Trying to figure out the true worth of an asset can often feel like solving a complex puzzle. Whether it is for tax purposes, selling property, or settling an estate, understanding the fair market value of something is absolutely crucial. It is the price at which a property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts. Getting this figure right isn’t just about avoiding legal headaches; it is about ensuring fairness and accuracy in all your financial dealings.

This is where a well-structured fair market valuation form template becomes an invaluable tool. It transforms what could be a confusing and time-consuming process into a clear, step-by-step procedure. Instead of starting from scratch every time you need to value something, a reliable template provides a consistent framework, guiding you through all the necessary considerations and ensuring no vital details are overlooked. It is all about bringing simplicity and professionalism to a process that demands precision.

Understanding Fair Market Valuation: Why a Template is Your Best Friend

Fair market value is more than just a number; it represents the consensus price of an asset in an open and competitive market. Its importance spans across numerous scenarios, from determining capital gains for tax returns and probate for estates to establishing a reasonable asking price when selling a business or a piece of land. Without a clear and documented approach, arriving at this value can be subjective and prone to error, potentially leading to disputes, penalties, or missed opportunities.

Imagine trying to value a unique piece of artwork or a specialized piece of equipment without any structured method. You might compare it to similar items, but how do you document your research? What factors do you consider to be most relevant? Without a template, you risk overlooking critical data points or failing to present your findings in a way that is easily understandable and defensible to others. This lack of structure can introduce inconsistencies and make it challenging to justify your valuation, especially to third parties like auditors or legal teams.

This is precisely where a dedicated fair market valuation form template shines. It acts as your standardized checklist, ensuring that every relevant piece of information is gathered and presented in a logical order. From initial asset identification to the final valuation figure, the template prompts you for all the necessary details, significantly reducing the chances of errors and omissions. It standardizes your approach, making the valuation process more efficient and transparent, whether you are a professional appraiser or simply someone needing to value a personal asset.

A good template not only guides you through the process but also helps in organizing your supporting documentation. It transforms what could be a messy collection of notes and figures into a professional, easy-to-read report. This organized approach is invaluable when you need to present your valuation to others, providing a clear audit trail and enhancing the credibility of your assessment. It is all about bringing clarity and professionalism to every step.

Key Elements of an Effective Fair Market Valuation Form Template

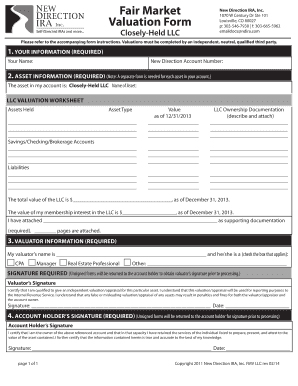

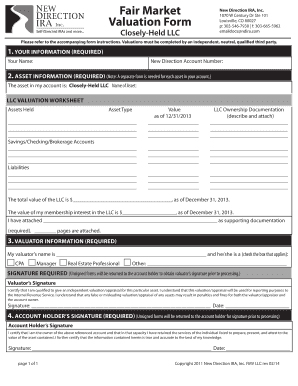

When you are looking for a template, you will want one that includes certain core components to ensure a comprehensive and defensible valuation. These elements are designed to capture all the essential information that contributes to an accurate assessment.

- **Asset Description:** A detailed identification of the asset being valued, including make, model, serial numbers, condition, and any unique features.

- **Valuation Date:** The specific date on which the valuation is effective, as market conditions can change rapidly.

- **Valuation Methodology:** A clear indication of the method used to arrive at the value (e.g., comparable sales approach, income approach, cost approach), along with a brief explanation of why that method was chosen.

- **Supporting Data and Research:** Space to document the data used, such as comparable sales, market research, professional opinions, or relevant financial statements.

- **Appraiser or Preparer Information:** Details of the person or entity conducting the valuation, including their qualifications if applicable.

- **Assumptions and Limiting Conditions:** Any underlying assumptions made during the valuation process or conditions that might affect the value.

- **Final Valuation Figure:** The ultimate fair market value expressed numerically, often with a range or a specific point estimate.

How a Fair Market Valuation Form Template Simplifies Various Scenarios

The practical applications of a robust fair market valuation form template are incredibly diverse, touching upon numerous aspects of personal and business finance. Consider estate planning and probate, for instance. When a loved one passes away, their assets need to be accurately valued for inheritance purposes and tax filings. A template ensures that every item, from real estate to personal collections, is assessed systematically, simplifying a potentially emotional and complex process for the beneficiaries and executors. It provides a consistent record that stands up to scrutiny from tax authorities.

In the realm of business, the template proves indispensable during transactions like the sale of assets, mergers, or buyouts. Whether it is valuing intellectual property, machinery, or the entire goodwill of a company, having a standardized form helps both buyers and sellers arrive at an equitable price. It provides transparency and a common basis for negotiation, reducing the likelihood of disputes and facilitating smoother transactions. For businesses, this means more efficient deal closures and better financial planning.

Furthermore, a fair market valuation form template is incredibly useful for charitable donations. If you are donating a valuable non-cash asset, such as art or property, to a nonprofit organization, the IRS requires a fair market valuation to determine the deductible amount. Using a template ensures that your valuation is well-documented and adheres to the necessary guidelines, providing peace of mind during tax season and helping you maximize your charitable contributions legally and effectively. It provides a clear audit trail should any questions arise from tax authorities.

Finally, in legal contexts, such as divorce settlements or civil disputes, an unbiased and well-documented valuation is paramount. When assets need to be divided fairly between parties, a standardized template ensures that the valuation process is transparent, objective, and defensible in court. It helps avoid lengthy disagreements and provides a clear basis for equitable distribution, saving both time and legal expenses. The consistency offered by a template can make all the difference in complex legal proceedings.

- Estate Planning and Probate: Streamlining the valuation of assets for inheritance and tax purposes.

- Business Asset Sales: Providing a clear, defensible value for machinery, property, and other business assets during sales or acquisitions.

- Charitable Contributions: Documenting the fair market value of non-cash donations for tax deduction purposes.

- Insurance Claims: Assisting in accurately assessing the value of damaged or lost property for insurance compensation.

- Lending and Collateral Assessment: Helping financial institutions determine the value of assets offered as collateral for loans.

Adopting a structured approach to asset valuation brings numerous advantages, primarily ensuring consistency, accuracy, and defensibility in your financial records. It removes guesswork, replacing it with a methodical process that considers all relevant factors, leading to valuations that are not only reliable but also easy to understand and justify to any third party. This level of detail and organization is invaluable for both individuals and businesses.

Ultimately, embracing a reliable valuation template means investing in clarity and peace of mind. It empowers you to approach any valuation task with confidence, knowing that you have a comprehensive tool that guides you toward an accurate and well-documented result, safeguarding your financial interests every step of the way.