Utilizing such a structured approach offers several key advantages. It allows for immediate identification of potential cash shortages or surpluses, enabling timely intervention. This proactive financial management can prevent missed payments, optimize investment opportunities, and facilitate more accurate forecasting. Furthermore, consistent monitoring helps identify spending patterns and areas for potential cost savings, contributing to greater financial efficiency.

This understanding of daily financial tracking lays the groundwork for exploring key aspects such as the specific components, various formats available, and how to effectively implement such a system for optimal financial management.

1. Date

Accurate date recording is fundamental to a daily cash flow statement template. The date establishes the precise timing of each transaction, creating a chronological record of cash inflows and outflows. This chronological order allows for analysis of daily, weekly, and monthly trends. Without accurate dates, identifying patterns and anomalies within cash flow becomes significantly more challenging. For instance, attributing a large expense to the correct accounting period relies heavily on accurate date entry. Pinpointing the date of a significant sale helps correlate revenue with specific marketing campaigns or seasonal trends.

The “Date” field facilitates comparisons across periods. By analyzing cash flow data from the same date in prior weeks or months, businesses can identify recurring patterns, seasonal fluctuations, or unexpected deviations. This historical context informs forecasting and budgeting processes, contributing to more accurate financial projections. For example, comparing sales revenue on the first Monday of each month can reveal growth trends or highlight potential issues if revenue falls below expectations. Similarly, tracking expense patterns by date can reveal recurring operational costs or uncover irregular spending.

Precise date tracking within a daily cash flow statement template is crucial for accurate financial reporting, informed decision-making, and effective financial management. Challenges in date recording, such as incorrect entries or missing data, can lead to skewed analyses and hinder the ability to accurately assess financial performance. Consistent and accurate date entry ensures the integrity of financial records and supports sound financial planning.

2. Description

Within a daily cash flow statement template, the “Description” field provides crucial context for each recorded transaction. A concise yet informative description clarifies the nature of the cash inflow or outflow. This descriptive detail transforms raw financial data into meaningful information, enabling effective analysis and informed decision-making. For instance, an entry labeled “Invoice #1234 – Client A” offers significantly more insight than simply “Payment Received.” This level of detail facilitates tracking specific payments, identifying clients contributing to revenue streams, and reconciling transactions with invoices. Similarly, an outflow described as “Office Supplies – Printer Ink” provides greater clarity than “Office Expense,” allowing for analysis of specific expense categories and identification of potential cost-saving opportunities.

Detailed descriptions facilitate categorization and analysis of cash flow data. By consistently applying specific descriptions (e.g., “Marketing Expenses – Online Advertising,” “Sales Revenue – Product X”), users can easily filter and analyze cash flow based on specific categories. This granular view enables tracking of spending patterns, identification of top revenue sources, and more effective budget management. Without descriptive details, analyzing spending patterns or identifying key revenue drivers becomes significantly more challenging. Imagine trying to understand monthly marketing spend without distinguishing between online advertising, print materials, or event sponsorshipsdetailed descriptions provide this crucial level of granularity. Moreover, detailed descriptions provide an audit trail for financial records. If discrepancies arise, clear descriptions allow for easier tracing of transactions and reconciliation of records.

The “Description” field, therefore, plays a pivotal role in maximizing the value of a daily cash flow statement template. Clear, concise, and consistent descriptions transform raw data into actionable insights, enabling effective financial monitoring, informed decision-making, and accurate financial reporting. Challenges in maintaining descriptive consistency or omitting crucial details can hinder analysis and limit the utility of the cash flow statement. Prioritizing detailed descriptions enhances transparency and supports sound financial management practices.

3. Inflows

Within a daily cash flow statement template, “Inflows” represent all sources of incoming cash for a business during a given day. Accurate recording of inflows is crucial for understanding the business’s liquidity and short-term financial health. These entries capture revenue generated from various sources, providing a comprehensive view of incoming funds. This comprehensive view is essential for effective cash flow management, enabling informed decisions regarding expenses, investments, and overall financial strategy. For instance, cash inflows might stem from sales revenue (both cash and credit card sales), loan proceeds, investments maturing, or interest earned. Accurately capturing these diverse sources ensures a realistic picture of the business’s daily financial position.

The “Inflows” section directly impacts the calculated daily closing balance. As cash inflows increase, the closing balance rises, signifying improved liquidity. Conversely, lower inflows can lead to a tighter cash position, potentially hindering the business’s ability to meet immediate financial obligations. Understanding this direct relationship between inflows and the closing balance is crucial for proactive cash management. For example, consistently low inflows might signal underlying issues with sales performance or revenue collection processes, prompting investigation and corrective action. Strong inflows, on the other hand, could create opportunities for strategic investments or debt reduction. A furniture retailer might experience higher inflows during a weekend sale, offering a chance to reinvest profits in inventory or marketing initiatives for the following week.

Accurate and detailed recording of inflows within a daily cash flow statement template is fundamental for sound financial management. Challenges in tracking inflows, such as incomplete records or misclassification of income, can distort the overall financial picture and lead to inaccurate decision-making. Consistent and meticulous tracking, on the other hand, provides valuable insights into revenue streams, facilitates accurate cash flow projections, and empowers businesses to make informed financial decisions. This detailed tracking enables businesses to identify trends, anticipate potential cash shortages, and optimize financial strategies for sustainable growth and stability. It lays the foundation for proactive rather than reactive financial management, allowing businesses to navigate short-term financial challenges and capitalize on opportunities for growth.

4. Outflows

Within a daily cash flow statement template, “Outflows” represent all expenditures made by a business during a given day. Accurate tracking of outflows is essential for understanding profitability and maintaining healthy financial operations. These entries encompass all expenses, providing a comprehensive view of where money is being spent. This comprehensive perspective enables effective cost management and facilitates informed decisions regarding resource allocation. Outflows can include various expenses such as salary payments, rent, utilities, inventory purchases, marketing costs, loan repayments, and equipment purchases. A restaurant, for example, might record outflows for food supplies, staff wages, rent, and utility bills. Capturing these diverse expenditures accurately is crucial for assessing the business’s daily financial performance.

The “Outflows” section directly impacts the calculated daily closing balance. Increased outflows reduce the closing balance, potentially leading to cash shortages if inflows are insufficient. Conversely, lower outflows contribute to a stronger cash position, providing greater financial flexibility. Understanding this inverse relationship between outflows and the closing balance is paramount for effective financial planning and control. For example, consistently high outflows coupled with stagnant or declining inflows might indicate unsustainable spending patterns, necessitating a review of operational expenses and cost-cutting measures. A retail store experiencing declining sales might need to reduce inventory purchases or marketing expenses to maintain a healthy cash balance. Conversely, a period of low outflows could present an opportunity to invest in growth initiatives or build a cash reserve.

Accurate and detailed recording of outflows within a daily cash flow statement template is critical for sound financial management. Challenges in tracking outflows, such as missed expenses or inaccurate categorization, can lead to an inaccurate understanding of profitability and hinder effective financial planning. Consistent and meticulous tracking, on the other hand, allows businesses to identify areas of high spending, optimize resource allocation, and maintain a healthy financial position. This detailed tracking enables proactive cost management, facilitates accurate cash flow projections, and empowers businesses to make informed decisions about expenses and investments. It allows for informed decisions regarding pricing strategies, expansion plans, and overall financial stability, laying the groundwork for long-term financial health and sustainability.

5. Balance

Within a daily cash flow statement template, the “Balance” represents the net cash position at the end of each day. It is calculated by adding the day’s total inflows to the previous day’s closing balance and then subtracting the day’s total outflows. This figure provides a real-time snapshot of a business’s available cash, a crucial indicator of short-term financial health and solvency. Understanding the daily balance is essential for making informed decisions regarding payments, investments, and other financial activities. A positive balance indicates sufficient cash on hand to meet immediate obligations, while a negative balance signifies a potential shortfall, requiring immediate attention to avoid overdrafts or missed payments. For instance, a retailer with a positive balance can confidently reorder inventory or invest in marketing campaigns, while a negative balance might necessitate delaying payments or seeking short-term financing.

The daily balance serves as a critical control mechanism within cash flow management. Consistent tracking allows businesses to identify trends, anticipate potential cash shortages or surpluses, and take proactive measures to maintain a healthy financial position. Monitoring the balance helps prevent overspending, facilitates informed borrowing decisions, and enables optimization of cash reserves. For example, a consistent upward trend in the daily balance indicates improving financial performance, potentially creating opportunities for expansion or investment. Conversely, a declining balance might signal underlying financial challenges, prompting a review of expenses and revenue generation strategies. A manufacturing company experiencing a consistent decline in its daily balance might need to analyze production costs, optimize inventory levels, or explore new sales channels to improve cash flow.

Accurate calculation and interpretation of the daily balance are essential for effective financial management. Challenges in maintaining accurate records, such as incorrect data entry or omission of transactions, can lead to a distorted view of the business’s cash position and hinder informed decision-making. Consistent and meticulous tracking of inflows and outflows, coupled with accurate balance calculations, ensures a reliable picture of daily cash flow, empowering businesses to proactively manage their finances and maintain a healthy financial standing. This, in turn, supports informed strategic planning, efficient resource allocation, and sustainable long-term growth.

Key Components of a Daily Cash Flow Statement Template

Effective cash flow management hinges on a well-structured template capturing essential financial data. The following components ensure a template’s utility and provide a comprehensive view of daily financial activity.

1. Date: Precise date recording establishes a chronological record of transactions, enabling analysis of trends and comparison across periods. Accurate dates are crucial for attributing income and expenses to the correct accounting periods and identifying recurring patterns or anomalies.

2. Description: Concise yet informative descriptions provide context for each transaction, clarifying the nature of cash inflows and outflows. Detailed descriptions facilitate categorization, analysis, and reconciliation of financial records, enhancing transparency and supporting informed decision-making.

3. Inflows: This section captures all sources of incoming cash, including sales revenue, loan proceeds, investments, and interest earned. Accurate recording of inflows is crucial for understanding liquidity and short-term financial health. This data directly impacts the daily closing balance and informs decisions regarding expenses and investments.

4. Outflows: This section encompasses all expenditures, including salaries, rent, utilities, inventory purchases, and loan repayments. Accurate tracking of outflows is essential for understanding profitability and managing operational costs. This information directly impacts the daily closing balance and informs resource allocation decisions.

5. Balance: Calculated by adding daily inflows to the previous day’s closing balance and subtracting daily outflows, this figure represents the net cash position at the end of each day. Monitoring the daily balance is critical for identifying trends, anticipating potential cash shortages or surpluses, and making informed decisions regarding payments and investments.

These core elements provide a structured framework for tracking and analyzing daily financial activity, enabling proactive cash management, informed decision-making, and accurate financial reporting. A template incorporating these components empowers businesses to maintain a clear understanding of their financial position and make sound financial decisions.

How to Create a Daily Cash Flow Statement Template

Creating a daily cash flow statement template involves structuring a system for tracking daily inflows and outflows. A well-designed template provides a clear and organized view of daily financial activity, enabling informed decision-making.

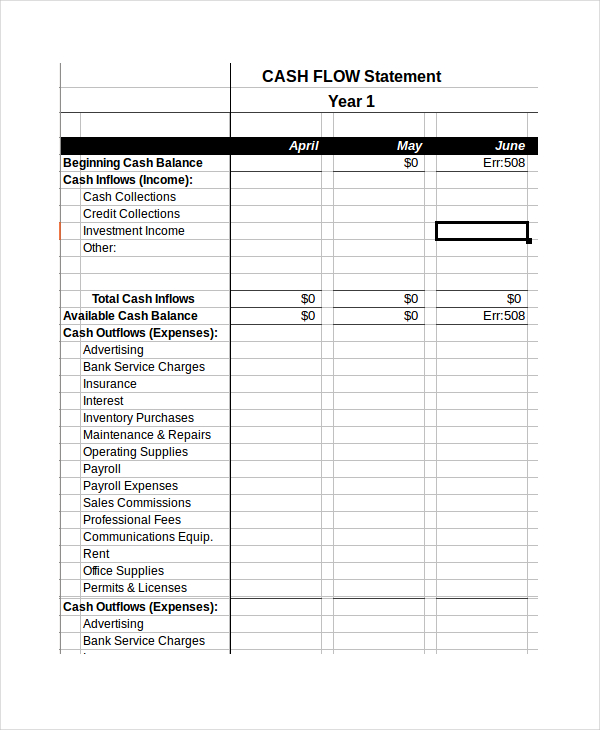

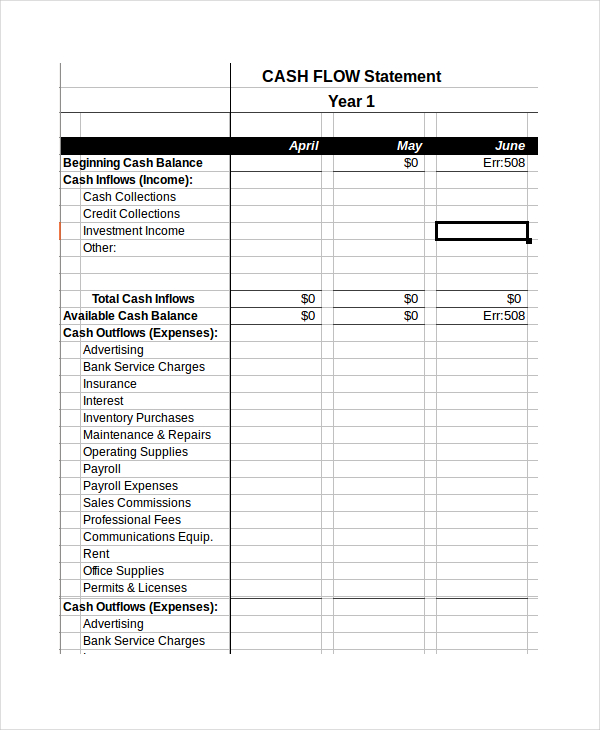

1. Choose a Format: Select a format suitable for the business’s needs. Options include spreadsheet software, dedicated accounting software, or even a simple paper ledger. The chosen format should facilitate easy data entry, calculations, and analysis.

2. Establish Columns: Create columns for “Date,” “Description,” “Inflows,” “Outflows,” and “Balance.” These core elements provide a structured framework for recording each transaction and calculating the daily closing balance.

3. Input Beginning Balance: Begin each day by entering the previous day’s closing balance. This ensures accurate calculation of the current day’s ending balance and provides a continuous view of cash flow.

4. Record Daily Transactions: Throughout the day, meticulously record each inflow and outflow. Provide concise yet informative descriptions for each transaction, including relevant details such as invoice numbers or client names. Ensure accurate entry of amounts in the appropriate inflow or outflow column.

5. Calculate Daily Balance: At the end of each day, calculate the closing balance by adding the total inflows to the beginning balance and subtracting the total outflows. This figure represents the net cash position at the end of the day.

6. Review and Analyze: Regularly review the daily cash flow statement to identify trends, potential cash shortages or surpluses, and areas for improvement. This analysis informs financial decisions, supports proactive cash management, and contributes to overall financial stability.

7. Maintain Consistency: Consistent and disciplined use of the template is crucial for accurate tracking and analysis. Establish a routine for recording transactions and calculating the daily balance to ensure data integrity and reliability.

A well-maintained daily cash flow statement offers a real-time view of a business’s financial health, enabling informed decisions regarding expenses, investments, and overall financial strategy. Consistent tracking, accurate data entry, and regular review contribute to effective cash management and support long-term financial stability.

A daily cash flow statement template provides a crucial tool for managing short-term finances. Its structured approach, encompassing date, description, inflows, outflows, and the resulting daily balance, offers a real-time snapshot of an organization’s financial health. This granular view enables proactive identification of potential cash shortages or surpluses, facilitating timely interventions and informed financial decisions. Consistent use, coupled with accurate data entry and regular review, empowers businesses to optimize resource allocation, control expenses, and make strategic investments. Understanding the core components and implementing a well-designed template are fundamental for sound financial management.

Effective cash flow management is not merely a reactive exercise but a proactive strategy for long-term financial stability and growth. Leveraging a daily cash flow statement template empowers organizations to navigate short-term financial complexities, optimize available resources, and make informed decisions that drive sustainable success. This commitment to diligent financial tracking fosters a foundation for informed strategic planning and positions businesses for continued growth and resilience in the face of economic fluctuations.