Navigating the world of insurance can sometimes feel like deciphering a complex puzzle, especially when it comes to understanding all the forms and requirements. One document that often prompts questions is the Evidence of Insurability, or EOI. Whether you’re an individual looking to increase your coverage or an HR professional managing employee benefits, understanding this crucial form is key. It’s essentially your way of demonstrating to an insurer that you meet their health and risk criteria for certain coverage levels.

This article will delve into what an Evidence of Insurability form entails, why it’s requested, and how a well-crafted evidence of insurability form template can streamline the process for everyone involved. We’ll explore the common scenarios where you might encounter this form and outline the essential components that make up a comprehensive and effective EOI document.

What Exactly is Evidence of Insurability and Why Do You Need It?

Evidence of Insurability, often abbreviated as EOI, is a health questionnaire and authorization form that an insurance company uses to assess an applicant’s health and lifestyle risks before issuing or increasing certain types of coverage. Think of it as a detailed health check-up on paper, providing the insurer with the necessary information to determine if you qualify for the requested amount of coverage at a specific premium rate. It’s a vital step for insurers to manage their risk exposures, ensuring that the premiums collected are commensurate with the potential payouts.

While many standard insurance policies, especially basic group life insurance, are issued without extensive health inquiries, there are specific situations where an EOI becomes mandatory. This is particularly true when an individual wants to obtain coverage amounts that exceed certain guaranteed issue limits, or when applying outside of initial enrollment periods. The insurer needs to ensure that they are not taking on undue risk without proper evaluation, preventing adverse selection where only those with higher health risks seek significant coverage increases.

The purpose of this form is multifaceted. For the insurance company, it’s about underwriting – the process of evaluating the risk of insuring a person or asset. They review your medical history, current health status, and sometimes lifestyle habits to determine if you meet their eligibility requirements and what your premium should be. For you, the applicant, it’s about providing a transparent picture of your health to secure the coverage you desire.

Key Scenarios Requiring Evidence of Insurability

A typical evidence of insurability form template will be requested in several common scenarios. Understanding these can help you anticipate when you might need to complete one:

- **Increasing Group Life Insurance Coverage:** If an employee wants to elect group life insurance coverage above the guaranteed issue amount offered by their employer.

- **Late Enrollment in Group Plans:** If an employee misses their initial enrollment period for a group benefit and wants to join later.

- **Applying for Certain Individual Policies:** For some individual life insurance or disability income policies, especially those with high coverage amounts.

- **Reinstating a Lapsed Policy:** If a policy has lapsed due to non-payment and the policyholder wishes to reinstate it.

- **Porting or Converting Group Coverage:** When leaving an employer and wanting to continue group coverage individually, which might require EOI depending on the carrier and specific plan.

Completing an EOI accurately and promptly is crucial. Delays or incomplete information can hinder the approval of your requested coverage, potentially leaving you or your beneficiaries without the financial protection you intended.

Crafting Your Own Evidence of Insurability Form Template

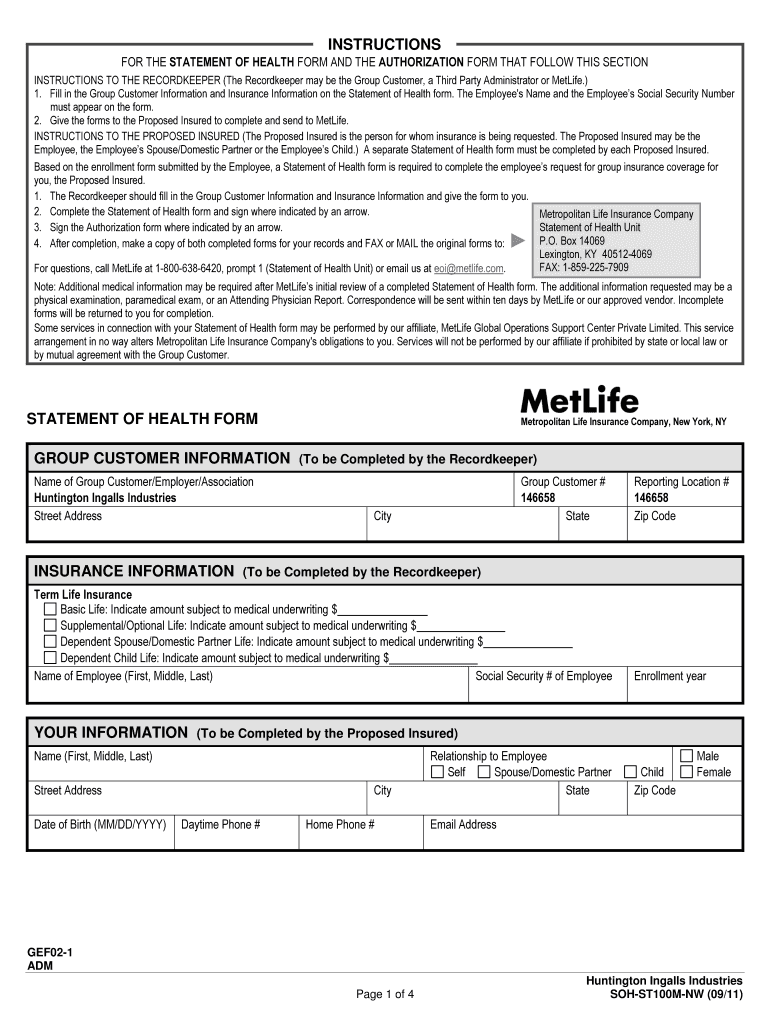

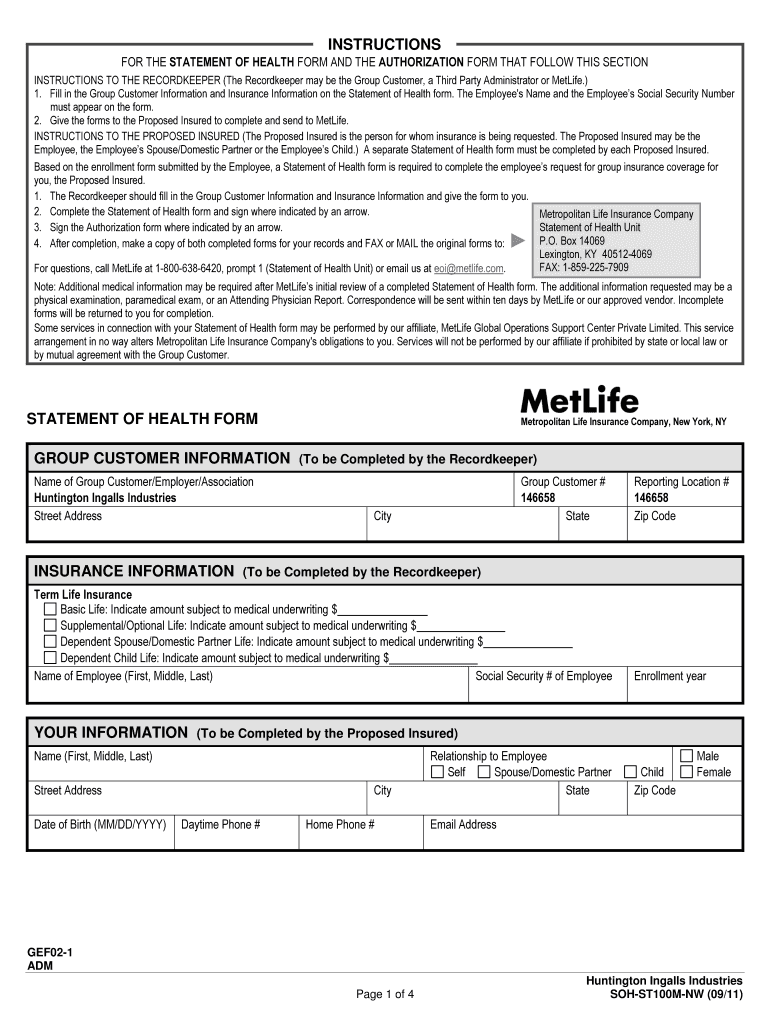

Developing a comprehensive evidence of insurability form template is essential for both insurance providers and HR departments. A well-designed template ensures that all necessary information is collected efficiently, minimizing back-and-forth communication and accelerating the underwriting process. It serves as a standardized tool, guiding applicants through the required disclosures and ensuring consistency in data collection across all submissions. This standardization not only saves time but also reduces the likelihood of errors and omissions that could delay approval.

The core of any effective EOI template lies in its ability to gather pertinent health and lifestyle information without being overly intrusive or confusing. It should strike a balance between obtaining enough detail for accurate risk assessment and maintaining a user-friendly experience. Typically, the form will begin with basic demographic information, but quickly transition into more specific health-related inquiries, often spanning several sections dedicated to different aspects of an applicant’s well-being.

The information requested in an evidence of insurability form template can vary slightly depending on the insurer and the type of coverage, but generally includes a thorough medical history, questions about current health conditions, medications, and treatments, as well as inquiries into lifestyle factors. This might involve questions about tobacco or alcohol use, hazardous hobbies, and even travel to certain regions. Providing honest and complete answers is paramount, as discrepancies can lead to future claims being denied.

When designing or choosing an evidence of insurability form template, consider including the following key sections to ensure a holistic assessment:

- **Applicant Information:** Full name, date of birth, address, contact details, Social Security Number.

- **Coverage Details:** Type of coverage being applied for (e.g., life insurance, disability), requested amount, effective date.

- **Medical History Questions:** Detailed inquiries about past and present health conditions, surgeries, hospitalizations, chronic illnesses (e.g., diabetes, heart disease, cancer).

- **Medication and Treatment Information:** List of all current medications, dosages, and conditions they treat.

- **Lifestyle Questions:** Questions regarding tobacco use, alcohol consumption, illicit drug use, hazardous occupations or hobbies, and recent travel.

- **Family Medical History:** Inquiries about immediate family members’ significant medical conditions.

- **Physician Information:** Names and contact details of all doctors seen in recent years for medical treatment.

- **Authorization and Declaration:** Crucial section where the applicant authorizes the insurer to obtain medical records and declares that all information provided is true and accurate to the best of their knowledge. This section also typically includes the applicant’s signature and date.

Having a robust template can significantly improve the efficiency of processing applications and ensuring that individuals receive the appropriate coverage they seek. Always ensure your template complies with relevant privacy regulations like HIPAA and any specific state or federal insurance laws.

Understanding the purpose and components of an Evidence of Insurability form is crucial for anyone seeking to extend or acquire specific insurance coverage. These forms serve as a critical bridge between your health status and the insurer’s willingness to provide coverage, ensuring a fair assessment of risk for all parties involved. By accurately completing these documents, individuals help facilitate a smoother underwriting process, enabling them to secure the financial protection they need.

Ultimately, whether you are completing one as an applicant or managing them as an administrator, recognizing the importance of an Evidence of Insurability form in the broader insurance landscape empowers you to navigate coverage decisions with greater clarity and confidence. It’s a fundamental step toward building a secure financial future for yourself and your loved ones.