In our increasingly digital world, moving money around has become an everyday occurrence. Whether it’s for business operations like payroll and vendor payments, or personal needs such as sending funds to family or managing investments, the act of transferring money needs to be handled with precision and clarity. Often, what seems like a simple task can become complicated without a proper system in place, leading to potential errors, delays, and frustrating back-and-forth communication.

That’s where a well-designed funds transfer request form template truly shines. It provides a structured, clear, and standardized way to initiate and document every financial movement. Think of it as your reliable co-pilot for navigating the often intricate skies of financial transactions, ensuring that every detail is captured accurately and every request is handled efficiently. It’s not just about getting the money from point A to point B; it’s about doing it securely, transparently, and without a hitch.

The Indispensable Role of a Structured Funds Transfer Process

Implementing a standardized approach to funds transfers, particularly through the use of a dedicated form, is far more than just a bureaucratic hurdle; it’s a critical component of robust financial management. For businesses, it’s about maintaining a clear audit trail, preventing fraud, and ensuring accountability for every dollar that moves. Without such a system, you’re essentially operating blind, leaving room for errors, miscommunications, and even potential financial irregularities that could prove costly.

Imagine a scenario where various departments are making payment requests via disparate emails, casual phone calls, or even handwritten notes. The chaos is palpable. A standardized funds transfer request form acts as the single source of truth, centralizing all necessary information and ensuring that no critical detail is overlooked. This might include beneficiary details, amounts, currencies, purpose of transfer, and authorization signatures. It builds a crucial bridge between the requestor and the finance department, ensuring everyone is on the same page.

Beyond internal clarity, a properly documented funds transfer process significantly streamlines external interactions. When dealing with banks, auditors, or even during routine compliance checks, having meticulously completed forms available can save immense amounts of time and effort. It demonstrates a commitment to financial governance and professionalism, which can be invaluable for an organization’s reputation and operational efficiency. It’s about instilling confidence in your financial operations, both internally and externally.

Ultimately, whether you are a large corporation handling complex international payments or a small business managing daily expenses, the underlying principle remains the same: clarity and control are paramount. A well-utilized funds transfer request form template becomes the backbone of this control, empowering you to manage your finances with greater precision and less stress. It moves financial requests from informal whispers to formal, auditable records, protecting all parties involved.

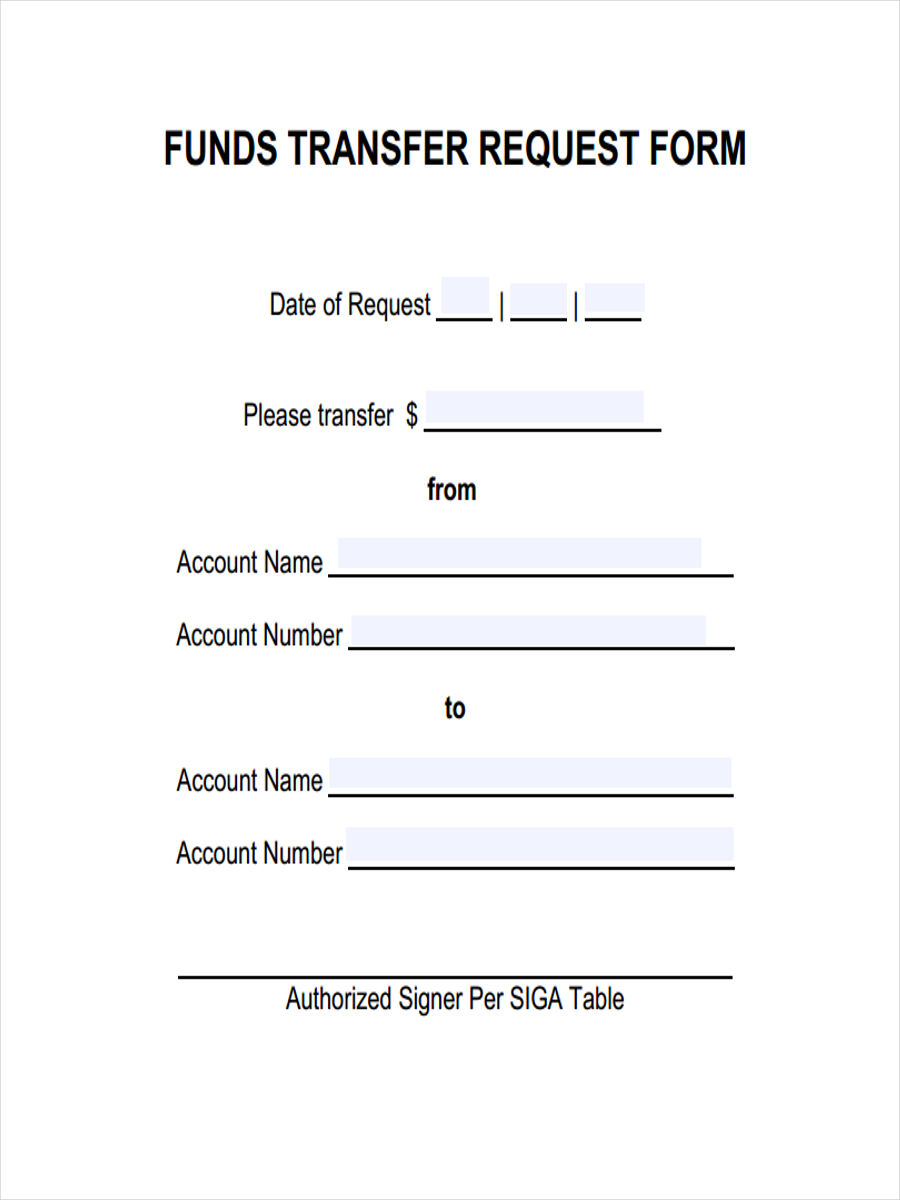

Essential Elements of a Comprehensive Funds Transfer Request Form

- Requester Information: Name, department, contact details.

- Date of Request: When the transfer was initiated.

- Beneficiary Details: Full name of recipient, bank name, account number, SWIFT/IBAN (if international).

- Transfer Amount and Currency: Clear indication of how much and in what currency.

- Purpose of Transfer: A brief but clear explanation (e.g., vendor payment, salary, inter-company transfer).

- Authorization: Space for necessary approvals and signatures.

- Supporting Documentation: A section to list or attach invoices, contracts, etc.

- Processing Notes: Internal use section for finance team.

Crafting Your Ideal Funds Transfer Request Form Template

While the core elements of any funds transfer request form remain consistent, the beauty of a template lies in its adaptability. Not all organizations or individuals have the exact same needs, and your template should reflect the specific nuances of your financial processes. This might mean adding fields for project codes, specific department approvals, or unique compliance checkboxes relevant to your industry. Taking the time to customize your funds transfer request form template ensures it seamlessly integrates into your existing workflows, making it a powerful tool rather than just another piece of paperwork.

Consider the medium you’ll use for your template. While a printable PDF or Word document might suffice for smaller operations, larger entities might benefit immensely from a digital, interactive form. Online forms can incorporate dropdown menus, conditional logic (showing specific fields based on previous answers), and automated routing for approvals. This not only enhances user experience but also reduces errors, as validation rules can be built into the form itself, preventing submission until all necessary fields are correctly filled.

Security and data privacy are non-negotiable when dealing with financial information. Ensure that any template you use or create aligns with relevant data protection regulations and internal security policies. If you opt for a digital form, consider secure platforms that offer encryption and access controls. For physical forms, establish clear protocols for storage and handling. The integrity of the information captured on your form is paramount, as it often contains sensitive banking and personal details.

Finally, once you’ve crafted your perfect funds transfer request form, don’t just launch it and hope for the best. Introduce it with clear communication, providing guidelines or even a brief training session for frequent users. Explain the benefits, not just the requirements. This proactive approach encourages adoption and ensures that everyone understands how to use the form effectively, leading to a smoother and more efficient financial process for all involved. A well-designed form is only truly effective when it’s well-understood and consistently applied.

Embracing a systematic approach to financial transactions through a clear and concise request form is more than just good practice; it’s a strategic move. It builds a foundation of trust, reduces the potential for costly mistakes, and frees up valuable time that would otherwise be spent troubleshooting errors or chasing missing information. This dedication to precision not only safeguards your assets but also contributes significantly to the overall operational health of any financial endeavor.

Ultimately, having a dedicated template for all funds transfer requests brings an unparalleled level of organization and peace of mind. It transforms a potentially chaotic process into a streamlined operation, allowing you to focus on growth and strategic initiatives rather than getting bogged down in administrative hurdles. It’s an investment in efficiency that pays dividends in accuracy, security, and clarity for every single financial movement.