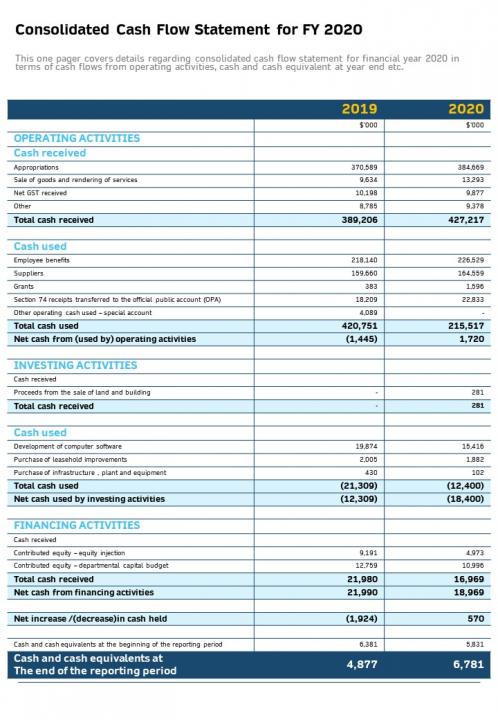

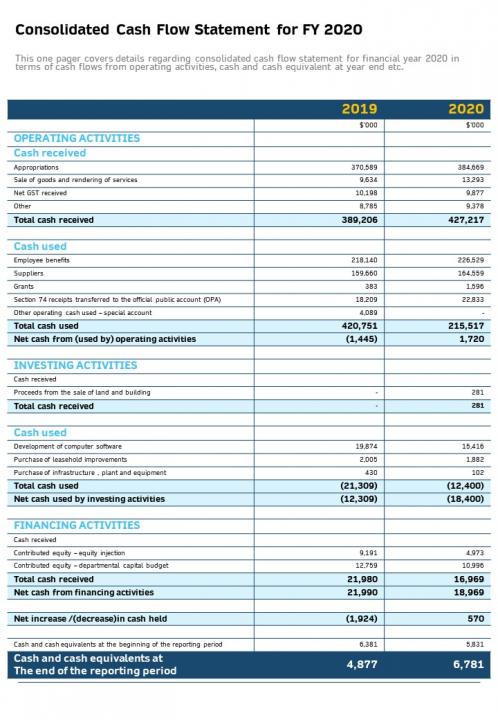

Utilizing such a structure provides several advantages. It enables stakeholders to assess the financial health and liquidity of the consolidated group, informing investment decisions and credit assessments. Furthermore, it allows for effective internal financial management by highlighting cash flow trends across the different business units and facilitating better resource allocation. The ability to compare performance across periods and against industry benchmarks promotes strategic decision-making and enhances operational efficiency.

This foundation of organized financial data is crucial for various analytical processes, including trend analysis, ratio analysis, and forecasting. Understanding these elements lays the groundwork for informed financial decisions and ultimately, contributes to stronger financial outcomes. Further exploration of specific components within this structure and their implications will provide a more nuanced understanding of consolidated financial reporting.

1. Standardized Format

A standardized format is fundamental to the utility of a consolidated cash flow statement template. Consistency in structure and presentation ensures comparability across reporting periods and facilitates efficient analysis by stakeholders. Without standardization, interpreting and extracting meaningful insights from the complex financial data of a consolidated entity becomes significantly more challenging.

- Uniformity of Line ItemsConsistent line items, such as “Cash from Operations” or “Cash from Investing Activities,” ensure that the same types of cash flows are categorized identically across all periods. This allows for straightforward trend analysis and performance evaluation. For instance, consistent reporting of capital expenditures under investing activities enables accurate tracking of investment strategies over time.

- Defined Calculation MethodsStandardized calculation methods for metrics like free cash flow or operating cash flow ensure that reported figures are derived using the same formulas, regardless of the subsidiary or reporting period. This eliminates ambiguity and allows for accurate comparisons. For example, consistently calculating free cash flow as operating cash flow less capital expenditures ensures comparability across the consolidated group.

- Presentation FormatA consistent presentation format, including the structure of the statement and the use of specific terminology, enhances readability and understanding. Whether using the direct or indirect method for presenting operating activities, maintaining consistency within the chosen format is paramount. This allows users to quickly locate and interpret key information.

- Currency and UnitsUsing a consistent currency and units of measurement (e.g., thousands or millions) across all subsidiaries and reporting periods is essential for accurate aggregation and analysis. This avoids the need for complex conversions and ensures that reported figures are directly comparable.

These facets of a standardized format collectively contribute to the reliability and interpretability of a consolidated cash flow statement template. By ensuring consistency and comparability, a standardized format empowers stakeholders to make informed decisions based on a clear and accurate understanding of the consolidated entity’s cash flows.

2. Combined Subsidiaries’ Data

The core purpose of a consolidated cash flow statement template is to present a unified view of the cash flows of a parent company and its subsidiaries. Therefore, the aggregation of data from all subsidiaries is paramount. This combination provides a holistic perspective on the financial health and performance of the entire corporate group, rather than isolated views of individual entities. Without this combined data, the statement fails to reflect the true cash position of the consolidated entity. This aggregation necessitates meticulous data collection and consolidation processes to ensure accuracy and completeness. For instance, a multinational corporation with subsidiaries in various countries must convert each subsidiary’s cash flow data into the reporting currency before consolidation, considering exchange rate fluctuations and local accounting standards.

The importance of combined subsidiaries’ data becomes particularly evident when analyzing cash flows related to intercompany transactions. Eliminating these transactions during the consolidation process prevents double-counting and ensures that only external cash flows are reflected in the consolidated statement. For example, if a parent company loans cash to a subsidiary, this transaction represents an internal transfer of funds within the consolidated group and should be eliminated to avoid overstating both the parent’s investing cash outflow and the subsidiary’s financing cash inflow. Understanding these intercompany flows allows for a more accurate assessment of the group’s overall liquidity and financial performance.

Accurately combining subsidiaries’ data is crucial for informed decision-making by stakeholders. Investors, creditors, and management rely on this consolidated view to assess the overall financial strength and stability of the group. Incomplete or inaccurate consolidation can lead to misinformed decisions, potentially impacting investment strategies, credit ratings, and overall financial management. The complexity of combining data from numerous subsidiaries, often operating in diverse environments, underscores the need for robust financial systems and processes. Overcoming these challenges ensures the reliability and integrity of the consolidated cash flow statement, providing a solid foundation for sound financial analysis and decision-making.

3. Categorized Cash Flows

Categorization of cash flows within a consolidated cash flow statement template is essential for providing a clear and comprehensive understanding of a corporate group’s financial activities. This structured presentation separates cash flows into three core categories: operating activities, investing activities, and financing activities. This segregation allows stakeholders to analyze the sources and uses of cash within each distinct area, providing insights into the underlying drivers of financial performance. Without this categorization, the interwoven nature of cash flows across a complex corporate structure would obscure meaningful analysis of financial health and trends. For example, separating cash generated from core business operations (operating activities) from cash used for acquiring new assets (investing activities) allows for a more nuanced understanding of the group’s ability to generate cash sustainably and invest for future growth.

The categorization of cash flows facilitates a more granular analysis of financial performance. Evaluating the cash flows generated from operating activities reveals the profitability and efficiency of the core business operations. Examining cash flows related to investing activities provides insights into the group’s capital allocation strategies and long-term growth prospects. Analyzing cash flows from financing activities illuminates the group’s capital structure and debt management practices. For instance, a significant increase in cash flow from financing activities through debt issuance might indicate an expansion strategy financed by borrowing, while a substantial cash outflow for debt repayment suggests a focus on deleveraging. This detailed understanding allows for more informed decision-making regarding resource allocation, investment strategies, and financial risk management.

Effective categorization of cash flows forms a cornerstone of a well-structured consolidated cash flow statement template, offering critical insights into the financial dynamics of a corporate group. This organized presentation clarifies the complex interplay of cash flows, facilitating informed decision-making by stakeholders. Challenges can arise in consistently classifying cash flows across diverse subsidiaries and complex transactions, necessitating clear guidelines and robust accounting practices. However, the benefits of enhanced transparency and analytical depth derived from categorized cash flows significantly contribute to a more comprehensive understanding of the consolidated entity’s financial position and performance.

4. Specified Reporting Period

A defined reporting period is fundamental to the structure and utility of a consolidated cash flow statement template. This specified timeframe, whether a quarter, a year, or any other designated period, provides the boundaries for capturing and presenting the combined cash inflows and outflows of the parent company and its subsidiaries. Without a clearly delineated period, the information presented lacks context and comparability. The specified reporting period establishes the timeframe for assessing performance, analyzing trends, and making informed financial decisions. For instance, a company analyzing quarterly cash flow statements can identify seasonal fluctuations in sales and adjust inventory management accordingly, while annual statements provide a broader perspective on long-term financial health.

The choice of reporting period influences the insights derived from the statement. Short-term periods, like quarters, allow for more frequent monitoring and quicker identification of emerging trends or potential issues. This granularity is crucial for tactical decision-making and operational adjustments. Longer-term periods, such as annual or multi-year periods, offer a broader perspective on the financial health and sustainability of the consolidated entity. This longer view is essential for strategic planning, long-term investment decisions, and evaluating overall financial performance. For example, comparing annual cash flow statements over several years can reveal long-term trends in capital expenditures, debt repayment, and dividend payments, providing insights into the long-term financial strategy of the consolidated group.

A well-defined reporting period is essential for comparing performance across different periods and against industry benchmarks. This comparability facilitates informed decision-making by management, investors, and creditors. Consistency in the reporting period is crucial for meaningful trend analysis and performance evaluation. Changes in the reporting period can distort comparisons and complicate the interpretation of financial data. Furthermore, the specified period must align with relevant regulatory requirements and reporting standards. Understanding the implications of the chosen reporting period enhances the analytical value of the consolidated cash flow statement, contributing to a more comprehensive assessment of the financial performance and position of the consolidated entity.

5. Comparative Analysis Enabled

A key benefit of a consolidated cash flow statement template lies in its ability to facilitate comparative analysis. The standardized structure, combined data from subsidiaries, and consistent reporting periods inherent in the template create a foundation for meaningful comparisons across different time periods and against industry benchmarks. This comparative capacity is crucial for identifying trends, evaluating performance, and making informed decisions regarding resource allocation, investment strategies, and overall financial management. For instance, comparing cash flow from operations over consecutive quarters can reveal seasonal patterns or underlying operational issues, while comparing capital expenditures over several years can provide insights into long-term investment strategies.

Comparative analysis using the template can highlight significant changes in cash flows across different categories. A substantial increase in cash flow from financing activities, coupled with a decrease in cash flow from operations, might indicate a shift towards debt-financed growth. Similarly, consistent growth in free cash flow over time suggests strong financial health and potential for increased shareholder returns. Benchmarking against industry peers reveals competitive positioning and identifies areas for improvement. For example, a company with consistently lower operating cash flow margins compared to its competitors might need to re-evaluate its pricing strategies or cost management practices.

Effective comparative analysis hinges on the accuracy and consistency of the data within the consolidated cash flow statement template. Challenges can arise from variations in accounting practices across subsidiaries, currency fluctuations in multinational corporations, and the complexity of consolidating data from diverse business units. Overcoming these challenges through standardized procedures and robust financial systems enhances the reliability and comparability of the data, strengthening the foundation for informed financial analysis and strategic decision-making. The insights derived from this comparative analysis contribute significantly to a deeper understanding of the consolidated entity’s financial performance, its position within the industry, and its long-term sustainability.

6. Enhanced Decision-Making

A consolidated cash flow statement template plays a crucial role in enhancing decision-making processes within a corporate group. By providing a comprehensive and structured overview of the combined cash flows of the parent company and its subsidiaries, the template empowers stakeholders with the information necessary for informed financial decisions. This structured presentation facilitates analysis, comparison, and interpretation of cash flow data, leading to more effective resource allocation, investment strategies, and overall financial management.

- Strategic Investment DecisionsAnalysis of cash flows from investing activities provides insights into capital allocation strategies and supports decisions regarding mergers and acquisitions, capital expenditures, and divestitures. For instance, a consistently positive free cash flow can indicate the financial capacity for strategic acquisitions, while a declining trend might necessitate prioritizing organic growth initiatives over external investments. Understanding the long-term implications of investment decisions requires a clear picture of cash flow generation and usage, which the template provides.

- Operational Efficiency ImprovementsEvaluating cash flows from operating activities reveals the efficiency of core business operations and informs decisions related to cost management, pricing strategies, and working capital optimization. For example, a declining cash conversion cycle, reflected in the statement, can indicate improved efficiency in managing inventory and receivables, while consistent negative cash flow from operations might signal underlying operational inefficiencies requiring immediate attention. The template thus facilitates data-driven decisions to enhance operational performance.

- Funding and Financing StrategiesAnalysis of cash flows from financing activities informs decisions related to debt management, equity financing, and dividend policies. For instance, a consistent reliance on debt financing, evidenced by high cash inflows from debt issuance, might signal a need to re-evaluate the capital structure and explore alternative funding sources. The template provides the necessary data to make informed decisions about balancing debt and equity, managing debt maturity profiles, and determining appropriate dividend payout ratios.

- Performance Evaluation and BenchmarkingThe standardized format of the template enables comparisons of cash flow performance across different reporting periods and against industry benchmarks. This facilitates the identification of trends, evaluation of the effectiveness of existing strategies, and development of data-driven performance improvement initiatives. For example, comparing key cash flow metrics like free cash flow margin or cash return on assets against industry averages can reveal a company’s relative financial strength and identify areas for potential improvement. The template thus supports performance evaluation and strategic planning based on objective data analysis.

The enhanced decision-making facilitated by a consolidated cash flow statement template contributes significantly to improved financial outcomes. By providing a structured and comprehensive view of cash flows, the template empowers stakeholders to make informed decisions across various aspects of financial management, from strategic investments and operational efficiency to funding strategies and performance evaluation. This data-driven approach enhances transparency, reduces financial risks, and ultimately contributes to the long-term financial health and sustainability of the consolidated entity.

Key Components of a Consolidated Cash Flow Statement Template

A well-structured template ensures consistent and comprehensive reporting of cash flows. Key components facilitate clear articulation of a consolidated entity’s financial activities.

1. Operating Activities: This section details cash flows generated from the core business operations of the parent company and its subsidiaries. It includes cash received from customers, cash paid to suppliers, and other cash flows related to the production and delivery of goods or services. Accurately representing these core operational cash flows is crucial for assessing the profitability and sustainability of the consolidated entity.

2. Investing Activities: This section reports cash flows related to the acquisition and disposal of long-term assets, including property, plant, and equipment (PP&E), investments in other companies, and other non-current assets. Analyzing these cash flows provides insights into the consolidated entity’s investment strategies and its commitment to long-term growth.

3. Financing Activities: This section details cash flows related to changes in the capital structure of the consolidated entity. It includes proceeds from issuing debt or equity, repayments of debt, and payments of dividends to shareholders. Understanding these cash flows is critical for assessing the financial health and long-term sustainability of the consolidated entity’s financing strategies.

4. Intercompany Transactions Elimination: A crucial aspect of consolidation is the elimination of cash flows between the parent company and its subsidiaries. This ensures that only transactions with external parties are reflected in the consolidated statement, preventing double-counting and providing a true picture of the group’s cash flows.

5. Currency Conversion: For multinational corporations, converting the cash flows of subsidiaries operating in different currencies into the reporting currency is essential. This ensures consistency and allows for meaningful aggregation of cash flow data across the consolidated group.

6. Non-Cash Transactions Disclosure: While the primary focus is on cash flows, disclosing significant non-cash transactions provides additional context and enhances transparency. These disclosures might include the acquisition of assets through debt assumption or the exchange of non-cash assets.

7. Comparative Figures: Including comparative figures from prior periods enhances the analytical value of the statement. This allows for trend analysis, identification of significant changes, and a more comprehensive assessment of financial performance over time.

These components, working in concert, provide a structured framework for understanding the complex financial activities of a consolidated entity. The template’s organization facilitates a clear and concise presentation, allowing stakeholders to assess financial performance, evaluate trends, and make data-driven decisions.

How to Create a Consolidated Cash Flow Statement Template

Developing a robust template requires careful consideration of key structural elements and data requirements. A well-designed template ensures consistent reporting, facilitates analysis, and supports informed decision-making.

1: Define Reporting Period and Currency: Specify the timeframe (e.g., quarterly, annually) and the reporting currency for the consolidated cash flow statement. Consistent application of these parameters across all subsidiaries is essential for accurate consolidation and comparability.

2: Establish Standardized Format: Implement a uniform structure for presenting cash flows from operating, investing, and financing activities. Consistent line items and calculation methods ensure comparability across periods and facilitate analysis. Choose either the direct or indirect method for presenting operating activities and apply it consistently.

3: Gather Subsidiaries’ Financial Data: Collect cash flow data from all subsidiaries, ensuring accuracy and completeness. This data should align with the defined reporting period and currency. Implement robust data validation procedures to minimize errors and ensure data integrity.

4: Eliminate Intercompany Transactions: Identify and eliminate all cash flows between the parent company and its subsidiaries. This prevents double-counting and ensures that the consolidated statement reflects only transactions with external parties.

5: Convert Currency (if applicable): For multinational corporations, convert each subsidiary’s cash flow data into the reporting currency using appropriate exchange rates. Maintain consistent currency conversion methods across all subsidiaries.

6: Categorize Cash Flows: Classify each cash flow into its respective category: operating, investing, or financing activities. Adhere to established accounting standards for consistent categorization.

7: Incorporate Comparative Figures: Include comparative figures from prior periods to facilitate trend analysis and performance evaluation. This historical context enhances the analytical value of the statement.

8: Disclose Non-Cash Transactions: Include a separate section or footnotes to disclose significant non-cash transactions, such as acquisitions through debt assumption or exchanges of non-cash assets. This enhances transparency and provides a more complete picture of the consolidated entity’s financial activities.

A robust template, incorporating these elements, provides a structured and transparent view of a consolidated entity’s cash flows, facilitating informed financial analysis and strategic decision-making.

A consolidated cash flow statement template provides a crucial framework for understanding the financial dynamics of a complex corporate structure. Its standardized format, encompassing categorized cash flows from operating, investing, and financing activities across all subsidiaries within a specific reporting period, enables comprehensive analysis and informed decision-making. Elimination of intercompany transactions and consistent currency conversion ensure the accuracy and comparability of the consolidated data, allowing stakeholders to assess the overall financial health and performance of the entire corporate group. This structured approach to cash flow reporting facilitates trend analysis, performance evaluation against benchmarks, and the development of effective financial strategies.

Effective utilization of a consolidated cash flow statement template is essential for navigating the complexities of modern financial reporting. Its ability to provide a clear, consolidated view of cash flows empowers stakeholders to make data-driven decisions, optimize resource allocation, and enhance long-term financial sustainability. As business environments continue to evolve, the importance of this structured approach to financial analysis will only continue to grow, solidifying its role as a cornerstone of sound financial management.