Navigating the world of share ownership can sometimes feel a bit like deciphering a complex puzzle, especially when it comes to transferring shares. Whether you’re gifting shares to a family member, settling an estate, or moving investments between individuals, you’ll likely encounter the need for a stock transfer form. For many UK-based shareholders, Equiniti is a familiar name, serving as a primary registrar for numerous companies. This often means that if you’re dealing with shares managed by them, finding the correct equiniti stock transfer form template is your crucial first step.

Understanding how to properly complete and submit this document is essential for ensuring a smooth and successful transfer. Without the right form or a clear grasp of the process, you might face delays or complications. This guide aims to demystify the Equiniti stock transfer form, walking you through its purpose, what information you’ll need, and how to navigate the transfer process with confidence. Let’s dive in and make sense of transferring shares the Equiniti way.

Understanding the Equiniti Stock Transfer Process and Form

Equiniti acts as a share registrar for a vast number of publicly traded companies, managing shareholder records and facilitating various share-related activities. When shares are bought and sold through a broker on an exchange, the transfer is usually handled electronically. However, for “off-market” transfers – those not conducted through a stock exchange, such as gifts, transfers between family members, or certain inheritance situations – a physical stock transfer form is typically required. This is where the Equiniti stock transfer form comes into play.

The form itself is a standardized document that legally facilitates the change of ownership of certificated shares from one person or entity (the transferor) to another (the transferee). It ensures that Equiniti, as the registrar, has the necessary authorization and information to update their records accurately. Without this completed form, they cannot legally effect the transfer of ownership, leaving the shares registered in the name of the previous owner. It’s a critical piece of paperwork that validates the transaction outside of the typical market mechanisms.

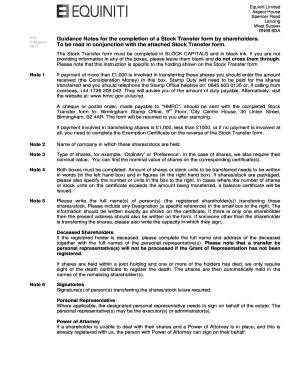

Acquiring the correct form is straightforward. You can often download a generic stock transfer form (usually the J30 form in the UK, which Equiniti uses) directly from the Equiniti website or by contacting their shareholder helpline. While it’s a general form, Equiniti’s specific guidance on their website or from their support team will ensure you’re using the appropriate version for shares they administer. Always ensure you’re using the most current version available to avoid any issues.

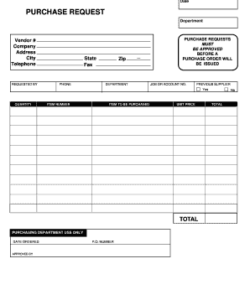

Filling out the form requires careful attention to detail. Any errors can lead to the form being rejected and necessitate starting the process over. This not only delays the transfer but can also be frustrating. The form typically requires details of the transferor (the person giving the shares) and the transferee (the person receiving the shares), including their full names and addresses. You’ll also need to specify the company whose shares are being transferred, the number and type of shares, and the consideration (the value of the shares being transferred – which can be zero for a gift). Signatures from both parties, sometimes witnessed, are also a mandatory part of the process.

Key Information You’ll Need to Complete the Form

- Full name and address of the transferor (current share owner).

- Full name and address of the transferee (new share owner).

- The exact name of the company whose shares are being transferred.

- The number of shares being transferred.

- The type of shares (e.g., ordinary shares).

- The share certificate number(s) relating to the shares being transferred.

- The consideration value of the transfer (this can be ‘Nil’ for gifts).

- Appropriate signatures from both the transferor and transferee, often requiring a witness signature.

Common Scenarios and Tips for Completing Your Equiniti Stock Transfer Form

There are several common scenarios where you might find yourself needing to use an Equiniti stock transfer form. One of the most frequent is gifting shares, perhaps from a parent to a child, or as a charitable donation. Another significant use case is when shares form part of an estate after someone has passed away; the executors will use this form to transfer the shares to the beneficiaries. Joint holders might also use it to remove a name or add a new one, subject to specific circumstances. Each scenario requires the same attention to detail on the form, though the accompanying documentation might vary.

Accuracy and legibility cannot be overstated when completing the form. Use a black pen and write clearly in block capitals where appropriate. Double-check every piece of information against your share certificates and official identification documents. A common mistake is misspellings of names or incorrect addresses, which can easily cause delays. If you do make an error, it’s generally best to start with a fresh form rather than using correction fluid or striking through mistakes, as registrars can be very particular about the cleanliness and integrity of official documents.

Once you’ve meticulously completed the equiniti stock transfer form template, along with ensuring all necessary signatures are present, you’ll need to send it to the correct department at Equiniti. Often, this will be their share registration department, along with the original share certificate(s) that are being transferred. It’s highly advisable to send these documents via recorded or special delivery to ensure they arrive safely and you have proof of postage. Losing share certificates or completed forms in the post can be a significant setback.

Before sending, always make a photocopy or scan of the entire completed form and any accompanying documents for your records. This serves as a vital backup in case of loss or if any queries arise later. While the process is designed to be straightforward, having a copy can save a lot of hassle. If you’re unsure about any aspect of the transfer, especially concerning tax implications for gifts or inheritance, it’s always wise to seek professional financial or legal advice. Equiniti can provide guidance on their forms and processes, but they cannot offer financial or tax advice.

- Read all instructions provided by Equiniti carefully before you begin filling out the form.

- Ensure all names and addresses match exactly with official records and identification.

- Use a black pen and write clearly to avoid misinterpretation.

- Include the original share certificate(s) with the completed form.

- Send documents via a secure, trackable postal service.

- Keep a full copy of the completed form and all supporting documents for your records.

- For complex situations or tax queries, consult a financial advisor or solicitor.

Successfully transferring shares via an Equiniti stock transfer form doesn’t have to be a daunting task. With careful attention to detail and a clear understanding of the requirements, you can ensure your share transfer proceeds without a hitch. Remember to gather all necessary information beforehand, complete the form accurately, and submit it along with the relevant share certificates. Following these steps will pave the way for a smooth transition of ownership.

By taking a methodical approach, you’re well on your way to completing the transfer efficiently and effectively. Whether it’s a gift or a part of estate planning, having shares accurately registered in the correct name provides peace of mind and ensures compliance with all necessary procedures. Always refer to the latest guidance from Equiniti for the most up-to-date information, as requirements can occasionally be updated.