Utilizing a standardized format offers several advantages. It simplifies reconciliation, minimizes disputes arising from unclear payment information, and streamlines tax reporting processes. This documentation promotes better financial management for all parties involved and contributes to a more efficient and transparent working relationship within the construction project. Accurate and readily available financial records also facilitate effective auditing and ensure adherence to industry best practices.

This article will further explore the key components of such documentation, the legal requirements surrounding its use, and best practices for its implementation and management within a construction business context. Understanding these aspects is crucial for maintaining compliance and fostering positive financial relationships within the construction industry.

1. Standardized Format

Standardized formatting within CIS payment and deduction statements provides crucial benefits for all parties involved in construction projects. A consistent structure ensures clarity and minimizes ambiguity in interpreting payment information. This clarity facilitates efficient processing and reconciliation of payments, reducing administrative overhead and the potential for disputes. Furthermore, a standardized format supports accurate tax reporting and compliance with HMRC regulations. For subcontractors, this clarity enables easier tracking of income and deductions, simplifying their own financial management. For contractors, it streamlines payment processes and promotes better financial record-keeping across multiple projects.

Consider a scenario where a contractor manages numerous subcontractors across several projects. Without a standardized statement format, variations in presentation and terminology can lead to confusion and errors during payment processing. Standardization eliminates this risk, allowing for efficient and accurate payment dispersal. Moreover, standardized statements simplify audits, enabling HMRC to easily verify compliance and reducing the likelihood of investigations. This consistency benefits the entire construction ecosystem, fostering trust and transparency between contractors and subcontractors.

In summary, adopting a standardized format for CIS payment and deduction statements offers significant practical advantages. It streamlines administrative processes, reduces errors, improves compliance, and promotes transparent financial management within the construction industry. This structured approach benefits both contractors and subcontractors, fostering smoother operations and contributing to a more efficient and compliant sector. The long-term benefits of adopting standardized formats contribute to greater stability and professionalism within the industry as a whole.

2. Gross payment details

Accurate gross payment details form the foundation of a compliant and transparent Construction Industry Scheme (CIS) payment and deduction statement. This figure represents the total payment due to a subcontractor before any deductions are made, such as tax withholdings or material costs. Its accurate representation is crucial for several reasons. Firstly, it establishes the baseline for calculating the correct CIS tax deduction, ensuring compliance with HMRC regulations. Inaccurate gross payment figures can lead to incorrect tax calculations, potentially resulting in penalties or disputes. Secondly, clear documentation of the gross payment provides transparency for the subcontractor, enabling them to reconcile payments against invoices and track their income accurately. This transparency fosters trust and facilitates a smoother working relationship between contractors and subcontractors.

Consider a scenario where a contractor mistakenly underreports the gross payment on a CIS statement. This error will result in an under-deduction of CIS tax, leaving the contractor liable for the shortfall. Conversely, overreporting the gross payment could lead to over-deduction of tax, impacting the subcontractor’s cash flow and potentially leading to disputes. Furthermore, accurate gross payment information is essential for accurate project cost accounting. By tracking gross payments across all subcontractors, contractors can effectively monitor project expenditure and maintain budgetary control. This data is crucial for informed decision-making and successful project completion.

In conclusion, the accurate recording of gross payment details within the CIS statement template is fundamental for compliance, transparency, and effective financial management within the construction industry. It ensures correct tax calculation, supports accurate income tracking for subcontractors, and facilitates robust project cost accounting for contractors. Diligence in this area contributes to a more efficient and compliant construction sector, minimizing financial discrepancies and promoting stronger working relationships between all parties involved.

3. Deduction breakdown

A comprehensive deduction breakdown forms a critical component of the CIS payment and deduction statement template, contributing significantly to transparency and compliance within the Construction Industry Scheme. This breakdown details all deductions made from a subcontractor’s gross payment, including CIS tax deductions, material costs, and any other agreed-upon deductions. A clear and itemized breakdown allows subcontractors to understand precisely how their net payment is calculated, reducing the potential for misunderstandings and disputes with contractors. This transparency fosters trust and promotes stronger working relationships within construction projects. Moreover, a detailed deduction breakdown simplifies tax reporting for both contractors and subcontractors, ensuring accurate records are maintained and facilitating compliance with HMRC regulations. Without a clear breakdown, reconciling payments and deductions becomes complex and increases the risk of errors. For example, if a deduction for materials is not clearly documented, it could be misinterpreted as a general deduction, affecting both the subcontractor’s taxable income and the contractor’s tax liability.

Consider a scenario where a subcontractor is supplied with materials directly by the contractor. The cost of these materials must be deducted from the gross payment before calculating the CIS tax deduction. A detailed breakdown within the statement clarifies this deduction, preventing the subcontractor from being taxed on the cost of materials. This precision is essential for ensuring compliance and preventing financial discrepancies. Furthermore, detailed deduction breakdowns facilitate accurate project cost analysis for contractors. By tracking deductions for materials, labor, and other expenses across multiple subcontractors, contractors can gain valuable insights into project expenditure and identify potential cost overruns. This information informs better financial planning and contributes to more efficient project management. Additionally, detailed records simplify year-end reporting and tax reconciliation processes, minimizing administrative burden and reducing the likelihood of audits or investigations.

In summary, a thorough deduction breakdown within the CIS payment and deduction statement template is essential for transparency, compliance, and effective financial management within the construction industry. It provides clarity for subcontractors, simplifies tax reporting, and supports accurate project cost analysis for contractors. This detailed approach fosters trust between parties, reduces the likelihood of disputes, and contributes to a more efficient and compliant construction sector. Ensuring meticulous attention to deduction breakdowns strengthens financial accountability and promotes professionalism within the industry.

4. Material Cost Tracking

Within the context of the Construction Industry Scheme (CIS), material cost tracking plays a vital role in accurate payment and deduction calculations. Properly documenting material costs within the CIS payment and deduction statement template ensures correct tax deductions and facilitates transparent financial management for both contractors and subcontractors. Understanding the nuances of material cost tracking is crucial for compliance and efficient project accounting within the construction industry.

- Accurate Deductions:Accurate material cost tracking ensures that subcontractors are not taxed on expenses incurred for project materials. This requires clear documentation of all material purchases and their allocation to specific projects. When materials are supplied directly by the contractor, the cost must be deducted from the subcontractor’s gross payment before calculating the CIS tax deduction. This prevents over-deduction of tax and ensures the subcontractor receives the correct net payment. For instance, if a subcontractor purchases 1,000 of timber for a project and provides valid invoices, this amount should be deducted, leaving only the labor cost subject to CIS deductions.

- Transparency and Dispute Prevention:Transparent material cost tracking promotes clear communication and minimizes potential disputes between contractors and subcontractors. Itemized records of material costs within the statement provide a verifiable audit trail, allowing both parties to reconcile expenses easily. This transparency fosters trust and contributes to a more positive working relationship. For example, if a dispute arises regarding the cost of materials, clear documentation within the statement serves as a reference point for resolution, avoiding protracted disagreements.

- Project Cost Management:Detailed material cost tracking within the CIS statement template supports effective project cost management for contractors. By meticulously documenting material expenses across all subcontractors and projects, contractors can gain valuable insights into overall project expenditure. This information facilitates budget control, allows for identification of potential cost overruns, and supports informed decision-making throughout the project lifecycle. For instance, tracking material costs across different phases of a project can highlight areas where costs are exceeding budget, enabling timely intervention and cost-saving measures.

- Compliance and Auditing:Accurate material cost tracking is essential for compliance with HMRC regulations and simplifies the auditing process. Detailed records within the CIS statement demonstrate due diligence and facilitate easy verification of deductions. This reduces the likelihood of HMRC investigations and potential penalties. Maintaining organized and readily accessible material cost records strengthens financial accountability and promotes professionalism within the construction industry. Comprehensive documentation provides a solid foundation for demonstrating compliance and minimizing audit risks.

In conclusion, effective material cost tracking is intrinsically linked to the proper utilization of the CIS payment and deduction statement template. Accurate documentation of material costs ensures correct tax calculations, promotes transparency between contractors and subcontractors, supports effective project cost management, and facilitates compliance with HMRC regulations. This meticulous approach to material cost management fosters financial accountability and strengthens the overall integrity of the construction industry.

5. Verification Data

Verification data plays a crucial role in ensuring the legitimacy and accuracy of CIS payment and deduction statement templates. This data serves to authenticate the information presented, mitigating the risk of fraud and ensuring compliance with HMRC regulations. Verification typically includes unique identifiers such as the contractor’s Unique Taxpayer Reference (UTR), the subcontractor’s UTR or National Insurance number, and verification numbers related to the subcontractor’s CIS registration status. Inclusion of this data allows HMRC to cross-reference information, verify the validity of deductions, and confirm that both parties are correctly registered within the CIS. Without accurate verification data, the integrity of the statement is compromised, potentially leading to investigations, penalties, and disputes.

Consider a scenario where a contractor submits a CIS statement with an incorrect subcontractor UTR. This error could lead to the deduction being applied to the wrong subcontractor’s record, affecting their tax liability and potentially triggering an HMRC inquiry. Similarly, if a contractor uses an outdated verification number for a subcontractor’s CIS registration status, the deduction might be incorrectly calculated, leading to financial discrepancies. These examples highlight the practical significance of accurate verification data within the CIS statement. Accurate verification data also facilitates efficient processing of payments and deductions, streamlining administrative processes for both contractors and subcontractors. It enables automated verification checks, reduces the likelihood of manual errors, and minimizes the need for follow-up inquiries regarding payment information.

In conclusion, the inclusion of accurate verification data within the CIS payment and deduction statement template is paramount for ensuring compliance, preventing fraud, and maintaining accurate financial records within the construction industry. This data provides a crucial link between the statement and the official CIS records held by HMRC, enabling efficient validation and reducing the risk of errors or discrepancies. Diligence in verifying and accurately recording this information contributes to a more robust and transparent CIS system, benefiting both contractors and subcontractors. Failure to maintain accurate verification data undermines the integrity of the system and exposes parties to potential financial and legal repercussions.

6. Retention details (if applicable)

Retention, a common practice within the construction industry, involves withholding a portion of the payment due to a subcontractor until the satisfactory completion of a project or phase. When retention applies, the CIS payment and deduction statement template must clearly reflect this. Specifically, the statement should detail the amount retained, the percentage of the total payment this represents, and the anticipated release date of the retained funds. This transparent recording of retention details is crucial for several reasons. Firstly, it provides clarity to the subcontractor regarding the actual payment received versus the total amount earned. This clarity minimizes potential disputes and fosters a more transparent financial relationship between contractors and subcontractors. Secondly, accurate recording of retention within the CIS statement facilitates accurate financial reporting for both parties. Contractors can track outstanding retention liabilities, while subcontractors can account for expected future income. This accurate accounting contributes to more effective financial planning and management.

Consider a project where a contractor retains 5% of a subcontractor’s payment. The CIS statement should clearly show the gross payment, the calculated CIS deduction, the retention amount (5% of the gross payment), and the final net payment disbursed to the subcontractor. Without this detailed breakdown, the subcontractor might be unclear about the reason for the reduced payment. Furthermore, clear documentation of retention details simplifies the reconciliation process when the retained funds are eventually released. Both the contractor and subcontractor can easily refer back to the original CIS statement to confirm the retention amount and ensure accurate payment. This reduces the risk of errors and disagreements during the final payment process.

In summary, incorporating retention details within the CIS payment and deduction statement template, when applicable, is essential for maintaining transparency, facilitating accurate financial reporting, and minimizing potential disputes within construction projects. This detailed approach strengthens financial accountability and contributes to more professional and efficient project management. Omitting or inaccurately recording retention details can lead to misunderstandings, delays in payment releases, and damage to the working relationship between contractors and subcontractors. Therefore, meticulous attention to retention details within the CIS statement is crucial for fostering trust and promoting sound financial practices within the construction industry.

Key Components of a CIS Payment and Deduction Statement Template

Accurate and compliant Construction Industry Scheme (CIS) operation necessitates a thorough understanding of the key components within the payment and deduction statement template. These components ensure transparency, facilitate accurate tax calculations, and promote efficient financial management within construction projects.

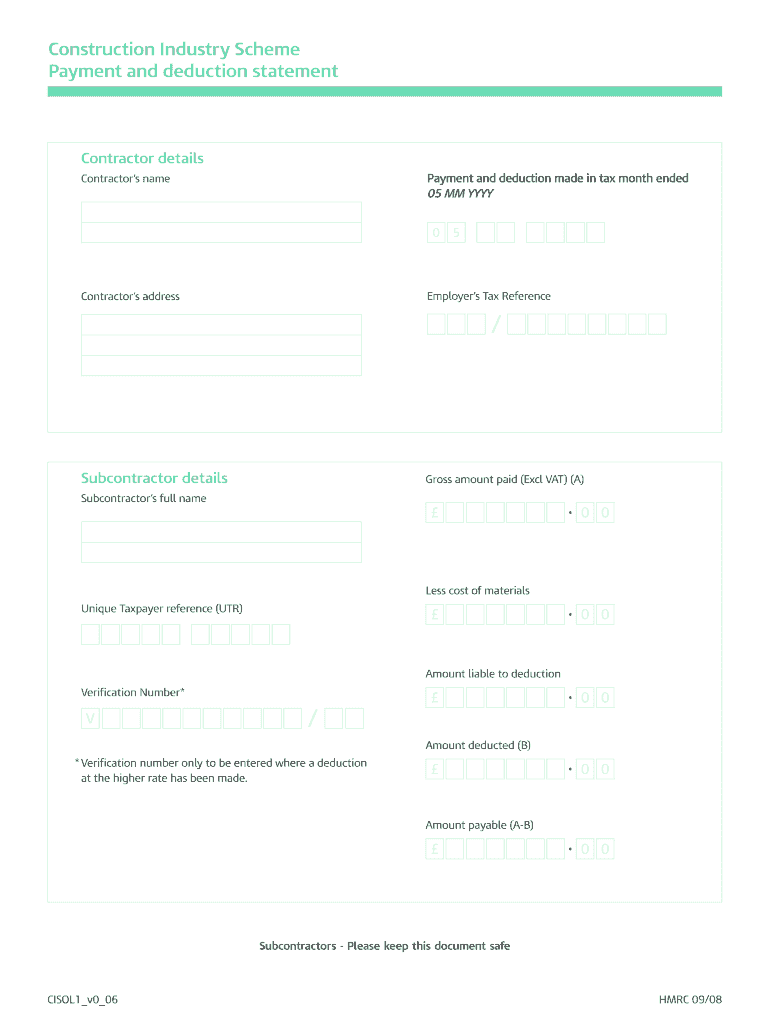

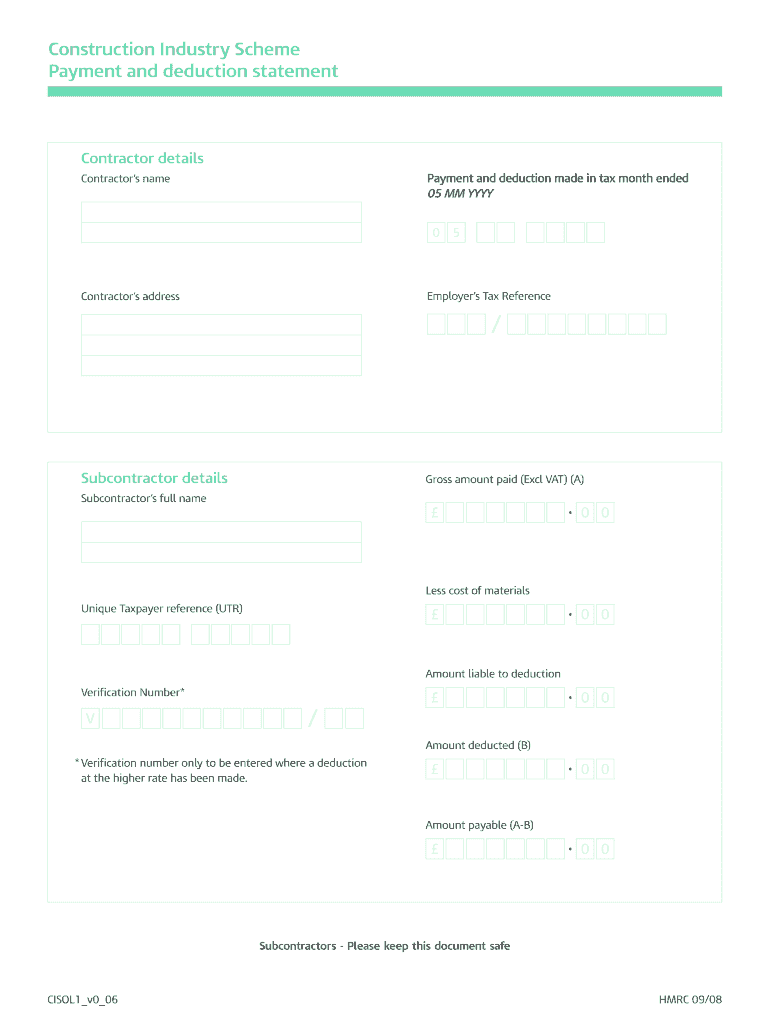

1. Contractor and Subcontractor Details: Accurate identification of both parties involved is paramount. This includes full legal names, addresses, and unique identifiers like Unique Taxpayer References (UTRs) for accurate record-keeping and HMRC reporting. This information facilitates clear communication and ensures payments are correctly attributed.

2. Payment Period: Clearly defining the payment period covered by the statement is essential for proper reconciliation and financial tracking. This allows both contractors and subcontractors to accurately allocate income and expenses to the correct period.

3. Gross Payment Amount: This represents the total amount payable to the subcontractor before any deductions. Accurate representation is crucial for calculating the correct CIS tax deduction and ensuring accurate income reporting.

4. Material Costs: Itemized details of material costs, supported by invoices where applicable, are vital. These costs are deducted from the gross payment before calculating CIS tax, preventing subcontractors from being taxed on material expenses.

5. CIS Deduction: The calculated CIS tax deduction, based on the subcontractor’s verification status and the net payment amount (gross payment less material costs), must be clearly displayed. This ensures compliance with HMRC regulations.

6. Other Deductions: Any other agreed-upon deductions, such as those for previous overpayments or specific contractual agreements, must be itemized separately. Transparency in these deductions minimizes potential disputes.

7. Net Payment: The final amount paid to the subcontractor after all deductions is clearly stated. This represents the actual amount received by the subcontractor and should reconcile with their bank records.

8. Retention (if applicable): If retention applies, the amount withheld, the percentage retained, and the expected release date must be clearly documented. This ensures transparency and facilitates accurate financial planning for both parties.

9. Verification Data: Inclusion of verification information, such as UTRs and CIS verification numbers, ensures the authenticity of the statement and facilitates compliance with HMRC regulations. This data enables cross-referencing and validation of the information provided.

These components, working in concert, establish a transparent and auditable record of payments and deductions within the CIS framework. This structured approach facilitates efficient financial management, minimizes disputes, and promotes compliance within the construction industry. Accurate and comprehensive completion of each component is essential for maintaining sound financial practices and a positive working relationship between contractors and subcontractors.

How to Create a CIS Payment and Deduction Statement Template

Creating a robust and compliant Construction Industry Scheme (CIS) payment and deduction statement template requires careful consideration of key components and adherence to established best practices. A well-structured template ensures clarity, facilitates accurate tax calculations, and promotes efficient financial management within construction projects.

1. Define Essential Fields: Begin by clearly identifying the essential fields required for comprehensive record-keeping. These typically include contractor and subcontractor details (names, addresses, UTRs), payment period, gross payment amount, material costs, CIS deduction, other deductions (if any), net payment, retention details (if applicable), and verification data.

2. Structure for Clarity: Organize the template logically to ensure ease of understanding and use. Group related information together, use clear headings, and adopt a consistent format for dates, currency, and other numerical values. A well-structured template minimizes ambiguity and facilitates efficient processing.

3. Incorporate Calculation Formulas: Implement formulas within the template to automate calculations for CIS deductions, net payments, and retention amounts. Automated calculations reduce the risk of manual errors and ensure consistent application of deduction rules.

4. Material Cost Breakdown: Include a dedicated section for itemizing material costs, allowing for detailed tracking and clear separation from labor costs. This section should allow for descriptions of materials, quantities, unit costs, and total costs.

5. Verification Data Integration: Incorporate fields for essential verification data, such as UTRs and CIS verification numbers. This facilitates validation of information and ensures compliance with HMRC requirements.

6. Retention Mechanism (if applicable): If retention applies, incorporate a section to detail the retention percentage, amount retained, and anticipated release date. This clarity is crucial for both contractors and subcontractors.

7. Software Integration: Explore compatibility with accounting software or payroll systems to streamline data entry and reporting. Integration with existing systems enhances efficiency and minimizes data duplication.

8. Regular Review and Updates: Periodically review and update the template to ensure ongoing compliance with evolving CIS regulations and industry best practices. This proactive approach maintains accuracy and minimizes potential compliance issues.

A well-designed CIS payment and deduction statement template provides a structured framework for managing payments and deductions within the construction industry. This structured approach strengthens financial accountability, promotes transparency, and supports efficient project management. Regular review and updates are essential for maintaining its relevance and ensuring ongoing compliance with industry regulations and best practices.

Accurate and comprehensive utilization of standardized documentation for Construction Industry Scheme (CIS) transactions is critical for maintaining compliance, promoting transparency, and fostering financial stability within the construction sector. Understanding the key components, including gross payment details, deduction breakdowns, material cost tracking, verification data, and retention details, ensures accurate tax calculations, simplifies financial reporting, and minimizes potential disputes between contractors and subcontractors. Adherence to established best practices in creating and implementing these templates ensures efficient payment processing, strengthens financial accountability, and fosters a more professional and transparent operating environment.

Within the evolving landscape of the construction industry, maintaining rigorous financial practices is paramount. The proper utilization of CIS payment and deduction statement templates contributes significantly to this objective. It empowers businesses to operate within a framework of compliance and transparency, fostering trust and stability within the sector. Continued emphasis on accurate and comprehensive completion of these statements reinforces the professionalism and financial integrity of the construction industry as a whole.