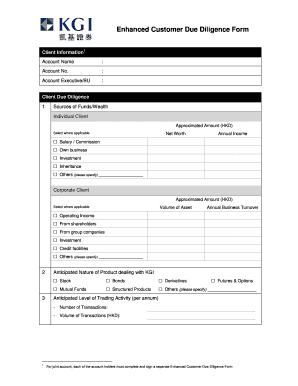

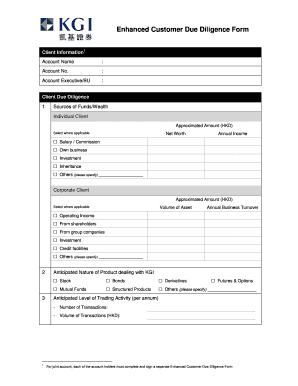

Navigating the complex world of financial compliance can often feel like walking through a minefield. With regulations constantly evolving and the risks of illicit activities ever-present, businesses must go beyond standard customer identification processes. This is where Enhanced Due Diligence, or EDD, steps in, providing a deeper dive into a client’s background, transactional behavior, and overall risk profile to safeguard your operations from financial crime.

While the concept of EDD is critical, the practical application can be daunting. Gathering extensive information, performing rigorous checks, and documenting everything meticulously requires a systematic approach. This is precisely why having a robust enhanced due diligence form template is not just a convenience, but a necessity for any organization serious about compliance and risk management. It acts as your structured guide, ensuring no crucial stone is left unturned.

Why Your Business Needs a Robust Enhanced Due Diligence Form Template

In today’s interconnected global economy, the stakes for financial institutions and other regulated entities are incredibly high. Standard Customer Due Diligence (CDD) provides a foundational understanding of a client, but it’s often insufficient for higher-risk scenarios. This includes dealing with politically exposed persons (PEPs), clients from high-risk jurisdictions, or those involved in complex transactions. Failing to identify and mitigate these elevated risks can lead to severe penalties, reputational damage, and even complicity in financial crimes like money laundering or terrorism financing.

An enhanced due diligence form template becomes your first line of defense in these high-stakes situations. It formalizes the process of collecting additional data points that go far beyond basic identity verification. Imagine trying to conduct these in-depth investigations ad-hoc, without a predefined structure. It would be inefficient, prone to oversight, and incredibly difficult to maintain consistency across different clients or analysts.

The beauty of a well-designed template is that it provides a consistent framework, guiding your team through every step of the EDD process. It ensures that the right questions are asked, the necessary documents are requested, and crucial risk indicators are systematically assessed. This structured approach not only enhances the quality of your due diligence but also significantly improves efficiency and reduces the potential for human error.

The Benefits of a Structured EDD Process

- Mitigated Risk: Effectively identifies and assesses higher risks associated with specific clients or transactions, reducing exposure to financial crime.

- Regulatory Compliance: Ensures your organization meets stringent regulatory requirements set by anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

- Operational Efficiency: Streamlines the data collection and analysis process, saving time and resources compared to ad-hoc methods.

- Consistency and Quality: Guarantees that all EDD procedures are applied uniformly, leading to more reliable and defensible outcomes.

- Audit Readiness: Provides clear, documented evidence of your due diligence efforts, which is invaluable during regulatory audits.

Key Elements to Include in Your Enhanced Due Diligence Form Template

When developing or customizing your enhanced due diligence form template, it’s crucial to think comprehensively about the information you need to gather to truly understand and assess a high-risk client. This isn’t just about ticking boxes; it’s about building a complete picture that allows for informed risk decisions. The template should guide your team to collect qualitative and quantitative data that sheds light on a client’s financial behavior, source of wealth, and potential vulnerabilities.

Beyond basic identification details, a robust template will delve into the beneficial ownership structure of entities, especially for complex corporate structures that might obscure the true individuals behind a transaction. Understanding who ultimately benefits from an account or transaction is paramount in preventing the misuse of financial systems for illicit purposes. This often requires exploring multiple layers of ownership and control.

Furthermore, the template should prompt for in-depth analysis of the source of wealth and source of funds. These are distinct concepts: source of wealth refers to how the client accumulated their total assets (e.g., salary, inheritance, business profits), while source of funds relates to where the specific funds for a particular transaction originated. Verifying these sources with supporting documentation is a critical step in flagging potential money laundering activities.

Finally, an effective enhanced due diligence form template integrates checks for adverse media, sanctions lists, and politically exposed person (PEP) status. These external checks provide crucial context and can highlight past or current risks not immediately apparent from direct client interactions. The template should also include sections for risk scoring, a clear rationale for the EDD decision, and a framework for ongoing monitoring, ensuring that a client’s risk profile is continuously assessed over time.

- Client and Entity Identification: Comprehensive details beyond basic ID, including all beneficial owners.

- Nature of Business and Activity: Detailed understanding of the client’s operations and intended use of services.

- Source of Wealth and Source of Funds: Documented proof of how wealth was accumulated and specific funds originated.

- Geographic Risk Assessment: Evaluation of risks associated with the client’s domicile, operational locations, and transaction corridors.

- Adverse Media and Reputational Checks: Results from searches for negative news or public records.

- Politically Exposed Person (PEP) Status: Determination and verification of any PEP affiliations.

- Sanctions and Watchlist Screening: Confirmation against international and national sanctions lists.

- Transaction Monitoring Plan: Outline for ongoing scrutiny of client activity.

- Risk Rating and Rationale: Justification for the assigned risk level and EDD outcome.

Implementing a well-structured framework for enhanced due diligence significantly streamlines a complex compliance function. It empowers your team to conduct thorough investigations efficiently, ensuring that all necessary information is systematically gathered and analyzed. This proactive approach not only fortifies your defenses against financial crime but also demonstrates a commitment to regulatory excellence.

Ultimately, a tailored and comprehensive enhanced due diligence form template is an indispensable asset for any organization facing heightened compliance demands. It transforms a potentially overwhelming task into a manageable process, safeguarding your business, maintaining your reputation, and securing your place within a compliant global financial landscape.