Keeping tabs on your business expenses and mileage might feel like a chore, but it is an absolutely essential part of running a smooth and financially sound operation, whether you are a small business owner, a freelancer, or an employee needing to submit reimbursements. Accurate records are not just about knowing where your money goes; they are crucial for maximizing your tax deductions, staying compliant with regulations, and gaining a clear picture of your financial health. Without a system in place, you could be leaving money on the table or even facing headaches during tax season.

Many people find themselves overwhelmed by the sheer volume of receipts and trip logs. This is where a structured approach comes in handy, helping you transform a mountain of paperwork into manageable data. Having a reliable method for tracking every single business-related expense, especially those related to travel and vehicle use, can simplify your financial life immensely and ensure you are always prepared for whatever comes your way, from budgeting decisions to audits.

Why Accurate Mileage and Expense Tracking is Crucial

Diligent tracking of your gas mileage and other business expenses goes far beyond simply knowing how much you spent. For many businesses and self-employed individuals, vehicle expenses represent a significant portion of their operational costs. The IRS allows deductions for business use of a personal vehicle, either through a standard mileage rate or by deducting actual expenses like gas, oil, repairs, and insurance. Without meticulous records, proving these deductions can be challenging, potentially leading to missed savings or even issues during an audit. Properly documented expenses mean you can confidently claim what is rightfully yours, reducing your taxable income.

Beyond tax benefits, consistent expense tracking provides invaluable insights into your business’s financial performance. It helps you understand exactly where your money is going, allowing you to identify areas of overspending, pinpoint cost-saving opportunities, and make more informed financial decisions. For instance, if you notice your fuel costs are consistently higher than expected, it might prompt you to review your travel routes, consider more fuel-efficient vehicles, or even explore remote work options for certain tasks. This level of detail empowers you to manage your budget proactively rather than reactively.

Furthermore, an organized expense system significantly reduces stress during tax preparation. Instead of scrambling to find old receipts and recall details of past trips, all the necessary information is readily available in one place. This not only saves you time but also minimizes the risk of errors that could trigger an audit. Peace of mind knowing that your financial records are accurate and complete is an underrated benefit that allows you to focus more on growing your business and less on administrative burdens.

An effective system also aids in cash flow management. By regularly reviewing your expenses, you can anticipate future outlays and ensure you have sufficient funds available. This foresight is crucial for maintaining liquidity and preventing unexpected financial shortfalls. It also makes the reimbursement process smoother and faster for employees, improving overall internal financial operations.

Key Elements of an Effective Expense Tracking System

- Date of expense: Always record when the expense occurred.

- Vendor or payee: Who received the money.

- Purpose of expense: A brief but clear description of why the expense was incurred and how it relates to business.

- Amount: The exact monetary value.

- Category: Classify the expense (e.g., fuel, meals, lodging, office supplies).

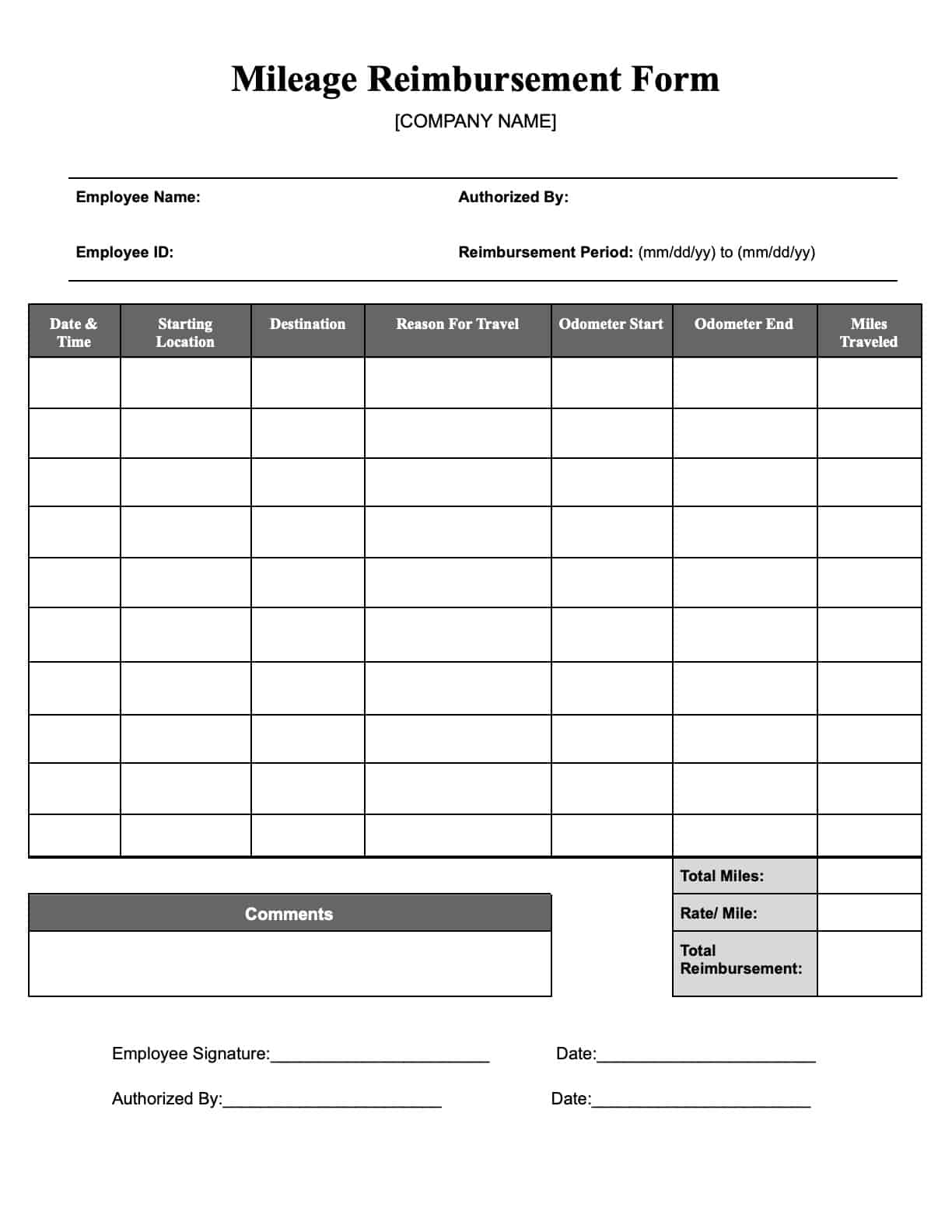

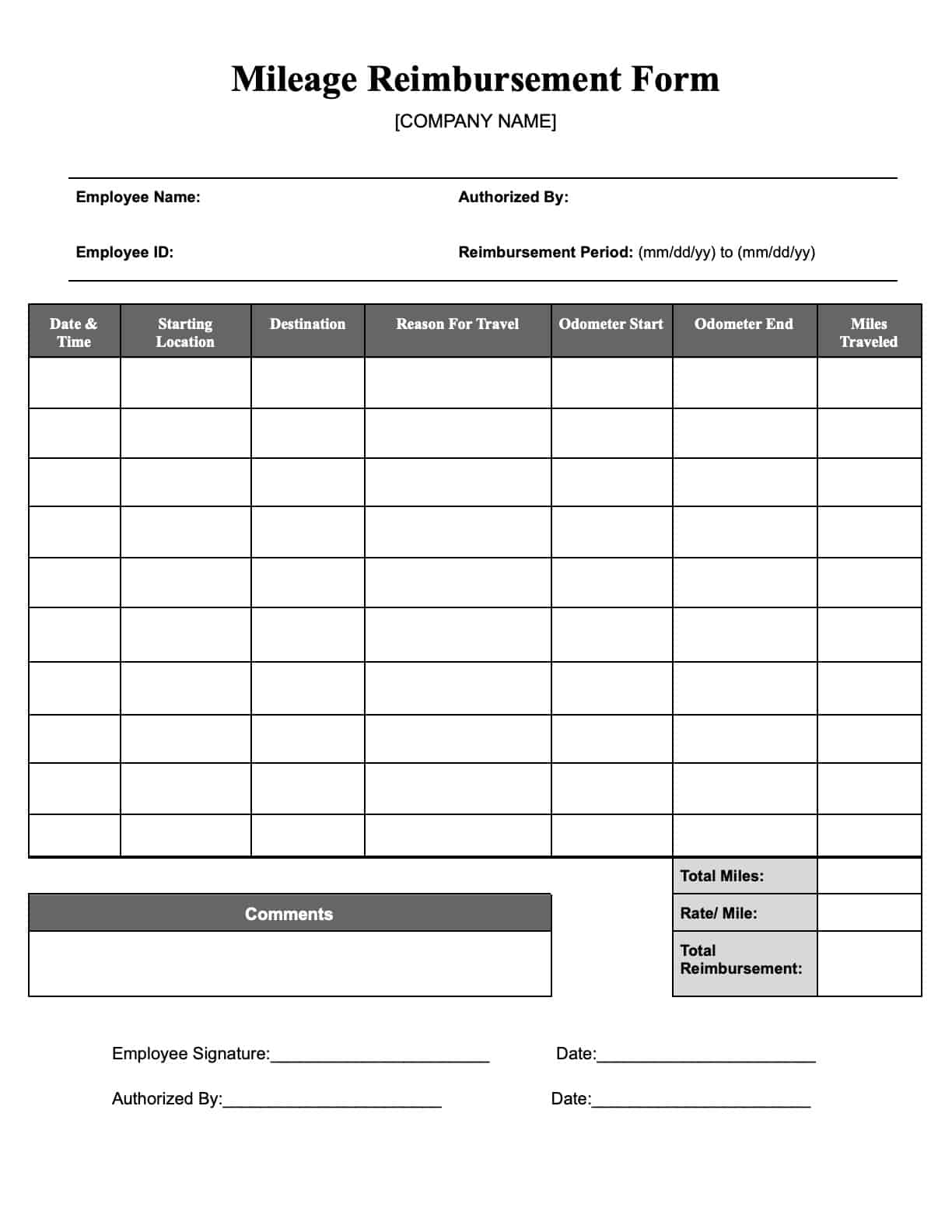

- Mileage details: For vehicle use, include odometer readings at the start and end of the trip, total miles, and the business purpose.

Finding and Using the Perfect Gas Mileage and Business Expense Form Template

The digital age offers a wealth of resources for managing your financial records, and finding the ideal gas mileage and business expense form template has never been easier. You can discover a wide array of options online, ranging from simple printable PDFs to more complex spreadsheets designed for popular software like Microsoft Excel or Google Sheets. Many accounting software solutions also offer integrated expense tracking features, which can be a game-changer for businesses seeking an all-in-one solution. The key is to choose a template that aligns with your specific needs, whether you are a solo entrepreneur with minimal expenses or a growing company with multiple employees requiring reimbursements.

What makes a good template truly stand out is its user-friendliness and comprehensiveness. An effective template should be intuitive, allowing for quick and accurate data entry without confusion. It should include all the necessary fields mentioned previously, ensuring that no crucial detail for tax purposes or internal financial analysis is overlooked. Look for templates that are customizable, allowing you to add or remove categories, personalize headings, or even incorporate your company’s branding. The ability to tailor the template to your unique business operations will greatly enhance its utility and encourage consistent use.

Once you have selected your gas mileage and business expense form template, the next step is to integrate it into your daily or weekly routine. Consistency is paramount. Instead of letting receipts pile up, aim to record expenses as they occur or at least on a regular schedule, such as at the end of each workday or week. For mileage tracking, make it a habit to jot down your odometer readings at the start and end of any business-related trip. Many people find it helpful to keep a small notepad or use a mobile app for immediate logging, then transfer the data to the formal template periodically.

Regular review of your completed forms is also beneficial. This allows you to catch any potential errors early, ensure all receipts are accounted for, and identify any patterns in your spending that warrant attention. By making expense tracking a non-negotiable part of your workflow, you transform what could be a dreaded task into a seamless and empowering process. This diligence ensures your financial records are always audit-ready and provide a clear, real-time snapshot of your operational costs.

Implementing a consistent system for tracking your gas mileage and business expenses, perhaps by using a reliable gas mileage and business expense form template, significantly simplifies your financial management. It removes the guesswork and the last-minute scramble, replacing it with clarity and confidence. This disciplined approach not only optimizes your tax deductions but also provides crucial data for budgeting, forecasting, and strategic decision-making, ultimately contributing to the long-term success and stability of your endeavors.

Embracing proactive expense tracking means more than just avoiding financial pitfalls; it empowers you to take control of your financial narrative. It frees up valuable time and mental energy that can be redirected toward core business activities and growth initiatives. With well-organized records, you are always prepared, always informed, and always in a better position to make smart choices that benefit your bottom line.