Every business dealing with cash, from a bustling retail store to a cozy cafe or a service-based operation, faces the daily challenge of accurately reconciling its finances. At the close of each business day, ensuring that all transactions are accounted for and that the physical cash matches the recorded sales can feel like a complex puzzle. Without a clear, systematic approach, errors can creep in, leading to discrepancies, lost revenue, and unnecessary stress for you and your team.

That is precisely where a reliable end of day cash out form template becomes an indispensable tool. It transforms what could be a chaotic process into a smooth, efficient routine. This isn’t just about counting money; it’s about establishing transparency, accountability, and accuracy in your daily financial operations, providing a clear snapshot of your business’s performance before you even open your doors the next morning.

Why a Cash Out Form is a Game-Changer for Your Business

Implementing a structured process for your end-of-day cash reconciliation is more than just good practice; it’s a fundamental pillar of robust financial management. Think about it: every transaction, whether cash, card, or otherwise, contributes to the day’s total. Without a dedicated system to track these, it’s all too easy for minor errors to snowball into significant financial headaches. An effective cash out form ensures that every penny is accounted for, providing a clear audit trail that can be invaluable for bookkeeping, tax preparation, and identifying any potential issues early on.

Beyond simple accounting, a well-designed cash out form fosters a culture of accountability among your staff. When employees know there’s a standardized procedure for reconciling their tills, they are naturally more diligent in handling transactions throughout the day. This proactive approach minimizes discrepancies, reduces the likelihood of theft or errors, and creates a more trustworthy environment for everyone involved. It removes guesswork and replaces it with concrete data, making it easier to pinpoint exactly where any issues might have occurred, should they arise.

Consider the time saved. Instead of scrambling at closing, trying to piece together sales figures from various sources, an end of day cash out form template streamlines the entire process. It guides your staff through each step, ensuring nothing is overlooked. This efficiency not only saves valuable time at the end of a long day but also reduces the stress associated with financial reconciliation, allowing your team to focus on serving customers rather than wrestling with numbers.

Ultimately, having a dedicated end of day cash out form template is an investment in your business’s long-term health. It provides a consistent framework, ensures accuracy, and boosts financial transparency, all of which are critical for sustainable growth. It’s about building a solid foundation for your daily operations, giving you peace of mind that your cash flow is meticulously managed.

What Makes a Great End of Day Cash Out Form Template?

When you are looking for an effective end of day cash out form template, there are several crucial components that make all the difference in its utility and accuracy. A good template should be comprehensive yet easy to understand, guiding the user through each step of the reconciliation process without unnecessary complexity.

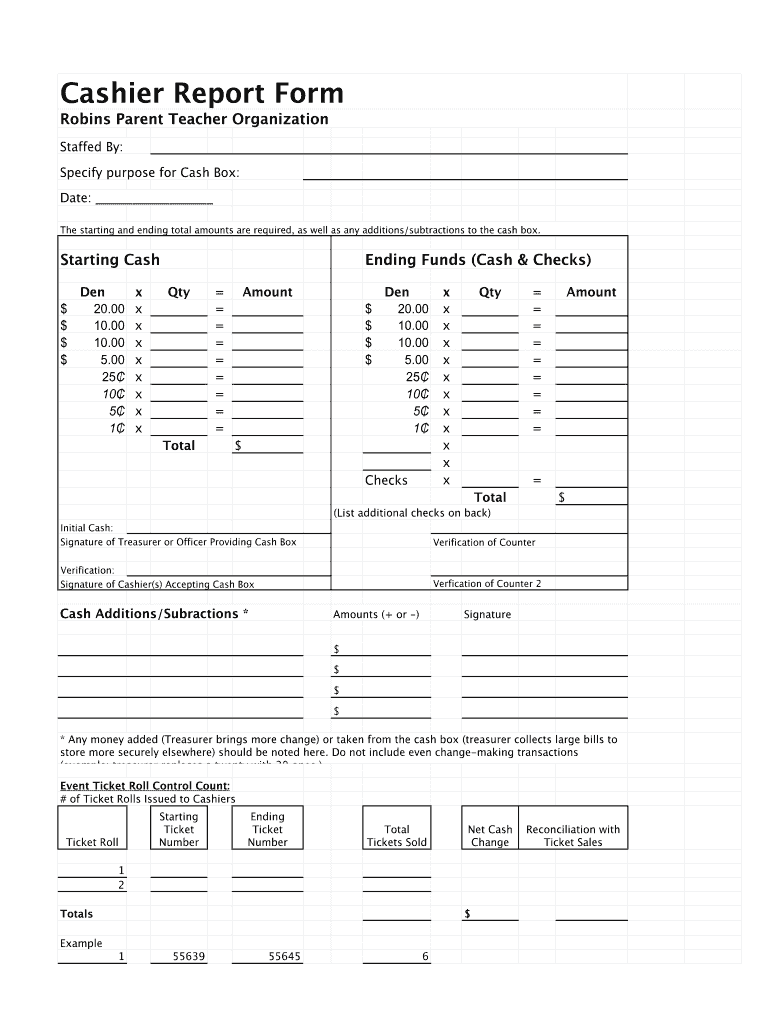

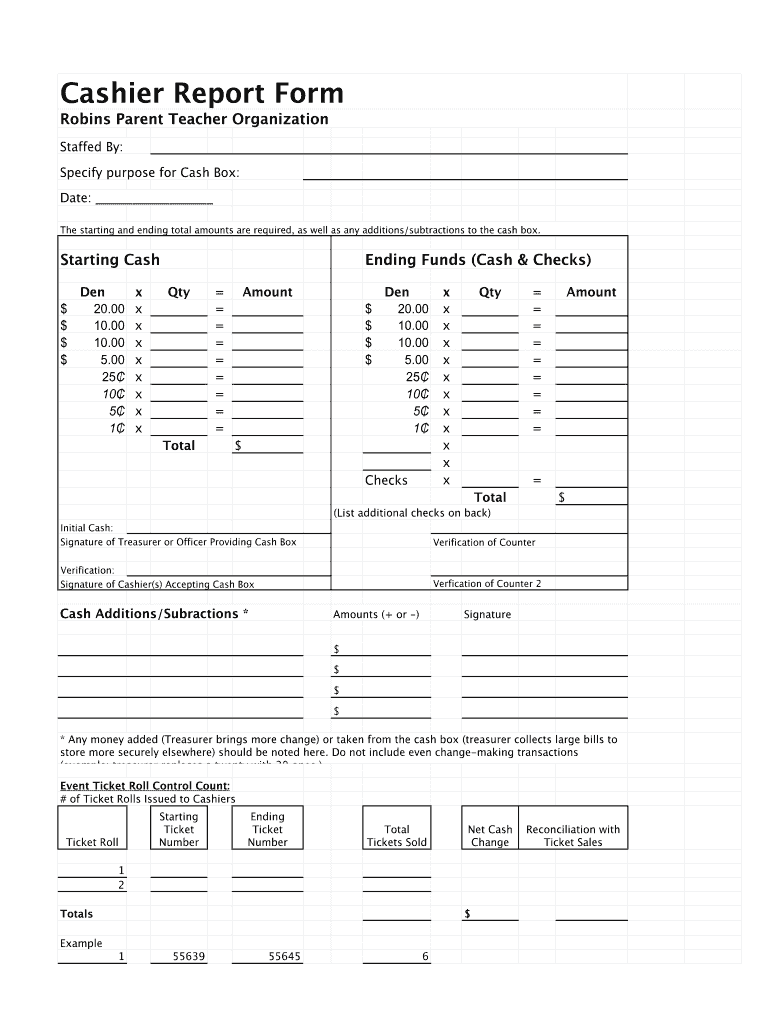

- Details about the sales period: This includes the date, shift number, and the name of the individual responsible for the cash out. This ensures clear accountability for each reconciliation.

- Categorization of sales: Separate sections for cash sales, credit card sales, mobile payments, gift certificate redemptions, and any other relevant payment methods. This provides a granular view of revenue streams.

- Breakdown of cash tendered: A detailed section for counting physical cash, listing denominations (e.g., number of twenties, tens, fives, ones, and coins). This helps in verifying the actual cash on hand against the system’s recorded cash sales.

- Discrepancy section: A dedicated area to note any overages or shortages, along with a space for explanations or comments. This is vital for troubleshooting and understanding the root cause of any imbalances.

- Non-cash transactions: Space to record transactions that affect the till but aren’t sales, such as petty cash disbursements, paid-outs, or deposits made throughout the day.

- Signature lines: A final section for the person counting the cash and a manager or supervisor to sign off, confirming the accuracy of the reconciliation. This adds an extra layer of verification and accountability.

How to Implement and Customize Your End of Day Cash Out Process

Once you have a solid end of day cash out form template, the next step is to effectively integrate it into your daily operations. This isn’t just about printing out a form; it’s about establishing a routine and ensuring everyone understands their role. Start by clearly defining the responsibilities for cash out—who is responsible for counting, who verifies, and who signs off. Consistency is key, so make sure the process is followed diligently every single day, regardless of how busy or slow it might have been.

Customization is often overlooked, but it’s a powerful way to make your end of day cash out form template truly work for your unique business. Every business has its own quirks, whether it’s specific types of sales, unique payment methods, or internal reporting requirements. Don’t hesitate to modify the template to fit your specific needs. You might add lines for loyalty program redemptions, specific product categories, or even integrate it with your point-of-sale system’s daily reports. The goal is to create a form that captures all the necessary data without being overly complicated.

Training your staff is paramount. Even the most perfectly designed form is useless if your team doesn’t know how to use it correctly. Conduct thorough training sessions, explaining not just how to fill out the form, but also why each section is important. Emphasize the benefits of accuracy and the role each individual plays in maintaining financial integrity. Providing clear, written instructions alongside the form can also be incredibly helpful, especially for new hires or as a quick reference guide.

Finally, review and refine your process regularly. As your business grows or changes, your cash out needs might evolve. Periodically, perhaps quarterly or annually, review the effectiveness of your end of day cash out form template and the overall process. Are there recurring discrepancies? Can any steps be simplified? Is there new technology that could make the process even more efficient? Being open to adjustments will ensure that your cash management system remains robust and effective over time, adapting to your business’s evolving landscape.

Adopting a meticulous approach to your daily financial reconciliation, bolstered by a comprehensive template, truly simplifies what can often be a daunting task. It empowers your team with a clear pathway to accurate reporting, minimizing errors and fostering a sense of control over your finances. This dedication to precision ensures that your business operates on a foundation of trust and transparency, allowing you to make informed decisions with confidence.

Ultimately, a streamlined cash out procedure does more than just balance the books; it provides invaluable insights into your daily operations and contributes significantly to the overall health and stability of your business. Embracing such a tool frees up valuable time and resources, letting you focus more on growth and less on chasing down numerical discrepancies, paving the way for a more organized and profitable future.