In the dynamic world of business and employment, ensuring smooth transitions and clear financial records is paramount. Whether you’re an employer processing a departing employee’s final pay, or a service provider settling the last invoice with a client, the act of a “final check” signifies the culmination of a financial obligation. This critical step demands not only accuracy but also a clear paper trail, providing peace of mind for all parties involved and preventing future disputes.

Having a clear and standardized final check receipt form template is not just good practice; it’s a fundamental aspect of transparent and professional operations. It helps solidify the financial closure, ensuring that both the payer and the recipient have a documented understanding of the transaction. This document serves as proof that all dues have been settled, acting as an invaluable record for accounting, legal, and personal purposes.

Understanding the Importance of a Final Check Receipt

A final check receipt is far more than just a piece of paper; it’s a formal acknowledgment that all outstanding financial matters between two parties have been resolved and paid in full. This is particularly crucial in employer-employee relationships, where final paychecks often include not only regular wages but also accrued vacation time, severance, expense reimbursements, or other complex calculations. Without a proper receipt, misunderstanding or disputes about the final amount paid can easily arise, leading to costly legal battles or damage to reputations.

Beyond employment scenarios, similar final checks occur when a project is completed, a rental agreement ends, or a significant service contract concludes. In each case, documenting the final payment ensures clarity and prevents any party from later claiming unpaid dues. It provides a definitive end to the financial commitment, allowing both sides to move forward without lingering concerns.

This is precisely where a well-designed final check receipt form template becomes indispensable. It automates the process of creating these vital documents, ensuring consistency and accuracy with every use. Instead of drafting a new receipt from scratch each time, which is prone to errors and omissions, a template provides a pre-formatted structure that guides you to include all necessary details.

Utilizing a template also projects an image of professionalism and meticulousness. It shows that your organization values transparency and proper record-keeping, building trust with employees, clients, and partners alike. Furthermore, it significantly reduces administrative burden, saving time and resources that can be better spent on core business activities.

Key Elements to Include in Your Final Check Receipt Form Template:

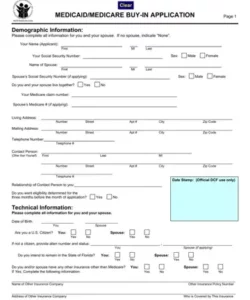

- Date of Payment: When the final payment was issued.

- Payer Information: Full legal name, address, and contact details of the entity making the payment (e.g., company name, individual’s name).

- Recipient Information: Full legal name, address, and contact details of the person or entity receiving the payment.

- Reason for Payment: A brief description of what the final check covers (e.g., “Final Wages for Employment,” “Project Completion Payment,” “Rental Deposit Refund”).

- Breakdown of Amount: A clear, itemized list of how the total amount was calculated, including regular wages, accrued vacation pay, commissions, bonuses, deductions, etc.

- Total Amount Paid: The final sum in both numerical and written form.

- Payment Method: How the payment was made (e.g., direct deposit, check number, cash).

- Acknowledgement Statement: A simple statement confirming receipt of the payment in full.

- Signatures: Spaces for both the payer and recipient to sign and date, indicating their agreement and acknowledgment.

Streamlining Operations with a Robust Receipt System

Employing a dedicated final check receipt form template brings a multitude of operational advantages, transforming what could be a tedious, error-prone task into a smooth, efficient process. One of the primary benefits is the standardization it offers. Every receipt generated will have the same professional look and contain consistent information, regardless of who is preparing it. This consistency is crucial for internal record-keeping and external audits, ensuring that all financial closures are handled uniformly across the board.

Beyond standardization, templates are powerful tools for mitigating risk. In an age where disputes over financial transactions are common, having a signed final check receipt acts as definitive proof of payment. This simple document can prevent or quickly resolve potential legal challenges, saving businesses significant time, money, and reputational damage. It provides a clear audit trail that can be referenced years down the line if questions ever arise about past transactions.

Another significant advantage is the efficiency gained. Instead of spending valuable time formatting documents and ensuring all necessary fields are included, a template allows for quick population of data. This speed not only reduces administrative overhead but also allows businesses to process final checks promptly, which is often a legal requirement or a matter of good customer/employee relations. A swift and accurate final payment process reflects positively on your organization.

Furthermore, a well-designed template can be customized to fit specific business needs or legal requirements, whether you’re dealing with different types of final payments, specific industry regulations, or even just your company’s branding. This flexibility ensures that while the core structure remains consistent, the document can adapt to various scenarios without losing its core purpose or professional appearance. Ultimately, a robust receipt system powered by templates enhances overall financial hygiene and operational excellence.

Embracing a systematic approach to final payments, supported by a reliable form, creates a ripple effect of positive outcomes. It ensures compliance with financial regulations and labor laws, minimizing the risk of penalties. Moreover, clear and consistent documentation fosters an environment of trust, which is invaluable in maintaining healthy relationships with employees, contractors, and clients.

Implementing a standardized receipt for final payments is a smart investment in your business’s future. It’s about building a foundation of clarity, efficiency, and legal protection that supports long-term success and growth, ensuring every financial chapter closes on a clear, positive note.