When tax season rolls around, many employees find themselves sifting through various documents to ensure everything is in order. One of the most crucial pieces of mail you’ll receive from your employer is the form detailing your annual earnings and tax withholdings. This document is essential for accurately filing your income tax return, and sometimes, the sheer volume of information can feel a bit overwhelming.

Understanding these forms and knowing how to organize the information they contain is key to a smooth tax filing process. This is where a well-structured template can become your best friend. Imagine having a clear, organized way to track everything, ensuring no detail is missed. Let’s dive into what these forms mean for you and how a convenient template can simplify your life.

Understanding Your Annual Tax Forms

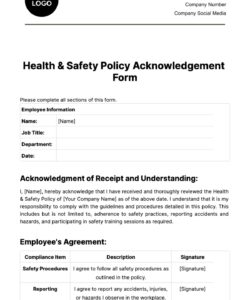

As an employee, your employer is legally obligated to provide you with specific tax forms that summarize your income and any taxes withheld throughout the year. These forms are indispensable, serving as the official record of your earnings and the amounts that have already been paid towards your tax liability. Without them, you wouldn’t be able to accurately report your income to the Internal Revenue Service (IRS) or claim any refunds you might be due.

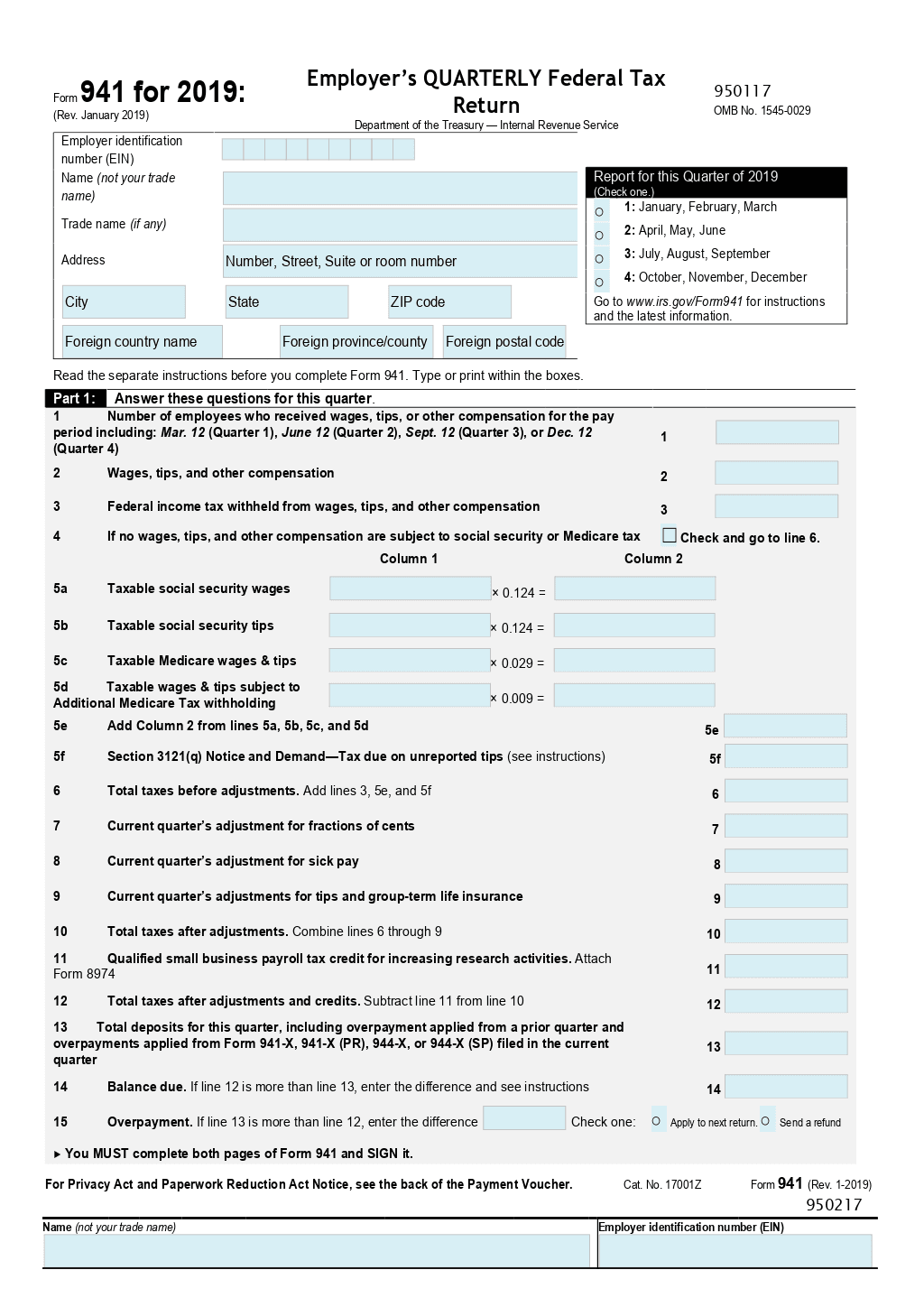

The information contained within these documents includes your gross wages, tips, and other compensation, as well as federal income tax withheld, state income tax withheld, and Social Security and Medicare taxes. Each piece of data has its specific place on your tax return, influencing your final tax calculation. It’s not just about what you earned, but also about ensuring that the amounts your employer reported align with your records.

For many, the most common form received is the W-2, Wage and Tax Statement. However, depending on your employment situation, you might also receive other forms that report different types of income or transactions. Knowing which forms apply to your situation is the first step toward a stress-free tax season. Let’s look at some of the common ones.

Key Forms You Might Receive

-

Form W-2, Wage and Tax Statement: This is the staple for most employees, reporting your annual wages, tips, and other compensation, along with federal, state, and local taxes withheld. Employers must send these out by January 31st each year.

-

Form 1099-NEC, Nonemployee Compensation: If you performed services as an independent contractor rather than an employee, you might receive this form instead of a W-2. It reports income of $600 or more paid for nonemployee compensation.

-

Form 1099-MISC, Miscellaneous Income: While previously used for nonemployee compensation, it’s now primarily for reporting other types of miscellaneous income, such as rents, royalties, or awards.

-

Form 1098-E, Student Loan Interest Statement: If you paid student loan interest, your lender will send you this form, which can allow you to claim a deduction for the interest paid.

Receiving these forms might seem like just another piece of mail, but each one holds vital information for your tax return. Taking the time to understand what each box signifies can save you headaches later on and help you ensure accuracy when you finally file.

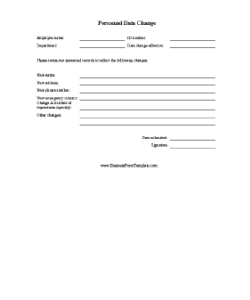

Simplifying Your Tax Season with an Employee Received Tax Return Form Template

Once you have all your necessary tax forms in hand, the next challenge is often organizing the information in a way that makes filing straightforward. This is precisely where an effective employee received tax return form template truly shines. Instead of haphazardly jotting down figures or searching through piles of paper, a dedicated template provides a structured environment to compile all your crucial data.

Using a template offers several significant advantages. Firstly, it promotes accuracy by guiding you through each necessary piece of information, minimizing the chance of overlooking a vital detail or transposing numbers. Secondly, it saves a tremendous amount of time. Instead of deciphering complex official forms each year, you can quickly transfer the data to a familiar layout. Lastly, it provides a sense of control and organization, reducing the stress often associated with tax preparation.

So, where can you find a reliable employee received tax return form template? Many reputable sources offer these, including official IRS publications, popular tax preparation software providers, and trusted financial websites. When choosing a template, look for one that is easily editable, clearly structured, and ideally, aligns with the common tax forms you receive. Some templates even allow you to categorize expenses or income types beyond just what’s on your W-2 or 1099, giving you a more comprehensive financial overview.

Implementing a template into your tax routine is simple. As each tax form arrives, take a few minutes to input the relevant data into your chosen template. This proactive approach prevents a last-minute scramble and ensures all information is readily accessible when you sit down to complete your return, whether you’re using tax software or working with a professional. Consider the following steps for optimal use:

-

Identify Your Forms: Gather all W-2s, 1099s, and any other relevant income or deduction forms you received.

-

Choose a Template: Select a digital or printable template that suits your needs. Ensure it has fields for all common forms you expect to receive.

-

Input Data Systematically: As each form arrives, fill in the corresponding sections of your template. Double-check numbers for accuracy.

-

Keep it Updated: If you receive corrected forms or additional documents, update your template promptly.

-

Review Before Filing: Before submitting your tax return, cross-reference your template with your actual forms to ensure everything matches perfectly.

Embracing the use of such a template transforms tax preparation from a daunting annual task into a manageable, organized process. It’s a proactive step that empowers you to take charge of your financial documents with confidence.

Navigating the world of tax forms doesn’t have to be a source of anxiety. By understanding the purpose of the documents you receive from your employer and actively utilizing tools like an organized template, you equip yourself with the knowledge and structure needed for a smooth tax season. Being prepared means less last-minute stress and more confidence in your filing accuracy.

Taking the initiative to organize your tax information throughout the year, rather than waiting for April, truly makes a significant difference. It frees up your time, minimizes errors, and ultimately leads to a more efficient and perhaps even enjoyable tax preparation experience. Embrace organization, and you’ll find that tax time becomes a breeze.