributing to overall organizational health and productivity.

So, if you’re looking to bring more clarity and efficiency to your financial operations, consider how a thoughtfully designed template can make a world of difference. It’s a small change with a massive ripple effect, ensuring that every dollar spent is properly accounted for, and every reimbursement is handled with precision and speed. Embrace the power of structure to achieve greater financial control and peace of mind.