Utilizing such a structured format offers several advantages, including improved financial transparency, simplified decision-making regarding resource allocation, and enhanced ability to secure financing. It facilitates accurate forecasting, identifies potential liquidity issues, and provides a basis for comparing performance against industry benchmarks.

Understanding the components and purpose of this structure is fundamental to effective financial management. The following sections will explore these aspects in detail, covering the preparation, analysis, and interpretation of this valuable tool.

1. Standardized Format

A standardized format is fundamental to the utility of an accounting cash flow statement template. Consistency in structure and presentation ensures comparability across different periods within a company and between different companies within an industry. This standardization facilitates clear communication of financial performance to stakeholders and enables more effective analysis.

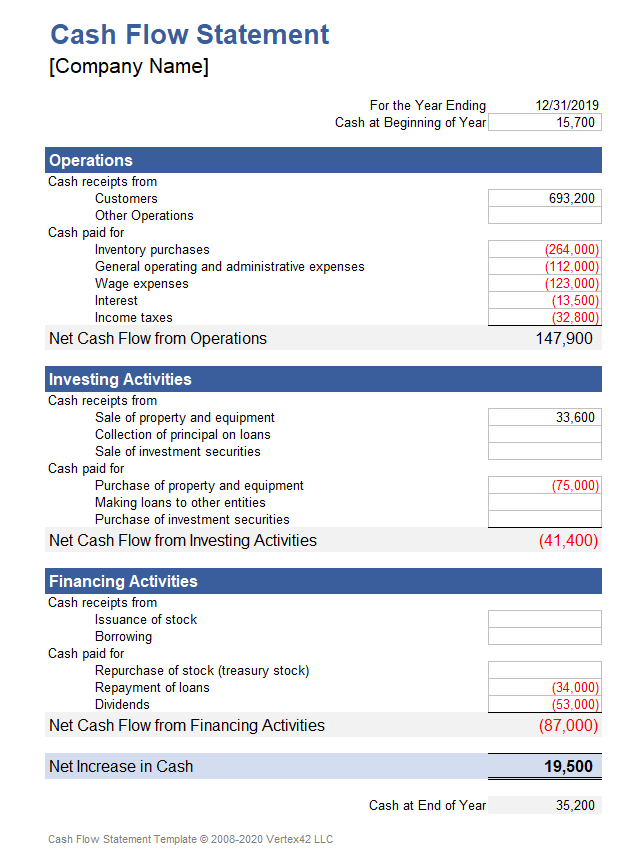

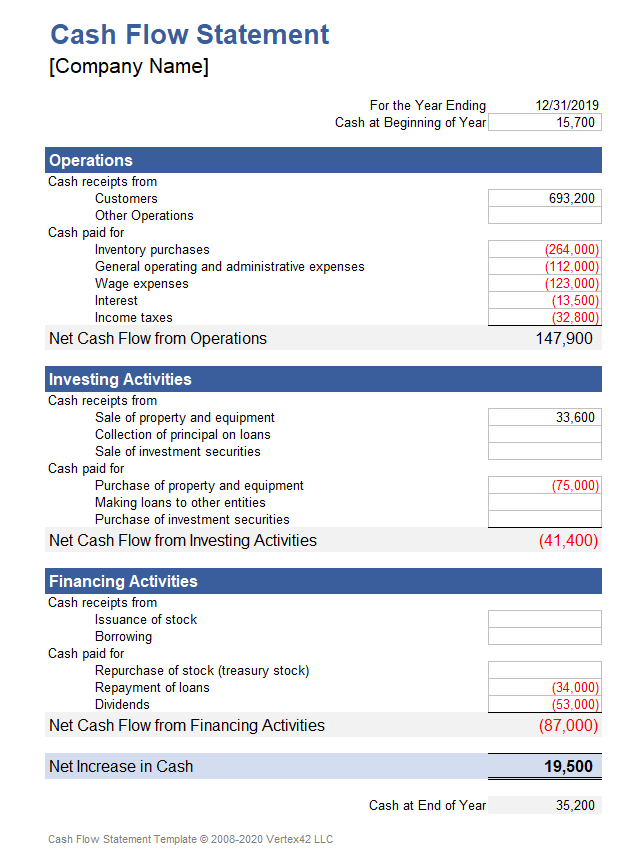

- Categorization of Cash FlowsStandardized templates categorize cash flows into operating, investing, and financing activities. This categorization provides a clear picture of the sources and uses of cash. For example, cash generated from core business operations is distinguished from cash obtained through debt financing. This segregation is crucial for assessing the sustainability and quality of cash flow generation.

- Consistent Line ItemsTemplates use consistent line items within each category. This allows for easy identification of specific cash inflows and outflows, such as net income, depreciation, capital expenditures, or debt repayments. Consistent labeling facilitates trend analysis and performance comparison over time, revealing, for instance, whether increases in operating cash flow are driven by revenue growth or cost reductions.

- Defined CalculationsStandardized templates often include defined calculations, such as the calculation of free cash flow. These pre-defined formulas ensure consistency in deriving key metrics and provide valuable insights into a companys financial flexibility and capacity for future investment or distributions.

- Presentation FormatThe presentation format, whether direct or indirect method for operating activities, is also generally consistent within a standardized template. While both methods ultimately arrive at the same net cash flow from operating activities, the chosen method influences the level of detail presented and the ease of understanding for users.

By adhering to a standardized format, an accounting cash flow statement template promotes transparency, enhances comparability, and simplifies analysis, contributing significantly to effective financial management and informed decision-making.

2. Operating Activities

Operating activities represent the core business functions that generate revenue and incur expenses. Within an accounting cash flow statement template, this section provides crucial insights into a company’s ability to generate cash from its day-to-day operations. This involves analyzing cash flows related to sales, production, and delivery of goods or services. The direct method presents cash inflows and outflows directly related to these operations, such as cash received from customers and cash paid to suppliers. The indirect method starts with net income and adjusts for non-cash items like depreciation and changes in working capital accounts (accounts receivable, inventory, accounts payable). For example, an increase in accounts receivable, while contributing to revenue, doesn’t immediately translate to cash inflow and is therefore deducted from net income. Conversely, an increase in accounts payable represents a source of cash and is added back. Understanding the nuances of these methods is critical for interpreting a company’s true cash generating capacity from its core business activities.

The significance of analyzing operating activities within the cash flow statement template lies in its ability to reveal the sustainability and quality of a company’s earnings. Strong and consistent positive cash flow from operations indicates a healthy business model, capable of funding its own growth and meeting its short-term obligations. Conversely, consistently negative operating cash flow can signal underlying problems within the business, even if net income appears positive. For instance, a company might show profitability due to high sales but struggle to collect cash from customers, leading to negative operating cash flow and potential liquidity issues. Furthermore, manipulating accruals or deferring payments can temporarily boost reported profits but will eventually be reflected in the operating cash flow, highlighting the importance of this section for assessing long-term financial viability.

Analyzing operating activities provides critical information about a company’s financial health. This section of the cash flow statement, presented within the structured framework of the template, allows stakeholders to assess the sustainability of earnings, identify potential liquidity risks, and gain a deeper understanding of the connection between profitability and cash generation. Evaluating the trends in operating cash flow over time, in conjunction with other sections of the cash flow statement and the overall financial statements, provides a comprehensive view of a company’s financial performance and future prospects.

3. Investing Activities

Investing activities within an accounting cash flow statement template detail the acquisition and disposal of long-term assets. These activities provide critical insights into a company’s capital allocation strategies and its focus on future growth. Analyzing this section helps stakeholders understand how a company invests its resources and the potential implications for future profitability and cash flow generation.

- Capital Expenditures (CAPEX)CAPEX represents investments in fixed assets, such as property, plant, and equipment (PP&E). Significant capital expenditures may indicate a company’s commitment to expansion, modernization, or increased production capacity. For example, a manufacturing company investing heavily in new machinery could signal anticipated growth in demand for its products. Within the template, CAPEX appears as a cash outflow, potentially impacting short-term liquidity but positioning the company for long-term growth.

- Asset SalesProceeds from the sale of long-term assets are reflected as cash inflows. These sales might represent a strategic divestment of non-core businesses, the replacement of obsolete equipment, or a response to financial difficulties. Analyzing the reasons behind asset sales within the context of the broader financial picture provides valuable insights into management’s strategic priorities and the overall financial health of the company.

- Investments in Other CompaniesThis category includes investments in securities, joint ventures, or acquisitions of other businesses. These investments can represent strategic moves to diversify operations, gain market share, or access new technologies. The magnitude and nature of these investments within the template offer insights into a companys growth strategy and risk appetite.

- Intangible AssetsPurchases and sales of intangible assets, such as patents, copyrights, and trademarks, are also classified under investing activities. These transactions often reflect a company’s focus on innovation and intellectual property. Significant investment in intangible assets can signal a long-term strategy focused on developing unique competitive advantages.

Analyzing investing activities within the structure of an accounting cash flow statement template offers crucial insights into a companys strategic direction. By examining the balance between investments and divestments, stakeholders can assess managements long-term vision and its implications for future growth and profitability. Evaluating investing activities in conjunction with operating and financing activities provides a holistic understanding of a company’s overall financial performance and its ability to generate sustainable value.

4. Financing Activities

Financing activities within an accounting cash flow statement template detail how a company obtains and manages its capital. This section provides crucial insights into a company’s capital structure, its reliance on debt versus equity financing, and its distribution policies. Analyzing financing activities helps stakeholders understand the long-term financial viability of the company and its approach to balancing growth with financial risk.

- Debt FinancingThis encompasses borrowing activities, including issuing bonds, securing loans, and utilizing lines of credit. Proceeds from these activities represent cash inflows, while principal repayments constitute cash outflows. The level of debt financing within the template reveals a company’s leverage and its associated financial risk. For example, a company relying heavily on debt may be vulnerable to interest rate fluctuations and economic downturns.

- Equity FinancingEquity financing involves issuing common or preferred stock. Proceeds from stock issuances represent cash inflows, while repurchasing company stock represents a cash outflow. A company’s reliance on equity financing, as reflected in the template, signals its approach to ownership and control. Issuing new equity can dilute existing ownership but avoids the fixed obligations associated with debt.

- Dividend PaymentsDistributions of earnings to shareholders, whether through cash dividends or stock repurchases, appear as cash outflows within the financing activities section. The level and consistency of dividend payments within the template indicate a company’s commitment to returning value to shareholders and can signal management’s confidence in future earnings.

- Other Financing ActivitiesThis category may include other transactions related to financing, such as changes in short-term borrowings or lease obligations. Analyzing these activities provides a more complete picture of a company’s financing strategy and its impact on cash flow.

Analyzing financing activities within an accounting cash flow statement template provides essential context for understanding a company’s long-term financial health and sustainability. By examining the mix of debt and equity financing, dividend policies, and other financing activities, stakeholders can assess a company’s financial risk, its approach to capital management, and its ability to generate sustainable value over time. Evaluating financing activities in conjunction with operating and investing activities within the structured framework of the template provides a comprehensive and insightful perspective on a company’s overall financial position and its prospects for future growth.

5. Periodicity (quarterly/annual)

The periodicity of accounting cash flow statement templates, typically quarterly or annually, provides a crucial temporal dimension to financial analysis. This regular reporting frequency allows stakeholders to track changes in cash flows over time, identify trends, and assess the ongoing financial health of an organization. Quarterly statements offer a more granular view of short-term fluctuations and operational performance, while annual statements provide a broader perspective on long-term financial sustainability.

The importance of periodicity stems from its ability to reveal dynamic changes in a company’s financial position. For instance, a seasonal business might experience predictable spikes in cash inflows during peak seasons and corresponding declines during off-seasons. Quarterly statements would capture these cyclical variations, enabling stakeholders to anticipate and manage potential liquidity challenges. Analyzing annual statements, on the other hand, would smooth out these seasonal fluctuations, providing a clearer picture of overall annual performance and long-term trends. A consistent decline in operating cash flow over several years, even if masked by strong performance in a single quarter, would signal a deeper underlying issue requiring further investigation. Consider a rapidly growing technology company investing heavily in research and development. Quarterly statements might show negative cash flow from investing activities due to these ongoing investments. However, annual statements, viewed over several years, might reveal a consistent increase in operating cash flow, demonstrating the positive long-term returns generated by these strategic investments.

Understanding the interplay between the periodicity of reporting and the structure of the accounting cash flow statement template is essential for informed financial analysis. Quarterly reporting provides timely insights into short-term performance and operational efficiency, while annual reporting offers a broader perspective on long-term financial health and sustainability. By analyzing cash flow trends across different reporting periods, stakeholders gain a comprehensive understanding of a company’s financial performance, its ability to generate and manage cash, and its prospects for future growth.

6. Financial Health Analysis

Financial health analysis relies heavily on the insights derived from an accounting cash flow statement template. The template provides the structured data necessary to assess critical aspects of a company’s financial well-being, including liquidity, solvency, and operational efficiency. Cause and effect relationships between different cash flow activities become clearer within the template’s framework. For example, increased cash flow from financing activities through debt issuance could lead to subsequent cash outflows for interest payments and principal repayments, impacting future liquidity. A sustained inability to generate positive cash flow from operations, even with increased financing, often signals underlying operational weaknesses and potential future solvency issues. Conversely, consistent positive cash flow from operations suggests a healthy business model capable of funding growth and meeting financial obligations.

As a crucial component of the accounting cash flow statement template, financial health analysis translates raw data into actionable insights. Consider a retail company experiencing declining operating cash flow despite increasing sales. Examination of the template might reveal growing inventories, suggesting potential issues with product demand or inefficient inventory management. This insight could prompt management to re-evaluate sales strategies, optimize inventory control, or adjust pricing policies. Another example might involve a manufacturing company showing significant cash outflows for investing activities. While this might appear concerning in isolation, analysis within the template could reveal that these outflows represent investments in new, more efficient equipment, expected to improve future operational cash flow and profitability.

A robust understanding of the connection between financial health analysis and the accounting cash flow statement template is essential for effective financial management and decision-making. While the template provides the structured data, financial health analysis provides the interpretative framework. This analysis facilitates proactive identification of potential financial challenges, supports data-driven decision-making, and ultimately contributes to enhanced long-term financial stability and growth. Challenges may arise from inaccurate or incomplete data within the template, requiring careful validation and reconciliation. Ultimately, however, leveraging the template for comprehensive financial health analysis provides a powerful tool for navigating the complexities of the financial landscape and achieving sustainable financial success.

Key Components of a Cash Flow Statement Template

A structured cash flow statement template provides a standardized framework for analyzing a company’s financial performance. Understanding its key components is essential for interpreting the sources and uses of cash within a business.

1. Operating Activities: This section details the cash flows generated from a company’s core business operations. It includes cash received from customers, cash paid to suppliers, and other operating expenses. Analyzing operating activities reveals the sustainability and quality of a company’s earnings.

2. Investing Activities: This section tracks cash flows related to the acquisition and disposal of long-term assets. Capital expenditures, asset sales, and investments in other companies fall under this category. Analyzing investing activities provides insights into a company’s growth strategies and capital allocation decisions.

3. Financing Activities: This section details how a company obtains and manages its capital. It includes cash flows from debt financing, equity financing, and dividend payments. Analyzing financing activities illuminates a company’s capital structure and its approach to financial risk.

4. Beginning and Ending Cash Balances: The template captures the cash balance at the start and end of the reporting period. This provides context for understanding the net change in cash during the period and its impact on the company’s overall liquidity.

5. Non-Cash Transactions: While not directly impacting cash flow, significant non-cash transactions, such as stock-based compensation or debt-for-equity swaps, are often disclosed within the template to provide a more complete picture of the company’s financial activities.

6. Periodicity: Cash flow statements are typically prepared on a quarterly and annual basis. This periodicity allows for analysis of trends and comparisons of performance over time, providing valuable insights into a company’s financial trajectory.

7. Standardized Format: The standardized format of the template ensures consistency and comparability, facilitating analysis both within a company over time and between different companies within an industry.

By analyzing these interconnected components within a cash flow statement template, stakeholders gain a comprehensive understanding of a company’s financial performance, its ability to generate and manage cash, and its prospects for future growth and stability. This understanding is critical for effective decision-making regarding investment, lending, and overall financial strategy.

How to Create an Accounting Cash Flow Statement Template

Creating a structured template facilitates consistent and accurate cash flow reporting. The following steps outline the process of developing an effective template.

1. Determine the Reporting Period: Specify the timeframe for the statement, whether quarterly or annually. This establishes the boundaries for data inclusion and ensures comparability across periods.

2. Structure the Main Sections: Divide the template into the three core sections: Operating Activities, Investing Activities, and Financing Activities. This categorization provides a standardized framework for organizing cash inflows and outflows.

3. Define Line Items Within Each Section: Within each section, specify relevant line items to capture key cash flows. For Operating Activities, this might include net income, depreciation, and changes in working capital. Investing Activities would include capital expenditures and asset sales, while Financing Activities would encompass debt issuance, equity transactions, and dividend payments.

4. Incorporate Formulas for Calculations: Include formulas to automate calculations, such as net cash flow from each activity and the overall net change in cash. This ensures accuracy and consistency in reporting.

5. Include Beginning and Ending Cash Balances: Capture the cash balance at the start and end of the reporting period. This provides context for understanding the net change in cash during the period.

6. Add a Section for Non-Cash Transactions: Include a dedicated area to disclose significant non-cash transactions, providing a comprehensive view of financial activities.

7. Design for Clarity and Readability: Use clear labels, consistent formatting, and a logical flow to enhance the template’s usability and ensure ease of interpretation.

8. Test and Refine: Apply the template to a sample period to ensure its functionality and accuracy. Refine the structure and line items as needed based on practical application and specific reporting requirements.

A well-designed template ensures consistent reporting, facilitates analysis, and enhances understanding of a company’s financial dynamics. Utilizing a standardized structure promotes comparability and supports informed decision-making based on accurate and readily available cash flow information.

An accounting cash flow statement template provides a crucial framework for understanding the financial dynamics of any organization. Through its structured presentation of operating, investing, and financing activities, the template facilitates clear analysis of cash inflows and outflows, enabling stakeholders to assess liquidity, solvency, and overall financial health. Standardized formatting and consistent periodicity enhance comparability, allowing for trend analysis and informed decision-making. From evaluating the sustainability of core operations to understanding strategic capital allocation decisions and financing strategies, the template serves as an indispensable tool for interpreting financial performance.

Effective utilization of an accounting cash flow statement template empowers stakeholders to move beyond superficial profit analysis and delve into the true drivers of financial strength and vulnerability. This deeper understanding fosters more effective resource management, informed investment strategies, and ultimately, the pursuit of sustainable financial success. The ability to accurately interpret and leverage the insights provided by a cash flow statement remains essential for navigating the complexities of the modern financial landscape and achieving long-term financial stability and growth.