Regular generation of these summaries offers several advantages. Businesses gain the ability to track profitability in real time, facilitating proactive adjustments to strategies and operations. This frequent monitoring also allows for rapid identification of cost overruns, inefficiencies, and revenue shortfalls. Furthermore, these reports can serve as valuable data points for forecasting future performance and making informed business decisions.

Understanding the components and benefits of such a reporting mechanism lays the groundwork for exploring its practical application and effective utilization within various business contexts. Subsequent sections will delve into the creation, interpretation, and strategic use of this essential financial tool.

1. Revenue Streams

A comprehensive understanding of revenue streams is fundamental to the effective utilization of a daily profit and loss statement template. Revenue streams represent the various channels through which a business generates income. Accurately categorizing and recording these streams within the template allows for granular analysis of sales performance. For example, a restaurant might categorize revenue streams as dine-in, takeout, and catering. This detailed breakdown enables identification of the most and least profitable areas, informing resource allocation and strategic adjustments. Disaggregating revenue data provides insights beyond top-line figures, revealing potential weaknesses or opportunities for growth within specific segments.

The relationship between revenue streams and the daily profit and loss statement template is one of cause and effect. Fluctuations in individual revenue streams directly impact overall profitability, reflected in the daily bottom line. Identifying the sources of these fluctuations is crucial for effective management. For instance, a decline in online sales for an e-commerce business, identified through a daily profit and loss statement, could prompt an immediate investigation into website functionality, marketing campaign effectiveness, or competitor activity. This rapid response capability is facilitated by the detailed revenue stream data captured within the template.

Effective revenue stream analysis, facilitated by a well-structured daily profit and loss statement template, is essential for data-driven decision-making. Understanding the nuances of revenue generation empowers businesses to optimize pricing strategies, target marketing efforts, and allocate resources effectively. Furthermore, accurate revenue data within the daily report provides a critical foundation for forecasting, budgeting, and long-term strategic planning. By analyzing trends and patterns within individual revenue streams, businesses can anticipate potential challenges and proactively adapt to changing market conditions. This proactive approach, informed by detailed revenue data, contributes significantly to sustained profitability and long-term success.

2. Direct Costs

Direct costs, intrinsically linked to production, represent expenses directly attributable to creating goods or services. Within a daily profit and loss statement template, accurate direct cost accounting is crucial for determining gross profit and understanding profitability dynamics. A clear delineation of these costs allows businesses to assess the efficiency of production processes and identify potential areas for cost optimization. For instance, a bakery’s direct costs would include ingredients like flour and sugar, as well as the labor costs of bakers directly involved in production. Tracking these costs daily allows for immediate identification of variances, such as increased ingredient prices or unexpected labor overruns.

Cause and effect relationships between direct costs and overall profitability are readily apparent within a daily profit and loss statement. Increases in direct costs, without corresponding adjustments to pricing or sales volume, directly reduce profit margins. Conversely, reductions in direct costs, achieved through process improvements or strategic sourcing, contribute to enhanced profitability. Consider a manufacturing company implementing a new production method that reduces material waste. This efficiency gain, reflected in lower direct costs on the daily statement, translates to a higher profit margin. This real-time feedback loop enables businesses to make proactive adjustments and optimize resource allocation.

Accurately capturing and analyzing direct costs within a daily profit and loss statement template is essential for informed decision-making. Understanding these costs facilitates effective pricing strategies, product development decisions, and cost control measures. Furthermore, detailed direct cost analysis allows businesses to assess the viability of new product lines or expansion plans. By monitoring direct costs daily, businesses can quickly identify and address inefficiencies, ensuring sustainable profitability and competitiveness in the long term. This granular insight fosters a proactive management approach, promoting financial stability and informed strategic planning.

3. Operating Expenses

Operating expenses, distinct from direct production costs, represent the costs incurred in running a business. These expenses are essential for daily operations but do not directly contribute to creating a product or service. Within a daily profit and loss statement template, meticulous tracking of operating expenses is critical for understanding overall profitability and operational efficiency. Categorizing and monitoring expenses such as rent, utilities, marketing, and administrative salaries provides insights into cost structures and potential areas for optimization. For example, a retail store’s operating expenses would include rent for the store space, electricity costs, marketing campaign expenses, and salaries for administrative staff. Daily tracking allows for immediate identification of unusual spikes in utility costs or the effectiveness of marketing spend.

The relationship between operating expenses and profitability, as reflected in a daily profit and loss statement, is significant. Uncontrolled operating expenses can quickly erode profit margins, even with healthy sales revenue. Conversely, effectively managing and optimizing operating expenses directly contributes to increased profitability. Consider a software company transitioning to a cloud-based infrastructure. This shift could reduce operating expenses related to server maintenance and IT support, directly impacting the bottom line as reflected on the daily profit and loss statement. This rapid feedback mechanism enables informed decisions about resource allocation and cost control strategies.

Accurate accounting for operating expenses within a daily profit and loss statement template provides essential data for informed financial management. Understanding these expenses allows businesses to identify areas for cost reduction, optimize operational efficiency, and make data-driven decisions regarding resource allocation. Analyzing trends in operating expenses within the daily report also facilitates accurate budgeting and forecasting, promoting financial stability. Furthermore, this granular insight allows for proactive adjustments to business strategies, ensuring long-term sustainability and competitiveness. By monitoring and analyzing operating expenses daily, businesses can maintain a healthy financial position and adapt to changing market conditions effectively.

4. Profit/Loss Calculation

Profit/loss calculation, the core output of a daily profit and loss statement template, represents the net financial outcome of a business’s operations over a 24-hour period. This calculation, derived from the difference between total revenues and total expenses (both direct and operating), provides a crucial indicator of daily financial performance. Accurate and timely profit/loss calculations are essential for understanding the effectiveness of business strategies, operational efficiency, and overall financial health. For example, a positive profit indicates that revenues exceeded expenses for the day, while a negative result (a loss) signifies that expenses outweighed revenues. This daily insight allows businesses to immediately assess their financial position and identify potential issues.

The cause-and-effect relationship between individual components of the template and the final profit/loss calculation is direct and significant. Fluctuations in revenue streams, changes in direct costs, and variations in operating expenses all directly impact the bottom line. Understanding these interconnected dynamics allows businesses to pinpoint the drivers of profitability or loss. For instance, a sudden increase in raw material costs (direct cost) could lead to a reduced profit or even a loss for the day, even if sales revenue remains consistent. This immediate visibility empowers businesses to take corrective actions, such as adjusting pricing strategies or exploring alternative suppliers. Conversely, a successful marketing campaign leading to increased sales could positively impact the profit/loss calculation, demonstrating the effectiveness of specific business initiatives.

Effective profit/loss calculation, facilitated by a well-structured daily profit and loss statement template, is paramount for informed financial management. This daily metric provides actionable insights into business performance, enabling timely adjustments to operations, pricing, and resource allocation. Furthermore, consistent tracking of daily profit/loss figures allows businesses to identify trends, anticipate potential challenges, and develop data-driven strategies for long-term financial success. Regular review of these calculations contributes significantly to proactive financial management, facilitating sustainable growth and informed decision-making.

5. Actionable Insights

Actionable insights derived from a daily profit and loss statement template represent the transformative power of data-driven decision-making. This report, while providing a snapshot of daily financial performance, becomes truly valuable when its data points are translated into strategic actions. The following facets illustrate the connection between data and action.

- Cost Control MeasuresIdentifying expense overruns through daily reports enables immediate cost control measures. For instance, unusually high energy consumption, highlighted by the statement, might prompt an investigation into equipment efficiency or operational practices. This immediate awareness allows for prompt corrective action, minimizing financial impact.

- Sales Strategy AdjustmentsAnalyzing daily sales data, broken down by product or service, can inform targeted sales strategies. If a particular product line consistently underperforms, the data can prompt adjustments in pricing, marketing, or even product discontinuation. This data-driven approach ensures that resources are focused on profitable avenues.

- Operational Efficiency ImprovementsDaily tracking of labor costs against productivity metrics can reveal operational inefficiencies. For example, high labor costs coupled with low output might indicate a need for process improvements, staff training, or resource reallocation. Addressing these inefficiencies, identified through daily data, directly contributes to profitability.

- Real-time Performance MonitoringThe daily profit and loss statement provides a real-time pulse on business performance. Tracking key performance indicators (KPIs) daily, such as gross profit margin or customer acquisition cost, allows for continuous monitoring and immediate response to deviations from targets. This real-time feedback loop enables proactive adjustments and prevents minor issues from escalating into major problems.

These actionable insights, derived from a daily profit and loss statement template, represent the practical application of financial data. By consistently analyzing and acting upon these insights, businesses gain a competitive edge, optimize resource allocation, and promote sustainable financial growth. The daily nature of the report allows for proactive management, enabling businesses to adapt quickly to changing market conditions and maximize profitability.

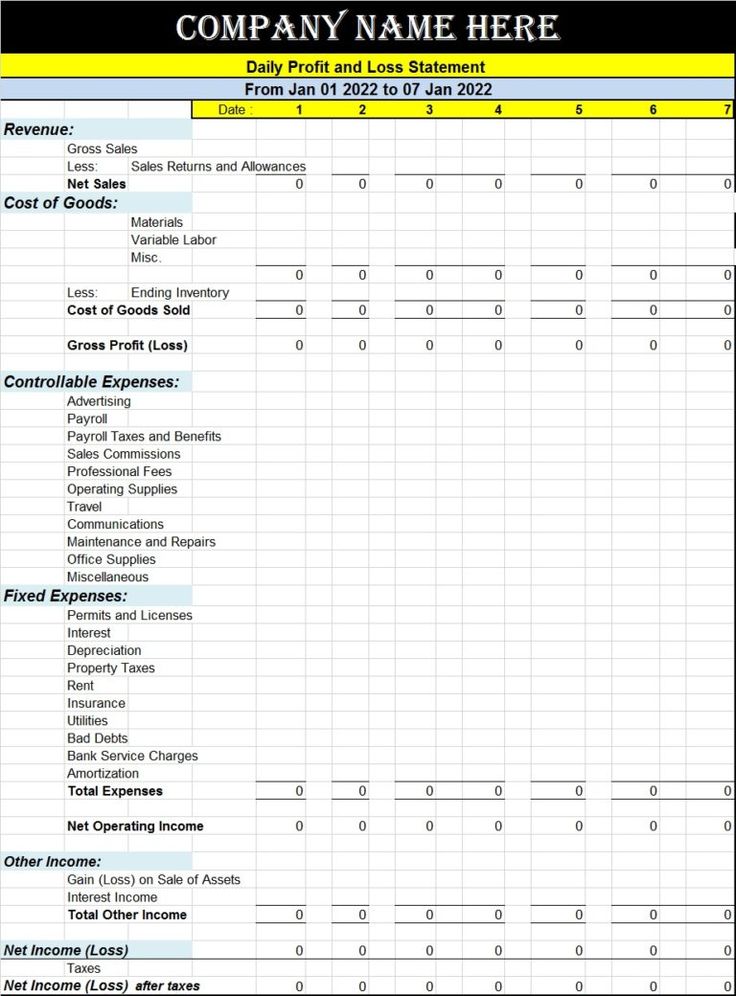

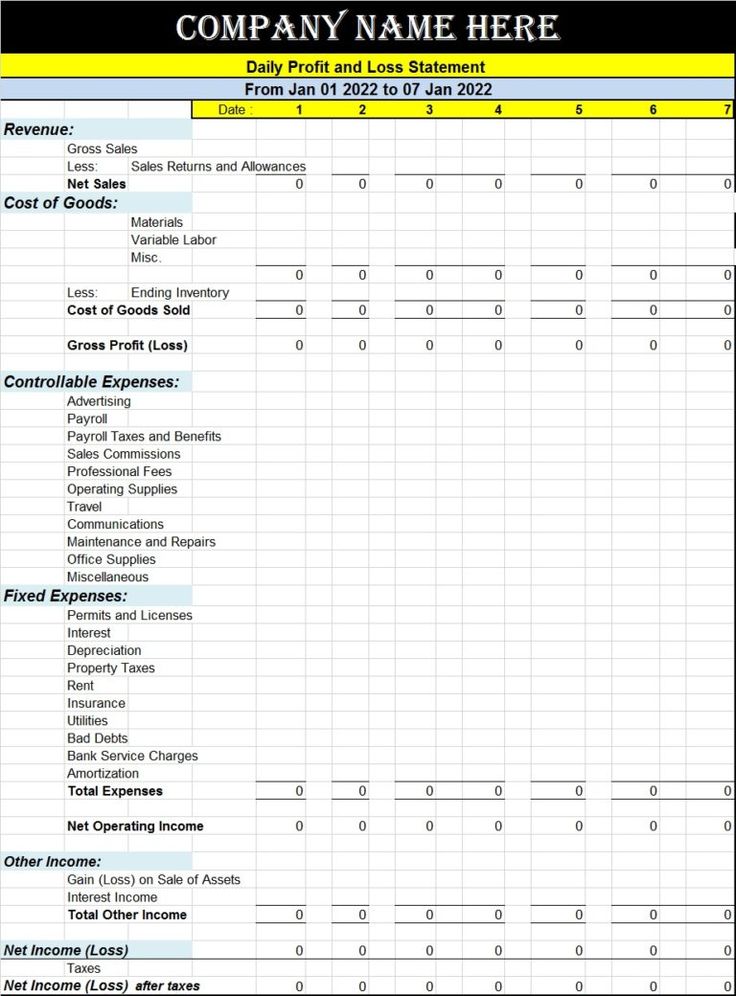

Key Components of a Daily Profit and Loss Statement Template

A well-structured daily profit and loss statement template provides a concise overview of a business’s financial performance over a 24-hour period. Its efficacy relies on the inclusion of key components, each contributing crucial data points for informed decision-making.

1. Revenue: This section details all income generated within the 24-hour period. It should include a breakdown of revenue streams, such as sales by product category, service type, or location. Precise revenue figures are fundamental for assessing overall performance.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profitability of core business operations before accounting for operating expenses. This metric provides insights into pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include rent, utilities, marketing expenses, salaries, and administrative costs. Detailed tracking of operating expenses is crucial for identifying areas for cost optimization.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the business after accounting for all operating costs. This metric provides a clear picture of operational efficiency.

6. Other Income/Expenses: This section captures any non-operational income or expenses, such as interest income, investment gains, or losses. While not directly related to core operations, these items contribute to the overall financial picture.

7. Net Profit/Loss: This is the bottom line, representing the final profit or loss for the day. Calculated as Operating Income plus/minus Other Income/Expenses, this figure provides a definitive measure of daily financial performance.

8. Date and Time Period: Clearly indicating the specific 24-hour period covered by the statement is crucial for accurate record-keeping and analysis. This allows for day-to-day comparisons and trend identification.

These components, working in concert, provide a comprehensive overview of daily financial performance. This granular level of detail enables businesses to monitor trends, identify potential issues, and make informed decisions to optimize profitability and ensure long-term financial health.

How to Create a Daily Profit and Loss Statement Template

Creating a daily profit and loss statement template involves structuring a document to capture essential financial data for a 24-hour period. A well-designed template facilitates accurate tracking, analysis, and informed decision-making.

1. Define Reporting Period: Clearly specify the start and end times for the 24-hour period covered by the statement. Consistent reporting periods ensure comparability and trend analysis.

2. Categorize Revenue Streams: Establish distinct categories for all revenue sources. This allows for granular analysis of sales performance by product, service, or location.

3. Itemize Direct Costs: List all direct costs associated with producing goods or services. Include raw materials, direct labor, and manufacturing overhead. Ensure accurate allocation to specific products or services.

4. Categorize Operating Expenses: Create categories for all operating expenses, including rent, utilities, marketing, salaries, and administrative costs. Detailed categorization facilitates cost control and optimization.

5. Establish Calculation Formulas: Define formulas for calculating key metrics, such as gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net profit/loss (Operating Income +/- Other Income/Expenses). Accurate formulas ensure reliable results.

6. Design Template Layout: Structure the template in a clear and logical format. Use tables or spreadsheets to organize data effectively. Ensure all key components are included and clearly labeled.

7. Implement Data Entry Procedures: Establish procedures for consistent and accurate data entry. Define responsibilities and timelines for data collection and input. Regular data entry ensures timely reporting and analysis.

8. Review and Refine: Regularly review the template and its effectiveness. Refine categories, formulas, or layout as needed to ensure the template continues to meet evolving business needs and provides actionable insights.

A well-structured template, incorporating these elements, provides a framework for capturing and analyzing daily financial performance. Consistent use of this template enables informed decision-making, contributing to operational efficiency, cost control, and ultimately, sustainable profitability.

Effective financial management hinges on timely and accurate data. A daily profit and loss statement template provides a structured framework for capturing, analyzing, and interpreting critical financial information. Understanding revenue streams, managing direct and operating costs, and calculating profit/loss figures are crucial for informed decision-making. Regular use of this template empowers businesses to identify trends, pinpoint inefficiencies, and make proactive adjustments to operations, pricing, and resource allocation.

In the dynamic landscape of modern business, the ability to adapt quickly to changing conditions is paramount. A daily profit and loss statement template equips businesses with the real-time insights necessary for navigating challenges and capitalizing on opportunities. Consistent application of this tool contributes significantly to operational efficiency, informed strategic planning, and ultimately, sustainable financial success. It represents a commitment to data-driven decision-making, fostering a proactive management approach essential for long-term growth and stability.