Did you know that you might be eligible for a refund on your gap insurance policy, especially if you’ve recently paid off your car loan, sold your vehicle, or refinanced? It’s a common situation many car owners find themselves in, yet often, they don’t realize there’s money waiting for them. Unlocking these funds simply requires a clear and concise request to your insurance provider or the finance company that sold you the policy.

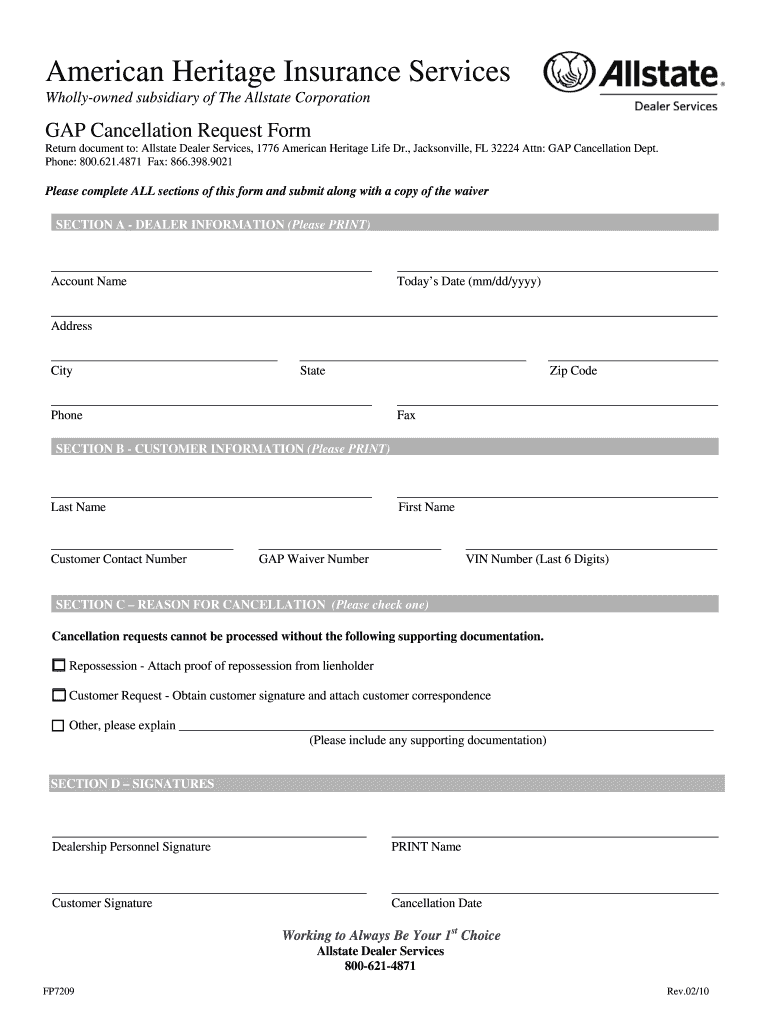

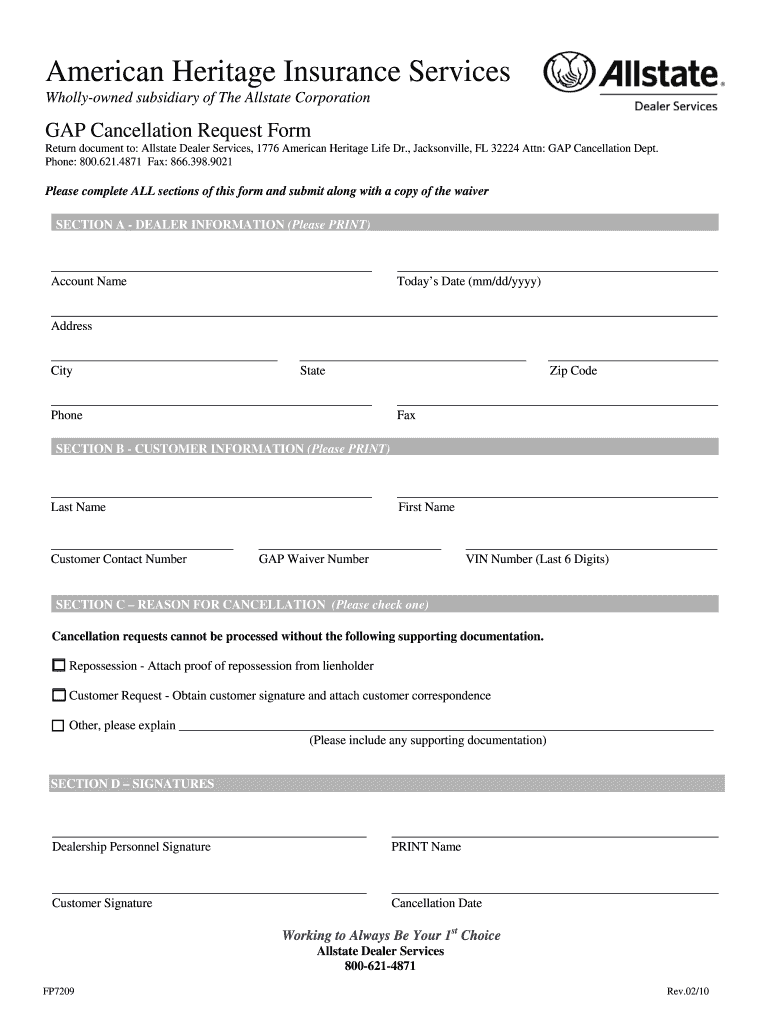

Navigating the process can feel a bit daunting, but with the right guidance and, ideally, a solid gap insurance refund request form template, it becomes significantly smoother. We’re here to walk you through the essential steps and what you need to know to ensure your refund request is handled efficiently, getting that money back into your pocket where it belongs.

Understanding Your Eligibility for a Gap Insurance Refund

Gap insurance, or Guaranteed Asset Protection insurance, is designed to cover the “gap” between what you owe on your car loan and what your standard auto insurance policy would pay out if your vehicle is declared a total loss or stolen and not recovered. It’s an excellent safeguard against depreciation, especially during the early years of a car loan. However, unlike traditional auto insurance, its utility diminishes as your loan balance decreases.

So, why would you be entitled to a refund? The most common reason is that the original purpose of the gap insurance no longer exists. For instance, if you pay off your car loan ahead of schedule, the “gap” you were protecting against has been eliminated. The same applies if you sell your car before the loan is fully repaid, as the new owner takes over, or if you refinance your vehicle and a new gap policy is bundled into the new loan. In these scenarios, the unused portion of your premium is typically refundable on a pro-rata basis.

It’s important to remember that most gap insurance policies are designed to cover the entire loan term. If that term is cut short for any reason, you’ve essentially paid for coverage you no longer need. Many states and policies mandate that providers offer a refund for this unused portion. However, the exact refund amount will depend on how much time was left on your policy and whether any administrative fees apply.

Before initiating any request, it’s wise to review your original gap insurance policy documents. These papers will usually outline the specific conditions for a refund, including any limitations or requirements. Being well-informed about your policy’s terms will help you understand what to expect and gather all necessary information for a successful claim.

Common Scenarios Leading to a Refund

- You paid off your car loan early.

- You sold your vehicle before the loan was fully satisfied.

- You refinanced your car loan, and the gap coverage was not transferred or a new policy was issued.

- Your vehicle was totaled or stolen, and your primary insurance paid off the loan, making the gap policy redundant.

- You returned a leased vehicle early.

Crafting Your Gap Insurance Refund Request

When it comes to getting your money back, clarity and completeness are key. While you might be able to simply call your provider, submitting a formal written request, often using a gap insurance refund request form template, provides a clear record of your communication and ensures all necessary details are included. This can significantly expedite the refund process and prevent misunderstandings.

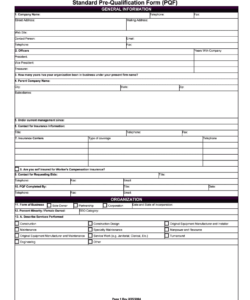

A well-structured request form should leave no room for ambiguity. It needs to contain all pertinent information about you, your vehicle, your loan, and your gap insurance policy. Think of it as a clear business communication designed to provide the insurer or finance company with everything they need to process your refund without having to ask for follow-up details. This proactive approach can save you a lot of back-and-forth.

Gathering all your documentation beforehand is crucial. This includes your original gap insurance policy number, the date you purchased the policy, the date your loan was paid off or your car was sold, your original loan agreement, and proof of loan payoff or sale (like a bill of sale or a loan payoff letter from your lender). Having these documents ready will make filling out any refund request form a breeze and demonstrate your readiness for processing.

Once you have your completed form and all supporting documents, the next step is to submit your request. This typically involves sending it via mail, often certified mail, to the finance company or insurance provider that issued the policy. Some companies might offer an online submission portal or an email address, but always confirm the preferred method to avoid delays. Remember to keep copies of everything you send for your records.

What to Include in Your Request

- Your full name and current contact information (address, phone, email).

- Your gap insurance policy number.

- The original date you purchased the gap insurance policy.

- Your vehicle’s make, model, year, and Vehicle Identification Number (VIN).

- Your original loan account number and the name of the lender.

- The specific reason for your refund request (e.g., loan paid off, vehicle sold).

- The exact date the qualifying event occurred (e.g., loan payoff date, sale date).

- Your signature and the date of the request.

Taking the initiative to reclaim your unused gap insurance premium is a smart financial move. With the right information and a clear process, getting your refund can be a straightforward task. Don’t let valuable funds sit unclaimed; a little effort can go a long way in ensuring your money comes back to you.

Remember that thoroughness in your documentation and clarity in your communication are your best allies. By following a structured approach and providing all necessary details upfront, you significantly improve the chances of a swift and successful refund, allowing you to reallocate those funds as you see fit.