Navigating the aftermath of a loved one’s passing is an incredibly difficult time, filled with grief and a myriad of practical responsibilities. If you’ve been named the executor of an estate, you’re stepping into a crucial role that involves managing the deceased’s affairs, paying off debts, and distributing assets according to their will. It’s a significant undertaking, and understanding where to begin can feel overwhelming, especially when faced with legal paperwork and processes that seem complex.

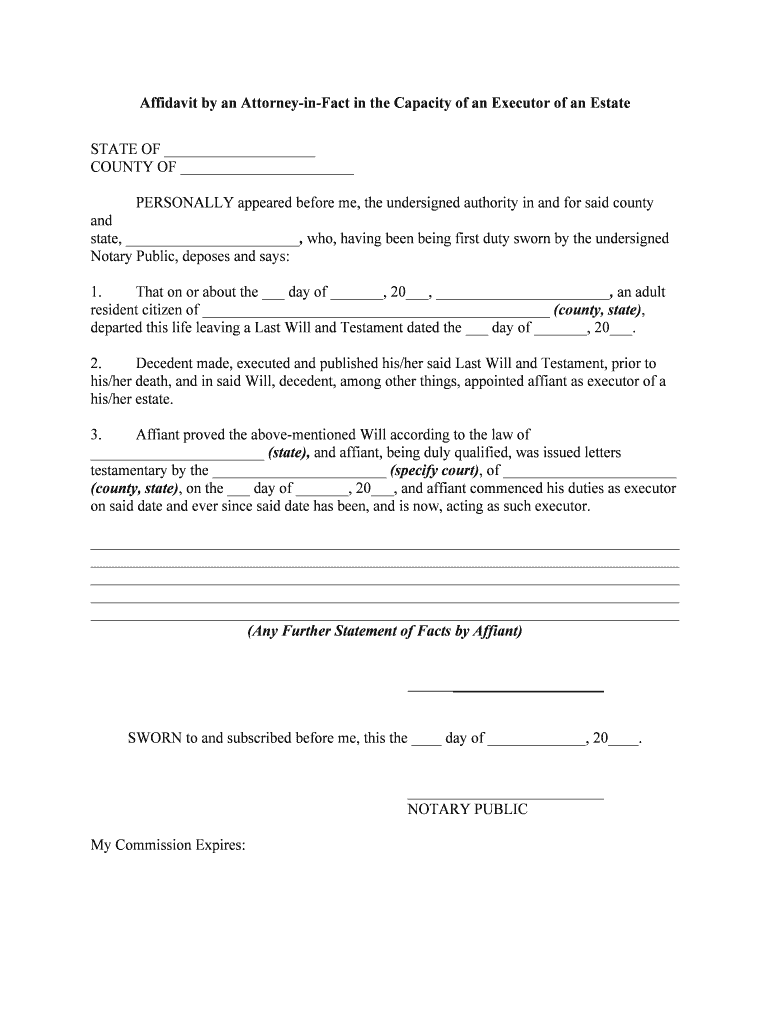

Fortunately, you don’t have to tackle this journey entirely alone. Many resources exist to help streamline the process, and one of the most practical tools you can utilize is an executor of estate form template. These templates are designed to guide you through the necessary steps, ensuring you cover all your bases and fulfill your duties efficiently. They act as a roadmap, helping you organize the estate’s finances, communicate with beneficiaries, and meet legal deadlines, ultimately providing peace of mind during a challenging period.

Understanding the Executor’s Role and Essential Documentation

The role of an executor is multifaceted and carries significant legal responsibility. You are essentially stepping into the shoes of the deceased to finalize their financial and legal life. This involves a range of duties, from locating the will and identifying assets to settling debts and distributing inheritances. It’s not just about managing money; it’s about honoring the wishes of the deceased and ensuring a smooth transition for their beneficiaries.

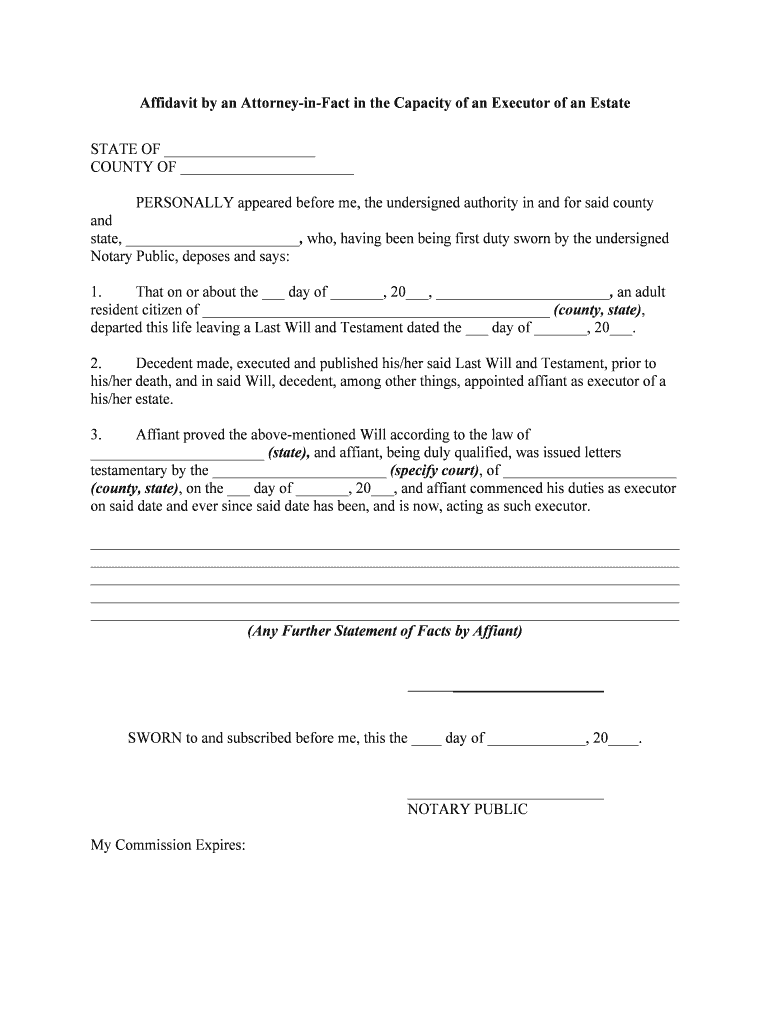

Before you can begin distributing assets, there’s a specific legal process, often called probate, that needs to be followed. This process legally validates the will and confirms your authority as executor. Throughout probate, you’ll need to gather a substantial amount of information, contact various parties, and file numerous documents with the court. This is where the sheer volume of paperwork can become daunting.

Key Responsibilities of an Executor

- **Locating and Securing Assets:** This includes everything from bank accounts and real estate to personal belongings and digital assets.

- **Notifying Beneficiaries and Heirs:** Informing all relevant parties about the estate and their potential inheritance.

- **Paying Debts and Taxes:** Identifying creditors, settling outstanding bills, and filing final income and estate taxes.

- **Managing Estate Finances:** Setting up an estate bank account and keeping meticulous records of all transactions.

- **Distributing Assets:** Ensuring that remaining assets are distributed to the rightful beneficiaries according to the will or state law.

- **Communicating with the Probate Court:** Filing necessary petitions, inventories, and final accountings.

Each of these responsibilities requires specific forms and precise documentation. For instance, you’ll need forms to petition the court to be officially appointed as executor, forms to inventory all assets, and forms to notify creditors. Without a structured approach, it’s easy to overlook a crucial step or miss a deadline, which could lead to complications and delays in the probate process. This is precisely why having a reliable framework, like an executor of estate form template, can be invaluable.

Finding and Effectively Using an Executor of Estate Form Template

When you’re faced with the complex task of administering an estate, a well-structured executor of estate form template can be an absolute lifesaver. These templates are designed to simplify what often feels like an intricate puzzle, guiding you through each necessary step, from the initial notification of beneficiaries to the final distribution of assets. They provide a clear outline, helping you keep track of all the details and ensuring you don’t miss any critical elements of the process. It’s like having a personalized checklist, tailored to the responsibilities of an estate executor.

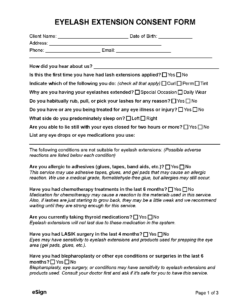

Finding a suitable template usually involves looking at reputable online legal resource platforms, estate planning websites, or even through legal software providers. While many free options are available, consider investing in a template from a trusted source, especially if it’s designed to be state-specific. Estate laws vary significantly by jurisdiction, so a template that aligns with your specific state’s requirements will save you considerable time and potential headaches down the line. Always double-check the source’s credibility to ensure the forms are legally sound and up-to-date.

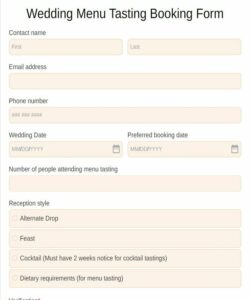

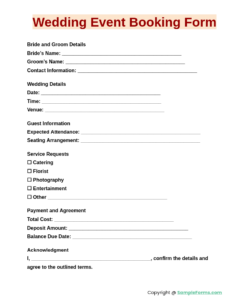

A good executor of estate form template will typically include a variety of documents that cover the most common aspects of estate administration. These might include forms for inventorying assets, notifying creditors, preparing accountings for the court, and even creating distribution plans for beneficiaries. The best templates are comprehensive, editable, and easy to understand, allowing you to fill in specific details and customize them to the unique circumstances of the estate you are managing.

Remember, while an executor of estate form template is an incredibly useful tool for organization and guidance, it’s not a substitute for legal advice. Estate law can be intricate, and specific situations may require the expertise of an attorney. These templates are designed to help you organize and present information, making the process smoother, but for complex legal questions or unique estate circumstances, consulting with a qualified estate attorney is always recommended. They can provide tailored advice and ensure that all legal requirements are met, giving you the confidence to manage the estate effectively.

Managing an estate as an executor is a profound responsibility, but it doesn’t have to be an overwhelming one. By leveraging tools like a comprehensive form template, you can bring structure and clarity to what might otherwise seem like a chaotic process. These resources empower you to fulfill your duties diligently, ensuring that the wishes of the deceased are honored and that their legacy is handled with care and precision.

Embracing a systematic approach, supported by reliable documentation, will not only make the administrative tasks more manageable but also provide a sense of control and confidence during a period of adjustment. You are taking on an important role, and by using the right tools and seeking guidance when needed, you can navigate the complexities of estate administration efficiently and respectfully, bringing closure to a significant chapter.