Utilizing this structured approach offers several advantages. It allows for more informed decision-making based on a clearer understanding of profitability and operational efficiency. Furthermore, it provides a standardized framework for comparing financial performance across different periods and against industry benchmarks. This standardized reporting is also typically required for compliance with generally accepted accounting principles (GAAP).

Understanding the structure and application of this financial reporting tool is fundamental to sound financial analysis and management. The following sections will delve deeper into the key components, practical examples, and best practices for its effective implementation.

1. Revenue Recognition

Accurate revenue recognition is a cornerstone of the accrual basis income statement template. It dictates how and when revenue is recorded, directly impacting the reported financial performance and providing a realistic view of a company’s earnings.

- The Matching PrincipleThis principle ensures revenue is recognized in the same period as the related expenses are incurred. This matching provides a clearer picture of profitability by linking income generated to the costs involved in its generation. For example, a construction company recognizes revenue as a project progresses, aligning it with the labor and material costs incurred during each stage.

- Realization PrincipleRevenue is recognized when it is earned, regardless of when cash is received. This signifies that the seller has substantially completed its obligations to the buyer. Consider a software company selling a perpetual license: revenue is recognized upon delivery and installation of the software, even if payment terms extend over several months.

- Deferred RevenueWhen a customer pays in advance for goods or services yet to be delivered, this payment is recorded as deferred revenue, a liability. As the goods or services are provided, the deferred revenue is recognized as earned revenue. A magazine subscription paid annually upfront illustrates this: revenue is recognized monthly as each issue is delivered, reflecting the fulfillment of the obligation.

- Impact on Financial StatementsAccurate revenue recognition ensures the income statement reflects the true economic activity of the period. Overstating or understating revenue can mislead stakeholders about a company’s financial health and performance, impacting investment decisions and operational strategies. Consistently applying revenue recognition principles is therefore critical for maintaining financial statement integrity within the accrual accounting framework.

By adhering to these principles of revenue recognition, the accrual basis income statement provides a more accurate and reliable representation of a company’s financial performance, facilitating informed analysis and strategic decision-making.

2. Expense Matching

Expense matching forms a crucial component of the accrual basis income statement template. This principle dictates that expenses be recognized in the same period as the revenues they generate. This pairing of costs with associated earnings provides a more accurate representation of profitability than simply recording expenses when cash is disbursed. A fundamental aspect of accrual accounting, expense matching ensures the income statement reflects the true economic relationship between revenue generation and resource consumption.

Consider a manufacturing company purchasing raw materials in December but using them to produce goods sold in January. Under expense matching, the cost of these materials is recognized as an expense in January, aligning with the revenue generated from the sale of the finished goods. This approach provides a clearer picture of the profit generated from that specific production and sales cycle. Another example lies in salaries: employees earn wages throughout a pay period, but the expense is recognized in the period the work is performed, matching the revenue generated through employee efforts during that time. This consistent application of expense matching ensures a more accurate reflection of profitability and operational efficiency.

Failure to adhere to expense matching principles can distort the income statement, potentially misrepresenting a company’s financial performance. Incorrectly associating expenses with different periods can lead to inaccurate profit calculations, impacting investment decisions, operational strategies, and overall financial analysis. Accurately matching expenses to revenues provides stakeholders with reliable data to assess the true profitability of a business. Understanding and applying expense matching is therefore essential for sound financial reporting and analysis using the accrual basis income statement template. This principle reinforces the accuracy and reliability of financial reporting, allowing for more informed decision-making based on a clear understanding of resource utilization and profit generation.

3. Periodicity

Periodicity is a fundamental concept in accounting, inextricably linked to the accrual basis income statement template. It refers to the division of a company’s ongoing business activities into specific time periods for financial reporting purposes. These periods, typically monthly, quarterly, and annually, provide the framework for measuring and reporting financial performance. Without these defined periods, tracking revenue and expenses in a meaningful way using the accrual method would be impossible. Periodicity allows for the consistent application of revenue recognition and expense matching principles, ensuring that financial statements accurately reflect the economic activity within each designated timeframe.

Consider a company with a fiscal year ending December 31st. Periodicity mandates that all revenues earned and expenses incurred between January 1st and December 31st are reported on the income statement for that year. This demarcation ensures comparability across periods, allowing for trend analysis and informed decision-making. For instance, comparing the performance of the first quarter to the same quarter of the previous year provides insights into growth patterns and operational efficiency. Furthermore, periodicity facilitates compliance with regulatory reporting requirements, as financial statements must be submitted at specific intervals. A retail business, for example, can track sales and inventory costs for each month, enabling them to identify seasonal trends and optimize inventory management strategies. This demonstrates the practical application of periodicity within a specific industry context.

The accurate application of periodicity is crucial for the reliability and comparability of financial statements prepared using the accrual basis. Inconsistencies in period definition can lead to distorted financial results, making it difficult to assess performance trends and make informed decisions. Understanding the interplay between periodicity and the accrual basis income statement template is therefore essential for sound financial reporting and analysis. This structure ensures that financial information is presented in a consistent and comparable manner, enabling stakeholders to gain a clear understanding of a company’s performance over time and make well-informed decisions based on reliable data.

4. Standardized Format

The standardized format of an accrual basis income statement template ensures consistency and comparability in financial reporting. This structured presentation allows stakeholders to readily understand and analyze financial performance across different periods and against industry benchmarks. A consistent structure facilitates the identification of trends, the assessment of profitability, and informed decision-making based on reliable data.

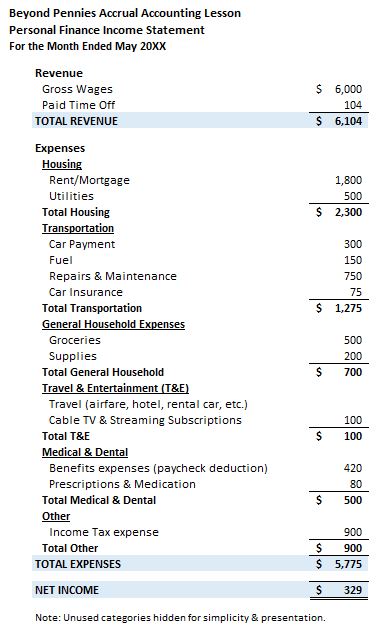

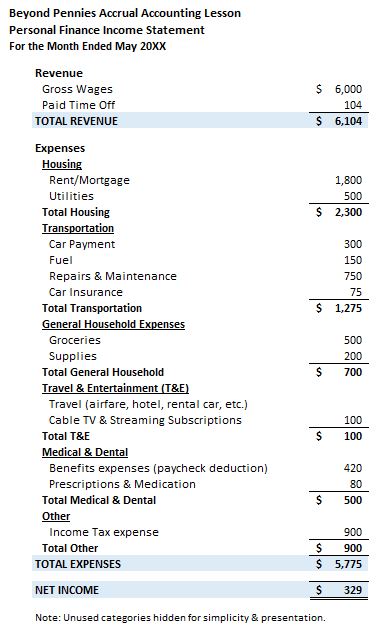

- Key ElementsStandard elements include revenues, cost of goods sold (COGS), gross profit, operating expenses, operating income, other income/expenses, and net income. Each element occupies a specific position within the statement, allowing for easy comparison across different companies and time periods. For example, placing revenue at the top allows for immediate assessment of a company’s top-line performance, while the subsequent COGS deduction reveals gross profitability, a key indicator of operational efficiency.

- Presentation ConsistencyConsistent presentation includes clear labeling of each line item, use of standard terminology (e.g., “Revenue” not “Sales”), and consistent formatting of numerical values. This consistency reduces ambiguity and ensures all stakeholders interpret the information uniformly. Presenting operating expenses as a categorized list, for instance, with consistent formatting for currency values, enhances clarity and comparability. This meticulous approach to detail eliminates potential misinterpretations and promotes informed decision-making.

- Comparability and BenchmarkingThe standardized format allows for meaningful comparisons across different reporting periods and against competitors or industry averages. This comparability enables stakeholders to identify trends, evaluate performance against benchmarks, and make informed decisions about resource allocation and strategic direction. Comparing a company’s profitability margins against industry averages can reveal competitive strengths and weaknesses, guiding strategic adjustments for improved performance.

- Regulatory ComplianceA standardized format is often required for compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). This standardization ensures transparency and allows regulators to effectively monitor and compare financial data across different entities. Adherence to these standards ensures consistency and reliability in financial reporting, contributing to the stability and integrity of financial markets. This rigorous adherence fosters trust among investors and stakeholders, promoting financial stability within the broader market.

The standardized format of the accrual basis income statement template plays a vital role in ensuring transparency, comparability, and effective communication of financial performance. This structure provides a clear and consistent framework for understanding a company’s financial health and making informed decisions based on reliable and comparable data. Consistent application of this standardized format enhances the value and utility of the accrual basis income statement, contributing to informed decision-making and efficient resource allocation.

5. Financial Analysis

Financial analysis relies heavily on the accrual basis income statement template. This statement provides a comprehensive overview of a company’s financial performance over a specific period, enabling analysts to assess profitability, operational efficiency, and overall financial health. The accrual basis, by recognizing revenues when earned and expenses when incurred, offers a more accurate picture of economic activity than cash-basis accounting, making it essential for robust financial analysis.

- Profitability AssessmentThe accrual basis income statement allows for the calculation of key profitability metrics such as gross profit margin, operating profit margin, and net profit margin. These metrics provide insights into a company’s ability to generate profit from its operations. For example, comparing gross profit margins across different product lines can reveal areas of strength and weakness within a company’s product portfolio, informing pricing strategies and resource allocation decisions.

- Operational Efficiency EvaluationAnalyzing operating expenses on the accrual basis income statement helps assess operational efficiency. By examining trends in expenses like selling, general, and administrative (SG&A) expenses, analysts can identify areas for potential cost reduction and improved efficiency. Tracking SG&A expenses as a percentage of revenue over time can reveal whether a company is effectively managing its overhead costs, a key aspect of long-term sustainability.

- Trend AnalysisComparing income statements across multiple periods allows for trend analysis, revealing patterns in revenue growth, expense management, and profitability. This analysis can inform forecasts and strategic planning. Consistent growth in revenue coupled with controlled expenses indicates a healthy financial trajectory, while declining profitability may signal underlying operational issues requiring attention. This analysis of financial trends provides valuable insights for strategic decision-making and future planning.

- Comparison with Industry BenchmarksThe standardized format of the accrual basis income statement allows for comparison with industry benchmarks, providing a context for evaluating a company’s performance relative to its competitors. This comparative analysis can identify areas for improvement and competitive advantages. A company with higher profit margins than its competitors may possess a superior business model or operational efficiency, while lower margins may suggest areas needing improvement to maintain competitiveness.

The accrual basis income statement template forms the cornerstone of effective financial analysis. Its structure, grounded in accrual accounting principles, provides the necessary information for assessing profitability, evaluating operational efficiency, identifying trends, and comparing performance against industry benchmarks. This comprehensive view of a company’s financial performance is essential for informed decision-making, strategic planning, and effective resource allocation. Without this structured data, informed financial analysis would be significantly more challenging, hindering the ability to make sound judgments about a company’s financial health and future prospects.

Key Components of an Accrual Basis Income Statement Template

Understanding the core components of an accrual basis income statement is crucial for accurate financial reporting and analysis. These components provide a structured framework for presenting financial performance based on the accrual accounting method.

1. Revenue: This section reports all income earned during the accounting period, regardless of when cash is received. It includes sales of goods or services, interest income, and other revenue streams. Accuracy in revenue recognition, following established accounting principles, is paramount.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold during the period. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. This metric provides insight into production efficiency and pricing strategies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. These expenses include salaries, rent, marketing, and administrative costs. Categorizing and tracking operating expenses is essential for managing overhead and assessing operational efficiency.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the core business operations. This metric indicates management’s effectiveness in controlling costs and generating profits from the company’s primary activities.

6. Other Income/Expenses: This section captures income and expenses not directly related to core operations, such as interest income, interest expense, gains or losses from asset sales, and other non-operational items. These items, while not central to daily operations, can significantly impact overall profitability.

7. Net Income: Representing the bottom line, net income is calculated by adding or subtracting other income/expenses from operating income. This figure represents the total profit or loss after all revenues and expenses have been accounted for during the specific period. It is a key indicator of a company’s overall financial performance and profitability.

These components, when presented within the standardized format of an accrual basis income statement, offer a comprehensive and accurate portrayal of a company’s financial performance, enabling informed decision-making by stakeholders.

How to Create an Accrual Basis Income Statement

Creating an accrual basis income statement requires a systematic approach to ensure accurate representation of financial performance. The following steps outline the process:

1. Establish the Accounting Period: Define the specific time frame for the income statement, such as a month, quarter, or year. This period sets the boundaries for recognizing revenues and expenses.

2. Record Revenue: Document all revenue earned during the defined period, regardless of when cash is received. Apply appropriate revenue recognition principles to ensure accuracy.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold during the period. This involves tracking raw materials, direct labor, and manufacturing overhead.

4. Calculate Gross Profit: Subtract COGS from Revenue to determine the gross profit, representing profit from core operations before operating expenses.

5. Itemize Operating Expenses: List all expenses incurred in running the business, excluding COGS. Categorize expenses for better analysis and control.

6. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income, reflecting the profitability of core business activities.

7. Account for Other Income/Expenses: Include any non-operational income or expenses, such as interest income or losses from asset sales.

8. Calculate Net Income: Add or subtract other income/expenses from operating income to determine the net income, the bottom-line profit or loss for the period.

Accurate data entry and consistent application of accrual accounting principles are essential for generating a reliable and informative accrual basis income statement. This structured approach ensures that the statement accurately reflects financial performance and provides a solid foundation for analysis and decision-making.

The accrual basis income statement template provides a crucial framework for understanding financial performance. Its structured approach, based on accrual accounting principles, offers a more accurate and comprehensive view of a company’s profitability and operational efficiency than cash-basis methods. From revenue recognition and expense matching to the standardized format and its role in financial analysis, each aspect contributes to a more robust and reliable portrayal of financial health. Understanding and utilizing this template effectively is fundamental for informed decision-making, strategic planning, and compliance with accounting standards. Its consistent application ensures transparency and comparability, allowing stakeholders to gain meaningful insights into a company’s financial activities.

Mastery of this template empowers stakeholders to make informed decisions based on a clear understanding of financial performance. As business environments continue to evolve, the importance of accurate and reliable financial reporting remains paramount. Leveraging the accrual basis income statement template as a core tool for financial analysis will remain critical for navigating complexities, evaluating opportunities, and driving sustainable growth. Its consistent application provides a cornerstone for sound financial management and strategic decision-making, contributing to long-term success.